January 2020 – Surfactants Monthly Review

Highlights of this month, of course, include the ACI annual meeting in Orlando. Many great sessions, some organized, some spontaneous. If you’re expecting Page 6 gossip, of the what-Meghan-told Harry, what Kim wore and what Cardi did, type. Sorry. We don’t do that here. To know all that stuff, you gotta be there. Like a thousand of our colleagues were.

This blog is brought to you by Desmet Ballestra. I’ve always wanted to say that. Unfortunately it’s not true. No money changed hands to have me run the ad below. It’s interesting and relevant to the dioxane issue, so I’m putting it in here. And I guess I can say that the dioxane matter was extensively discussed at ACI. It’s a big deal if you’re a sulfonator or a user of ether sulfates in your cleaning products. You can be assured that we’ll have a number of views on this topic at our conference in May.

Last month’s editorial on Cardi B and Mother Theresa actually, surprisingly, got some positive feedback, but don’t worry – this blog will be strictly the news until the, clearly marked, final section where we dip into the lyrics of Neil Peart for our education and entertainment.

The News: At the beginning of the month, Sasol announced that their Lousiana expansions are expected to be delayed until the second quarter. The 100,000 tonne/year ethoxylates unit expansion is currently under commissioning, with the first volumes targeted for the end of January [which did happen] or early February. The 173,000 tonne/year Ziegler alcohol plant expansion, which includes a 30,000 tonne/year alumina unit and 30,000 tonne/year Guerbet alcohol unit, is expected early in the second quarter. The alumina unit, which is part of the Ziegler alcohol plant, will start with the Ziegler expansion early in the second quarter. Alumina, also known as aluminium oxide, is produced as a result from the use of aluminium as a catalyst to produce the alcohol. Commissioning of the Guerbet alcohols unit is expected following the Ziegler expansion, with volumes expected in early summer. The Guerbet unit will produce C12, C16 and C18 alcohols as well as longer-chain C20, C24, C24-26, C28 and C32 alcohols included in the standard Guerbet alcohol product slate.

On Monday 13th of January, Sasol reported a small fire on the site in Lake Charles Louisiana. Local media reported a loud boom, which apparently blew the hurricane doors off a fire department next door. No injuries were reported.

In related news, ICIS reported that US first quarter fatty alcohols contracts were assessed flat to up from the fourth quarter amid a sustained upswing in palm oil and feedstock palm kernel oil (PKO) costs over the last three months, as buyers begin first-quarter restocking efforts. Players that finalised negotiations earlier secured contracts skewed toward the low end of the posted ranges, while players that finalised negotiations late secured contracts toward the high end of the posted ranges.

Contracts also varied based on buyer size and and shipping point, with east coast suppliers and New Orleans, Louisiana, based suppliers facing higher logistics costs than those in the Houston, Texas, area. Single-cut C16 and C18 alcohols were heard to be more available relative to the C16-18 blend, limiting the upswing in the contract range. Single-cut alcohols tend to sell at a premium to blended cuts.

Demand is rebounding, with demand for the mid-cut C12-C15 alcohols especially strong relative to the C16-18 alcohols following maintenance among surfactants producers in the fourth quarter. Although demand is rebounding, it remains to be seen if the market will fully absorb higher costs. Sasol has delayed the startup of its alcohols expansion to the second quarter, which may keep synthetic alcohols inventories tight until the second-half of the year, further pressuring the market.

In the spot market, the upswing in PKO and other feedstock oil markets continues to put serious upward pressure on prices. One buyer who lost out on first-quarter volumes was heard to have bid in the 80 cent/lb DEL (delivered) range for mid-cut material in the US Gulf following a delayed shipment. Spot prices in the Gulf were heard no lower than the 70 cent/lb range. Q1 mid-cut C12-C15 alcohols were assessed up 4.5 cents/lb from the fourth quarter at 66-75 cents/lb DEL (delivered) in the US Gulf. C16-18 alcohols were assessed 5 cents/lb higher on the high end at 77-85 cents/lb DEL US Gulf.

