Greetings from Jersey City. We were back,on the top floor of the Hyatt with stunning views all round of the skylines of Manhattan and Jersey City. Our conference concluded on Friday May 5th, and, while we generally eschew event summaries here, I do feel motivated to relay some of what the ICIS reporters said about the proceedings. Joe Chang, Melissa Wheeler and Lucas Hall each reported on and spoke at the conference. A gathering of the masters of the surfactant universe if ever there was one.

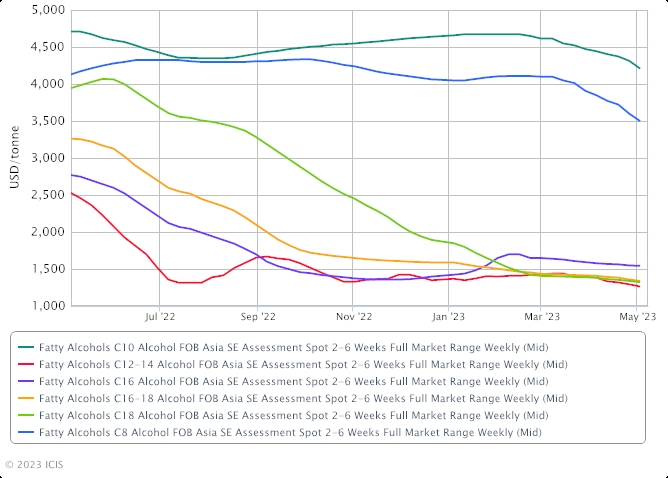

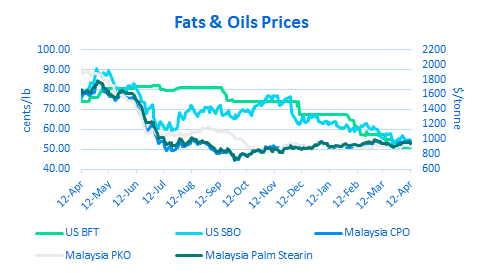

On Thursday afternoon, we heard from IP Specialities’, Martin Herrington, a master of the oleochemical universe, who said that global oleochemicals markets face short- and long-term challenges as players grapple with high-cost inventories in a weak demand environment alongside expanding biofuels policies and trade regulations.. While oleochemical prices are down alongside depressed demand conditions globally, many companies continue to sit on high-cost inventories, increasing their risk of insolvency. Longer-term, supply chain reliability remains a concern following several unexpected plant disruptions within close proximity to one another. Expanding biofuels policies, namely the expansion of renewable diesel capacity in the US market, raise concerns over the viability of traditional biofuels like biodiesel as well as the availability and cost of so-called "low carbon intensive" feedstocks like tallow, traditionally used for domestic fatty acids production. At least one producer has transitioned towards a majority vegetable-based platform, with others looking at palm and other feedstocks as a substitute for tallow as these concerns grow. Trade barriers also pose a concern, namely in the EU, as sustainability concerns increase traceability and logistics challenges for players in the region.

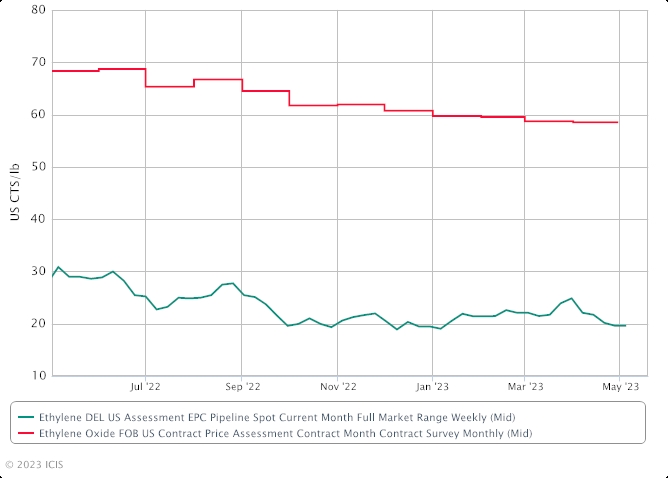

A keynote address by BASF senior vice president of Care Chemicals Marcelo Lu discussed, among other things, the New York bill limiting 1,4-dioxane. 1,4-dioxane forms as a byproduct during the process of certain surfactants and other ingredients made with ethylene oxide (EO). The Department of Environmental Conservation in consultation with the Department of Health can determine, by rule, if the “trace concentration threshold shall be lowered to better protect human health and the environment”. This new regulation could potentially decrease EO consumption in the surfactants industry as companies begin to find alternatives to 1,4-dioxane. Currently, the restrictions are only in the state of New York, but with EO already in the Environmental Protection Agency’s (EPA's) crosshairs (see below article), this could mean decreases for EO consumption on a wider scope.

