Surfactants Monthly – April 2021

Later this month – May 25th – 27th, we have our 11th World Surfactants Conference. It’s online. Co-produced, as always, between your author and ICIS. We’ve got P&G, American Chemistry Council, Buss, IP, Integrity Biochem, Kline, Stepan and many many more participants with papers, panels and, of course, the famous surfactants awards which bring you the best and brightest in the indusry. Sign up and you can still get the cheap rate until May 7th. End of commercial.

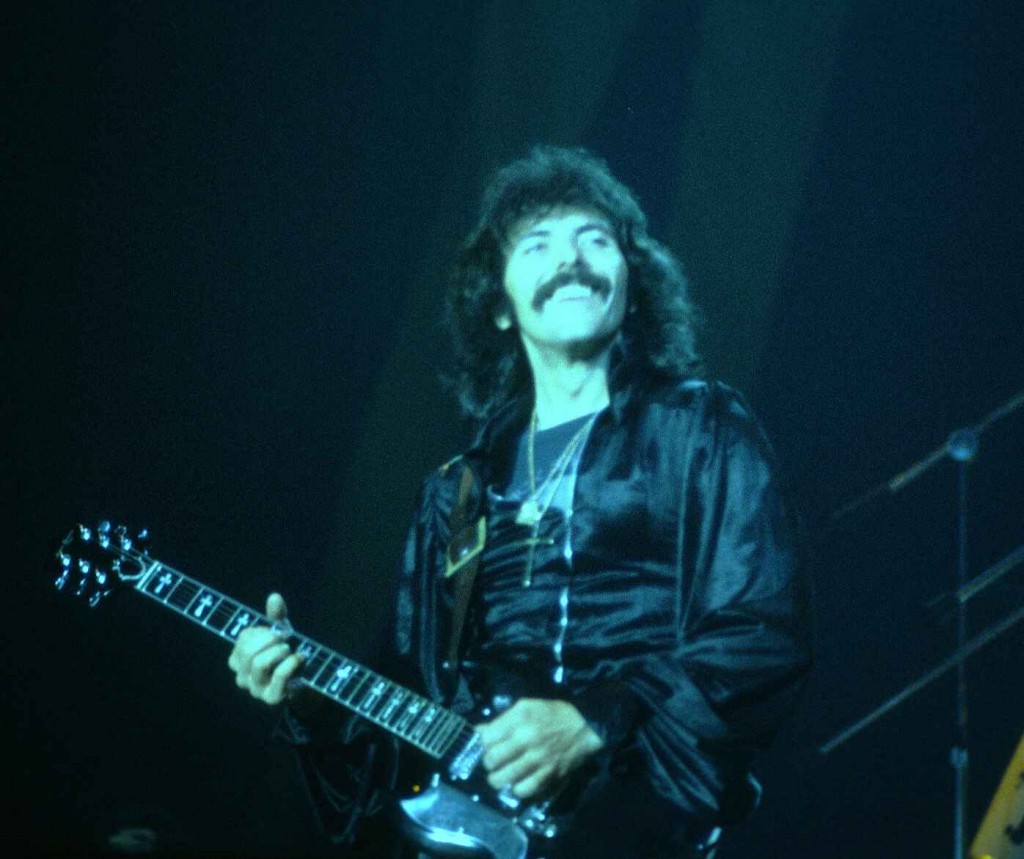

If you’re only here for the music – and I happen to know that’s a meaningful minority of you, skip to the end, where we muse on the incredible catalogue of Black Sabbath. Ever wondered what it takes to become the category defining best-in-the-world at something? One way – create the category, which is of course what Black Sabbath did. One can imagine some early 70’s movie director saying “hey get me one of those, like, heavy metal guitarist type guys, from central casting” and out would trot Tony Iommi. But of course, that would never happen because heavy metal was just invented in 1970 with the release of the first Black Sabbath album, largely written by the inimitable Iommi who, had the most ridiculously appropriate back-story to his invention of this world-changing musical genre. Skip to the end to read on. End of music teaser.

Start of News: This month, again, seems to be chock full of news, so let’s get cracking.

