Happy New Year my dear readers. We have the month’s news and some end of year music picks. This month’s promised fiction will come to you via a link at the end of the blog to a site I like which is publishing some interesting short stories.

Now – straight into the news, which, as always, comes to us courtesy of our good friends at ICIS. Of course, I can’t kick off the year without mentioning that the 13th World Surfactants Conference, will again be held in Jersey City at the Hyatt on May 4th and 5th. Register here https://events.icis.com/website/8544/

OK – now the news.

ICIS has published some good end of year summaries and I’ll excerpt some of the surfactant relevant ones here.

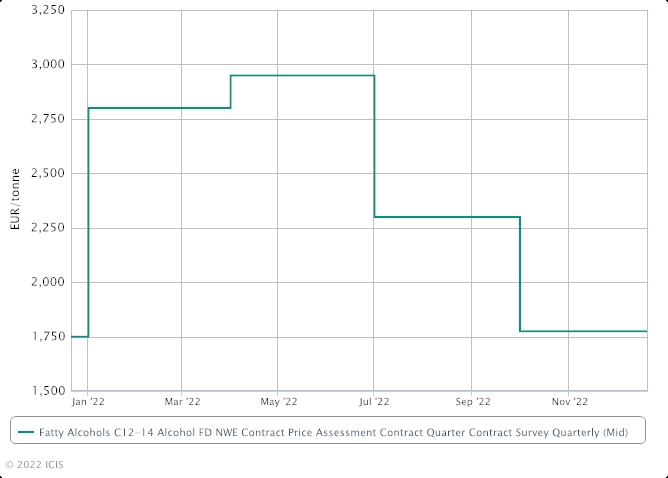

First up, according to ICIS the European fatty alcohols market is rather subdued looking ahead to 2023. Supply is widely available, while downstream demand from the ethoxylates market is weak for the first quarter. “Ethoxylates demand is very poor […] It’s clear the demand is a strong reduction,” said a producer.

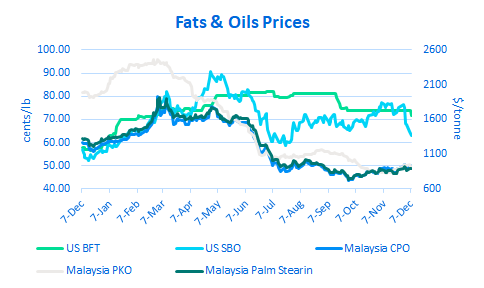

Feedstocks have also trended downwards in recent months. Supply, demand and palm kernel oil (PKO) costs are the main factors discussed in Q1 contract negotiations.

Uncertainties and low demand mean most buyers have been reluctant to commit to Q1 volumes so far. As a result, there has been limited progress in Q1 talks. Prices quoted so far have been stable to soft in comparison to those for the fourth quarter.

“When the world is so uncertain, you shouldn’t sit with so much material in stock because prices tend to drop. Even if gas prices remain high, end-user consumption will be lower,” said a buyer. Some have preferred to fix volumes sooner rather than later, however, to ensure security of supply. “We decided to cover part of our need as a lot of uncertainties and wanted to be on the safe side,” said another buyer. More progress regarding Q1 contract talks is expected in coming weeks. Feedstock developments are also likely to provide more clarity on the market direction for 2023.