Lu went on to note that the 12.5m tonnes of surfactants consumed globally in 2021 to produce household detergents and cleaners accounted for around 40m tonnes of carbon dioxide (CO2) equivalents emitted. This is about the same amount that the 200m square kilometres of forest area disappearing from the planet every year can absorb. “The 2030 targets [for CO2 emissions reductions] are starting to make people very uncomfortable. When it comes to Scope 3 emissions, this is a real challenge,” said Lu. A large part of a company’s Scope 3 emissions comes from the raw materials it buys.

BASF’s journey to a fossil carbon-free portfolio for Care Chemicals includes Avoidance, or reduction, which entails the use of high-performance ingredients and enzymes to make formulations more efficient; Replacement which involves use of bio-based feedstocks; and Recycling which involves chemical recycling or using CO2 as a feedstock, the executive said. As hydrogenation is a key process for producing certain surfactants, low carbon or green hydrogen will likely play a bigger role in the future, said Lu. BASF is building a methane pyrolysis pilot plant at its site in Ludwigshafen, Germany, which would produce hydrogen without CO2 emissions. The company expects this technology for large-scale production to be available by 2030 at the latest.

Bio-based feedstocks can be used to produce surfactants directly, or through a biomass balance approach where it is used in the early stage of production - such as in a cracker - along with petroleum-based feedstocks. Using this approach, liquid laundry detergents formulated in the US can result in about a 35% reduction in CO2 equivalent emissions versus conventional products, and dishwashing liquids around a 45% reduction, certified with RSPO (Roundtable on Sustainable Palm Oil) standards, Lu pointed out. In BASF’s Care Chemicals business, around 60-70% of feedstocks are bio-based or bio-derived, and the company has a goal of bringing this to over 90%, said Lu.

There is also a big trend towards greater transparency in cleaning products. A survey by the American Cleaning Institute (ACI) in 2020 had 82% of respondents saying it is important to know the ingredients in these products, and 70% seeking information on cleaning product ingredients. Another survey by cleaning products producer Seventh Generation showed that 90% of respondents want to know all the ingredients in such products - not just the active ones. “This is not a blip but a trend that will continue,” said Lu.

Sasol aims to scale up production of bio-based sophorolipids surfactants to up to 20,000 tonnes/year by 2025, said Edwin Habers , business manager, Personal Care & Health at Sasol at the conference. The sustainability benefit of sophorolipids is that it can be made from local feedstocks such as rapeseed oil and sugar rather than tropical oils. On the performance, side, it is “ultra mild” with multi-functional benefits to skin and scalp, he noted. Sophorolipids also have a much lower carbon footprint than SLES (sodium lauryl ether sulphate) surfactants – 80% lower greenhouse gas (GHG) emissions than PKO (palm kernel oil)-based SLES and 66% less than fossil-based SLES, he pointed out. Sasol produces sophorolipids through a partnership with UK-based Holiferm. The Holiferm process uses fermentation of plant oils with minimal processing and no solvent usage. This year, Sasol expects to produce just around 1,100 tonnes of sophorolipids, but Haber sees a market potential of 400,000 tonnes/year. Sasol plans to increase production to up to 3,000 tonnes in 2024 and scale this to up to 20,000 tonnes by 2025, said Haber. “We would like to go for the potential of hundreds of kilotons,” said Haber. The Holiferm manufacturing process is also continuous rather than batch, and uses at least 50% less energy than the traditional SLES process, he noted.

