December 2020 – Monthly Surfactants Review

Happy New Year, my dear readers and thanks for all your great comments and expressions of support over the past year. Every time, someone tells me they read these blogs, I get a bit of a chill. It’s excitement mingled with some pride, obviously but also a bit of nervousness. If folks are really reading this stuff, it had better be good – or at the very least, not boring. The one commandment I have for our blog here is “above all, do not be boring”. If this ever happens, please do let me know, won’t you?

A great clutch of news items this month. As always, most of the news is provided courtesy of my good friends at ICIS. I get no recompense from them for promoting their service, but, as you know, we produce a series of conferences together. In any case, if you like what you read here or experience at the conferences, you should subscribe to their stuff. Fair enough?

Spoiler alert: The end of the blog contains what I believe to the biggest news of the month, if not the year – out of Brazil. It’s not too surprising though..read on..

But first up – Lucas Hall reports from the Alcohol beat. As of mid-month, US Q1 fatty alcohols contract negotiations are ongoing, with freely-negotiated settlements largely emerging at an increase from Q4, tracking bullish feedstock costs and record freight costs against the backdrop of stable-to-strong demand. Mid-cut prices face major upward pressure compared to C16-18 prices. C16 supply from southeast Asia is tight, while C18 supply is ample amid weak demand.

Feedstock costs across the oil palm complex were mostly stable but remain overall bullish, maintaining pressure on the wider market. Freight costs remain at record highs amid tight vessel availability and strong shipping demand in the US. Mass balance material remains tight from the summer, sustaining upward pressure on premiums.

Demand across the core personal care sector is stable to strong, depending on the end product. Demand in other end segments is largely rebounding but overall uneven. Sasol remains on force majeure for linear alcohols and ethoxylates at its US Lake Charles, Louisiana, Chemical Complex (LCCC) into December following a hurricane-related outage earlier in the year. The plant restarted in late October.

Prices for mid-cut alcohols have been heard in the low-80 to mid-90 cent/lb DEL (delivered) USG (US Gulf) range. Prices for C16-18 alcohols have been heard in the upper-70 to upper-90 cent/lb DEL USG range. Volumes with higher concentrations of C16 were at the higher end of the range because of the tight supply environment. Prices for mass balance premiums have been heard around 5 cents/lb.

The sharp increase in offers has prompted some buyers to adopt a wait-and-see approach, buy less volumes or spread their volumes across multiple producers in order to mitigate their exposure to the countervailing cost pressures. Some sellers are unwilling to offers volumes unless they account for the feedstock and freight cost increases. Synthetic (petrochemical) alcohols prices have been heard mixed amid the ongoing force majeure in the US market. Demand into Mexico is mixed amid ongoing ethylene oxide (EO) disruptions in the country. [this, by the way, is not an unusual situation].

Attendees at my surfactants business essentials course will know that BASF regularly evaluates its portfolio of surfactants businesses and cast a critical eye on the resources that it allocates to its various business segments. It should come as no surprise, then that the company announced that it would sell its Kankakee, IL, manufacturing site to private equity buyer One Rock Equity Partners. BASF had acquired the plant when it purchased Cognis a decade ago.

The company decided to put the site, which produces surfactants and other vegetable oil-based raw materials, up for sale after determining that it no longer fit its core strategy. The deal is expected to close in the first half of 2021, with the value of the site reported at potentially $250m when rumours first emerged.

The site employs 160 people, and One Rock intends to grow the units into a standalone business, according to managing partner R Scott Spielvogel. BASF has been moving to rationalise its manufacturing footprint in the surfactants and personal care space, according to care chemicals division head Ralph Schweens.

Surfactant history buffs will already know that the facility was built in 1948. Originally home to General Mills Chemicals, Henkel bought the company in 1978. In 2000 Cognis spun-off from Henkel. BASF acquired Cognis in 2010. The site manufactures more than 200 products used by the Care Chemicals, and Nutrition & Health industries. The products are used as ingredients in soaps, detergents, shampoos, pharmaceuticals, and food additives.

