PIPOC Edition

This week, we’re at PIPOC in Malaysia and so have delayed publication of the blog so that we include some impressions from the event.

Some dates for your diary: First up the upcoming Surfactants Business Essentials Course takes place November 20 – 22nd. It’s the online version targeted at hit Singapore at 6PM (local time), The UAE at 2PM, London at 10AM and for those really keen, New York at 5AM. Yes, I’ll be in NY.

Next up – the great World Surfactants Conference in Jersey City: May 9th and 10th (Training on the 8th). The website is not up yet, but please save the date. It is going to be huge!

Now for the news, much of which comes courtesy of ICIS. I subscribe and you should too.

US October ethylene oxide (EO) contracts fell from September on lower feedstock ethylene costs. The October EO contract price came in around 59 – 61 cents/lb.

Supply is a bit tight as Dow's Plaquemine site remains down, while derivative demand into the housing and auto sectors is being pressured by high interest rates and a general economic slowdown.

According to ICIS, Asia’s fatty alcohol 1214 market saw some increased demand in China and India and support for increased prices. Feedstock PKO stabilized around $800 / MT in Malaysia. Further support came from crude oil pricing pushing upward.

Nonetheless October pricing remained now at around $1,280 / MT FOB SE Asia.

Further downstream: ICIS reported that Asia’s fatty alcohol ethoxylates (FAE) market continues quiet as consumption drops due to economic conditions. Adding to the downward price pressure has been the steady decline in C12-14 prices, which are down about 15% since August.

Meanwhile in the US – and still in the EO value chain: Dow Plaquemine continues to be down but Dow hopes to have it back up and running in Q2, 2024, according to a recent statement by the company. The plant as a capacity of 320,000 MT / yr of EO.

ICIS reported that in China, bulk LAB prices have nudged up by $100/ MT to around $1,470/MT on the back of increased oil prices.

Meanwhile in India, LAB prices have increased to Indian rupees (Rs) 150/kg ($1.8/kg) ex-works for October.

News from Stepan: The company’s alkoxylation expansion, a $265M project, in Pasadena TX, will start up mid-2024. Capacity will be 75,000 MT / year for ethoxylation and propoxylation.

Also - Stepan’s Q3 adjusted EBITDA fell 44% year on year to $48.0m, primarily due a 9% reduction in sales volume, the US-based chemicals company reported last month. This was due overall to a drop in demand. Sales volumes fell 7% in the surfactants segment and 12% in the polymer segment.

Three months ended 30 September:

| (in thousand $) | Q3 2023 | Q3 2022 | +/- % |

| Sales | 562,226 | 719,185 | -21.8% |

| Cost of sales | 490,990 | 600,709 | -18.3% |

| Gross profit | 71,236 | 118,476 | -39.9% |

| Operating expenses | 46,091 | 63,725 | -27.7% |

| Operating income | 19,517 | 54,659 | -64.3% |

| Net income | 12,571 | 39,384 | -68.1% |

The company sees Q4 bringing similar challenges to the first 9 months, including continued destocking in the agricultural end market. Cost savings measures are expected to bring $50m in pre-tax savings in 2024, offsetting increased expenses associated with the planned commissioning of the new alkoxylation assets

New name on old assets - Kensing announced the acquisition of Advanced Organic Materials (AOM), a producer of non-GMO plant-based vitamin E and phytosterols derived from sunflower and rapeseed. AOM operates facilities in Valencia, Spain, and Buenos Aires, Argentina. The acquisition expands Kensing's network across five plants in the US, Europe and Latin America.

Finally, ICIS reported that the Wilmar fatty alcohol outage at Rozenburg, in the Netherlands, which began on 25 July is due to end early November, a company source confirmed. Spot offers for October 1214 were in a range of €1,600-1,700/tonne FD NWE

More news in the wider world related to surfactants. : Following earnings declines across all of its major trading categories in Q3 2023, Unilever’s new CEO, Hein Schumacher, said there will be no major acquisitions for the foreseeable future as he unveiled a recovery plan for the remainder of the financial year. This plan also includes the sale of Dollar Shave Club to Nexus Capital Management, a US-based private equity firm. The planned sale is part of an overall plan to focus the product offerings. Over 50,000 skus have been removed from its Personal Care division, and it has delisted over 60 local brands.

