Not a lot of news this summer month, so music and musings are upfront and the news comes last. Skip if you must. The sections are clearly labeled.

Music

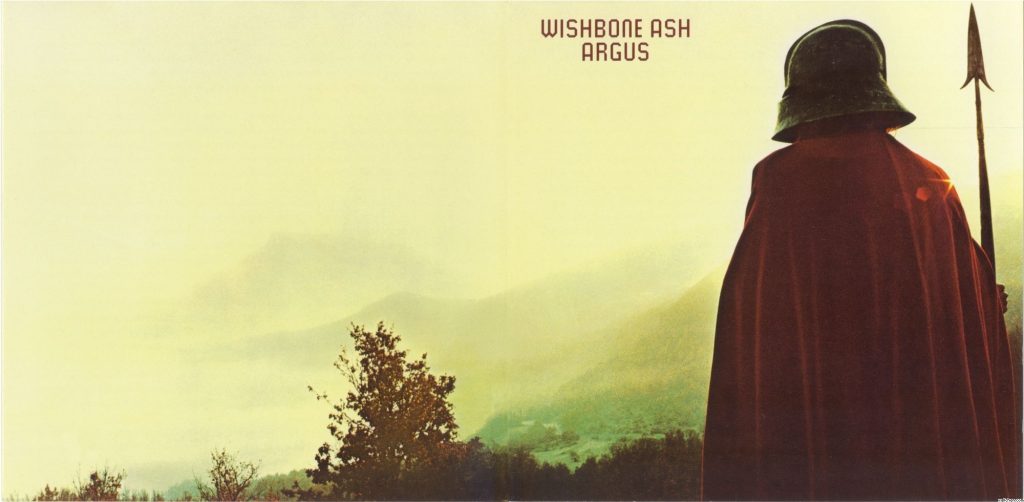

I’ve been listening to Wishbone Ash a bit recently. It’s been 50 years since Argus, their third album, was released in I think April of ’72. It was named album of the year by Sounds the weekly music newspaper. Any of our UK readers remember Sounds? There were 3 music papers back then: Melody Maker – for the intelligent and sophisticated, covered jazz, blues and rock. New Musical Express – for the sophisticated, covered the hip and new wave. Sounds – for those of us who identified as neither (intelligent nor sophisticated) covered the rest, including heavy metal, punk and such. I was a proud, card-carrying Sounds reader, of course.

I have to admit, if you care, that I was not a fan, at the time in 1972. This was the music of people’s older brothers, like Gordon’s brother John. Cool, different and with incredible album art that suggested something other-worldly. Something disconnected from coal-dust, fog, rain, baked beans, rock-hard porkpies, greasy chips, stale beer, smoke, times-tables, spelling tests, strikes, power-cuts, skinheads, the IRA and other staples of grim British life in the 70’s. It was the music of whispering Bob Harris of the Old Grey Whistle Test, for a time, it’s only outlet. It was in the ether, if not literally in the air (regular radio never played it) however, and influenced many great musicians and even entire genres, which we’ll address in a bit.

What got me listening afresh to Wishbone Ash? John Hibbs. Yes, the John Hibbs, long-time member of our industry and blog reader. He recently founded a consulting firm named Argus and alluded in a social media post that the name may have derived from the famous 50 – year old album. I say “alluded” because he left us guessing as to the actual name origin story. Interesting when you think about it; maybe appropriate. John’s got to be one of only a handful of folks in the world that have such a deep experience in surfactants and related products and is still active as an engaged industry participant with an unbiased perspective. This is not a paid promo, by the way – or any type of promo. But it occurred to me that folks often just disappear from our industry, which is of course, their right. But anyway, there’s a vanishingly small number of true independent experts around that are going to give you more than just old-guy platitudes. And one of them might have named his company after a classic album, that we’re going to dig into now.

I think you should listen to Argus now. It’s 45 minutes and time well spent. Here it is.