Best of luck to all the folks involved with this business and best of luck to the new owners. It’s no fun being a non-core business in a large company, so I think, ultimately this should be for the best for all concerned. [see our last item in the blog, by the way]. We’ll be looking out for news along the way. From a surfactants point of view, this was BASF’s only sulfonation site in the North America (having recently sold the Mexican business to Stepan). It therefore would have been nice, for industry consolidation, if, for example, Stepan, Pilot or Solvay could have acquired this site. Well, let’s see what happens in the coming years.

Late in the month, Joe Chang wrote an excellent article on M&A in ICIS Chemical Business. There’s a little snippet on surfactants that I will reproduce here: “Flavours and fragrances (F&F), personal care ingredients, as well as paints and coatings, adhesives, water treatment, building products, surfactants and some value-added distribution assets are generally highly sought-after and command relatively high multiples, said Federico Mennella, managing director and co-head of the global chemical and materials practice at Rothschild & Co.” Good to know. Again – see our last section of the blog.

From Europe: Some good analysis on the Ethylene Oxide (EO) market by Melissa Hurley of ICIS. : European ethylene oxide (EO) supply is tight as the year draws to a close and the situation is expected to continue in January 2021. EO supply has tightened due to production limitations in Europe. Earlier in December, there was a force majeure declaration at the INEOS Germany plant, which has not been confirmed by the producer. It is unclear if the issues have been resolved for EO or if problems are persisting on downstream monoethylene glycol (MEG) in Germany. Some think the issue will last until the end of the year and unconfirmed reports suggest the plant is expected back on stream sometime in January.

BASF’S Antwerp EO/ethylene glycol (EG) unit was out for maintenance in October and November and had its restart delayed. The outage was not confirmed by the producer.

“EO seems to be very tight in January. We are getting several requests from non-contract customers and also for additional volumes from contract customers”, a supplier added. Tightness in the upstream ethylene market has been identified as a contributing factor, filtering downstream to the EO market.

Check out this cool graphic – I hope it works for you in your browser – if not – hey why not subscribe to ICIS ?

The European ethylene market is tighter than expected because of ongoing production constraints and healthy demand amid upward cost pressure from feedstock gains. In the Netherlands, there was mention of minor production issues at the Moerdjilk Shell facility after reports of cracker flaring was heard at the start of the week. This has not been officially confirmed. There is a larger turnaround expected in the second quarter of 2021 at Ludwigshafen, Germany. Once again, this has not been officially confirmed by BASF.

The upstream 2021 cracker turnaround schedule will be bigger than originally expected as some of last year’s turnarounds were postponed in 2020. Additionally, as new cases of Covid-19 surge, border control has tightened especially in and out of the UK, causing delivery nightmares. “EO deliveries to UK are very uncertain because of the border closures. There is the uncertainty whether drivers can return to mainland,” added a market player. EO demand has been solid or high for this time of year and it has been a challenge to cover requirements, a buyer added this week.

2021 adder fees stable-to-soft; some talks ongoing: 2021 EO adder fee talks have so far been agreed at roll overs and varied decreases with outstanding agreements expected to be concluded by January. The holiday period will draw market players away from the market temporarily. The level of decreases are dependent on the length of the contract, volume requirement and starting point. Formulas can also vary in terms of ethylene cost pass through. In 2020, EO adder fees were lower year on year, mainly driven by the relaxed supply situation and poor downstream demand which characterised 2019.

European EO December contract prices increased on the back of higher ethylene feedstock costs. The January ethylene contract price is set to emerge soon for a clearer picture of formula-related prices.

