Surfactants Monthly – April 2020

The news this month, as in other months, comes from ICIS and I continue to encourage you to subscribe, as I do , to their many great services. We’ll get straight into it first and then I’ll follow the news with a brief editorial on COVID, health, wellness and freedom - accompanied by a couple of American punk rock classics.

As you might expect with what is going on in oil markets, the month started with US March ethylene oxide (EO) contracts being settled at a decrease, to the lowest level since summer 2012, on lower upstream ethylene contracts. Contracts are assessed at 46.4-55.9 cents/lb ($1,023-1,232/tonne) FOB (free on board) US Gulf. March feedstock ethylene contracts settled at a decrease of 2.25 cents/lb to 21.75 cents/lb, their lowest level since 2002.

In other unsurprising news: US-based polyurethanes and chemicals producer Huntsman Corp will hit the pause button on mergers and acquisitions (M&A), its CEO said in an interview with ICIS. “Certainly at this point we’re taking a pause just because cash is king. Our first and foremost responsibility to our shareholders is to make sure we have a strong balance sheet,” said CEO Peter Huntsman in an interview with ICIS. “We have a revolver well in excess of $1bn and we’ve got $1bn of cash on our balance sheet. We have a very strong balance sheet today - among the strongest in the chemical industry - and we want to make sure we maintain that,” he added.

Huntsman on 16 March announced the planned acquisition of epoxy resins and nitrile latex producer CVC Thermoset Specialties for $300m in cash, representing about a 10x multiple on earnings before interest, tax, depreciation and amortisation (EBITDA), in a deal expected to close by mid-2020.

This follows the closing of its $350m acquisition of spray polyurethane foam (SPF) producer Icynene-Lapolla on 20 February. “We’ll be very, very cautious, and again, I don’t think we’ll recover [from the coronavirus crisis] overnight - it’s not that we’re back in 45 days doing deals again,” said Huntsman. “At the same time, we do need to look at the value of our shares, that we’re protecting our dividend, and we need to make sure we’re not only preserving capital but also looking at opportunities as they may come,” he added.

Huntsman gained the financial flexibility for its latest two deals from the sale of its intermediates and surfactants business for around $2bn to Indorama on 5 February. Even prior to the deal, Huntsman has been steadily reducing debt levels through the years. “If you’re today trying to reduce debt, generate cash and get a strong balance sheet in [this] environment, it’s not going to work. You’ve got to have done that before you get into these sort of crises. That’s why we’ve been putting such an emphasis on this over the last couple of years and since the last recession - to make sure we get in shape before the next crisis,” said Huntsman.

The sales of its intermediates and surfactants business gave Huntsman a leaner and less capital spending (capex)-driven portfolio.“It’s a bit smaller, but more nimble with a stronger balance sheet. And we have the levers in place that when we get to another great recession or a 9/11 incident or even today, that we have the ability to move freely,” said Huntsman.

Another unsurprising development: Contracts for natural mid-cut alcohols among large volume buyers negotiated earlier in the quarter largely settled at a decrease amid the downward correction in feedstock palm kernel oil (PKO) costs and healthier inventory levels at the beginning of the year. Mid-cut contracts settled later in the quarter - including contracts for synthetic volumes - toward the higher end of the range, amid tightening supply in southeast Asia, Europe and the US as a result of the coronavirus, made worse by the March plunge in crude oil futures.

C1618 contracts were mixed amid similar fundamentals, with prices for mixed C1618 and C18 single-cut alcohols settling toward the lower end of the range and prices for C16 single-cut alcohols toward the higher end of the range amid more protracted supply tightness in the global market. Contracts for premium material settled at a 3-5 cent/lb premium over non-premium volumes. Despite the settlements, supply is tight amid weaker production and sustained shipping and logistics constraints in south and southeast Asia and Europe stemming from coronavirus-related lockdowns and other disruptions.

Many Asian oleochemical producers have reduced operating rates and/or declared force majeure as a result of the lockdowns and other coronavirus-related disruptions. Disruptions in Asia are causing a knock-on effect across Europe and the US, which are also facing their own constraints as a result of the virus. As a result, many Q2 shipments are delayed until later in the quarter or Q3, prompting increased demand for spot volumes at higher prices within and above the posted ranges. Ongoing supply tightness is expected to continue to put upward pressure on the market until these constraints ease and the virus subsides.