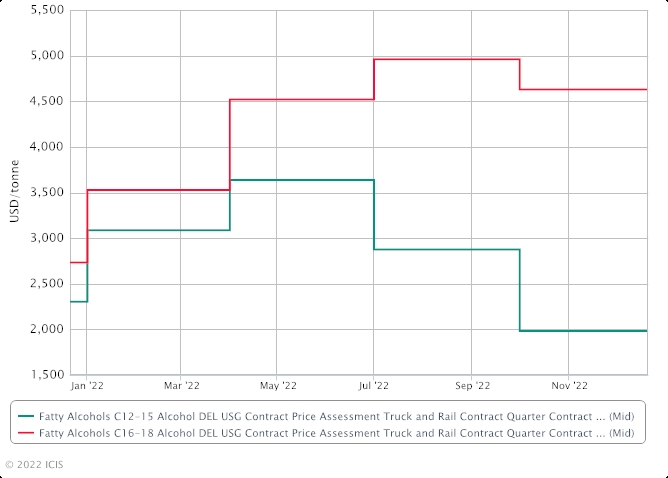

Meanwhile in the US market for fatty alcohols, Lucas Hall reports that Fatty alcohols are seeing improved production margins in southeast Asia and subdued demand in China prompting an increase in exports to the US as demand continues to slow.vMid-cut alcohol supply is expected to remain long in H1 2023. Q1 contracts have been limited, with players separately looking to reduce their current inventory levels or commit to longer term agreements with a price adjustment.v Single cut C16 is also long, weighing on C16 and C16-18 blends. C18 remains snug relative to these other chains, but slowing demand is offsetting these concerns. vThese conditions are likely to persist despite an ongoing force majeure at Sasol's US Lake Charles, Louisiana, Ziegler alcohols and alcohol-based surfactants site. vSasol expects to complete the repairs at the site by the end of Q1. One dynamic that may shift is in the 16-18 chain. Because C18 markets are relatively snug compared to C16 alcohols, producers in southeast Asia are likely to maximise C18 production, in turn reduced C16 output. This could help get the market into a better supply balance in H1 2023.

Reporting from ICIS’s alcohol guru, Lucas Hall, noted that Mid-cut supply is long, limiting discussions for Q1 material, with large volume buyers looking to make long-term agreements over quarterly contracts. C16 supply is also long, weighing on discussions. Tight supply for C18 is offsetting the downward pressure in C18 and C16-18 markets.

Sasol expects to complete repair work at its Ziegler alcohol unit at Lake Charles, Louisiana, by the end of the first quarter of 2023, subject to delivery of equipment. The site remains on force majeure for Ziegler alcohols and Ziegler alcohol-based surfactants. Demand is overall slow as players conduct year-end rightsizing against the backdrop of major economic concerns globally.

Q1 contract discussions*

| Product | Price (cents/lb) | INCO | Location |

| C12-C15 | upper 70s - lower 80s | DEL | USG |

| C16 | 115-120 | DEL | USG |

| C18 | 175 | DEL | USG |

| C16-18 | low 150s | DEL | USG |

*The prices in the table represent free negotiations among buyers and sellers for standard balance material and not confirmed settlements/assessments.

US Q4 fatty alcohols contracts decrease with downtrend in PKO

Q4 contract ranges*

| Product | Price (cents/lb) | INCO | Location |

| C12-C15 | 82-98 | DEL | USG |

| C16 | 120-150 | DEL | USG |

| C18 | 170-220 | DEL | USG |

| C16-18 | 190-230 | DEL | USG |

*The prices in the table represent a range of settlements for standard balance material heard throughout the quarter for the majority of market participants. Prices heard above and below those listed in the table were excluded as they were not viewed as representative of the wider market.

Source: CME Group, Matthes & Porton, WSJ Cash Markets

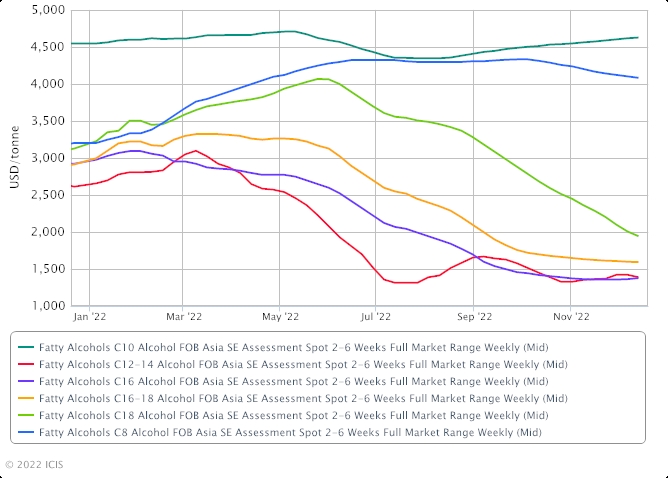

And, completing the picture, ICIS’ Helen Yan reports that Asia’s fatty alcohols demand may pick up in the second quarter (Q2) of 2023 following the relaxation of China’s zero-COVID policy.