Toward the end of the month, we saw a press release from Sasol outlining new initiatives in biosurfactants which announced the launch of CARINEX and LIVINEX, two brands that will expand Sasol’s offerings of sustainable products. CARINEX SL AND LIVINEX SL, both biosurfactants, are the first product offerings under these new brands.

Sasol Chemicals, one of the world’s largest manufacturers of surfactants, previously announced plans to begin exploring alternatives to traditional surfactants. In March 2022, the company announced a strategic partnership with Holiferm Limited to develop sophorolipids, a fermentation-derived biosurfactant offering an extensive reduction in carbon footprint compared with petroleum or bio-based surfactants. Using Holiferm’s proprietary technology, Sasol’s sophorolipids are fully derived from natural palm-free oils and/or sugars, making them environmental-friendly products without compromising performance.

“As Sasol continues to find ways to offer our customers lower-carbon footprint products, we believe partnerships are the key to unlocking and accelerating sustainable innovation and transformation,” said Eric Stouder, Senior Vice President of Sasol Chemicals. “Combining Holiferm’s advanced technology with Sasol’s unique chemistry and global reach, we can now offer our customers mass produced, high performing and more sustainable solutions at competitive prices.”

CARINEX will target the personal care market, while LIVINEX will be offered to customers in the home care, technical, institutional and industrial cleaning markets. While fully biodegradable, CARINEX and LIVINEX sophorolipids (SL) are well-tolerated by aquatic organisms, acting as detergents, dispersants, emulsifiers, foaming agents or wetting agents commonly needed for daily personal care products, such as shampoos and conditioners, as well as detergents, degreasers and more in cleaning and technical applications.

“Our partnership with Sasol Chemicals allows us to increase the reach and use of biosurfactants to markets across the globe,” said Richard Lock, Managing Director of Holiferm. “We are seeing an increase in interest and uptake of sustainable solutions and are well-placed with our partners to meet this demand.”

Around the same time, Sasol and Solugen announced an agreement to explore commercialization of new solutions to meet rapidly growing consumer demand for sustainable ingredients in home and personal care products.

Sasol Chemicals will evaluate the effectiveness of Solugen’s proprietary products, blends and derivatives in its household, personal care, and industrial and institutional cleaning surfactant formulations, initially focusing on chelating agents.

“This agreement is an example of our approach of partnering to find innovative solutions for our customers,” said Jonathan Ward, Senior Manager of Strategy and Sustainable Growth for Sasol’s Essential Care Chemicals business division. “Our focus is delivering high-performing products with lower carbon footprints at competitive prices, and we are eager to see how Solugen’s products might help us do that.”

Solugen’s bio-based ingredients are high-performing and cost-competitive materials used in detergents, cleaning products, and personal care products. Solugen manufactures these ingredients at its Bioforge facility in Houston, which uses a first-of-its-kind chemienzymatic process to convert plant-derived substances into essential materials that traditionally relied on fossil fuels – all with no or low emissions and waste.

"We are thrilled to partner with Sasol Chemicals, one of the world’s largest producers of surfactants, to drive positive impact in the home and personal care market,” said Gaurab Chakrabarti, Chief Executive Officer of Solugen. “Sasol’s commitment to sustainability makes it an ideal partner for Solugen. We look forward to leveraging our combined strengths in technology, production, and market development to meet increasing consumer demand for our high-performance, bio-based solutions.”

The high efficiency and scalability of Solugen’s process offers an extensive reduction in carbon footprint compared with conventional ingredients, resulting in overall carbon negative or neutral GHG emissions (cradle-to-gate).