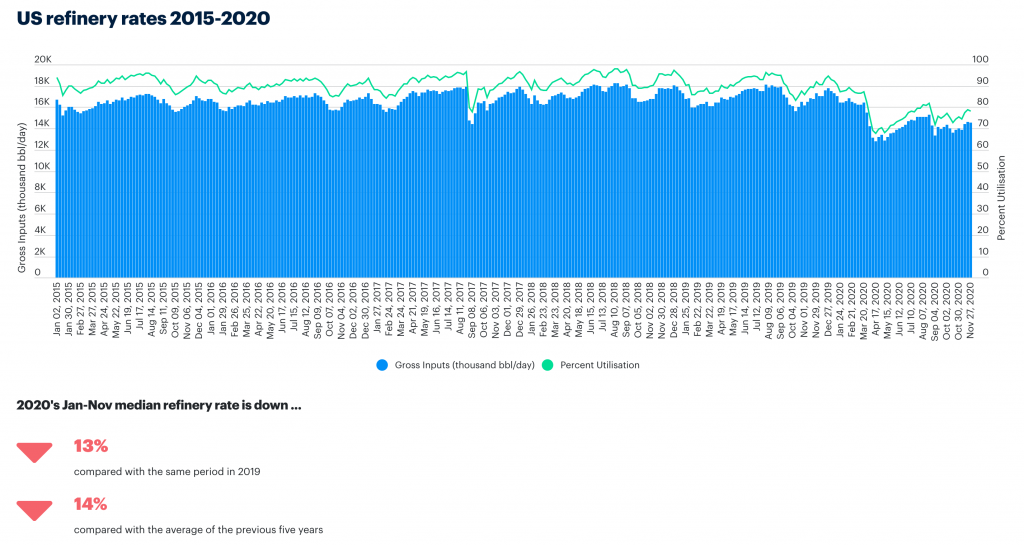

Back over in the US, ICIS published some interested data on refinery operations from the EIA. Here’s the screenshot.

Interesting right? Obviously the drop in demand is largely COVID related due to decreased commuting to work. Good? Bad? Indifferent. I’ve enjoyed the lighter traffic up and down the 95 this year, but how much of my enjoyment is on the back of folks who have lost their livelihoods in those industries that relied on people physically showing up in NYC? Hmm.. I don't feel so good about the lovely commute now.

The final news of the year – that is the final thing I write in the blog – even though it hit the ICIS newswire around the middle of the month - is something that the legendary Al Greenwood reported: The Brazilian conglomerate Ultrapar is considering the possible divestment of surfactants producer Oxiteno. The divestment is among the strategic alternatives it is considering for the company, Ultrapar said. These would fall in line with Ultrapar's growth strategy and allow Oxiteno to continue expanding. Wow – big news but certainly not head-scratching”

Oxiteno is ramping up production at its new surfactants plant in Pasadena, Texas, in the US. As you all know - the company is the sole producer of ethylene oxide (EO) in Brazil. It also makes ethylene glycol. In addition to Oxiteno, Ultrapar also owns the fuel distributor Ipiranga, which has placed a bid to acquire the Presidente Getulio Vargas refinery (REPAR) in Parana state in southern Brazil. If Ipiranga's bid is successful, it would be the company's first refinery. Ultrapar also owns the fuel distributor Ultragaz, liquid bulk storage firm Ultracargo and drugstore chain Extrafarma.

Well, how about that. Here’s a little more background. The company published on it’s website on December 14th , a document that reads in full, as follows:

“São Paulo, December 14, 2020 – Ultrapar Participações S.A. (B3: UGPA3 / NYSE: UGP, “Ultrapar” or “Company”), in order to clarify news published by the press, communicates the following:

- Consistent with the message the Company has been providing to its shareholders and the capital markets, Ultrapar evaluates periodically its portfolio of businesses, in order to maximize the value generation to is shareholders and stakeholders.

- Also aligned with the strategy the Company has been developing and informing the market, the priority in capital allocation for the next years is centered in the existing opportunities in the Oil & Gas value chain in Brazil, where the Company operates with three businesses and has structural competitive advantages.

- Oxiteno was built and has been developed by Ultrapar for more than 40 years and has an outstanding position in Brazil and Latin America, with modern industrial facilities and world-class technology in the chemical industry, a sector that has been going through a restructuring and consolidation process worldwide.