US Q2 mid-cut alcohols were assessed 3 cents/lb lower on the low end and 3 cents/lb higher on the high end at 63-78 cents/lb delivered (DEL) in the US Gulf. US Q2 C1618 alcohols were assessed 2 cents/lb lower on the low end and 3 cents/lb higher on the high end at 88 cents/lb DEL in the US Gulf.

Meanwhile in Europe, European fatty alcohols second-quarter contract prices dropped amid falling upstream palm kernel oil (PKO) values throughout the first quarter. Prices decreased €100/tonne on the low end and €110/tonne on the high end to €1,100-1,300/tonne FD (free delivered) NWE (northwest Europe). Although palm kernel oil (PKO) values increased at the end of March and beginning of April, a number of contracts were settled at lower prices before this took place. PKO prices dropped back down this week. At the beginning of April, the market was tight with limited volumes available for spot purchases.

Earlier delays to vessels from southeast Asia have now been resolved. However, the lockdown in Malaysia has seen some producers close plants or reduce production, which will limit exports to Europe during the second quarter. There are no production issues domestically in Europe currently. The shortages seen in the region have been prompted in the main by strong demand for surfactants.

Buying interest has surged amid preventative measures put in place to curb the spread of coronavirus. Demand for detergents and soaps has jumped. Some downstream alcohol ethoxylates producers are said to have limited material available.

In a fascinating interview with the CEO of MFG, ICIS’s Joe Chang teased out some encouraging nuggets. I won’t give you the whole thing here, but here’s some highlights:

US-based MFG Chemical is proceeding with upgrades and expansions at its three Dalton, Georgia, plants which would boost capacity by 20-25%, its new CEO said. “Covid won’t slow down our focus on capital improvements… “Post-Covid, we’ll have even more entrepreneurial swing capacity where we can meet customers’ new product needs and opportunities with speed and agility. Innovation starts with our customers - we don’t go direct to end-use markets but work collaboratively with our key customers that do,” said Turgeon.

One of MFG’s core products is dioctyl sulfosuccinate (DOSS), which is used in oilfield chemicals among many other applications such as clear coats for inks, mining surfactants, dispersants for agricultural formulations, stool softeners and scale control and corrosion inhibition in water treatment processes. Its key feedstock is MA. MFG’s other specialty chemicals include amides, esters, imidazolines, water soluble polymers, rheology modifiers, specialty anhydrides and DOSS formulations. Along with MA, MFG is a buyer of 2-ethylhexanol (2-EH) for DOSS and glacial acrylic acid (GAA) for water treatment formulations. The company is not seeing any major availability issues, as it sources most raw materials locally, said the CEO.

An excellent analysis by ICIS reporters on the relationship between EO and Crude was published around mid-month.

According to this ICIS analysis: The correlation between US ethylene oxide (EO) and crude oil prices has returned in 2020, after a sustained period of disconnect brought on by the shale gas boom. That correlation is likely to continue, as oil prices strongly influence the pace of drilling activity, and much of US natural gas liquids - including ethane - currently comes from shale oil wells. Crude production cuts are expected to reduce ethane co-production, helping to ease oversupply and possibly supporting ethane prices.

Although in the rest of the world most feedstock ethylene is produced using crude-source naphtha, most US ethylene is made using ethane, extracted from shale gas plays. As illustrated in the following chart, US EO contracts rise and fall with upstream ethylene contracts.

The majority of EO contracts are formula-based, and price movement comprises 80% of the change in the ethylene price and an additional conversion fee, or adder. Like ethylene, EO contracts are settled at the beginning of the month for the previous month’s price.

As seen in the following chart, ethylene movements closely correlated with crude prices until the early 2010s. That was when the shale boom began in the US, making ethane the preferred feedstock over crude oil, because of the significant cost advantage.

At the same time, ethylene derivative production became more integrated, causing EO prices to be based on ethylene contracts, which are settled by taking into consideration the month's ethylene spot prices and production costs. From that time, ethylene prices, and subsequently those of EO, much more loosely followed crude oil movements.