Big news from Clariant: On October 30, the company acquired Lucas Meyer Cosmetics, a provider of high value ingredients for the cosmetics and personal care industry, from IFF, for $810 million (Press Release) . This looks like a 16.3X EV/ EBITDA multiple. Not too shabby. The press release reads in full:

MUTTENZ, 30 OCTOBER 2023 – Clariant, a sustainability-focused specialty chemical company, today announced that it has agreed to acquire Lucas Meyer Cosmetics, a leading provider of high value ingredients for the cosmetics and personal care industry, from International Flavors & Fragrances (IFF) for a total cash consideration of USD 810 million (~ CHF 720 million) on a debt-free, cash-free basis, equivalent to an EV/ reported EBITDA multiple (LTM August 2023) of 16.3x. The proposed transaction is subject to regulatory approvals and customary closing conditions and is expected to close in the first quarter of 2024.

“The proposed acquisition of Lucas Meyer Cosmetics marks another major step forward for Clariant’s purpose-led growth strategy. It will strengthen our position as a true specialty chemical company, our exposure towards consumer markets, and our footprint in North America, while supporting our goal to accelerate customer- and sustainability-driven innovation. In addition, Lucas Meyer Cosmetics brings a highly experienced leadership team with an excellent track record”, said Conrad Keijzer, Chief Executive Officer of Clariant. “By combining our personal care ingredients portfolio with Lucas Meyer Cosmetics, Clariant will become a leader in the high value cosmetic ingredients space, one of the most attractive, profitable, and fastest-growing specialty chemicals markets. With this step, we will build on our successful track record of pursuing and integrating bolt-on acquisitions to enable value creation and profitable growth.”

“Lucas Meyer Cosmetics represents a significant, exciting growth opportunity for Care Chemicals. It is a perfect fit with our business, given the complementarity of our customers and products. Combining our respective strengths, including the R&D and innovation capabilities of Lucas Meyer Cosmetics, backed by a strong brand, will enable us to deliver a strong increase in annual sales to USD 180 million in 2028 from around USD 100 million currently. We look forward to welcoming our new colleagues after closing and leveraging our respective capabilities, expertise, and passion,” said Christian Vang, President of the Clariant Business Unit Care Chemicals and the Americas region.

Lucas Meyer Cosmetics, founded in 1999 and headquartered in Québec, Canada, is a leading player in the high value active and functional cosmetic ingredients market. Lucas Meyer Cosmetics’ competitive edge stems from its superior marketing and innovation capabilities, including global R&D and regional application centers, which translate into strong financial performance with ~ USD 100 million of revenues (~ CHF 90 million) and highly attractive profitability. The business is also highly cash generative due to its asset-light model and outsourced production. In addition, Lucas Meyer Cosmetics has a unique customer-centric business model, resulting in strong brand recognition among customers around the world.

Strong strategic and financial rationale

The acquisition is underpinned by a compelling strategic rationale given Clariant’s and Lucas Meyer Cosmetics’ complementarity in customer portfolio, product portfolio, regional strongholds and capabilities in R&D and marketing, making the combination of Clariant and Lucas Meyer Cosmetics a uniquely positioned solutions provider for high value personal care brands. The proposed transaction allows Clariant to further transform its portfolio towards high-growth, high-margin and highly cash generative specialty chemicals businesses and consumer end-markets underpinned by accelerating demand for natural and sustainable products. It will increase Clariant’s exposure to the active and functional cosmetic ingredients market and strengthen its North America presence in the Care Chemicals business unit.

The transaction will create considerable value for Clariant’s shareholders. With ~ 10 % sales growth , outstanding profitability and high cash conversion, Lucas Meyer Cosmetics is accretive to Clariant’s growth, margin and cash flow profile and exceeds Clariant’s financial target metrics for 2025. The transaction is expected to be mid-single digit percentage accretive to EPS from year one onwards. Given the strong strategic fit and high complementarity of the businesses, Clariant’s ambition is to grow Lucas Meyer Cosmetics’ annual sales from ~ USD 100 million to ~ USD 180 million by 2028.

Financing and expected timetable

The funding for the acquisition has been secured by a fully committed bridge facility which is intended to be refinanced soon after completion. On completion, Clariant’s net leverage is expected to moderately increase to ~ 2.8x times EBITDA including pension and lease liabilities, preserving the Group’s prudent capital structure and balance sheet strength. Clariant expects no change to its investment grade credit rating.