Could you call it a hippie album? Sure you could. It has those elements. Does it have pop sensibilities? Absolutely it does. Your mam wouldn’t necessarily beg you to turn it off. What else, dear reader, what else? You may not have been a Melody Maker subscriber but you’re still intelligent. Listen and think. What else? Well, this is what else: There’s Yes (OK…), Rush (Hmmm… I dunno) and Iron Maiden (Wait, what… no way). And if there’s Iron Maiden then there’s Metallica, Pantera and on and on… (OK now that’s ridiculous)

Track 1 : Hippie dippie heaven, acoustic then “I’ve got to rearrange my life” Oh really Gautama, well you can get to it after you’ve finished shoveling that dirt over there” But then keep listening around 2:50, bass and two guitars roll in and, well did Geddy Lee ever listen to that bass? How about Chris Squire? Probably. And a young Steve Harris (Iron Maiden) – did he ever listen to that bass and then hear the two guitars come in and think hmm … one day I’m going to that but heavier- much heavier. I believe so.

The second track, Sometime world (at 9:48), is a true classic. It has those Yes-esque harmonic vocals, the whistful hippie stuff still there. But wait until 12:36 – Oh yeah come on – you agree with me now about the Geddy Lee and Steve Harris thing right ? Keep listening, when the guitars come in. Would this be out of place, on any, any – Iron Maiden album. This stuff was in the ether before the Irons emerged. They were steeped in it and it shows. So yeah – think about it. Or just listen because it’s good stuff.

I think that's probably enough from me on the musical commentary. Listen to rest of the album – then maybe just for fun listen to that first track off Iron Maidens Killers album (1981). See what I mean – hopefully. Here:

Musings

What else?.. er .. oh as I mentioned last month, I was given the proceedings of the 1993, 3rd World Conference on Detergents. Another long-time industry member and blog reader, Mike Fevola gave the book to me. A very nice gesture, I thought. Many familiar names in there: Arno Cahn, AG Lafley, Bill Gasser, David Conner (Albright and Wilson – remember them?), Paul Sosis (Witco – remember them ?) Mike Cox (Vista - !), Icilio Adami (il professore of Ballestra!) and many others. Some of the topics, you may be struck by as they are timeless, such as sustainability and globalization. But it’s the little gems that got me:

Alan Lafley (P&G) was a keynote opening speaker and, from the book at least, seems to have written a small thesis. I don't think the actual speech was that long. Anyway – right at the end, he had this to say:

“Our industry should avoid exploiting “pseudo green” short-term advantages that do not redult in tangible environmental benefits. Petty tactical competition between members of our industry that resorts to ingredient bashing or marketing meaningless technical differences that confutes the public, enrage activists and encourage legislation will only create the belief that our industry cannot lead or be trusted on environmental issues.”

Right on, Alan. Clearly as relevant 30 years ago as today.

Here’s another clear gem from the Unilver keynote “We must not forget that the ability of detergents to clean is of paramount importance ……ingredients that perform a most important service in relation to private and public health.”

Heinz Graffmann of Henkel concluded his paper with 5 bullet points, one of which was “The trend towards increased segmentation leads to increased operational complexity . Yet we have to reduce costs” Indeed is doubtless still tbe driver behind Henkel’s digitalization efforts 30 years on.

Some of the titles say it al. Claude Fussler of Dow’s paper is “Life Cycle Assessment: A new business tool?”

Some predictions may not have panned out as much as authors thought. Keith Grime of P&G noted that “the days of 20-year lifetimes for detergent chemicals are gone forever…” In some cases true, but many makers and users LAS would disagree.

In his paper, Jan Vogel of Vista concluded that “Both oleochemical and petrochemical surfactants are in plentiful supply, are competitively priced, are safe for the environment, and are available for the foreseeable future.” Do you agree that still holds today?