Starting in January 2020, crude prices began a steep decline, due to lower demand amid the rapidly spreading coronavirus, and ample supply with dwindling storage space. In March, crude oil prices plummeted when Saudi Arabia and Russia announced they would not adhere to previous production cuts - effectively declaring an oil price war.

The following chart shows the recent correlation between ethane-based EO and crude oil prices.

To bolster oil markets, this week the members of OPEC and its allies (OPEC+) agreed to lower production by 9.7m bbl/day in May and June before tapering off the cuts through April 2022. But the historic production-cut agreement has so far failed to halt the decline in crude prices, threatening margins for petrochemical producers.

Stepan Company reported lower Q1 surfactants earnings because of higher supply chain expenses and lost sales associated with an unexpected shutdown at the company's Millsdale, Illinois, plant in February as well as lower demand in agricultural and oilfield end markets, it said in its quarterly earnings presentation.

Earnings were also down amid lower selling prices due to the passthrough of lower raw materials costs.

These factors fully offset strong volumes in global consumer product end markets driven by increased demand for cleaning and disinfection products as a result of the coronavirus pandemic and a $4.2m operating income improvement in Mexico.

Surfactants operating income was $36.2m, down $1m or 3% year on year. Net sales were down 6% year on year at $327m.

Despite weaker demand from the agricultural and oilfield sectors, Stepan expects surfactant demand to remain relatively strong in the short term. "With empty store shelves around the world due to high demand for disinfection and cleaning products, our surfactant volume in the consumer products market should remain relatively strong short-term," said CEO Quinn Stepan. Falling raw material costs may also provide an opportunity for margin improvement. "With dramatically lower oil prices, demand for surfactants within the oilfield market will be down. We anticipate our agricultural business should approximate last year's results. Overall, we believe our surfactant business should remain relatively recession resistant," said Stepan. [ my comment – as with the financial crisis in 2008 / 2009, we expect Stepan to weather this storm in much better shape than many other industrial companies. Surfactant businesses are recession resistant and Stepan is nothing if not a surfactant business. Attendees at our 2013 surfactant conference may remember my antifragile assessment of Stepan’s business model. It applies today perhaps even moreso. By the way, this is not a commnent on the stock price - just the business model]

Somewhat shocking news appeared late April in Bloomberg - Sasol Ltd. is looking to sell a large stake in its $13 billion chemical complex in the U.S., as the South African energy producer moves to shore up finances amid an historic rout in the oil market, according to people with knowledge of the matter.

The company has hired Bank of America Corp. to help find a buyer for a minority stake in the Lake Charles chemical project, said the people, who asked not to be identified because the matter is private. Sasol previously indicated it was considering a partial sale of its U.S. base-chemicals business to avoid a last-resort rights issue. Sasol would prefer finding an industrial partner for the stake and may structure any deal as a joint venture, one of the people said. The goal is to reach a deal by June, the person said.

The move to find a buyer highlights Sasol’s need for cash as it struggles with debt taken on to develop the Lake Charles complex in Louisiana, originally seen as a way to become a global operator and diversify away from oil. Its cost has more than doubled since early estimates to almost $13 billion, while the current crash in oil prices has choked off revenue and taken the company to the brink. Sasol shares have been in freefall since investors saw pressure building on the balance sheet, sliding 82% this year. They rose as much as 2.1% on Tuesday after news of the planned Lake Charles stake sale, before trading 1.1% lower at the close in Johannesburg.

Sasol said last month it plans to raise $6 billion by the end of its 2021 financial year, mainly through asset sales, as it seeks to reduce net debt of about $10 billion. The company left open the possibility of selling as much as $2 billion of shares, and is also in negotiations with lenders to arrange greater flexibility over its repayments.

According to additional reporting from ICIS, theplanned sale is drawing interest from both corporate and private equity buyers, but a transaction will be challenging, investment bankers said. “There might be opportunistic buyers observing the situation, but the valuation will not be high since Sasol apparently needs a quick deal,” said one banker.

The banker said he has been approached by a number of investors on a potential Sasol deal but noted they would only do it at a “significant discount”.

In its last earnings report on 24 February, Sasol said its Lake Charles Chemicals Project (LCCP) is 99% complete, with costs tracking at $12.8bn and around 80% of production capacity in use. The 1.5m tonne/year ethane cracker was producing to plan within pipeline specifications, the ethoxylates unit achieved beneficial operation at the end of January, the linear low density polyethylene (LLDPE) and the ethylene oxide/ethylene glycol (EO/EG) units were producing at targeted levels. The last piece - the low density PE (LDPE) unit was expected to reach beneficial operation in the second half of 2020.