The acquisition is expected to close in the first quarter of 2024.

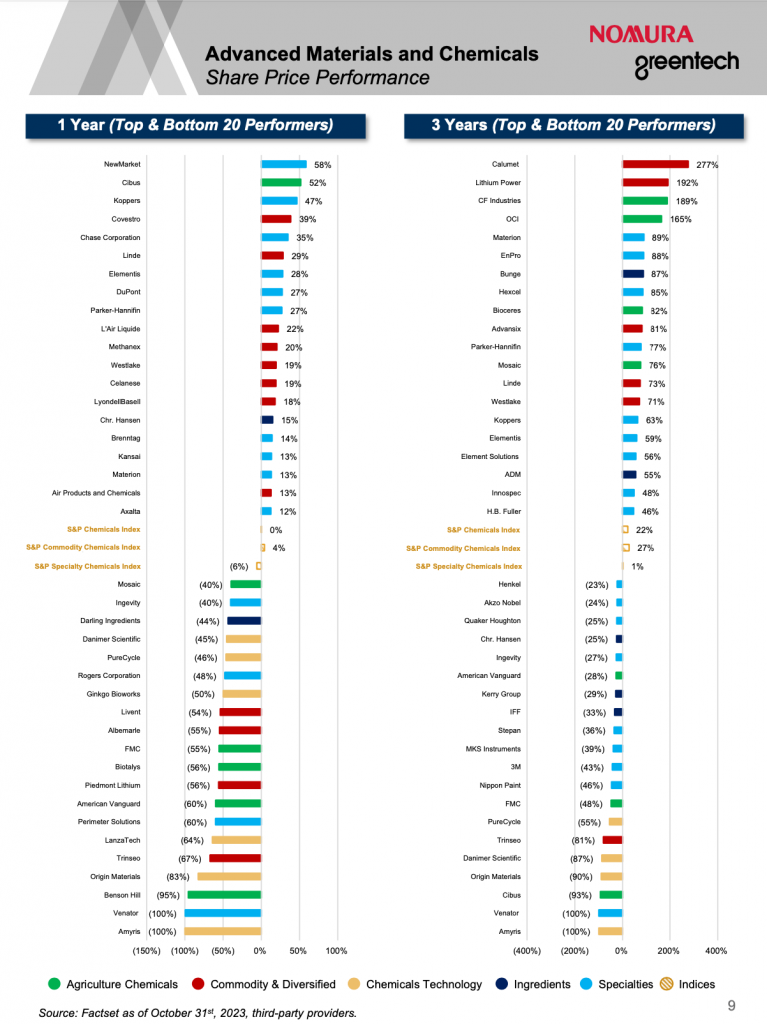

Our friends at Nomura Greentech just published one of their regular chemical stock performance analyses. The following tables show the top and bottom 20 for 1 and 3 year returns. You’ll notice some familiar names in the surfactant wider world listed there.