Let’s start right at the end of the month. ICIS, on April 30th, published an outstanding topic page updating the continuing effects of the US Gulf Coast polar storms. Link here. This includes an interactive map – below. Oxiteno, Clariant, Dow, Sasol, Indorama and Shell are among the surfactants related companies with capacity impacted by storm. Of course, the wider chemical industry continues to be affected by what happened a few months ago and this pulls in products like butanol, where over 60% of US production capacity was impacted, second only to tert-butyl alcohol and butyraldehyde. Check out this infographic.

ICIS reported at the beginning of the month that Asia alcohol ethoxylates are starting to tip downward in price after a substantial run-up for most of last year. As reported - Asia’s fatty alcohol ethoxylates (FAE) market is expected to see limited spot activities in the near term due to weak market sentiment.

Fluctuations in the upstream palm oil complex and fatty alcohols markets are likely to weigh on sentiment and curb spot demand in the near term. FAE moles 7, 9 drummed spot prices fell by $15/tonne week on week to $1,610/tonne CIF (cost, freight and insurance) China in the week ended 1 April, ICIS data showed.

The lull in demand and weak market sentiment are expected to prevail following the return of the Chinese players after the Qingming holiday on 5 April. “Chinese players are likely to remain cautious and adopt a wait-and-see stance when they come back to the market tomorrow,” a trader said. Chinese spot interest for imported goods is likely to remain soft, tracking the Chinese domestic FAE prices. Chinese domestic FAE mols 7, 9 prices fell by yuan (CNY) 200/tonne to CNY12,100/tonne ex-warehouse in east China in the week ended 1 April, ICIS data showed.

Meanwhile in the US, mid-month, ICIS reported that Shell will lift the force majeure on linear alcohols and ethoxylates products produced at its US Geismar, Louisiana, plant at the end of April. Shell temporarily reduced operating rates and declared force majeure on the products following extreme weather-related disruptions to feedstocks and truck, rail and marine logistics in Texas and the US Gulf in mid-February. The plant has a linear alcohols capacity of 195,000 tonnes/year, according to the ICIS Supply & Demand Database.

In not unrelated news, in an outstanding analysis by the great Lucas Hall, ICIS also reported that US fatty alcohol contracts are set to increase due to higher feedstock costs and shipping problems. Mid-month ICIS noted that Q2 fatty alcohols contracts were assessed higher, tracking volatile but overall higher feedstock costs, persistent shipping logistics constraints and strong demand across the core end sectors. Feedstock costs across the oil palm complex were overall higher in Q1, tracking strong demand in the key India and China markets as those countries recover from the coronavirus pandemic as well as historically tight stock levels in key producing country Malaysia. Historically tight stocks of other feedstock vegetable oils like soybean oil (SBO) have also underpinned the wider market.

Sustained shipping constraints, including labour shortages and tight shipping equipment availability continue to prompt major shipping delays and support higher internal and external freight costs. Q1 imports remain delayed and Q2 delays are expected.

Internal rail markets are also tight, increasing demand for trucks and prompting delays in that market. Rail lead times are heard around 4-6 weeks and truck lead times around 7-10 days. Shell confirmed it will lift the force majeure on linear alcohols and ethoxylates products produced at its US Geismar, Louisiana, plant at the end of April. Sasol confirmed its force majeure on alcohols produced at its US Lake Charles, Louisiana, plant will extend into May.

Mid-cut alcohols have grown tighter amid amid the bottleneck in demand for surfactants from the extreme weather-related disruptions to production in Texas and the US Gulf in mid-February. Surfactants are expected to remain short well into Q2. The recent bottleneck in the Suez Canal has delayed shipments on vessels making stops in Europe before they head across the Atlantic to the the North American East Coast. Shipments west have not faced further delays.

Prices:

The prices in the below table reflect freely negotiated prices confirmed among buyers and sellers of both synthetic (that’s petrochemical) and natural (that’s palm kernel oil based) alcohols. All prices De’ld US Gulf Coast basis.