And it goes on. Many of the key themes 30 years are the same today. Sustainability, supply chain and performance in particular. Is that a good thing? Probably. It shows that the industry was focused on long-term issues. And in surfactants (like many chemicals), 30 years is not that long a time. Missing though? Biosurfacants. The technology itself had been around for 30 years by then, but not ready for prime-time, it seems.

The News

As always, most of the news here is provided courtesy of our friends and partners at ICIS with whom we co-produce the great series of surfactants conferences. By the way, the 13 such event is now scheduled for May 4th and 5th in Jersey City, NJ. To register interest in the event, go here. If you feel like you may want to speak at the event, then get in touch with me.

Mid-month, the, quite useful, Indian Chemical News, reported that Galaxy Surfactants Limited, a leading manufacturer of performance surfactants and specialty care products with over 220+ product grades used in the Home and Personal Care industry, Q1 FY23 total revenue (including other income) stood at Rs. 1,156.9 crore, a YoY growth of 39.2% and QoQ growth of 9.7% on account of improved sales mix and realizations.

The company's EBITDA stood at Rs. 146 crore, YoY growth of 29.2%. The company achieved its highest ever quarterly PAT of Rs. 100.4 crore, YoY growth of 30.7% and QoQ growth of 2.0%.

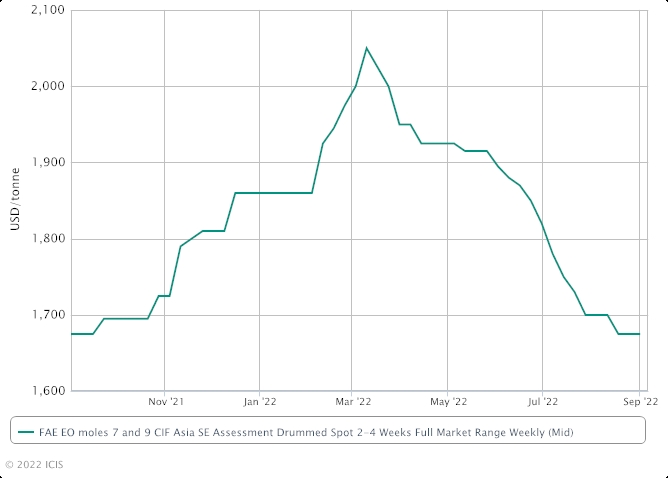

The great Helen Yan of ICIS gave her Q4 perspective on Asian ethoxylates at the end of the month. Asia’s fatty alcohols ethoxylates (FAE) market may improve in the fourth quarter if the Chinese economy gathers pace and feedstock fatty alcohols C12-14 mid-cuts and ethylene oxide (EO) prices remain firm Helen notes.

- Uptick in feedstock fatty alcohols C12-14 mid-cuts

- Feedstock EO lifts FAE domestic prices in China

- Chinese factory activities may gather pace in Q4

The FAE spot market has been in the doldrums amid mounting recession fears and a slowing global economy despite increases in feedstock fatty alcohols C12-14 and ethylene oxide (EO) prices recently. Spot FAE 7,9 mols prices have been languishing at $1,675/tonne CIF (cost, freight and insurance) southeast (SE) Asia since mid-August, after peaking at $2,050/tonne CIF SE Asia in early March, ICIS data showed. However, spot offers for September shipments are likely to be revised up by $20-30/tonne due to pressures from rising feedstock costs, market sources said. The feedstocks fatty alcohols mid-cuts C12-14 and ethylene oxide (EO) prices have been on an uptick recently. The feedstock fatty alcohols C12-14 prices have increased by about 25% since late July to average $1,655/tonne FOB (free on board) southeast (SE) Asia on 31 August, ICIS data showed. The other feedstock ethylene oxide (EO) price has also rebounded in the Chinese domestic market, lifting up the domestic FAE 7,9 mols prices to average yuan (CNY) 10,300/tonne ex-warehouse in east China on 1 September, up by about 11% since early August, according to ICIS.

