We divide these blogs, usually, into parts and I allow you to scroll to the item or items of interest, which may be the news or the music section. Today however, you have to read this commercial message before moving on. Don’t even try to scroll down. The screen is locked until you read and act on the following: Yes, it’s the May 4 – 5th ICIS / Neil A Burns World Surfactants Conference in Jersey City, NJ. It falls directly after SCC Suppliers Day and so if you are in town, come on by. We will have big familiar names like BASF and Sasol, along with some brand new ones like Ruby Bio and the Consumer Brand Association. Plus some secret special guests that I can’t yet reveal.

But wait, there’s more. I have a code for you that will save you some money off of an already low price. Just use this MKTSTDNBB5 at checkout. (Always wanted to say that..)

So.. did you click on the link, register and use the code? Yes? Good OK – so you can scroll on down now to the news and music sections if you like.

The News

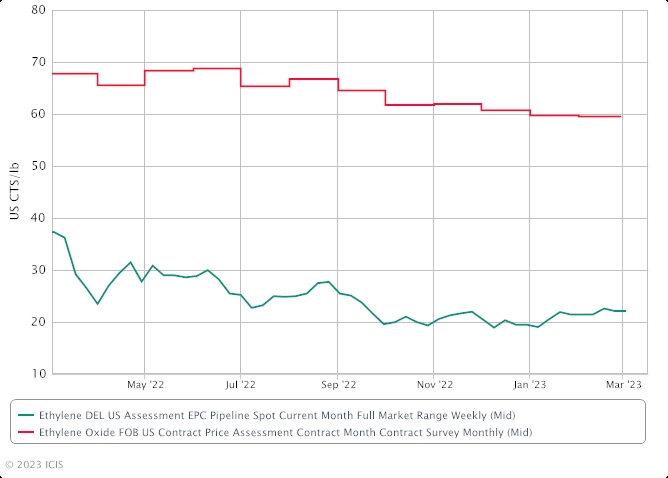

Right at the start of the month, ICIS reported that US February ethylene oxide (EO) contracts were assessed at 58.55-60.55 cents/lb ($1,290.79-1,334.89/tonne). EO contract prices continued to decrease for the fourth consecutive month on declining ethylene contract prices. Demand for EO continues to be weak on low discretionary spending due to increasing recession fears. Demand is expected to continue to be weak through Q1 and into Q2.

Further on EO, we had a bunch of force majeures and shutdowns in the month. 2/2, Formosa Plastics had an EO shutdown due to an overcurrent trip. Then on 2/9 ICIS reported that Indorama’s Clear Lake, Texas ethylene oxide (EO) and ethylene glycols (EG) plant remains down after experiencing issues restarting following winter storm Elliott in December. Indorama had shut down the plant as a precaution ahead of the freezing temperatures in December but remains down as the plant faced a technical issue while recommissioning, which caused a fire. The market expects the plant to remain down until at least the end of February. On Feb 10th, ICIS reported that US ethylene glycols (EG) and ethylene oxide (EO) producer LyondellBasell lifted a force majeure on its Bayport plant in Texas after a unit upset caused by winter storm Elliott. Finally on 7 February, an unexpected and unforeseeable equipment issue occurred at one of Dow Chemical’s upstream units at the Taft facility in St Charles, Louisiana. There were no injuries associated with the event and no impact to the community. However, the incident is expected to reduce downstream production capabilities over the next few weeks. There are several ethylene oxide (EO) derivatives on force majeure as a result of this incident, specifically EO-based glycol ethers. Additionally, Dow has stopped almost all EO-derivative exports. Dow is currently assessing how long the force majeures at the Taft facility are expected to last. Dow’s Seadrift, Texas, and Plaquemine, Louisiana, plants are both running, but at reduced rates.

Meanwhile on the oleochemical side of the market, ICIS notes that Indonesia’s Golden Agri Resources (GAR) is targeting capital expenditure (capex) of up to $240m this year, with some of it to be used to expand its oleochemical plants. The capex will be “mainly for replanting, expansion of kernel crushing and oleochemical plants, enhancement of downstream facilities, and carbon emission reduction initiatives”, the Singapore-listed firm said in notes accompanying its 2022 financial results. In November last year, GAR and Spain’s CEPSA signed an initial deal to grow bio-based chemicals production in Lubuk Gaung, Indonesia under their joint venture Sinar Mas Cepsa Pte Ltd, but details were not available. The planned expansion is in response to growing demand for home and personal care products, as well as increased demand for sustainable, bio-based solutions across a variety of industries as the driver for global fatty acids and natural alcohols demand.