| Product | Price (cents/lb) |

| C12-C15 | 100-110 |

| C16 | 90-107 |

| C18 | 80-97 |

| C16-18 | 85-109 |

Prices at the low end of the above ranges largely represented prices heard for petrochemical alcohols. Prices for natural mid-cut C12-14 alcohol were largely heard in the 105 cents/lb range and above. Prices for natural C16 alcohols were largely heard toward the 100 cents/lb range and above. Prices for natural C18 alcohols were largely heard toward the 90 cents/lb range and above. Prices for natural C16-18 blended alcohols were largely heard toward the upper-90 cents/lb range and above. Demand for C16-18 blended and single cut C16 alcohols outpaced C18 alcohols demand, tightening those markets and supporting higher prices. Some producers are blending a higher proportion of C18 alcohol into their blended cuts in order to offset tight C16 alcohol supply, causing that market to tighten. Synthetic alcohols prices were largely heard significantly lower than natural alcohols prices as producers looked to capture market share amid a protracted outage and force majeure in the market made worse by weather-related disruptions from mid-February. Oleo alcohols prices were largely heard higher, tracking both higher feedstock and internal/external freight costs.

US spot mass balance premiums were assessed up 0.5 cents/lb on the high end at 5.0-7.5 cents/lb DEL (delivered) US Gulf. Prices were based on market feedback. Supply is short amid persistent shipping constraints following recent bans on palm imports from major Malaysian palm oil producers into the US market. Think about that – an unintended consequence or not.

Some great technology news from Unilever: ICIS notes that Unilever and partners LanzaTech and India Glycols have succeeded in producing a surfactant made from recycled industrial carbon emissions - rather than fossil fuels. The new surfactant will be used in an “OMO” laundry capsule, and it will be launched in China on 22 April. It will come at no extra cost to consumers, the companies said. The production process involves three stages: Capture: LanzaTech uses biotechnology to capture waste industrial emissions at its Beijing Shougang LanzaTech plant in China and converts these emissions to ethanol. Conversion: India Glycols Ltd converts the ethanol into ethylene oxide, a key feedstock to make surfactants at their site in India. Formulation: Unilever uses the surfactant in the new OMO laundry capsules, manufactured at its Hefei factory in China. Details about project costs or production volumes were not disclosed. [OK – and that’s fine. There’s every chance that, at this early stage, the whole thing is a cash – loser for the companies involved. But that’s OK as the point is to prove technology and capability. I wish this collaboration much success and we’ll be watching closely as the efforts scales into financial sustainability in the future. ]

I’ve written in another forum about inflation and the insidious effects of printing money on the economy. More than quadrupling the money supply over the course of the last year, has to have some effect. One area where the ugly kleptomanic head of inflation monster is seen now in the surfactant market. Much of it is supply disruption related, but in a time of high demand – is this something to be worried about on a macro level? Read on.

Antoinette Smith reported in ICIS that rising feedstock ethylene spot prices, snug supply and strong demand are pressuring prices for US ethylene oxide (EO) derivatives. Ethylene supply has been constrained since the mid-February storm that shut large portions of US Gulf chemical production. Storm-related outages pushed March ethylene contracts to the largest increase in 15 years and their highest level since October 2014. Most crackers have restarted, but more recent outages have kept ethylene spot prices elevated. Ethylene contracts are influenced by the month's spot prices along with production costs. In line with the March ethylene settlement, EO contracts also rose to a six-year high. Since November 2020, EO contracts have increased by a cumulative 62%, amid strong demand and production issues for EO plants.

With such significant increases in upstream values, EO derivatives and downstream surfactants are experiencing price pressure as well. Indorama nominated 8-10 cent/lb price increases for May EO derivatives, including ethoxylates, EO/PO (propylene oxide) block copolymers and surfactants, according to a customer letter seen by ICIS. The company cited continued increases in raw material and energy costs, as well as supply/demand dynamics. The company did not immediately respond to a request for comment from ICIS. Dow separately nominated 10 cent/lb increases for its May surfactants prices, and did not cite a reason in its customer letter. The company did not immediately respond to a request for comment from ICIS. US Q2 fatty alcohols contracts also recently settled higher, amid increased feedstock costs and persistent shipping constraints.

Meanwhile in related EO based reportage, the legendary AL Greenwood reports that Dow has started up a (new) polyethylene glycol plant in Louisiana, the US-based company confirmed on Friday. The new plant will allow the company to meet growing demand from pharmaceutical and consumer-product applications, Dow said. The company did not reveal the capacity. Regular readers know that - in the second half of 2021, Dow plans to complete a new alkoxylation plant in Plaquemine, Louisiana. The plant will supply surfactants to several end markets, such as home and personal care; oil and gas; lubricants; industrial and institutional cleaning; and infrastructure. The capacity of the new unit will be 100,000 tonnes/year, and it will allow Dow to expand in a number of key product lines, such as TRITON, TERGITOL, ECOSURF, CARBOWAX, SENTRY and UCON.