Meanwhile over in Europe, later in the month; European fatty alcohol first quarter contract prices rocketed amid strong increases in feedstock prices throughout the previous quarter. Values jumped €240/tonne on the low end and €310/tonne on the high end to €1200-1410/tonne FD (free delivered) NWE (northwest Europe).

Feedstock palm kernel oil (PKO) values spiked over the past few months. The sustained increases seen in recent months were due mainly to a rise in biodiesel mandates in Indonesia, as there is higher demand expected for palm products in Asia this year. Availability is healthy, with no production issues seen in the region. Demand has been fairly slow in January, with expectations that it will pick up further into the quarter. Some market participants are seeing lower demand from alcohol ethoxylates players in the first quarter, due to length in the ethoxylates market.

EO scrutiny continues: ICIS reports that a new project aims to improve air quality monitoring information for ethylene oxide (EO) in the US state of Georgia, according to an American Chemistry Council (ACC) statement. The project will collect, analyse and share the results as US Environmental Protection Agency (EPA) and state and local officials set safety standards and determine the best emission control technology. "Limited air emissions data from Georgia, as well as recent data released by the EPA regarding EO emissions in various areas around the country, raise questions about normal background levels of EO in the air," the ACC said.

"More research into levels of EO in the air is needed." As the blog noted in November representatives from the US states of Illinois and Georgia formed a bipartisan group to address the safety of EO emissions. The group's purpose is to urge the EPA to act.

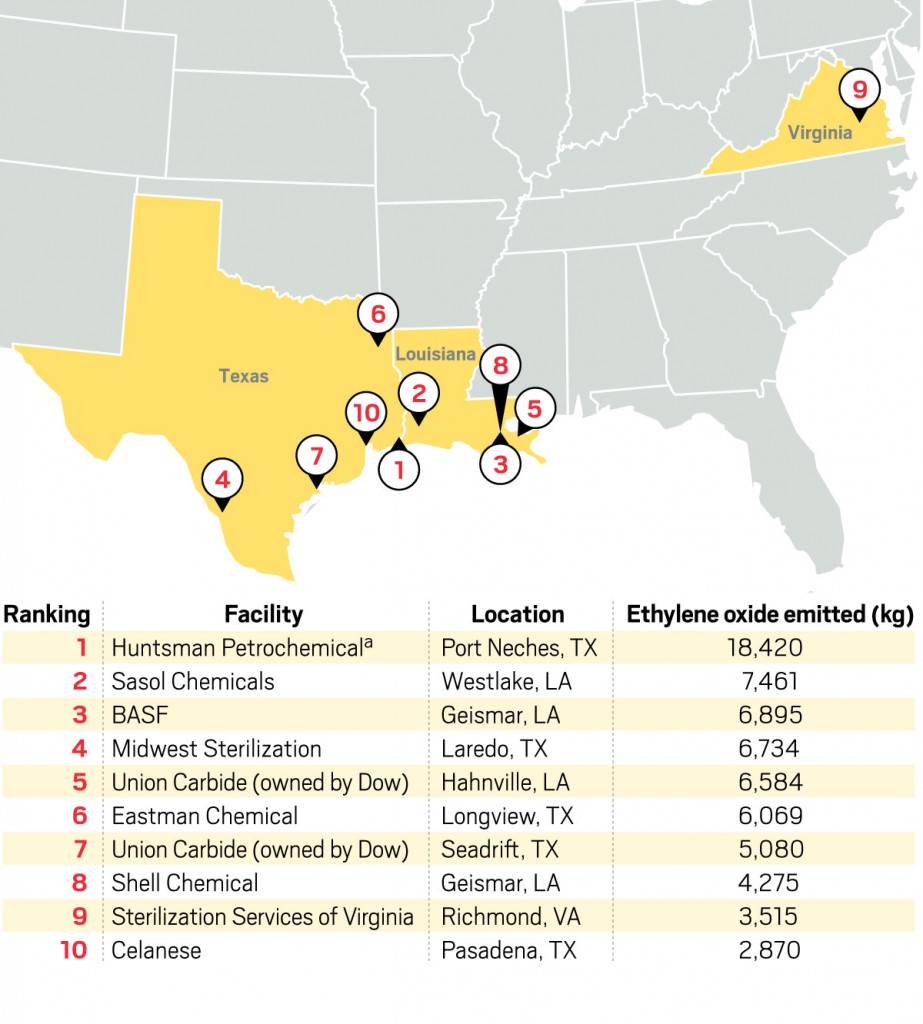

Interestingly, according to a table of EO emitters put together by C&E News, using EPA’s TRI data, none of the top sources of EO emissions in the US are in GA or IL. See below. They’re in LA and TX (with one in VA)