- Therefore, consistent with the growth strategy of Ultrapar and in order to allow the continuous expansion and strengthening of Oxiteno, Ultrapar is evaluating strategic alternatives to this business, which includes potential divestment.

The Company will maintain its shareholders and the market timely informed of any material announcement.”

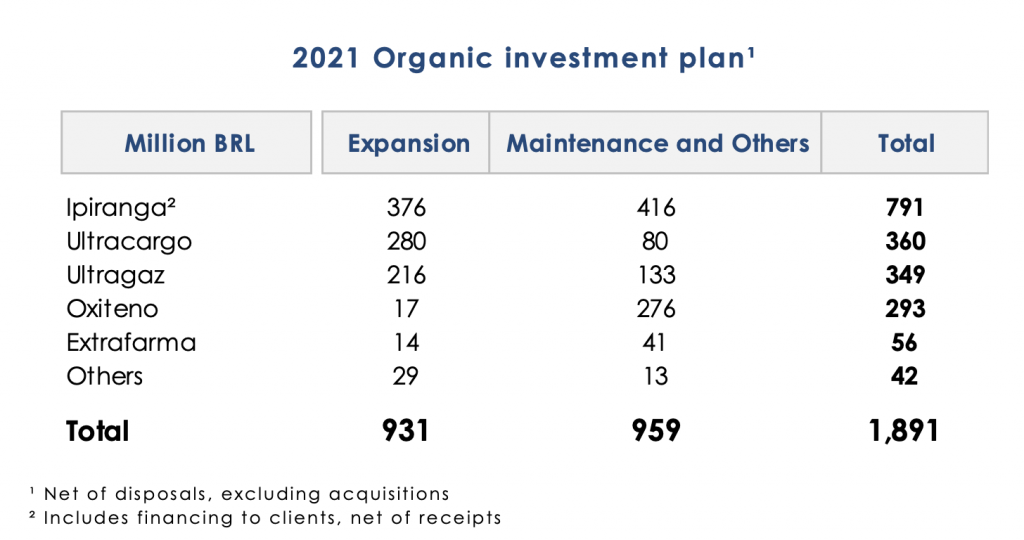

Interestingly, 4 days prior, Ultrapar published their 2021 invesment plan which looked like this.

It includes the equivalent of USD 53.1M at Oxiteno in logistics optimization to increase productivity. I’m not sure what that means exactly. Perhaps something to do with storage and pipelines? In any case, the owner is saying that their priority for investment in the coming years, is going to be the oil and gas value chain. Therefore they can’t really support the chemicals business in the manner to which it has become accustomed. Time for a new owner that is willing and motivated to do so.

Comment: As readers know, I have a bit of a soft-spot for Oxteno. I spent some time in Brazil and I was present at the birth of Oxiteno USA, back in 2007. Oxiteno is a young company. Literally and in outlook and attitude. It was at my first meeting there in Sao Paulo, that I realised I was the oldest person in the room, by a good few years - for the first time in my career. They are also serious. They study and think about the business they are in - at all levels in the company. You may be surprised how many companies really don't do that. For over 10 years, Oxiteno has been a big supporter of our conferences and courses providing many speakers and attendees around the world. The company has also provided much great material for our blog. I say this to inform you that my comments here may not be strictly objective.

So – first off, as I said – this announcement is certainly not hard to understand. Oxiteno has been looking increasingly out-of-place in the Ultrapar portfolio as Ultra continued to invest in oil and gas production and distribution over the last decade or 2. The establishment of a US presence (a 13 year ambitious project which continues today) was a huge achievement for Oxiteno and certainly changed the contour of the business from a purely Latin American one. However, the parent was increasingly doting more on its other children, especially since the elevation of Pedro Wongtchowski, who ran Oxiteno for many years (and had a deep attachment to the business) to the board of Utlrapar in a non-executive role. Having said all that, I am sure this decision was a very emotional one for all involved.