Also - by the end of 2021, Dow should complete the expansion of a cracker in Fort Saskatchewan, Alberta province in Canada. The expansion will add 130,000 tonnes/year. Dow is splitting the cost and its portion of the expansion with an unnamed regional partner. As a result, Dow's share of the expansion will be 65,000 tonnes/year.

Dow had disclosed the project in January 2020. At the time, the capacity of the cracker was 1.1m tonnes/year. Capital expenditures (capex) for the project were expected to be $200m-225m.

Speaking of going big in the surfactants value chain: Stepan had a great 2020 and so the results reported for Q1 of 2021 as many of the strong fundamentals and smart strategy of last year, continued to propel the business. ICIS reported that logged a 34.8% year-on-year increase in Q1 operating income, driven by its surfactant and polymer segments.

Three months ended 31 March 2021:

| (in thousand $) | Q1 2021 | Q1 2020 | % Change |

| Revenue | 537,740 | 449,987 | 19.5 |

| Gross profit | 108,980 | 79,269 | 37.5 |

| Operating income | 53,914 | 40,004 | 34.8 |

| Net income | 40,611 | 27,539 | 47.5 |

Surfactant operating income was $53.2m, up from $36.2m in Q1 2020, primarily driven by improved product and customer mix and higher global demand in the agricultural and oil field end markets. The upside was partially offset by lower North American sales volume into the consumer product end markets due to the supplier force majeures (ugh – that’s a real pity) which followed the severe weather in Texas in February. Surfactant supply chain expenses were lower year on year, mainly because in Q1 2020 the company had a plant power outage at its Millsdale site in Illinois. Total global surfactant sales volume was flat versus the prior year.

Polymer operating income was $18.0m, up from $7.5m in Q1 2020, with the increase primarily attributable to a 32% increase in global sales volume. In particular, global rigid polyol volume was up 32% year on year, largely due to the INVISTA polyester polyol acquisition. Global rigid polyol volume, excluding the INVISTA acquisition, was up 8%.

Also, the non-recurrence of the Q1 2020 Millsdale plant power outage lowered supply chain expenses year on year.

Specialty Product operating income was $2.6m, down from $4.0m in Q1 2020, with the decrease primarily attributable to lower margins, resulting from raw material shortages and manufacturing challenges within the medium chain triglycerides (MCTs) product line.

"Looking forward, we believe our surfactant volumes in the North American consumer product end markets should recover following the supply chain disruptions caused by the severe weather in Texas,” said CEO F. Quinn Stepan. Meanwhile, heightened consumer demand for disinfection, cleaning and personal wash products will continue, and demand for surfactants within the agricultural and oilfield markets is expected to improve, compared with 2020, the CEO said. Regarding rigid polyols, global demand continues to recover from pandemic-related delays and cancellations of re-roofing and new construction projects, he went on. This gradual recovery, combined with Stepan’s acquisition of INVISTA's aromatic polyester polyol business in Q1, should position the company’s polymer business to deliver growth versus prior year, the CEO said.

“We believe the long-term prospects for rigid polyols remain attractive as energy conservation efforts and more stringent building codes are expected to continue,” he said, adding that, in the specialty product business, results should improve slightly year on year. “Despite current raw material price increases and some supply constraints, we are cautiously optimistic about the remainder of the year," said the CEO.

In further comments during the presentation Stepan noted they anticipate continued Covid-related demand for surfactants into cleaners and disinfectants, even as the pandemic is expected to recede in coming months. "We believe there may be some decline in consumer washing habits as we go forward but those will be offset by enhanced cleaning in the industrial and institutional markets," said Quinn Stepan Jr,

“Cleaning protocols in public spaces - schools, hospitals and airplanes, for example - have changed due to the pandemic”, said Luis Rojo, vice president and CFO.

Scott Behrens, president and COO, said: "A lot of the hospitality industry is going to try to restore public confidence that their families can be safe in these public places, so visible cleaning should be a big part of economies reopening around the world." Behrens said these changes - for example, cleaning crews being active during the day when people are present to see the cleaning being done, rather than in the middle of the night - could provide a boost to Stepan's surfactants business. "We’ll see how that impacts us – if it offsets the consumer demand,” Rojo said.