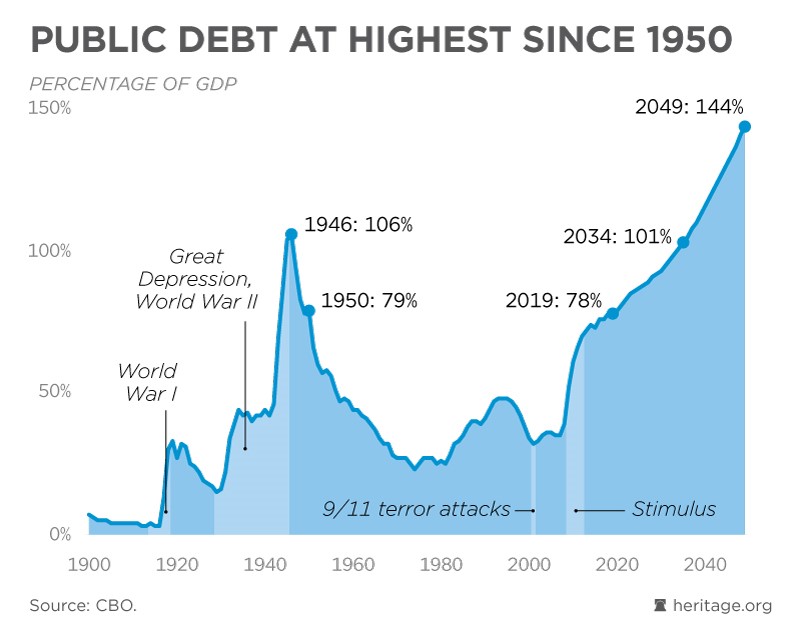

A highlight of our events is always Kevin Swift’s paper on the macroeconomic picture. A combination of several factors including restrictive interest rates, tightening credit from the regional banking turmoil and weakness in several leading indicators are pointing to a mild US recession starting in Q3/Q4 2023, noted Kevin. The ICIS US Leading Business Barometer (LBB) has been signaling recessionary conditions for many months, along with the inverted yield curve - 10 year Treasury yield lower than the 2 year Treasury yield - while money supply has declined. “All these factors tend to suggest a mild recession in the US,” said Swift, who noted that consensus among economists is for a recession to start in Q3 or Q4 2023. While goods inflation has come down, services inflation remains elevated and sticky, as this is tied to the labour market which remains very tight. While demographic effects tend to move very slowly, COVID-19 accelerated the retirement of Baby Boomers, compressing a typical six-to-eight-year period of retirements to about two to three years. “The upper end of experienced talent has left the workforce, and the three generations following the Baby Boomers has gotten smaller and smaller,” said Swift. “Colleges are facing crisis, as there are 15-20% less students than a decade ago. Companies recruiting for jobs ask - when is this going to end? It won’t,” he added.

The tight labour market has prevented a recession so far, but also has kept inflation elevated, he noted. However, restrictive Fed policy should lead to inflation easing to an average of 4.3% in 2023 and 2.5% in 2024, said the ICIS economist. The Fed Funds rate of 5-5.25% is considered restrictive given that the Fed’s preferred measure of inflation - the core Personal Consumption Expenditures (PCE) price index - is running at a three-month average of 4% year on year, said Swift. Surfactants demand is tied to consumer spending and confidence, the latter of which fell in the US April reading on persistent inflation as well as an uncertain employment outlook, he noted.

Overall, ICIS projects US GDP growth of just 1.0% in 2023 and 0.4% in 2024, and global GDP growth of 1.8% in 2023 and 2.7% in 2024 with China, India and southeast Asian countries leading the recovery. For the US Fed and other central banks, there is a risk of policy mistakes, if interest rates remain too high for too long while inflation eases, the economist noted. “Risks of a global recession are still present. Risks are shifting from supply chain to geopolitical,” said Swift. “And given underlying demographics, debt is a real threat around the world,” he added.

Main News Section

As noted above, the EPA’s tentacles continue to reach toward surfactants. In early April, Joe Chang reported that The US Environmental Protection Agency (EPA) has announced a proposal to significantly reduce hazardous air pollutants from chemical plants, including ethylene oxide (EO), chloroprene, benzene, butadiene (BD), ethylene dichloride (EDC) and vinyl chloride monomer (VCM). Under the proposal, facilities that make, store, use or emit these chemicals would be required to monitor levels of these pollutants entering the air at the fenceline of the facility. If annual average air concentrations of the chemicals are higher than an action level at the fenceline, owners and operators would have to find the source and make repairs, according to the EPA.