The Chinese economy has been beset with sporadic COVID-19 lockdowns and power rationing due to scorching heatwaves, which engulfed Sichuan and Chongqing municipality as well as several other cities and regions in China recently. China, the world’s second-biggest economy, posted a second straight month of contraction in its official purchasing managers' index (PMI) for August at 49.4, although the reading inched up from 49.0 in July.

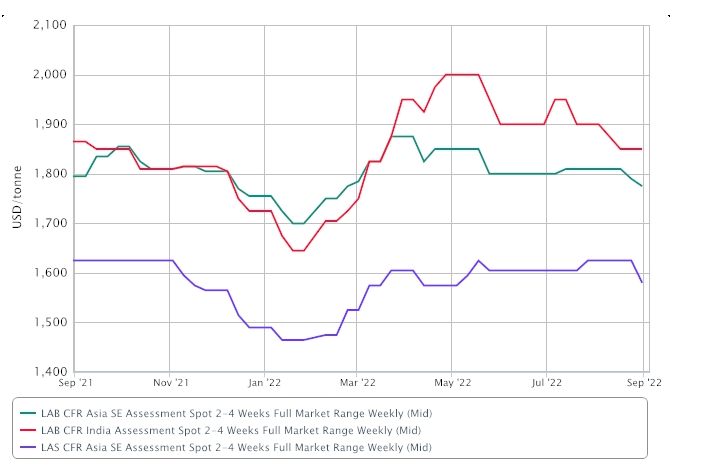

The other great surfactant workhorse in Asia – LAB is covered by Clive Ong in an ICIS article: The Asian and Indian linear alkyl benzene (LAB) markets remain under downward pressure from persistently tepid demand. The weak economic outlook continues to weigh on sentiment and prompt caution among buyers.

- Suppliers lament weak margins

- Buyers lobby for lower prices

- Monsoon season dampens demand in India

While sellers continue to lament weak margins and are not keen to reduce prices sharply, persistently weak demand has prompted some to consider lower numbers in order to keep buyers engaged. Export offers were heard largely at $1,650-1,700/tonne FOB China and around $1,800/tonne CFR SE Asia, ICIS data showed. In India, demand remains in a low ebb amid the monsoon season. Some players attributed the slowdown in trade to the upcoming deadline for India’s Bureau of Industry Standards (BIS) certification in October. Suppliers, both local and foreign, need to obtain the certification by the deadline before they can continue to sell LAB in India.

A minor portfolio cleanup by Clariant mid month. Clariant has reached a definitive agreement to divest its quats business to Singapore-based Global Amines Co in a deal worth $113m. Global Amines Co is a 50:50 joint venture owned by Clariant and Singapore-listed agribusiness and oleochemicals major Wilmar. "The transfer will be an asset sale of the sites in Germany, Indonesia, and Brazil and will provide for tolling agreements where needed," it said in a statement. The transaction is expected to be completed in the first half of 2023 pending regulatory and customary closing conditions, the company said. "This divestment is a further step in Clariant’s portfolio transformation to focus operations purely on specialty chemicals," the company said in a statement. This further proof that no-one ever sells a specialty business unless they are a family owner with a view to spending more time with their yacht.. er.. family or something ..

News from Malaysia, as reported by ICIS, in which a state government is acquiring a stake in a producer of surfactants. Malaysian state Terengganu is planning to acquire a 5% equity stake in PCG PCC Oxyalkylates which is currently building an oxyalkylates plant in Kerteh, parent firms PETRONAS Chemicals Group and PCC SE said. Terengganu state-owned firm Mentri Besar Trengganu signed a letter of expression with the two firms on 29 August to study the investment, they said in a statement. Construction of the oxyalkylates plant began in 2021, with production scheduled to begin in 2023, according to Peter Berger, a management member of PCC SE.

"When fully operational, the plant will produce up to 70,000 tonnes per year of specialty ethoxylates and specialty polyether polyols," he said. Further proof that no-one, especially state actors, ever invests in commodities, unless they are green commodities like er.. solar things or ethanol that will save the world..