Some Notes from PIPOC

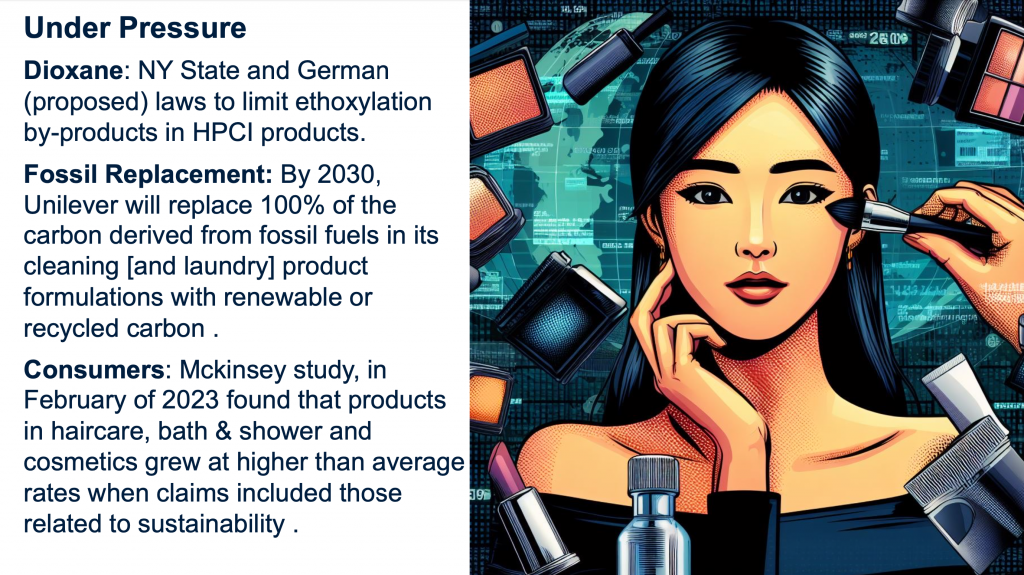

As I have since, 2011, I was again invited to speak at the MPOB (Malaysian Palm Oil Board) PIPOC Conference in KL. This biannual (is that once every 2 years? I hope so) event covers all things palm from plantation to consumer and industrial products – economics, technology, social aspect. It’s huge and well attended globally. My talk was on the cosmetics value chain and I’ve provided some of the slides below. One thing, you might notice is that I used Open AI’s Dall-E to illustrate them. I could not rely on GPT for any of the data, though. I tried, but it was resolutely making stuff up and then steadfastly denying it had. It was quite funny at first but then got to be a huge time sink, so I put them together the old-fashioned way, using my faulty human memory augmented by Google. One interesting thing; there was a video-recorded presentation shown there (I won’t say which company – but you won’t have heard of them) that I swear was made or at least augmented by AI. The delivery was flawless – too flawless, even for a paid actor, which this was not. But some of the intonation was a bit off. For example one would imagine that this company would know the customary intonation to use when saying “palm oil” . I’ll dig into this further and see what I can find out and let you know.

By the way, they always like to put me to work while I’m there, so I did another stint as session chairman. It’s a great way to meet people.

Other interesting things picked up at PIPOC:

A lot of discussion of bio-lubricants based on various types of palm-derived fatty acid esters. Oleon touted their chemical / enzymatic integrated processes to make a varieity of mono, di and poly – ol esters as lubricant basestocks.

Also much discussion of polyhydroxy estolides as base-stocks made from oleic acid.

Fairly new Malaysian company, CIDOLS Sdn Bhd touted a large range of esters including isoamyl laurate as emollient. One to watch. CEO Eddy Chong is also a great speaker.

Interesting presentation by the MPOB on the use of Oil Palm Biomass to make nanocellulose. An interesting cosmetics ingredient.

In the exhibition, which was huge and I didn't get to spend enough time in, top marks for impact has to go to Sime Darby for their exhibit on agricultural automation. Here’s a solar-powered(?) drone for data-gathering.

Other commenters noted that this was more aspirational than representative of general practice. It’s OK to have aspirations though, right?

Among the hundreds of posters, one caught my eye and that was by the MPOB regarding the preparation of a range of sorbitol esters using a lipase catalysis method. Expect to see a lot more of these enzyme catalysed reactions as more sustainable alternatives to high-temperature, high-pH, high-solvent current practice.

Also a lot of discussion of SAF at this event. SAF is sustainable aviation fuel. This is relevant to palm in that many of the feedstocks for SAF are waste fats, oils and greases. Other feedstocks include MSW (municipal solid waste), agricultural and forestry residues, wet wastes (I actually don’t know what this is but it was on someone’s slide so..) and non-food crops cultivated on marginal land. Global SAF production capacity in 2021 was 0.5 Million MT/yr and is projected to reach 26 Million MT / yr by 2028. Not surprisingly there’s a corresponding shortage of waste oils in Malaysia right now and I heard that in some cases, essentially fresh palm oil (or let's say gently used; frying one chip for one minute as someone quippped) is being put into SAF service on the margin. The leading user of waste oil today seems to be Neste. Leading countries include The Netherlands, Singapore and the UK. There’s some potential for expansion in Malaysia as only about 30% of used cooking oil is collected.