The proposed action levels would vary depending on the chemical. For EO, the EPA is proposing an action level of 0.2 micrograms per cubic metre of air. For chloroprene, the proposed action level is 0.3 micrograms per cubic metre. The EPA would make the monitoring data public through its WebFiRE database tool. The reductions would dramatically reduce the number of people with elevated air toxics-related cancer risks in communities surrounding the plants that use EO and chloroprene, and cut more than 6,000 tons of toxic air pollution annually, according to the EPA.

EPA Administrator Michael Regan made the announcement at an event in St John the Baptist Parish, Louisiana. “For generations, our most vulnerable communities have unjustly borne the burden of breathing unsafe, polluted air,” said Regan.

“When I visited St John the Baptist Parish during my first Journey to Justice tour [in November 2021], I pledged to prioritise and protect the health and safety of this community and so many others that live in the shadows of chemical plants,” he added.

The American Chemistry Council (ACC) said it recognises the concerns in communities and supports increased access to “accurate, up-to-date and scientifically robust” air monitoring data. It also noted that from 2010-2020, Responsible Care facilities within its membership have reduced Hazardous Air Pollutants (HAP) emissions by around 24%.

The ACC said it will review the EPA proposals before commenting in detail. However, it expressed particular concern about proposals on EO. “Ethylene oxide is a versatile compound that’s used to help make countless everyday products,” the ACC said, pointing to its role in the development of electric vehicle (EV) batteries, and use in agriculture, the oil and gas industry and sterilisation of medical equipment. “We oppose any rulemaking that uses the EPA’s flawed IRIS (Integrated Risk Information System) value for EO. ACC and others have detailed the severe science-based flaws with the IRIS value that resulted in an overly conservative value that is below background levels of EO,” said the ACC, which noted that the IRIS programme’s proposed toxicity value is 19,000 times lower than naturally occurring levels of EO found in the human body. “Overly conservative regulations on EO could threaten access to products ranging from EV batteries to sterilised medical equipment,” said the ACC. In the coming weeks, the EPA expects to announce proposed updates to its regulations for commercial sterilisation facilities that emit EO. The agency is also working to develop proposed rules for other sources of EO, including polyether polyols production, hospital sterilisers and smaller chemical manufacturers known as “area sources”. The EPA will accept written comments for 60 days after the proposal is published in the Federal Register and will hold a virtual public hearing. It will also hold a training programme for communities on 13 April 2023 to review the proposal and answer questions.

The EPA said its proposal would update several regulations that apply to chemical plants, including plants that make synthetic organic chemicals, and regulations that apply to plants that make polymers such as neoprene. The proposed updates would reduce 6,053 tons of air toxics emissions each year which are known or suspected to cause cancer and other serious health effects, according to the EPA. Those reductions include a 58 ton/year reduction in EO and a reduction of 14 tons/year in chloroprene. The proposal would also reduce emissions of smog-forming volatile organic compounds (VOCs) by more than 23,000 tons/year, the EPA said. The ACC said it supports strong, science-based regulations for the industry but is “concerned that EPA may be rushing its work on significant rulemaking packages that reach across multiple source categories and could set important precedents”. “We will be engaging closely throughout the comment and review process,” it added.

More tox-related news, this time from Germany: The country has submitted a restriction of 1,4 dioxane to the European Chemicals Agency (ECHA), the authority announced on Wednesday. The application to restrict 1,4 dioxane in surfactants was submitted as the substance is categorised as carcinogenic. Its persistence in aquatic environments makes it difficult to remove from drinking water resources. “Without taking action, the concentration of 1,4-dioxane will continue to increase, leading to adverse effects which will be difficult to reverse. The manufacture of surfactants has been identified as the major source of 1,4-dioxane emissions into the environment,” the ECHA document states. The restriction proposal aims at minimising emissions from surfactants manufacturers including emissions caused by the discharge of 1,4-dioxane residues from purification processes of surfactants in treatment plants. Stakeholders are requested to provide relevant information to the Dossier Submitter, which can then decide if there are any exemptions to the restriction based on risk and socio-economic bases. If the Dossier Submitter does not provide a derogation to the restriction, then relevant stakeholders will need to provide a full risk and socio-economic justification for use of the material in any consultation process. The start of the second call for evidence will begin on Thursday, and will be open until the deadline of 20 June 2023, with the expected date of submission of the restriction scheduled for 12 April 2024.