EO did not have a great month as news of the Industrias Quimicas de Oxido de Etileno (IQOXE) ethylene oxide (EO) plant explosion filtered through the industry. As reported in Chemanager, the explosion killed one worker and initially injured eight others in the late hours of Jan. 14. The ensuing fire raged into the morning hours of Jan. 15 and a local hospital confirmed the death of a second worker from extensive burns later in the day. According to reports, the explosion, which occurred in an ethoxylation reactor, then damaged a tank filled with 20 kg of EO, and shockwaves from the blast caused a building to collapse 2 km away, killing another man. Authorities said no toxic chemicals were measured in the atmosphere.

IQOXE, which is owned by Spain’s CL Grupo Industrial, said it has opened an internal investigation into the cause of the blast. The explosion took place in a part the complex that had begun operations in June 2017 and had been operating normally up to then. The affected facility may be one of several plants belonging to bankrupt PET producer La Seda de Barcelona that were acquired by Cristian Lay, a manufacturer of designer jewelry, watches and cosmetics, for only €15 million in 2014.

By the way, some of the video online is quite horrifiying:

Does EO have a problem? Is it a PR problem which turns quickly into a trial lawyer problem? To some extent that is up to the industry. The other side is already mobilizing.

Notwithstanding this run of bad news for EO, IHS published a rather bullish outlook on ethoxylation as summarized in the graph below:

After swallowing a large chunk of Huntsman, Indorama has created a new division to integrate the ethylene oxide (EO) and propylene oxide (PO) assets acquired from Huntsman, ICIS reported. Integrated Oxide will have under its name the $2.1bn assets acquired from Huntsman, which also included production plants for methyl tertiary butyl ether (MTBE) and surfactants. The facilities are located in Port Neches, Chocolate Bayou, and Dayton in Texas, US, as well as Ankleshwar in India, and Botany in Australia. The acquisition was announced in August 2019 and finalised earlier in January. Former Huntsman executive Alastair Port has been appointed president of Integrated Oxide, effective 3 January. He will report to Dilip Kumar Agarwal, CEO of the Feedstock and PET businesses. From what I understand most of the Huntsman organization remains in place at the acquired business.

A fascinating piece in ICIS News, discusses the Coronavirus, which this week killed more people than SARS. Among other things the outbreak was predicted to be potentially good for surfactants (as more are used in hygiene and washing) but potentially very bad for the Chinese and global economy. So, hard to say really how to play this one. Except – be careful when travelling out there.

Right at the end of the month, ICIS’s talented Lucas Hall published an outstanding analysis of the Q2 picture for fatty alcohols. He notes that the downward correction in the oil palm complex since the beginning of the year, as well as emerging concerns regarding the ongoing coronavirus outbreak in China, have stalled early negotiations for US Q2 fatty alcohols. Feedstock crude palm oil (CPO) and palm kernel oil (PKO) costs have posted significant declines in January following a sustained uptrend in Q4, tracking decreased demand for edible oils in China during the Lunar New Year holiday and decreased demand for Malaysian palm oils in India amid a diplomatic dispute between the two countries.

Feedstock oil prices trended up in Q4 ahead of the rollout of increased biodiesel blending mandates in Indonesia and Malaysia at the start of the year. The outbreak of the coronavirus in China as players return to the market following the Lunar New Year festivities has exacerbated concerns, as a lockdown in cities in China as well as curfews and curbs in travel weaken demand for edible oils in the food industry and limit economic activity in the country.