Rounding out the month, some good analysis in the US and Asian fatty alcohols markets points to upward price pressure partly supported by supply constraints.

First in the US: Lucas Hall reports US fatty alcohols supply is expected to remain snug to tight in Q2, amid volatile feedstock markets and continued shipping logistics constraints, against the backdrop of healthy-to-rebounding demand.

Supply chain management from southeast/south Asia remains constrained because of pandemic-related disruptions and ongoing shipping logistics constraints, including labour shortages, tight isotank/container/vessel availability and bullish freight rates.

Lead times from Asia are upwards of four months, particularly for product shipped in isotanks or containers. Bulk volumes also have longer lead times, but remain relatively more liquid. In particular, renewed lockdown measures across India may exacerbate lead times from that country. India is a key supplier of C16-18 alcohol chains to the US.

February imports were at multi-year lows despite overall healthy-to-strong demand, further suggesting supply chain constraints.

Source: ITC

US Domestic production also remains constrained following weather-related disruptions in Texas and the US Gulf in February. Shell will lift its force majeure at Geismar, Louisiana, on 30 April. However, Sasol will remain on force majeure at Lake Charles, Louisiana, into May. The plant has been on force majeure for alcohols production for the better part of the last year.

Volatile but overall bullish feedstock costs are adding to the pressure, weighing on production margins and operating rates. Feedstock costs across the oil palm complex rose around $50/tonne this week, tracking higher prices for soybean oil (SBO).

US SBO markets remain bullish, tracking historically tight inventories amid drought conditions in parts of the US, reduced crops, pandemic-related labour shortages and strong demand from the renewable diesel sector and China.

| Product | Delivery | 27 April | 20 April |

| CPO | DEL, south Malaysia | M$4,480.00 | M$4,250.00 |

| PKO | DEL, south Malaysia | $1,404.80 | $1,346.07 |

| Palm Stearin | FOB, Malaysia | $1,090.00 | $1,050.00 |

All prices are on a per tonne basis. Source: Matthes & Porton

Ethylene prices are also at historic highs following a roughly eight-month stretch of supply disruptions, ranging from the 2020 Atlantic hurricane season to February's winter storm, which have pressured synthetic alcohols markets.

Sustained supply constraints and feedstock cost pressures are limiting spot availability as demand continues to ramp up. Some manufacturers were keeping lower than usual inventories amid feedstock and demand volatility during the pandemic. As a result, downstream surfactants inventories were left critically low following the February storm just before the US economy started to reopen with the advancing vaccination programmess and easing pandemic-related restrictions nationwide. Demand in the core cleaning sector is expected to remain strong through 2021, especially as travel picks back up as restrictions ease. Demand in industrial applications is also increasing on the back of rising crude prices and easing restrictions.

This combination of factors is likely to maintain upward price pressure on the market through Q2, with spot prices likely to trend above contract levels in the near-to-medium term.

Meanwhile in Asia Helen Yan of ICIS reports that Asia’s fatty alcohols market is likely to remain buoyant in the near term due to the pandemic-induced demand for home and personal care products. Demand for fatty alcohols is expected to be firm because of the surge in infections in Asia, including India, Thailand and Japan. “Home and personal care is a growth sector, we expect demand for fatty alcohols to increase because the pandemic has raised consumer concerns for health safety and home and personal hygiene,” a supplier said

India, which is currently seeing soaring infections and rising fatalities, is expected to continue to see firm demand for fatty alcohols. Manufacturing, textile, consumer durables, automobile, travel, and hospitality, are facing disruptions as more states in India impose stringent curbs on public movement and transport to combat the pandemic. “Despite the renewed lockdown restrictions, the home care manufacturers in India are still running as they are providing essential services,” a supplier said.

Apart from growing demand, logistics issues, high freight costs and volatile upstream costs are likely to lend support to the fatty alcohols market in Asia in the near term, market sources said. However, with the key Chinese market closed for the Labour Day holidays 1-5 May, spot appetite is expected to remain sluggish in the coming week. “We will wait and see until the Chinese market reopens and hopefully we will have a clearer picture,” a buyer said. Demand for fatty alcohols is strong, a trader said.