Early May, the great Helen Yan reported that Asia’s fatty alcohols producers are facing another hurdle in the current tough market conditions, as India imposes countervailing duties (CVDs) on imports to protect its domestic market.

- Countervailing duties imposed on fatty alcohols imports into India

- Weak macroeconomics and geopolitical tensions weigh on demand

- Purchases mostly in smaller hand-to-mouth parcels, buyers cautious

Countervailing duties (CVDs) ranging from 3-30% will be imposed on fatty alcohols imports from Indonesia, Malaysia and Thailand, according to a notification dated 4 May issued by India’s Ministry of Finance. According to India’s Ministry of Finance, “the domestic industry has suffered material injury which was caused by the subsidized imports.” “It is bad news for us,” a regional fatty alcohols producer said. Regional producers may have to seek other markets in Asia, Africa and Latin America, given the trade barriers put up by India, market sources said. Regional fatty alcohols producers have been grappling with sluggish demand amid the global economic downturn and weak macroeconomic environment. Uncertainties due to geopolitical tensions between China and the US and the ongoing Ukraine-Russia conflict have also dampened sentiment and weighed on demand. Inflationary pressures, a looming global recession and the banking sector crisis in the US have eroded investor and consumer confidence and hampered trade. “Demand is low and there are not many enquiries. Seems like the EU and the US are already in recession,” another supplier said.

Demand has also been stymied by the change in buyers’ purchasing behaviour as well, market sources said. Buyers have adopted a prudent stance, restricting their purchases to mostly smaller parcels on a hand-to-mouth and staggered delivery basis rather than large bulk orders. This change in buyers’ behaviour to one of caution and prudence has largely curbed spot interest and trades and has inevitably weighed on demand.

“The weak demand is making trading difficult,” a third supplier said.

Meanwhile, China’s rebound in demand has been slower than expected despite reopening its borders in early January this year after nearly three years of pandemic-induced lockdown restrictions. Caixin’s China manufacturing purchasing managers’ index (PMI) for April slipped to 49.5 from the neutral 50.0 mark in March amid subdued domestic demand conditions, the Chinese media firm said on Thursday, 4 May.

A PMI reading above 50 indicates expansion in the manufacturing economy, while a lower number denotes contraction. The weaker Caixin PMI mirrors China’s official manufacturing PMI released earlier this week, which hit its lowest level since January 2023, contracting to 49.2 in April from 51.9 in March.

Meanwhile (again), Asia’s fatty alcohols ethoxylates (FAE) market is likely to see a pick-up in activities in second-half (H2) May following the holiday lull.

- Thin discussions amid holiday lull

- Activities likely to pick up in H2 May

- Feedstock C12-14 mid-cuts prices decline

Trading activities had been winding down due to the spate of holidays in April and early May in this diverse and multicultural region. “We expect discussions to pick up in mid-May. The market is quiet due to the holiday season in this region,“ a regional producer said.

Chinese players have just returned from the Labour Day holidays on 29 April-3 May while Japan’s market is shut for the Golden Week holidays in early May.

Indonesia and Malaysia observed the recent Muslim Eid-ul-Fitr holidays in late April and Labour Day holidays earlier this week. Meanwhile, Thailand’s market is shut on 4 May due to Coronation Day, while Malaysia is on holiday on 4 May due to Vesak Day, and South Korea will be closed for Children’s Day on 5 May. Apart from the holiday lull, uncertainties and declining prices in the feedstock fatty alcohols C12-14 mid-cuts have also dampened sentiment and slowed down demand. China’s official manufacturing purchasing managers’ index (PMI) hit its lowest level since January 2023, contracting to 49.2 in April from 51.9 in March, official data showed. A PMI reading above 50 indicates expansion, while a lower number denotes contraction. Demand for consumer products such as detergents, cosmetic and shampoos has fallen due to the erosion in consumer confidence, amid inflationary pressures and fears of a global recession.

The geopolitical tensions between China and the US and the ongoing Ukraine-Russia conflict in Europe had disrupted trades and weighed on demand. FAE is used mainly in sodium lauryl ether sulphate (SLES), a surfactant found in many home and personal care products such as soaps, shampoos, shower gels and detergents.