Crude palm oil (CPO) and palm kernel oil (PKO) closed lower at $661.12/tonne and $809.73/tonne on 28 January, the first day of trading after the market resumed in Malaysia following the Lunar New Year break, reflecting losses of 9.88% and 11.59% respectively. Costs have since come down further, prompting US players to establish a more wait-and-see stance as they monitor developments in China and elsewhere. CPO and palm stearin prices have fallen less significantly than PKO, easing any downward pressure faced by the long-chain alcohols.

Buyers rejected offers for the mid-cut, C12-15 detergent range of fatty alcohols commonly consumed into the US surfactants market in the low-to-mid 80 cent/lb DEL (delivered) USG (US Gulf) range, shifting instead to a more hand-to-mouth approach as they monitor movements in palm oil. Players are also monitoring developments ahead of the completion of Sasol's fatty alcohols expansion in Lake Charles, Louisiana.

In other news, MFG Chemical (Dalton, Georgia) continued integrating its Pasadena, Texas, facility in 2019, as well as implementing upgrades to its two plants in Georgia and Texas, as reported by ChemWeek. The Pasadena facility was acquired by MFG in 2018. Improvements in 2019 included a new stainless steel reactor at a pilot plant in Dalton, Georgia, and upgrades at Pasadena including a 20,000-gallon reactor and new capabilities for existing reactors. Oilfield chemicals and water treatment are two of the company’s four growth drivers, in addition to dioctyl sodium sulfosuccinate (DOSS), a specialty surfactant, and anhydrides.