- Demand may pick up in Q2 2023 on seasonally strong downstream production

- Buyers likely to still have high inventories for Q1 2023

- Geopolitical and macroeconomic uncertainties to curb spot interest

“We expect demand to pick up in Q2 which is usually the strong production season for the downstream markets,” a regional supplier said. “Spot interest for imports is also likely to emerge in February or March after the Lunar New Year,” he added. The Chinese market will shut on 21 January for the week-long festive holiday. Trades and business activities in Asia typically wind down about a week or so prior to the Lunar New Year holiday, which is also celebrated in Indonesia, Malaysia, Singapore, Vietnam and South Korea. The outlook for the first quarter of 2023 may be more subdued due to the high inventories held by buyers, amid weak sentiment and the slump in demand in 2022.

“Demand for [fatty] alcohol is very low as customers are still sitting on high inventories. This will mean lower offtake in Q1 as customers will not be able to take the contracted shipments due to the backlog of cargoes,” a major buyer said. Geopolitical and macroeconomic uncertainties, amid a prolonged Ukraine-Russia war, had dampened sentiment and weighed on demand in 2022.

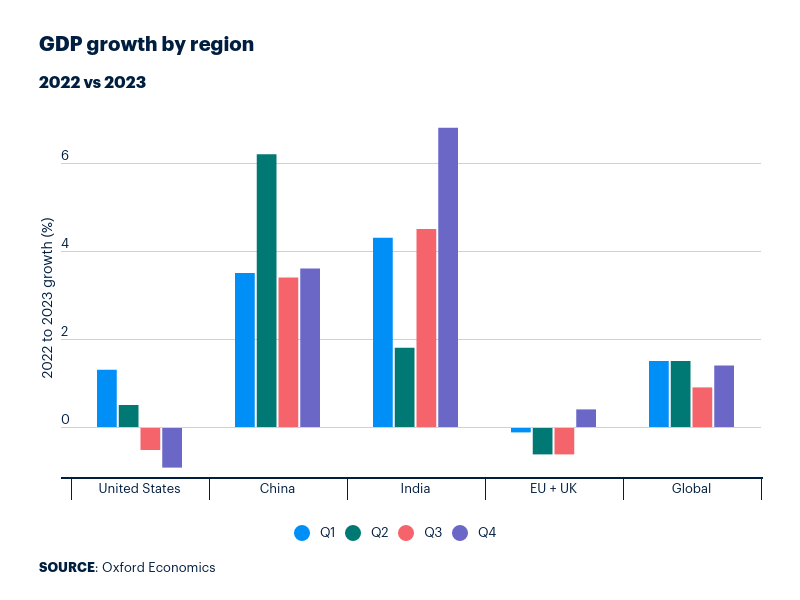

The economic fallout from the sanctions on Russia had led to rising energy and food costs, recession fears, inflationary pressures and a global economic downturn. Meanwhile, there are also concerns over the surge in COVID-19 infections in China and a looming recession in the EU and the US. China, the world’s second largest economy, is seeing a surge in COVID-19 infections. The country relaxed its zero-COVID policy on 7 December and the removed most of its restrictions. Although market players are generally optimistic that the relaxation of the COVID-19 rules and anticipated reopening of China’s border will boost demand and bolster the Asian market in Q2 2023, there are also concerns that this may be offset by the looming recession in the EU and the US.

The weak macroeconomic environment is expected to restrain growth potential in the US, while the EU’s logistics challenges and cost-of-living crisis will likely curb demand in 2023.

The key end-use for the core fatty alcohols product, C12-14 mid-cuts, is surfactants, which comprise numerous cleaning and detergent uses, ranging from household agents to oilfield applications. However, the supply of fatty alcohols may be constrained by regional plant maintenance shutdowns in the first half of 2023 in Malaysia and Indonesia.

In the world of LAB, ICIS’ Clive Ong provided a very insightful analysis into the markets in India and South Asia. Those markets continue to be mired in weakness with demand at a low ebb. Buyers remain mostly unhurried with supply ample in most regions.

In India, the LAB market has remained weak ever since the monsoon season in the third quarter and failed to revive before or after the subsequent Diwali festivities. The slump has been so severe that most suppliers have left the subcontinent alone as year end approaches, and are focused on other regions with higher net backs. The weak demand for LAB from downstream linear alkylbenzene sulphonate (LAS) and linear alkylbenzene sulphonic acid (LABSA) resulted in a widening buy-sell gap. LAS/LABSA makers talked of poor demand for their products as well, as makers of washing liquids and powders switch from a portion of LAB/LABSA usage to more competitive alternatives such as sodium lauryl ether sulphate (SLES), alpha olefin sulphonte (AOS), alcohol ethoxylates and the like where possible. The inflationary pressures over the past two years on other components in detergent production, apart from LAS/LABSA, such as soda ash, salt and even packaging have made producers sensitised to costs, resulting in an earnest search for alternatives to mitigate cost pressures.