US April ethylene oxide (EO) contracts were assessed at 57.55-59.55 cents/lb ($1,268.75-1,312.84/tonne). EO contract prices have declined for six consecutive months, tracking an ongoing drop in ethylene prices. This is the lowest ethylene contract price since November 2020. Demand for EO and its derivatives remains weak due to ongoing recession fears, which has decreased discretionary spending. Additionally, rising interest rates and mortgage rates has hampered demand from the housing and construction industries.

In more EO news: North America ethylene oxide (EO) operating rates are poised to recover with new derivatives capacity starting up in the coming years and a recovery in China, a Chemical Data (CDI) analyst said in April. Major new capacity additions in 2019-2022 were tied with ethylene glycols (EG) production, which suffered low demand from the key China market during the pandemic and China’s COVID lockdowns, said Antulio Borneo, vice president, PET chain at Chemical Data (CDI), part of ICIS.

However, a potential China recovery after the reopening, plus increased consumption of EO from more derivatives capacity and production should drive operating rates as well as prices higher, he added. Borneo spoke at a meeting of the Racemics Group in Monclair, New Jersey. EG, which is produced from EO, is a key feedstock for polyester. In North America, EG accounts for around two-thirds of EO consumption, with surfactants representing about a quarter of demand, according to the ICIS Supply and Demand Database. Other EO derivatives include ethanolamines and glycol ethers.

Through 2024, there should be a substantial increase in consumption with increased productivity from the integration by Indorama of its Oxiteno and Huntsman surfactants assets, Dow’s start-up of 60,000 tonnes/year of surfactants capacity in Plaquemine, Louisiana and Stepan’s upcoming 75,000 tonne/year surfactants project in Pasadena, Texas slated for start-up in 2024, said Borneo. Altogether, these factors could increase consumption of EO by 130,000-150,000 tonnes/year between 2022-2025, he pointed out. North America EO operating rates should rise from the low-70% range in 2022, to nearly 80% by 2025, according to the ICIS Supply and Demand Database.

Meanwhile, the only potential EO expansion project in North America is Mitsui & Co’s planned bio-EO/EG project, which could bring on 400,000 tonnes/year of renewable polyethylene terephthalate (PET) by 2025-2026, the CDI analyst noted.

Renewable paraxylene (PX) feedstock for PET could come from Origin Materials, he added. As noted in Decmeber Mitsui & Co and Petron Scientech are evaluating the production of ethylene from ethanol in the US, with several downstream projects, including EO, EG and PET.

More details on the Mitsui project: Mitsui & Co and Petron Scientech will evaluate producing ethylene from ethanol in the US as well as downstream plants that will produce ethylene derivatives. The two reached the agreement under a memorandum of understanding (MoU). Petron Scientech licenses ethanol to ethylene technology. Some of the derivatives mentioned by Petron include ethylene oxide (EO), ethylene glycol (EG) and polyethylene terephthalate (PET). Petron Scientech said it and Mitsui will evaluate carbon intensity (CI), life-cycle analysis (LCA), engineering design, supply chains and marketing opportunities. If the feasibility studies are approved and the two companies can reach a mutual agreement, then the first plant will be built in the southeastern US.

Big update from ExxonMobil this month: ExxonMobil remains on track for a mid-2023 startup for its new Vistamaxx and linear alpha olefins (LAO) plants in Baytown, Texas, the US-based energy and chemicals producer said in early May. Vistamaxx is a semi-crystalline copolymer of propylene and ethylene. The new plant will have a capacity of 400,000 tonnes/year. The LAO plant will be ExxonMobil's first, and it will have a capacity of 350,000 tonnes/year. The LAO plant will produce 10 products, the company said in October 2022. More than half of the nameplate capacity of the LAO plant will likely be for captive use, the company said at the time. The rest will be marketed externally under the ELEVEXX brand name, marking ExxonMobil's entry into the LAO market. LAOs are used in plastic packaging, surfactants and other specialty chemicals. They are also used to make polyalphaolefins (PAOs), which are used to make synthetic lubricants. During the first quarter, ExxonMobil completed the expansion of its refinery in Beaumont, Texas, adding 250,000 bbl/day of crude processing capacity. The expansion project raised the total processing capacity of the refinery to more than 630,000 bbl/day, making it one of the largest refineries in the US.