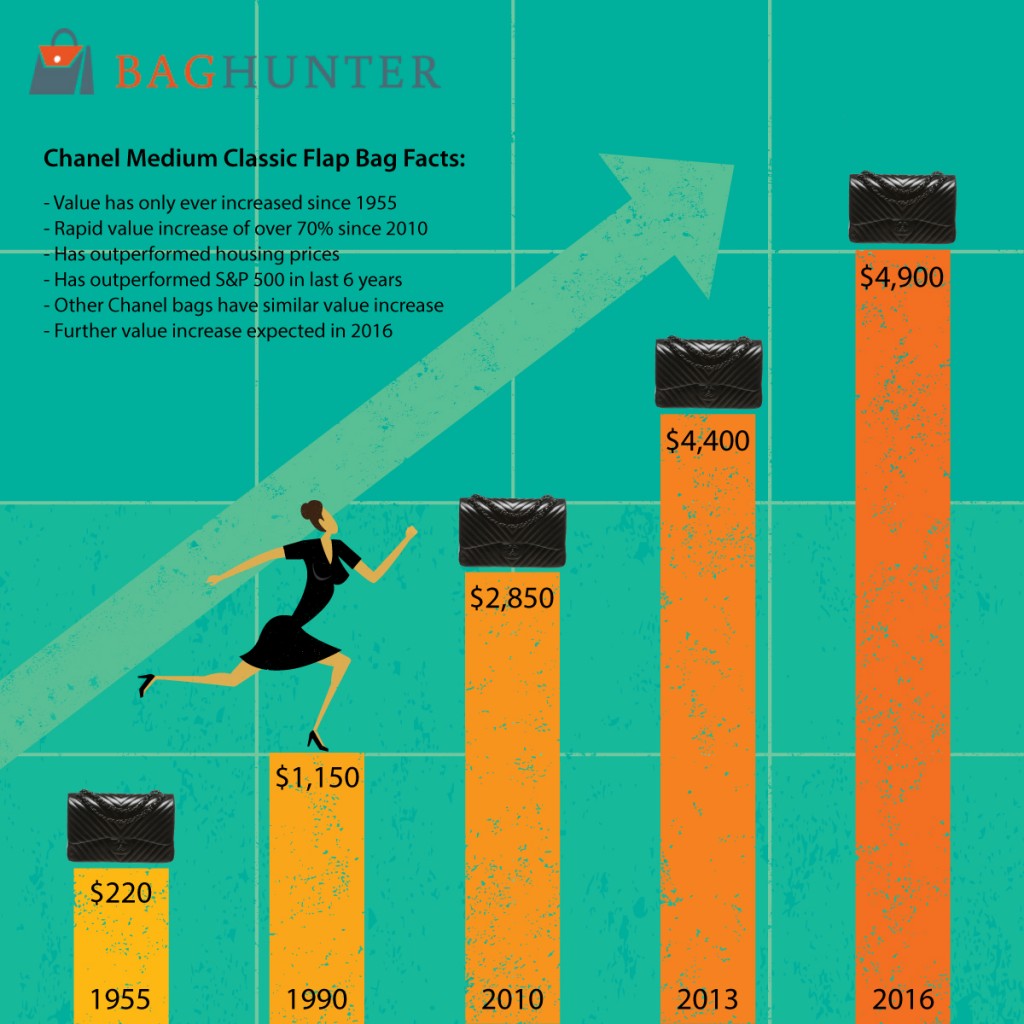

Finally, in news, only tangentially related to surfactants, P2 Science, of which your humble blogger is the CEO, reported the first close of its C-Round. The company brought in $12 Million and two new investors, one of whom is Chanel.

Yes, that Chanel, the one of perfume and handbag fame. This of course, is super-cool and a lot of new developments are slated for the coming year at our young company. I’m sure most of you are familiar with the BagHunter report showing that a Chanel handbag is one of the best investments you can make – right up there now with green chemistry.