Another important aspect of the surfactant/detergent sector in India is elevated power costs and utilities, which has been impacted by the volatile energy markets this year.

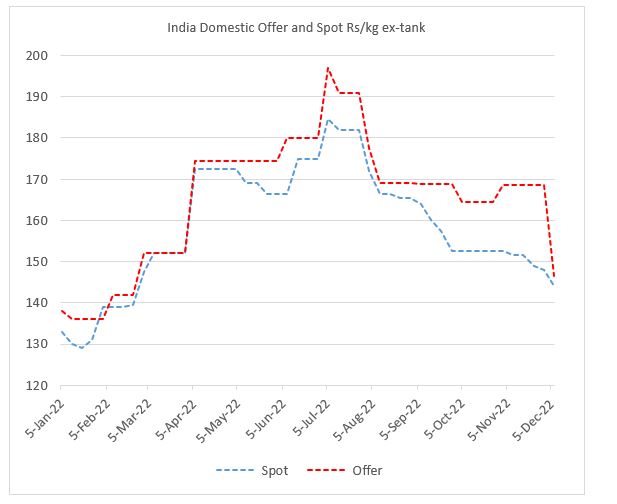

A number of participants anticipate that the weakness in the LAB market would likely persist into 2023, but some improvement could be in the offing when the second quarter demand season arrives. Users are understood to have modest stocks of LAB after months of buying on a need-to basis. Some continue to hold low stocks in anticipation of further weakness in the LAB market. Suppliers, on the other hand, are reluctant to discount prices sharply and give away more margins. The widening buy-sell gap continues to hamper sales in India. Producers have started to lower offers in order to move volumes in late year, as demand showed limited pickup. From the chart below, initial offers in December have moved down to close the gap against the spot market prices, with sellers conceding to prices needed to move material.

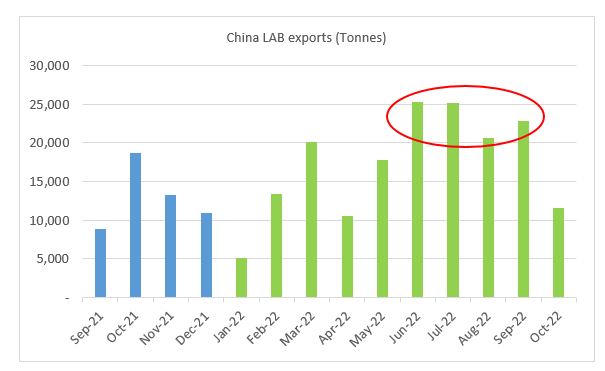

Over in northeast Asia, the Chinese market was hobbled by strict zero-COVID policies for most of the year. The sporadic and intermittent lockdowns across the country continue to dampen demand and trade of LAB in the domestic market. Earlier from the middle of the year, producers were saddled with huge inventories which resulted in an exodus of Chinese products to the broad Asian region and elsewhere. Users in Africa, south Asia, the Middle East and Europe saw an increase in competitively priced Chinese material weighing down their markets. These exports declined in the fourth quarter as the Chinese market regained some equilibrium. The COVID-19 restrictions, maintenance and decent demand helped curb supply and kept the market steady.

While offers of LAB from China and NE Asia continue to decline in tandem with weakness in the broader markets of Asia, south Asia and the Middle East, the initial easing of zero-COVID policies in China has boosted optimism to some degree.