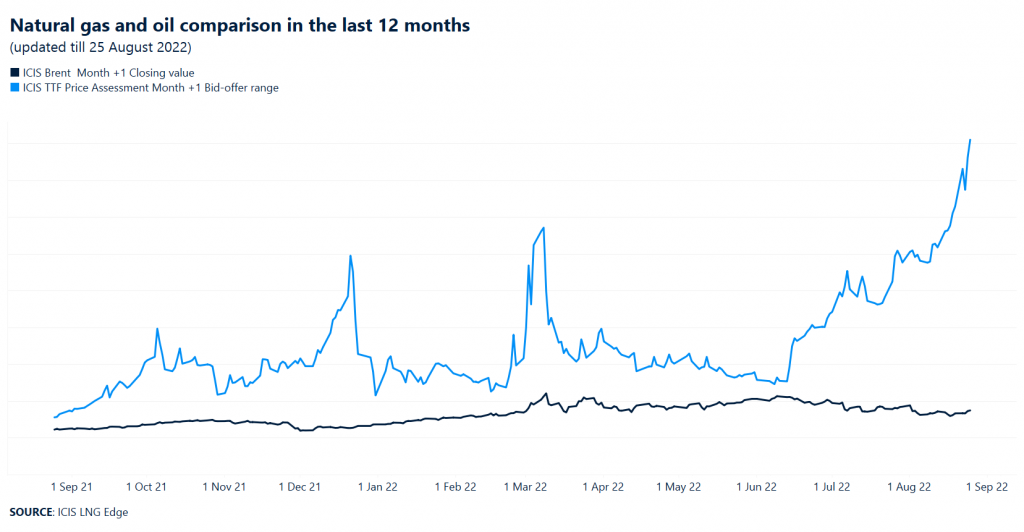

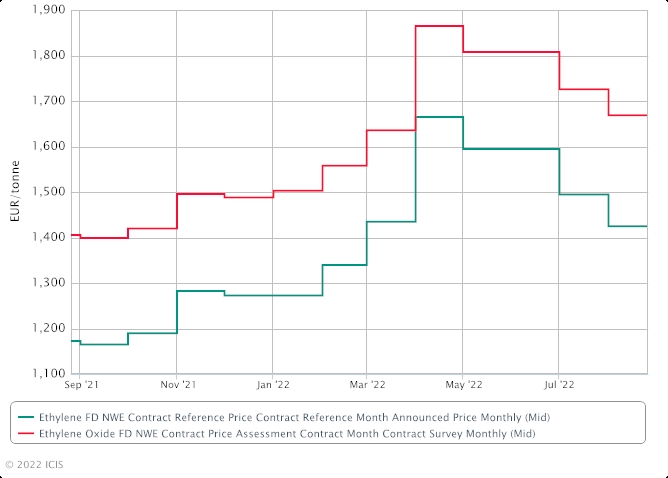

Meanwhile over in Europe, EO prices are going down still. How is that? They have to go up soon, following energy right? I guess there’s a lag. ICIS reporter, Melissa Hurley explains: European ethylene oxide (EO) market players are waiting for the next ethylene settlement for September to dictate formula pricing for the month ahead.

Concerns over production costs caused by record-high gas prices are mounting among market players. EO production is energy intensive and this is set to feature heavily in annual adder fee discussions for 2023.

The ICIS TTF benchmark price for gas in Europe reached record levels this month, fuelling production cost concerns for the winter months.

Downstream products such as monoethylene glycol (MEG) are experiencing very poor margins and low demand levels. There is a general concern over low demand among derivative markets. Economic activity in the eurozone contracted further, hitting an 18-month low in August, according to the latest Purchasing Managers’ Index (PMI) data on Tuesday. Despite concerns for certain derivatives, downstream surfactant demand was still described as healthy. Previously, European EO August contracts dropped by double digits on the back of upstream ethylene losses.