In Indonesia, Sinar Mas Cepsa currently operates a 200,00 tonne/year oleochemicals plant in Dumai, Sumatra which was inaugurated in 2017, at a cost of €300m. Sinar Mas also produces surfactants in Germany for the European market, according to its website. Palm oil giant GAR announced a record net profit of $782m in 2022, up 64% from the previous year, lifted by a 12% increase in sales and a 50% jump in earnings before interest, tax, depreciation and amortisation (EBITDA).

| in $m | 2022 | 2021 | % change |

| Sales revenue | 11,439 | 10,183 | 12.3 |

| EBITDA | 1,826 | 1,214 | 50.4 |

| Underlying profit | 922.0% | 603% | 52.9 |

| Net profit | 782 | 476 | 64.3 |

Total palm product output in 2022 increased by 3.3% to 3.06m tonnes, with crude palm oil (CPO) accounting for more than 79% of the total.

| Production (in '000 tonnes) | 2022 | 2021 | % change |

| Palm product output | 3,060 | 2,961 | 3.3 |

| CPO | 2,428 | 2,358 | 3.0 |

| Palm kernel | 632 | 611 | 3.4 |

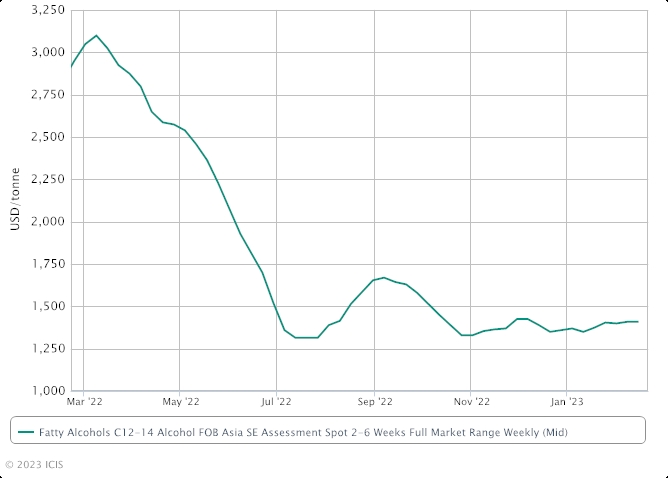

The great Helen Yan of ICIS reports that Asia’s demand for fatty alcohols C12-14 mid-cuts is expected to remain healthy as buyers sought to procure late March and April shipments. Buyers from China, India and South Korea were heard seeking late March and April shipments of C12-14 mid-cuts, prompting offers for fresh shipments to rise to $1,460-1,470/tonne FOB (free on board) southeast (SE) Asia this week, market sources said. “Demand for the C12-14 mid-cuts is healthy and we are sold out for March,” a regional supplier said.

China’s reopening has boosted sentiment, with players optimistic that the tourism and hospitality industry will rebound in the second quarter. "Demand for surfactants will pick up in the second quarter and remain firm in the third quarter, as China's reopening will boost the tourism and hospitality industry, " a downstream fatty alcohol ethoxylates producer said. \China reopened in early January this year after dismantling its zero-COVID policy in December last year. China was shut for nearly three years due to its pandemic-induced lockdown restrictions to contain the spread of the coronavirus pandemic.

There was a fair bit of news around Stepan’s Q4 2022 report and we’ll report it here. First off the results themselves: Stepan’s Q4 operating income fell by 41.5% year on year to $11.7m as sales volumes fell 17%, the US-based surfactants and polymers company reported.

Gross profit fell as the cost of sales rose at a higher pace than sales.

Stepan, three months ended 31 December:

| (in thousand $) | Q4 2022 | Q4 2021 | +/- % |

| Sales | 627,176 | 610,027 | 2.8% |

| Cost of sales | 559,416 | 526,774 | 6.2% |

| Gross profit | 67,760 | 83,253 | -18.6% |

| Operating expenses | 55,986 | 60,170 | -6.9% |

| Operating income | 11,691 | 19,997 | -41.5% |

| Net income | 10,834 | 16,995 | -36.3% |

KEY POINTS

- Surfactant and polymer operating income was "significantly impacted" by customer and channel inventory destocking, the company said;

- Surfactant operating income was $21.8m, down from $32.4m in Q4 2021, primarily due to a 15% decline in global sales volume;

- Polymer operating income was $3.0m, down from $12.9m in Q4 2021, primarily due to a 23% decline in global sales volume, including a 21% volume decline in rigid polyols and a lower demand in the specialty polyols and phthalic anhydride (PA) businesses;

- Stepan’s Specialty Products business reported operating income of $6.6m, up from $2.1m in Q4 2021, primarily due to improved margins and customer mix within the medium chain triglycerides (MCT) product line.