"We expect the market to remain firm in the near term, despite the volatility in the upstream palm oil markets,” the trader added.

Wrapping up this April’s news: We reported last month that Clariant and India Glycols formed a surfactant ventures in India. Clariant’s first quarter overall turned out OK according to the company as reported to ICIS. The Swiss producer’s first-quarter results on Thursday showed a return to growth. Earnings before interest, tax, amortisation and depreciation (EBITDA) margins were stronger than in the same period a year prior, and Clariant hopes to continue this in the second quarter, its CEO Conrad Keijzer said to ICIS. “We are pleased with our profitability, particularly considering the inflation we saw on raw materials and logistics, which we managed to offset in all business units for the first quarter,” said Keijzer. “We expect a continued recovery with moderate sales growth compared to last year and see EBITDA margins above pre-covid levels.”

Clariant’s ongoing cost savings programme helped to support the company’s growth, the CEO added, while at the same time compound the Swiss producer’s position as a specialty player.

“We are divesting one third of our portfolio, which are mature businesses. This helps us to focus on catalysts, care chemicals and natural resources, which are pure specialty,” said Clariant CFO Stephan Lynen. “This transformation sharpens the portfolio from a trading perspective, helping us get away from commodity chemicals into specialty valuation,” he added. Although streamlining remains a key strategy, acquisitions are not off the table, but there are currently no concrete deals. “We would love to make value creation in core business, there is pipeline lists of companies in all three business areas, but you need buyer and seller,” said Keijzer. Despite turbulent macroeconomic conditions in the first quarter, improvement in the aviation sector in Europe helped Clariant mark a return to growth. Seasonal demand for Clariant’s de-icing products used on airplanes helped sales in Europe rise by 17% in local currency in spite of the restrictions put on air traffic to contain the spread of the pandemic. The aviation industry is facing challenges not only in the short term, but while the longer term industry may be shaped by environmental concerns, Keijzer believes that it will be resilient. “Aviation will be there, it is a matter how can we make it more sustainable, but aviation is not an industry that will disappear,” he said. Strength in Europe is welcomed, but Clariant’s attentions lie in other regions. “Certainly, China is very important market for chemicals, as it already represents 40% of the global chemical market. For us, it is 10% of our sales, so there is a big growth opportunity,” said Keijzer.

“India is not the size of China for chemicals, but it is an important growth market, particularly for surfactants, and we were very pleased in Q1 with [newly established joint venture] India Glycols, makes us one of the country’s leading surfactants players right away.”

End of News – So what about Black Sabbath’s Tony Iommi as teased at the top of the blog? It’s a pretty well-known story – but I’m going to pull pretty heavily on Wikipedia here.

At the age of 17, Iommi lost the tips of the middle and ring fingers of his right hand in an industrial accident on his last day of work in a sheet metal factory. Iommi described how he "was told 'you'll never play again'. It was just unbelievable. I sat in the hospital with my hand in this bag and I thought, that's it – I'm finished. But eventually I thought 'I'm not going to accept that. There must be a way I can play'." After the injury Iommi's factory foreman played him a recording of famous jazz guitarist Django Reinhardt, who as Iommi would learn was only playing with two fingers on his fretboard hand because of an injury he sustained in a terrible fire. Inspired by Reinhardt's two-fingered guitar playing, Iommi decided to try playing guitar again, though the injury made it quite painful to do so. Although it was an option, Iommi never seriously considered switching hands and learning to play right-handed.

He decided to continue playing left-handed. To do so, he fitted homemade thimbles to his injured fingers to extend and protect them; the thimbles were made from an old Fairy Liquid bottle [and hence, dear reader, the link to surfactants – you think we just throw in random stories here? No way!] –Two problems: First, the thimbles prevented him from feeling the strings, causing a tendency to press down very hard on them. Second, he had difficulty bending strings, leading him to seek light-gauge guitar strings to make it easier to do so. However, Iommi recalls that such strings were not manufactured at the time, so he used banjo strings instead, until around 1970–71 when Picato Strings began making light-gauge guitar strings. Furthermore, he used the injured fingers predominantly for fretting chords rather than single-note solos. In 1974, Iommi told Guitar Player magazine that the thimbles "helped with his technique" because he had to use his little finger more than he had before the accident. Later, he also began tuning his guitar to lower pitches, sometimes as far as 3 semitones below standard guitar tuning (e.g., on "Children of the Grave", "Lord of this World", and "Into the Void", all on the album Master of Reality). Although Iommi states that the main purpose of doing so was to create a "bigger, heavier sound", slackening the strings makes it easier to bend them.