Sasol is under severe financial stress from the debt taken on for the LCCP and the collapse in crude oil prices. On 30 March, Moody’s Investors Service downgraded Sasol’s credit rating further into speculative grade (junk) territory to Ba2 from Ba1 with ratings on review for downgrade. This followed a downgrade weeks earlier on 5 March from Baa3 (investment grade) to Ba1. “Sasol has been caught at the intersection of a series of credit negative developments, including a significant deterioration in the operating environment from a combination of the collapse in oil prices, widening impact of the coronavirus outbreak and weakening of South Africa’s sovereign credit quality at a time when its balance sheet has reached peak gearing because of Lake Charles Chemicals Project (LCCP) related capital spending,” said Moody’s. Sasol’s stock price on the New York stock exchange has declined over 90% in a year.

Another banker calls any potential deal a “tough” one. “It will be hard to finance minority stakes except using equity - this favours a large strategic buyer. The question is: Who has the appetite? The market will be oversupplied,” he said. [First, I have no specific knowledge beyond what is in the news. I will speculate however. I think there are a few good strategic fits here. The only issue is the price at which Sasol does the deal. The obvious fits involved a degree of vertical integration. Others involve a US presence for a company large based in, say the Middle East or Asia. An additional fit could be found around some play that seeks to take advantage of the aforementioned recession resistant surfactant business. None of these options will be friendly to current Sasol shareholders, but neither is the alternative additional equity issue. I think a deal that helps Sasol emerge fro this global recession (or whatever it is) in a stronger strategic position, should beat the pure equity financing of the current business model. Let’s see.]

In other COVID impact news: Dow on reported Q1 sales down 11% year on year, with the operating earnings margin falling to 8.6%, from 10.4%, amid declining demand and prices. The company announced that it is cutting capital expenditure (capex) and idling certain capacities to cope with the downturn caused by the coronavirus (Covid-19) pandemic. Sales declined primarily driven by lower local prices in all operating segments due to a decline in global energy. Volumes fell 2%. Demand grew in food, health and hygiene packaging; surfactants and solvents for cleaning; and coatings end-markets. These gains were more than offset by declines in polyurethanes (PU) and silicone applications, including automotive and durable goods.

So what to make of all this? I mean this COVID business and the lockdown and the recovery and such.

I like the idea that countries are taking different approaches to the problem and that different states and cities within countries also are going their divergent ways. This will enable an objective observer to learn what works well and not so well, given certain metrics. Some countries and states will do better than others – by some metric such as deaths, infections, recoveries, economic impact etc. and then those that do any worse than the best (in any given category) of course will be pilloried by the armchair quarterbacks (inevitably the still-salaried, working from home, metropolitan dwelling, higher educated, hands-not-dirty, zipcode lottery winner types). That’s OK, I suppose; the old normal for sure.

One thing I wonder about. Do totalitarian states fare better in the face of pandemics than others? And does it matter? Well, yes, I think it matters. The totalitarian, authoritarian, conformist, collectivist (whatever you want to call it) model is very much in the spotlight today and this pandemic may well sway popular opinion both toward and away from such a philosophy. If, in 6 months time, it was objectively proven that Communist China dealt much better (again on some metric) with COVID that democratic Europe or North America, does that mean, the authoritarian route is the way to go – to manage a country in today’s world? That is the whole thing, not just pandemic response, but healthcare, business, culture. Has modern society just got too complex and interconnected for the enlightened self interest of educated and virtuous people to be a good guiding principle of governance. Far better today the leviathan to take care of keeping us safe? It’s a compelling thought.

Heroes and villains have emerged from this mess. Likely heroes and for a long time under-recognised are the nurses and others working to comfort and heal the sick. Many countries are recognizing them with nationwide clapping and cheering sessions on specific days. It’s heartwarming to see. Unlikely villains however, include owners of landscaping companies in places like Michigan who want to go back to work mowing lawns (about as socially distanced a profession as you might imagine – and outdoors to boot!). The governor is standing firm against these sociopaths. Let my people mow, indeed. Bad for both, I think.