OUTLOOK

In 2023, Stepan's business will be challenged by continued elevated inflation and high interest rates, said CEO and president Scott Behrens. “We believe this macro environment could negatively impact consumer demand and construction-related activity which will affect both our Surfactant and Polymer businesses,” he said.

Additionally, higher overall cost inflation, higher depreciation and pre-start up expenses associated with Stepan’s new site in Pasadena, Texas would challenge earnings growth in 2023, he said. “We are seeking to offset these 2023 headwinds partially with productivity improvements, pricing increases where possible, and furthering our efforts to improve product and customer mix,” the CEO said.

Further Stepan news as reported by ICIS, from the Q4 results presentation: The startup of Stepan's alkoxylation expansion in Pasadena, Texas, originally slated for late 2023, is now expected to start up in H1 2024, the company said in its Q4 results presentation. The startup is a further delay from H1 2024 timeline provided in the company's Q2 results presentation. President and chief executive officer (CEO) Scott Behrens said construction is about 20% complete and the startup of the site delayed by about a month or two max as a result of raw material delays on the civil construction of the site. Behrens added that the site should be mechanically complete and up by mid-year 2024. The new plant will provide “a flexible capacity” of 75,000 tonnes/year, capable of both ethoxylation and propoxylation. When operational the site will bring Stepan's alkoxylation network to three plants and provide strategically located redundancy and long-term capacity for growth in ethoxylates and propoxylates, it added.

Things continue to look better in Asia notes ICIS as Asia’s fatty alcohol ethoxylates (FAE) market is expected to see demand pick up in the second quarter, as the tourism and hospitality industry rebounds following China’s reopening. “We expect demand for FAE to pick up in Q2 and remain firm in Q3 as the tourism and hospitality industry will rebound following China’s reopening,” a regional producer said. China reopened in early January this year after abolishing its zero-COVID policy in December last year.

China was shut for nearly three years due to its pandemic-induced lockdown restrictions to contain the spread of the coronavirus pandemic. Meanwhile, spot trades were largely confined to smaller parcels on a need-to-basis as customers adopted a prudent stance, given the uncertain outlook and sluggish global economy. Demand from the downstream surfactant industry was tepid, given that major economies had slowed down amid rising interest rates and global recession fears. Cost-of-living issues have largely dented consumer confidence and capped spending.

Fluctuations in upstream palm kernel oil (PKO) and feedstock fatty alcohols C12-14 mid-cuts also weighed on demand and dampened market sentiment. However, the FAE market is expected to remain stable in the near term due to limited feedstock ethylene oxide (EO) supplies and reduced operating rates at FAE plants.

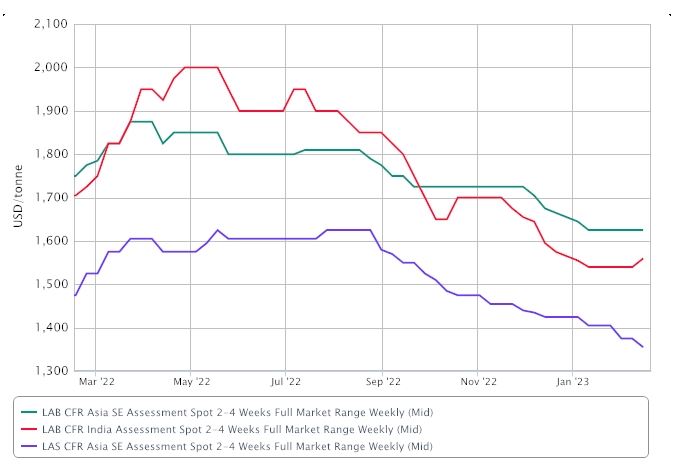

Meanwhile back in the LAB market, the market in east and south Asia showed signs of a revival this month, following a prolonged weakness that began in the third quarter of last year.