Stepan released Q1 results in April. Stepan’s Q1 operating income fell nearly 67% year on year to $21m as sales volumes in the surfactants and polymers segments fell amid softening demand, the US-based chemicals company reported. Also hurting results were delays in the startup of new low 1,4 dioxane production assets and continued customer and channel destocking, the company said.

Stepan, three months ended 31 March 2023:

| (in thousand $) | Q1 2023 | Q1 2022 | +/- % |

| Net sales | 651,436 | 675,276 | -3.5% |

| Costs of sales | 577,876 | 566,057 | 2.1% |

| Gross profit | 73,560 | 109,219 | -32.6% |

| Operating expenses | 52,346 | 45,821 | 14.2% |

| Operating income | 21,057 | 63,346 | -66.8% |

| Net income | 16,142 | 44,809 | -64.0% |

- Surfactant operating income fell to $27.1m, from $53.8m in Q1 2022, primarily due to a 13% decline in global sales volume;

- Polymer operating income was $10.0m, down from $14.1m in Q1 2022, primarily due to an 18% decline in global sales volume, including a 19% volume decline in rigid polyols and lower demand in the specialty polyols and phthalic anhydride businesses.

“Looking forward, we believe second quarter volumes will remain depressed as markets continue to reconcile forward demand with inventory levels throughout the channel,” said CEO Scott Behrens. “We expect second half year over year volume growth driven by modest recovery in demand for rigid polyols, growth in surfactant volumes associated with new contracted business, and a low comparable base," he said.

The Asian linear alkylbenzene (LAB) market was bolstered in April by elevated upstream sectors, with suppliers keen to achieve higher values in a bid to maintain workable margins.

- Suppliers push for higher offers on increased upstream market

- Demand in Asia and India remains slow

- Weak economic outlook dampens sentiment

While suppliers pushed for higher numbers in recent weeks, they conceded that demand remains weak with buyers slow to increase buying indications. Nonetheless, sellers continue to push for higher numbers as current margins remain narrow. Elevated crude oil markets have propped up upstream sectors such as benzene, which has crimped margins of LAB makers. “We have to try to achieve better prices as feedstock costs have increased,” said a producer in northeast Asia. Spot prices of LAB in southeast Asia have declined under $1,600/tonne CFR (cost & freight) SE (southeast) Asia in March, from the low-$1,600s/tonne CFR SE Asia previously, ICIS data showed.

The Chinese market slowed down in April with sales volume tapering off. Producers in China conceded that the market is currently in a lull season but constrained supply from maintenance at a plant and persistent output issues at another help keep the domestic market prices stable.

Over in India, with the implementation of the certification of producers selling into the subcontinent by the Bureau of Industry Standards (BIS) in the first half of April, spot imports into the country have dwindled as only a handful of producers have obtained the certification so far. However, the import market and domestic market of India remain stable with buying momentum still weak. Some participants believed that the ample stocks in the country still needed to be digested before the market could firm.

“It will take some weeks before inventories draw down sufficiently to engender renewed demand,” said a trader in India. With the key India market out of bounds for some still without the necessary certification, cargoes from these sellers were directed to other markets in south Asia such as Pakistan and Bangladesh. Others also pivoted to Africa to move some volumes but demand in these areas appear largely tepid, while buyers continue to ask for low numbers.

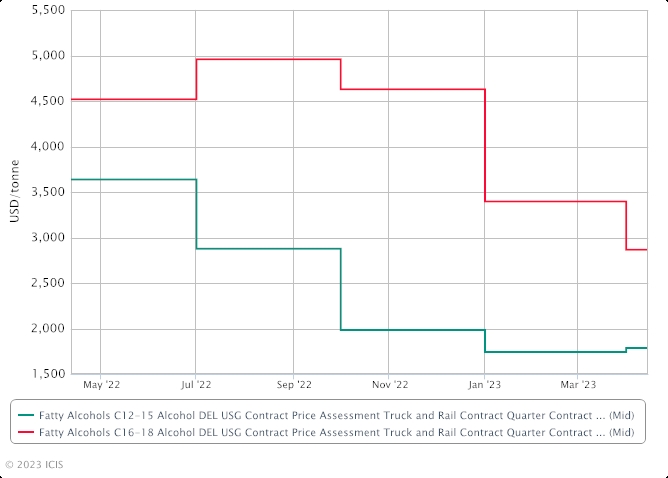

And so finally, Alcohols – the great hydrophobe; the US market as reported by Lucas Hall. Q2 fatty alcohols contracts were assessed mixed from Q1, tracking mixed feedstock and supply/demand fundamentals.