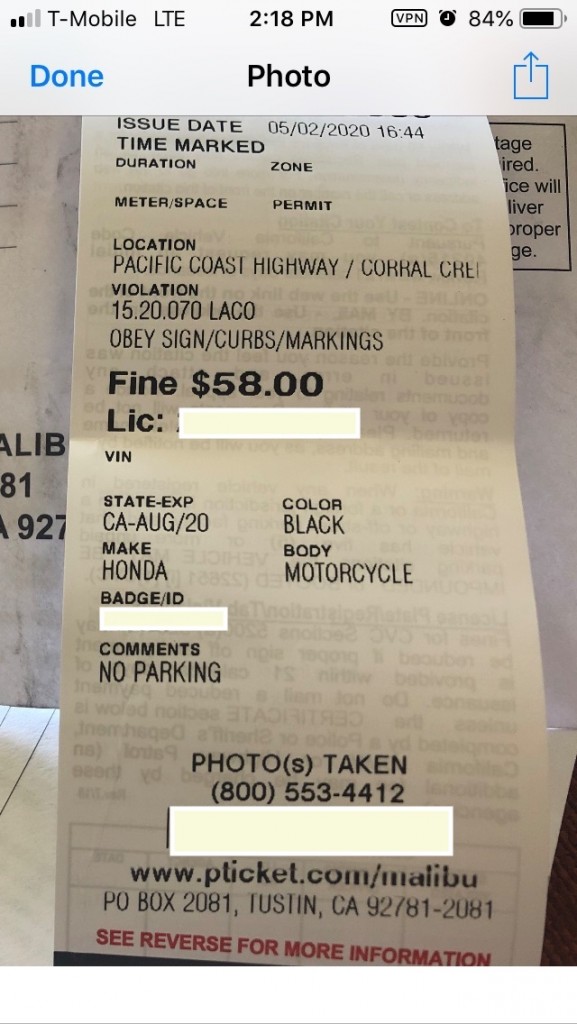

In certain parts of California, people are being ticketed for merely existing outside. …. A young lady of my close acquaintance was ticketed on Saturday for stopping her motorcycle by the side of the road and admiring the sea.

Can't do that, citizen. California Uber Alles, indeed..

Check out the lyrics below the video description on youtube. Prescient?

This is probably just my crazy contrarian way of looking at things. I’m reminded of a story told in the book Gulag Archipelago (by Aleksandr Solzhenitsyn). At the end of a political conference in 1937 in Soviet Russia … a tribute to Comrade Stalin was called for. Of course, everyone stood up (just as everyone had leaped to his feet during the conference at every mention of his name). ... For three minutes, four minutes, five minutes, the stormy applause, rising to an ovation, continued. But palms were getting sore and raised arms were already aching. And the older people were panting from exhaustion. It was becoming insufferably silly even to those who really adored Stalin.

.. However, who would dare to be the first to stop? … After all, NKVD men were standing in the hall applauding and watching to see who would quit first!.... Then, after eleven minutes, the director of the paper factory assumed a businesslike expression and sat down in his seat. And, oh, a miracle took place! Where had the universal, uninhibited, indescribable enthusiasm gone? To a man, everyone else stopped dead and sat down. They had been saved! That same night the factory director was arrested. ….. after he had signed Form 206, the final document of the interrogation, his interrogator reminded him: “Don’t ever be the first to stop applauding.”

A popular meme (before memes were a thing) when I was growing up in 70’s England was that - “yeah Communist Russia is supposed to be the enemy but, hey, they get things done over there”. Whereas in England at the time, we had powercuts, the (involuntary) 3 day workweek, strikes, record unemployment etc.. Indeed, in Russia “things” did get “done”. Stalin himself got millions of things done either directly by imprisonment and execution or indirectly via starvation.

The Dead Kennedy’s again captured this sentiment in this 1980 song: Lyrics below the video description on youtube (caution - not G-rated)

Now you can go where they get things done.

Sorry to end on such a dark note. I guess I just don't want to see one of the greatest achievements of Western civilization, human rights, end up as another casualty of the pandemic. Because without that, there’ll be no health, welfare and economic wellbeing to argue over. How do I know that? Because arguing won’t actually be a thing. Just standing. And clapping…