There was a lot of discussion of palm oil prices at this conference. In fact it’s not only allowed but encouraged. So – let's see if I can summarize here. Today (Q3 2023), CPO (Crude Palm Oil) price is down at RM3,811 /MT from a 2022 average of RM5,078 / MT. Forecasting where it goes next is where it gets interesting. Some points made by various speakers and commenters:

- Stocks: Higher inventories tend to push prices lower and vice versa. Inventory trends are suggesting higher prices next year.

- Soybeans: There’s a closely watched palm oil discount to soybean oil and so the production of soybeans and more importantly the crush volume of soy drives movements in CPO. The soybean crush is way down this year which suggests higher CPO prices next.

- The weather: The US NOAA called an El Nino on June 8, 2023. This is generally correlated with reduced palm yields the year after and therefore higher prices.

- Costs of production: Costs are going up due to labor and yield trends (older trees). This tends to push up prices.

- Demand for palm and other vegetable oils, especially soybean obviously plays a role. This is growing aided by huge amounts going into biodiesel and renewable diesel.

- Supply: Julian McGill of new firm, Glenauk made a great point. Global vegetable oil production grew exponentially from 1960 with only minor deviations from trend due to weather. Since 2019 production has fallen significantly behind trend and most of this gap can be attributed to very limited growth in palm oil production. At the same time the soybean crush is down but soybean oil use in diesel continues to increase.

- Bottom line of all this is that 2024 CPO price is estimated to be in the range RM 4,000 to 4,200 / MT on average. This is not my prediction. It is the range covered by 4 main speakers on the topic.

BTW it was tough to get anyone to talk much about laurics but with prices more than 40% below 2022 levels, hovering between $840 and $1,090 / MT all year in ’23, it is hard to imagine PKO and CNO going anywhere but up next year. Let’s see. Hey by the way, I am not a price prognositcator and none of this should be taken as prognositication on my part. I am merely taking and summarizing a lot of things I heard from true experts in this field at the event.

What else? Well, when in KL it’s always good to check in with KLK in Petaling Jaya. Since I was there last, they’ve updated the lobby and put in new cool-looking café / co-working space / coffee shop. And covered the walls with the over 100 year history (1906 founding) of the company. Had a good chat and update and, you may be interested, came away with a clutch of products built on palm tocotrienols (an extract of Vitamin E), made by KLK company, Davos Life Science. So I’ve committed to take the supplements for the next 30 days or so and report the results here in the blog. I have to say, straight off the bat, that the literature accompanying the products is quite impressive. Anyway, if nothing else I need my circadian rhythms repaired after this trip which also took in the UK and a set the clocks back, time change.

So – what’s new in the world of AI and Chemistry.

Well, as noted above I’ve been having fun with image generation to illustrate slides. In fact the package is Microsoft Bing on the Edge browser. This gives you free access to GPT-4 (usually $20 per month) and the ability to have GPT-4 configure Dall-E prompts for you. It is a tremendous deal. However, be very careful about asking it for actual facts. As with any LLM it will confidently and breezily make stuff up. This includes fabricating links to supposed original sources. And then it will deny doing so. If you push it further it will basically change the subject (literally starting a new session) or at the least make up really sad excuses like it “didn't have time”. Lame. Anyway still a fascinating tool integrated into the browser. This brings me to the embarrassing admission that in the August blog, I had a piece on biosurfactants and yes, one of the footnote links was completely fabricated. So I can only conclude that, what I thought was the original source of the information, that included a footnoted reference, had used a little LLM help and suffered a hallucination. Well done to the eagle-eyed reader, himself a key player in biosurfactants, that spotted this. And shame on me. Wow! – I will be more careful going forward.

I’ve written a couple of times already about my work with the University of Toronto’s Acceleration Consortium, led by Professor Alan Aspuru Guzik, but I’m not sure I did a good enough job of explaining what the initiative is all about. Thankfully, there’s a substack written by Paul Wells that does it very well. Here’s the link.