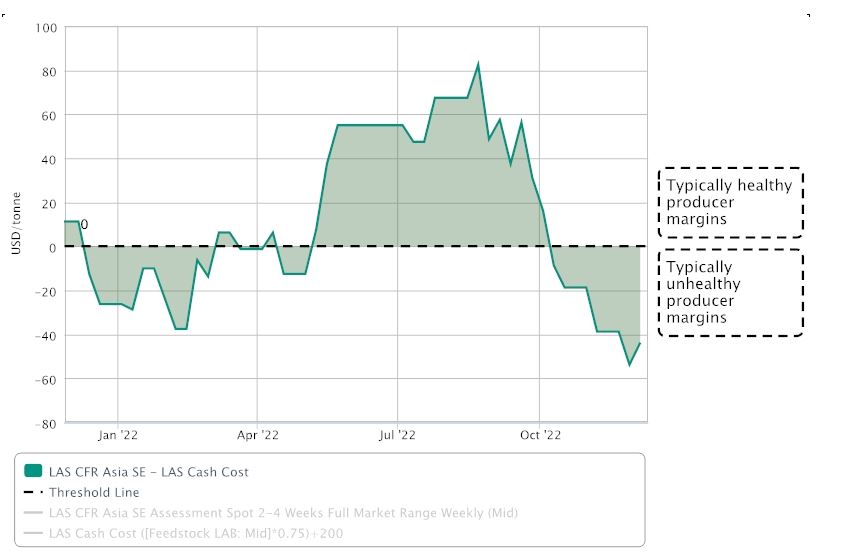

While the market still has to contend with the year-end lull season and the upcoming Lunar New Year holidays in the second half of January 2023, some participants anticipate that demand will be much firmer in spring, should the Chinese government hold fast to its decision to fast track the country out of its restrictive zero-COVID environment. Some factories in China which initially planned to shut weeks ahead of the Lunar New Year on the back of poor demand and margins appear to be considering otherwise, as players start to look for a comeback in demand as rules are progressively relaxed. In the meantime, should a recovery in demand for surfactants and detergents become a reality in the near term, the gap between LAS and LAB values would start to narrow, which would likely spur trade for both products. Currently LAS makers continue to lament the high costs of LAB, while LAB producers continue to struggle with protecting their own margins, resulting in a general malaise in the LAB spot market.

Around the middle of the month, Clariant announced a major project. They will invest Swiss francs (Swfr) 80m ($86m) to expand its Care Chemicals facility at Daya Bay in China’s Guangdong province, boosting support for pharmaceutical, personal care, home care and industrial application customers, the company announced. This investment will increase Clariant’s production capacity for existing products as well as the introduction of new products by the end of 2024. Clariant also aims for the site to become a new global hub for its healthcare business, saying it believes China would remain a growth driver for many chemicals. Clariant is looking to expand the contribution of China sales in its global total to 14% from its present 11% and raise its China production share to 50% from 35%, both by 2025. Its most recent investments in Daya Bay include a Swfr40m second production line of flame retardants, slated to come on stream in 2024, and its Swfr60m first line, due to start up in 2023.

In move reminiscent of the old days of Solazyme and LS-9, Genomatica (Geno) is attracting partners for the technology it is developing that would ferment sugar to produce oleochemicals, providing the industry with an alternative to palm-based feedstock.

Recently, Kao Group, a Japanese chemical and personal-care conglomerate, made an unspecified investment to help scale up and commercialise the sugar-to-oleochemical technology. Unilever, another personal-care company, also invested in the venture.

"Unilever + KAO have partnered with Geno ($120m-plus venture) to bring plant-based alternatives of palm oil into more products," the company said.

A fermentation route could be a simpler way to make oleochemicals. Currently, most oleochemicals are produced from fats such as soybean oil, beef tallow, tall oil, coconut oil, palm oil or palm kernel oil (PKO). The fats are hydrolysed to produce glycerine and mixtures of fatty acids. Different fats produce different proportions of fatty acids, as shown in the following table.

| Chain | Name | PKO | Coconut | Palm Oil | Soy | Tallow |

| C6 | Caproic | 0.3 | 0.3 | |||

| C8 | Capric | 4.5 | 7.5 | |||

| C10 | Caprylic | 3.5 | 8.0 | |||

| C12 | Lauric | 48.2 | 46.7 | 0.2 | ||

| C14 | Myristic | 16.0 | 18.0 | 1.0 | 2.0 | |

| C16 | Palmitic | 7.5 | 9.0 | 44.0 | 6.5 | 35.0 |

| C18 (total) | Stearic | 20.0 | 10.0 | 54.8 | 92.8 | 63.0 |

| C20 | Arachidic | 0.7 |

For companies that make surfactants and detergents, the fatty acids need to be converted into fatty alcohols. Current production methods cannot easily target an oleochemical of a specific carbon length. Instead, producers are left with byproducts.