- Q2 contracts settle mixed from Q1

- Mid-cut contracts edge higher with PKO but volume limited

- Long-chain contracts drop on supply imbalance, lower freights

- Wilmar declares force majeure on fatty alcohols after mechanical failure in Rotterdam

Q2 mid-cut alcohols contracts increased slightly from Q1, tracking higher feedstock palm kernel oil (PKO) costs. Long supply and below-average demand alongside continued macroeconomic concerns globally offset the upward pressure, including in the core consumer cleaning segment.

Q2 long-chain alcohols contracts extended their losses from Q1 as a return to more historical container freight costs alongside supply chain imbalances put downward pressure on the wider market. Long-chain markets are segmented, based on shipping capability and the feedstock used to produce the material. C16-18 contracts largely fell, owing to the length in the C16 market. C16 contracts plunged on the high end, tracking long supply in the wider market. C18 contracts fell at varying degrees, depending on supply and shipping capabilities. Only a handful of suppliers of long-chain material ship material in bulk. Others ship in containers, so a drop in container freights puts downward pressure on the wider bulk market. PKO produces far less long-chain material than crude palm oil (CPO) and other feedstocks like rapeseed and mustard seed. Sasol said it is progressing through the restart process of the offline section of its plant in Lake Charles, Louisiana, after a 15 October fire damaged the facility. The plant previously restarted production at 50% during November, as the fire impacted an area of the site in which Sasol has redundancies. The outage and force majeure at Wilmar's European facility is not expected to impact US availability given the prevailing supply length in the market.

Q2 contract ranges*

| Product | Price (cents/lb) | INCO | Location |

| C12-C15 | 75-87 | DEL | USG |

| C16 | 90-105 | DEL | USG |

| C18 | 120-140 | DEL | USG |

| C16-18 | 120-140 | DEL | USG |

*The prices in the table represent a range of settlements for standard balance material heard throughout the quarter for the majority of market participants. Prices heard outside those listed in the table were excluded from the quarterly assessment as they were not viewed as representative of the wider market.

For mid-cut alcohols, the low end largely represents synthetic material and the high end natural material.

Mass balance premiums were largely heard in the 10.0-13.5 cents/lb range.

Demand concerns continue to put downward pressure on premiums in the short-to-medium term. Increased consumer demand for sustainable material supports long-term demand. The US is a major net-importer of natural fatty alcohols and a key production region for synthetic alcohols. The key end-use for mid-cut alcohols is surfactants. This class of chemical products comprise numerous cleaning and detergent uses, ranging from household agents to oilfield applications.

And the music section:

I played a snippet of this at the conference. Here's the whole thing, recorded before the album came out. Has to be one of the greatest versions of the iconic song. Bill Ward's drumming is ridiculous! Do you think these four 20 / 21 year olds imagined that in over 50 years time, this song would remain as intensely relevant as it was back then?

I get three different reactions to the music here and at the conferences: i) "Great. I love it. Keep it up" - O ye of impeccable taste, thanks. ii) "Ugh how much of this do we have to sit through to get to the actual information" - Well, erm, you have to eat your vegetables first. iii) "I like some of that different stuff, like choral music that you worked in there" - Maybe you're being polite but this is for you. ..

Apparently, YouTube informs me, there is a whole genre of stairwell singing. Think about it. Have you ever done that? Here's some amazing examples of stairwell paens to the BVM.

And a quartet with the same song. Wow! Right?

This lady doesn't have the greatest voice but I love the way she just launches into the chant as she walks up the stairs and gets a shooutout from a fellow stairwell traveler.

Gotta be one of my favorite prayers. Clocking in at easily under a minute, it's a sort of safety in numbers prayer. Pray for us siners Not just me. But you know, all those other guys as well. I'm not the only one sinning here. When? Uh now, would be good. And when else ? Er well, at the hour of our death would cover it. Ora pro nobis peccatoribus, nunc et in hora mortis nostrae amen. Give it a shot next time you're heading up to the 3rd floor of a parking garage.!