Oxiteno itself was formed by Ultrapar in 1970 under the management of Paulo Cunha. The first plant, making EO, was in Maua, just outside Sao Paulo. History buffs will also recall that 1970 was the year in which Brazil defeated Italy 4-1 in the World Cup in Mexico City, with Pele scoring the first goal. It was Pele’s last world cup for Brazil and the team, with this third win, got to keep the Jules Rimet trophy, as it was then known.

In 1974, Oxiteno’s second plant was opened in Camacari. During he 70’s Oxiteno also formed a joint venture with ICI (as it was then) to produce ethoxylated surfactants. In the 80’s oxiteno bought out ICI’s stake in the JV. The 80’s further saw a new plant in Triunfo and a new R&D center in Maua for Oxiteno. Also in the 80’s (in 7/20/80 if you must know) - that other great Brazilian institution, Gisele Bundchen, was born in Horizontina Brazil.

The 2000’s saw a lot of action with the purchase of Canamex in Mexico in 2003, which came with 2 plants (Guadalajara and Coatzacoalcos) and a HQ in Mexico City. That same decade saw expansion into Argentina with a sales office, Venezuala with an ethoxylation plant (purchased from Arch), sulfonation assets in Mexico, purchased from Union Quimica and, in 2007, the incorporation of Oxiteno USA. In 2008, Oxiteno opened their fatty alcohol plant in Camacari – a huge investment. Similarly, for Gisele, the 2000’s saw her international breakthrough. In 2000 alone, she appeared on 37 Vogue covers.

In April 2012, Oxiteno bought its first plant site in the US, from Old World in Pasadena, Texas. The company went on to make massive investments there include a modular alkoxylation system, fabricated off-site in a novel partnership with Thyssen. The following month, Oxiteno bought American Chemical’s Uruguayan sulfonation assets in Montevideo. That same year, Gisele made 5,600 appearances in commercials in Brazil alone as well as appearing in Banco do Brasil’s first global ad campaign.

So what happens now? Over the years, speculation about a suitor for Oxiteno has been a bit of a parlor game in the industry. SABIC, Reliance, Sasol, Chemchina, BASF, Huntsman and others have been tipped, with varying degrees of seriousness. All would certainly give the company a good look-over if provided the opportunity. Until recently, I would have said Sasol could be a fit. However, their recent stretching on the capital front would seem to put them out of contention. Although, a motivated third party may well see an interesting opportunity to put together the chemicals businesses of the South African and Brazilian parents. SABIC, who through their recent investment in Clariant, is now knee-deep in specialties, would also be a reasonable fit. The challenge for any acquiror is Brazil itself. An acquisition of Oxiteno is still a bet on Brazil, although less so since the large capacity built in the USA. On paper, a Stepan / Oxiteno combination would be quite logical and Stepan does have solid experience in Latin American. Such a combination, however, would be a bet-the-company move for Stepan, something they have avoided through their almost 90-year history. But – getting Oxiteno onto the NYSE via a combination with Stepan could be quite interesting in terms of unlocking value. Then there are the many SPAC possibilities out there. They’re endless, of course, but SPACS affiliated with chemical industry veterans will already be in touch with the folks on Avenida Brigadeiro Luís Antônio. Of that we can be sure. Regardless of the buyer, this is a once-in-an-industry-lifetime opportunity. It's not as if a serious buyer could say to themselves - "Oh well, if we don't prevail here, we can just wait for the next Latam/Global surfactants powerhouse to come along".

So, let’s see. As we’ve said in the blog a fair bit recently. It’s the end of an era and beginning of another. Whoever buys Oxiteno, one must expect it will be a significant core business for them. This means that the business will enjoy a status that it clearly does not enjoy today with current owner Ultrapar (otherwise it would not be for sale). That’s got to be good in the long run for the business and most of the employees.

I have to wonder though, if Oxiteno ownership ceases to be Brazilian, must this blog also retire our gratuitous use of a certain supermodel to lavishly illustrate the merest mention of the company? Maybe we’d better.