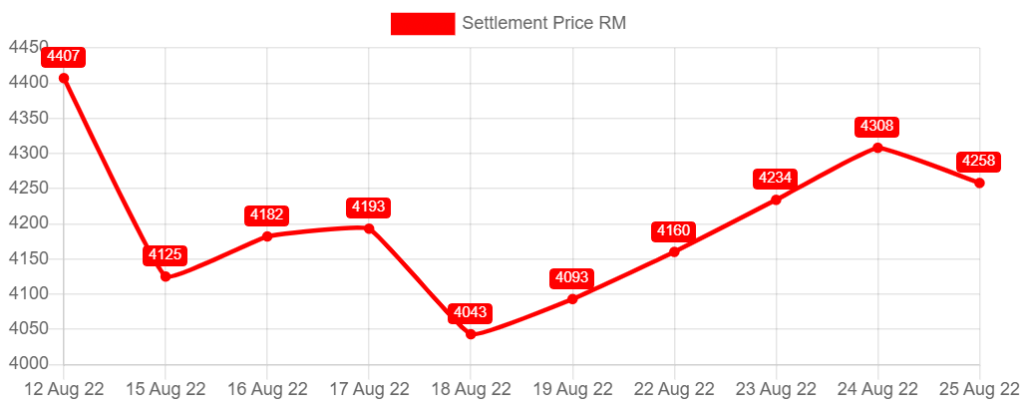

Indonesian palm oil never ceases to thrill. Indonesia’s extension of its waiver on its export levy on palm oil till the end of October is unlikely to have any significant impact on the oleochemicals market in southeast Asia., however, according to Helen Yan of ICIS. “I don’t see much downtrend. The market is already immune to any announcement by the Indonesian authorities as they keep changing every two weeks,” a regional producer said. Meanwhile, crude palm oil (CPO) futures have slipped lower following the announcement on 24 August by the Indonesian authorities. “It will be towards the downside for CPO as Indonesian oil will be cheaper. CPO will probably either be bearish or move around the current range,” another supplier said.

Indonesia has extended its waiver of the export levy on palm oil to 31 October, said Indonesian Trade Minister Zulkifli Hasan on 24 August. He added that the decision was made to boost exports and shore up prices of palm oil fruit for farmers. The waiver, which was implemented in mid-July, was originally expected to end on 31 August. Prior to the latest revision, a crude palm oil (CPO) export levy of a maximum of $240/tonne was due to take effect in September. Indonesia, the world’s largest palm oil producer, has been under pressure to reduce its build-up of stock following its three-week export ban in May. At the end of June, Indonesia had inventories of about 6.68 million tonnes, compared with around 4 million tonnes at the end of 2021, according to the Indonesian Palm Oil Association. The export levies and a separate export tax are used to fund subsidies for Indonesia’s biodiesel and smallholder replanting programmes.

A snippet from the UK as the German distribution juggernaut continues to build muscle: Brenntag has acquired UK distributor Prime Surfactants which supplies surfactants specialties for personal care, household, industrial and institutional cleaning, as well as other industry sectors in the UK. “The acquired business estimates sales of approximately £22m in the financial year 2022. Signing and closing of the transaction took place simultaneously,” Brenntag said in a statement. The Germany-based global chemicals and ingredients distributor said the acquisition would enhance its product and service offering to UK customers, while underlining the firm’s ambition to further strengthen the specialties business of its focus industries.

That’s it. The end of the news and the end of the summer (at least in the US). Now, we really plunge back into it with business travel, meetings, deals etc. Good fun. So how about a real piece of escapism. One of the friends of the blog sent me this piece of music that I have never heard before. It's a 63 minute song called Dopesmoker by the band Sleep. I can't say I condone what is sung about here – although It’s pretty much legal in many states. But the music is, well, it’s something a bit different. It’s like distilled essence of Black Sabbath. Check it out.