Speaking of Alan, here’s a paper, just published at the end of October, of which he is a co-author (https://link.springer.com/article/10.1007/s10514-023-10136-2 ). It’s open access so no payment needed. In summary: The paper proposes an approach to automate chemistry experiments using robots by translating natural language instructions into robot-executable plans, using large language models together with task and motion planning. So you can tell your chemist robot - “make me a methyl ester of that acid” and off it goes, no further instruction needed. Adding natural language interfaces to autonomous chemistry experiment systems lowers the barrier to using complicated robotics systems and increases utility for non-expert users. However, but translating natural language experiment descriptions from users into low-level robotics languages is not that easy. Furthermore, while recent advances have used large language models to generate task plans, reliably executing those plans in the real world ie. By a robot in a lab, remains challenging. To enable autonomous chemistry experiments and alleviate the workload of chemists, robots must interpret natural language commands, perceive the workspace, autonomously plan multi-step actions and motions, consider safety precautions, and interact with various laboratory equipment. The approach in this paper, CLAIRify, combines automatic iterative prompting with program verification to ensure syntactically valid programs in a data-scarce domain-specific language that incorporates environmental constraints. The generated plan is executed through solving a constrained task and motion planning problem using PDDLStream solvers to prevent spillages of liquids as well as collisions in chemistry labs (kind of a minimum requirement before even making any product). The effectiveness of the approach is demonstrated in planning chemistry experiments, with plans successfully executed on a real robot using a repertoire of robot skills and lab tools. This demo includes fundamental chemical experiments for materials synthesis: solubility and recrystallization. Further details about CLAIRify can be found at https://ac-rad.github.io/clairify/.

An article in AI Multiple, lists the 13 (don't know why this number) top AI uses in manufacturing this year, drawn from a CapGemini survey. These are:

- Predictive Maintenance

- Generative Design

- Price Forecasting of Raw Materials

- Robotics

- Edge Analytics (if you don't know what that is – check this link

- Quality Assurance

- Inventory Management

- Process Optimization

- Digital Twins (link)

- Product Development

- Design Customization

- Shop Floor Performance Improvement

- Logistics Optimization

Finally (before the music), the blog will move to a new website next month on a new server. It’s time for a refresh. It’s been a bit of a project as we have over 10 years-worth of blog posts that I am bringing over. We’re going to put about 3 years in the main site and the rest in an archive site. This is going to (I’m told) improve search engine rankings and site performance. Let’s see. There are going to be glitches, I’m sure, so please let me know if you have any issues accessing the materials.

Now the Music

As a long-time avid user of ad-blocking in all my web browsing, I have been blissfully unaware of the annoying ads that run on YouTube. Recently however, YouTube has started to sense when an adblocker is active and will not play a video until you deactivate. Not good. There is a way round this though. When you want an uninterrupted music (in my case) session, open a new private window in your browser. and paste the link in there. The adblocker (I use Adblock plus) continues to work undisturbed. My usual browser is Firefox (I know, I know) but am assuming others have the same option.

“Is this your new band? They’re giving me a headache” So quoth the real musician in our family. Well yes, I guess they are – Greenlung. Touted by the Grauniad of all papers, as typically British heavy rock. I guess I can see what they’re saying. Some good stuff so let’s give them a listen. Just a few videos here. The blog is long enough already.

First a an old-school bucolic-rural instrumental opening paired with a bombast-rock closer. See what you think..

And then another instrumental. Kind of a old-chant religious opening with more bombast. I know it's not original but, I dunno, has a good feel.

I'm trying to think who they remind me of - I mean other than Black Sabbath. There's something else in there, but I can't quite put my finger on it. Anyone else want to chime in here..?

And a long but surprisingly accessible song from their latest album. Oceans of Time.

Ok so I just thought that maybe there's a bit of Judas Priest in there. But still there's something else, I'm missing. Anyway here's Sinner from Priest (1977!). Saw them shortly after this came out. I just remember a very hot and sweaty environment.. good fun..

That’s it. See you all soon.