Iommi reflected in 2016 saying “Right at the beginning I was told by doctors: ‘You won’t be playing guitar.’ But I believed I could do it, and I did.”

Need I say more? Can there be a better more inspirational biographical story for the guy that created heavy metal. He lost the tips of his fingers in a metal-working accident and still played an iconic guitar sound that came to be imitated by millions across the world. So, you think have some setbacks? OK but you know what? You can still be the best in the world. Tony Iommi, the central- casting guy for heavy metal guitarist did it.

OK then – so what about that sound? The one thing I loved about Black Sabbath when I first heard them at 9 years old, was their completely unapologetic unself-conscious nature. They had something to say and a way to say it - and they just ploughed ahead, completely oblivious to the critical scorn poured on them by the musical cognoscenti of the time. Here’s track 1 from their first album. A little thunder and lightning, a doom laden riff and Ozzy starts singing about “Satan sitting there, he’s smiling”. In a year when Simon & Garfunkel topped the charts was anything ever so out of step with the culture?

From that point forward, those fairy-liquid bottle tipped fingers inspired so many guitars ranging from those in Metallica, Judas Priest and Iron Maiden to today’s thrash and doom metal bands. A niche band? Well, in the beginning, they created the niche, which turned into a mainstream genre. 46 Million album sales over 19 releases. Not exactly obscure.

Here’s another favorite of mine we had in last month’s blog, but so what. It’s my blog so… also off the first album – The Wizard

Notice not only the riff, but the drums – and bass - and the harmonica. And no-one listening to this for the first time can claim not to have goosebumps at the 44 second mark with that break. That’s losing-the-tips-your-fingers creativity right there!

Next – also in 1970 came the second album Paranoid. Everyone in the Western hemisphere for sure, but also in many parts of Asia knows the title track and much of lyrics “finished with my woman, ‘cos she couldn't help me with my mind” – but there are many other metallic treasures on these 12 vinyl inches. For example, this iconic opening track with air-raid sirens, blood freezing chords and intensely relevant lyrics. This song is fifty years old today but at the time it was released came just 25 years after the end of WWII.

How about this one from the same album, which has worked its way into the popular culture – Iron Man. Gotta love the incredible thud-thud-thud buildup to another one of the 20th Century’s most recognizable riffs.

The third album, Master of Reality, released in 1971 contains this gem which, on first listen sounds like it could be amalgam of or tribute to every heavy metal song ever recorded. Except – well, no-one else was doing this 50 years ago.

<

The Sabs' views on the environmental movement are not known, but this song, coming a year after the first earth day, should be enough to warm the most ardent tree-huggers heart – Into the Void. Check out the most ridiculously ponderous opening segment before the chugging riff imitates the steam-punk progress of a spaceship escaping the “misery and woe” on earth. Then at 3.04 they crank it up again – Hey do you think the lads of Iron Maiden might have listened to a bit of Black Sabbath when they were growing up? Yeah – I think so.

The 4th Sabbath Album, Volume 4, in 1972 contains this song which I believe may be the most upbeat metal song ever recorded. Supernaut.

I could go on and on, but I’ve got a day-job, so, let’s finish with something off Sabbath Bloody Sabbath, which to me as a 12 year old kid, when it was released, had the scariest album cover I had seen then or since. The eponymous title track had a catchy riff for a Sabbath song and some populist lyrics that captured something of the Zeitgiest at that time - including that bit in the middle – you know that bit you would sing at the top of your lungs when your parents weren’t around…

And don't forget the bit starting at 3:20. Wow – never gets old.

OK – so there it is. The kid with his fingertips sliced off in the metal factory goes on to define a global musical phenomenon. It’s Monday. You have some challenges. Everything's not quite perfect in your life. What're you gonna do in the week ahead?

One thing you should do is invest in yourself and register for our conference. Sorry - had to do that. The bigger point still stands though. It's Monday. What are you going to do?