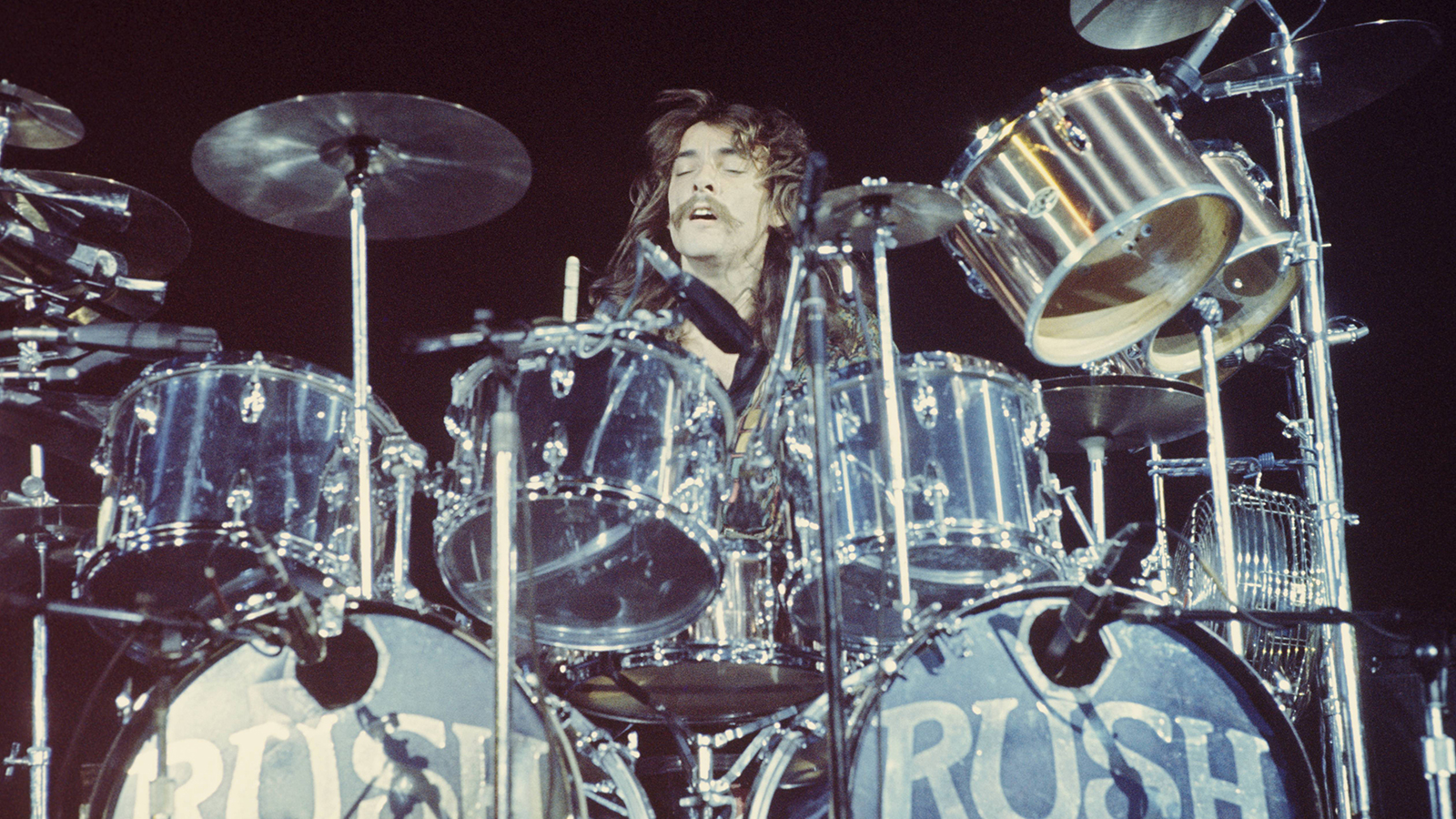

OK – that was the end of the news. Now as promised last month, more on Neil Peart. What to write about the world’s greatest drummer in the world’s greatest musical group, while still being interesting and readable? I’m going to focus on the lyrics because, since joining the group after the first album, Peart, a reader and thinker, wrote all of Rush’s lyrics. These songs, to me, were a soundtrack to growing up and are still a robustly relevant soundtrack to life today. I’ll talk about just a few songs that really got me thinking.

There are a few key themes that run through Peart’s lyrics. These are i) the struggle of the individual against an overbearing state – and particularly, within that category, the evils of communism ii) the tensions between the head and the heart , between logical reason and illogical love and iii) it has to be said, there’s a healthy distaste for religion in his songs, something which always bothered me a bit.

Here’s the first song from Fly by Night (1975) the first album on which Peart appeared. We sample the live version from 1976 in Toronto.

I’m not even going to comment on drumming, but honestly, the average 2 second drum fill from Peart is chock full of more goodness than a 10 minute drum solo by pretty much anyone else. In the lyrics, though you can already tell our lad’s been reading Ayn Rand and of course back then we all dutifully followed suit and got Atlass Shrugged etc out of the library. Interesting. Pure, harsh, objectivism, but still interesting.

Nonetheless, even after crediting the “genius of Ayn Rand” on one album, Peart was already driven to explore the role of the heart opposite the head. A pinnacle of this journey was the first side of the album Hemispheres, where Peart writes about the ancient struggle between the gods of love and reason for the possession of the hearts and souls of men. Here’s a video with lyrics.

Check out the incredibly percussive intro as Neil brings along Alex and Geddy especially from 1:57

If there was one thing pretty obvious early on with Peart, he really despised communism; not exactly a trendy view back then in that era of Che Guevara T shirts and red-star caps. A really crisp and shocking exposition of his views was captured in the song The Trees also from the Hemispheres album. Here’s the song and lyrics.

“And now the trees are all kept equal, by hatchet, axe and saw”

Peart loved free will as much as he hated totalitarianism. This next song also hints at some of his problems with religion. Freewill.

“The stars aren’t aligned or the gods are malign. Blame is better to give than receive”

The greatest example of Rush music to me is 2112 off the album of the same name. This was the album that propelled Rush into autonomy (meaning it made enough money so that they did not have to listen to the record company telling them what to write any more). The song is about the struggle of a lone man against the overpowering state. Our hero discovers a banned guitar in a future totalitarian world and is dismissed as a troublemaker. The song leaves an enormous question mark, however. Peart starts with a quote from the sermon on the mount. “and the meek shall inherit the earth” but does he mean it literally or is it stated with irony? Then at the end of the song, it appears that our hero actually commits suicide, but that is not 100% clear. It seemed unfair and inappropriate to me, notwithstanding the fact that the song overall is a 20 minute, guitar-bass-drums, masterpiece.

“My spirits are low in the depths of despair. My lifeblood spills over”

So where to go from here. For me it takes Peart 40 years to close the loop on 2112. The last song on their last album. The Garden.

“The measure of a life is a measure of love and respect. So hard to earn, so easily burned. In the fullness of time a garden to nurture and protect. “

I could go on forever on Neil Peart, but I hope this brief selection brought back some good memories. It did for me.

Thanks for reading.