Sugar fermentation opens up the possibility of producing palm oil alternatives in a single step while minimising all of the byproducts or additional conversions. LS9, the predecessor of the REG life sciences business acquired by Geno, had started up a demonstration unit a decade ago that was developing a route to ferment sugar to produce fatty alcohols. Geno has already demonstrated its ability to make highly pure chemicals. It has successfully launched butanediol (BDO), butylene glycol (BG) and Avela, its brand of (R) BDO. Geno did not elaborate on its sugar-to-oleochemicals process other than saying it is targeting molecules including 8-16 carbon atoms.

An interesting snippet out of Singapore earlier in the month: Nouryon has acquired a specialty surfactant alkoxylation plant on Singapore’s Jurong Island petrochemicals hub, the Netherlands-based chemical company said in a statement. The acquired plant will enhance Nouryon’s ability to serve growing regional customer demand in end-markets such as agriculture and food, home and personal Care, natural resources, and paints and coatings, it said. Details about capacities, the acquisition price or the seller’s identity were not disclosed. [ Our readers know everything – so – can someone tell me who the seller is and I will updated the post with that information – without attribution if you so wish.] Update Jan 4th: A number of you got in touch within hours of the blog going live to let me know that the seller was Solvay. I was a bit surprised, honestly, but am quite sure the information is accurate. This plant was commissioned in 2015 and is on a pipeline EO supply. There you go!

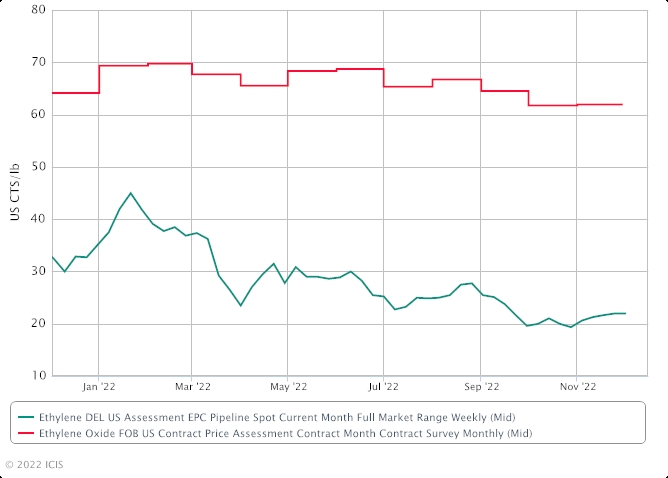

And finally, in the US, November EO actually ticked higher as demand grew. US November ethylene oxide (EO) contracts were assessed at 61.95 cents/lb ($1,365.75/tonne). The increase in EO contract prices can be attributed to the uptick in ethylene contract prices for the month of November. Availability of EO continues to improve as demand remains balanced with supply. Additionally, two turnarounds have since been completed. The market is expected to remain balanced through the fourth quarter, according to ICIS.

That's it. As noted above, I have some music links for you, that I am pretty sure, I've not put in the blog before, that are also some interesting pieces I've listened to this year, often while writing the blog. Enjoy!

First up: The Death Wheelers, I Tread on your Grave. An instrumental album with 70's biker movie vibe. Some of the between songs commentary is hilarious, e.g. at 18:38. Well worth a listen all the way through.

A colleague in the industry has alerted me to delights of Viking Metal, a genre which, until about a month ago, I had no idea existed. Here's Amon Amarth with Put your Back into the Oar. In my part of the world, the Vikings made quite an impression and not in a particularly good way!

On the same label as the Death Wheelers, check out Death and Consolation by the Well. As if you needed any more evidence that Black Sabbath have a lot to answer for. Generally the Riding Easy Records Youtube channel has a very rich trove of music which, I for one, have never come across. Good soundtrack for cold winter afternoons working in the home office, if that's your thing.

Finally, I was prompted to re-listen to this classic by a story I read recently. Rattus Norvegicus by The Stranglers. Ridiculous lyrics with even more ridiculous bass lines..Outstanding!

So that's it for now. As promised, here's a link to an intersting short story that I read on a website dedicated to short stories. It has some tenuous connection to chemicals, but not surfactants. See what you think. https://728stories.com/

All the best.