- Sellers push for higher values

- Buyers replenish stocks

- Players look to firmer demand post winter

Sales of spot parcels were firmer as buyers accepted some increments. Flexi tank lots, ex-Asia, were heard sold in the low-to-mid $1,600s/tonne CFR (cost & freight) India. The India domestic prices also edged higher in February to rupees (Rs) 138-139/tonne ex-tank, ICIS data showed. Flexi-tank cargoes from the Middle East also found buyers in northeast Asia in the low $1,600s/tonne CFR NE Asia, up from previous levels in the $1,500s/tonne CFR NE Asia. Regional suppliers in northeast Asia also talked of higher offers for March cargoes, as elevated feedstock costs have narrowed margins.

“Sellers have told us that March quotations will be higher than February,” said a buyer in northeast Asia. With the passage of winter, market participants largely anticipate further strengthening of demand for LAB in the weeks ahead, which is typical of warmer months. “We should see better demand from March onwards,” said a producer in India.

While the outlook appears to have brightened, the India market still has to work through imported inventories procured previously. However, supply-demand conditions have improved after a lengthy period of slow buyers’ offtakes and reduced output from local makers. “The market condition is better than before, although cheap imported stocks are still available,” said an end-user in India. Offers in Asia have also been increased as suppliers to the region tried to lift margins. Some buyers’ acceptance appears to be forthcoming, as low-priced material has started to disappear. The downstream LAS market in southeast Asia has also seen some demand uptick recently, as bargain hunting kicked off after LAS prices fell to a level deemed acceptable to buyers.

“Demand in Asia is quite firm recently, after prices declined,” said an LAS producer in NE Asia.

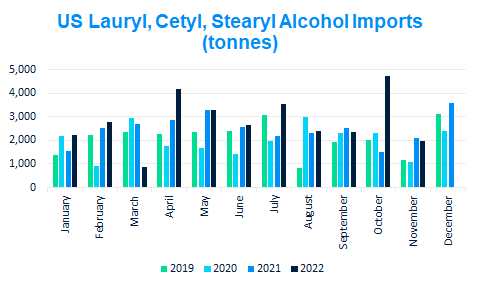

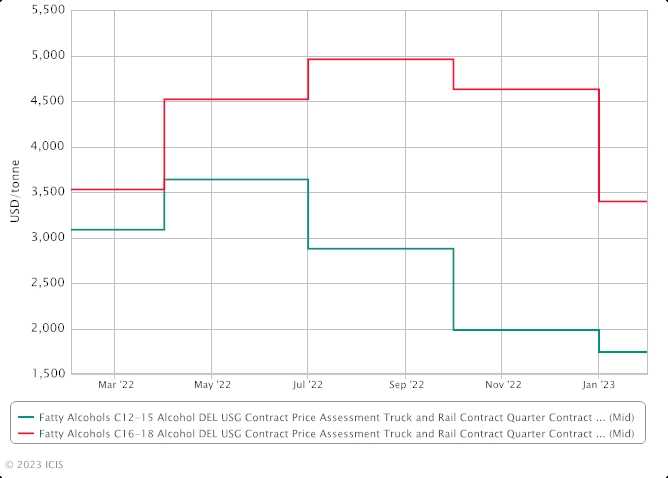

At the beginning of February, our alcohol guru, Lucas Hall reported from the ACI (and so I guess it’s OK to note what he had to say). He notes that US Q1 mid-cut fatty alcohols supply largely continues to outstrip demand, according to sources on the sidelines of the American Cleaning Institute (ACI) annual meeting and industry convention, but ongoing ethylene oxide (EO) disruptions could in the near-term absorb some of the supply glut as they weigh on the production of downstream alcohol ethoxylates.

- Q1 supply long, largely sufficient to meet demand

- MB spot premiums edge lower on weaker demand

- China post-holiday demand key indicator for oleochemical trade flows

- US lifts ban on palm oil, derivatives from Malaysian Sime Darby Plantation

In Texas, Indorama remains on force majeure for EO and ethylene glycols (EG) at its Clear Lake site, disrupting supply to nearby Clariant. In Louisiana, Sasol remains on force majeure for Ziegler alcohols and Ziegler alcohol-based surfactants, following a 15 October fire at the company's Lake Charles site. \ Sasol resumed production at 50% utilisation in November and expects to complete the repairs of the alcohols unit by end Q1 2023. Sasol said the fire was limited to a portion of the plant for which it has redundant processes. Allocations stemming from the Sasol outage have largely been offset by weak demand in the wider market, but the Indorama outage has created some hiccups in recent weeks. Sources said tolling fees have increased in the wake of the Indorama outage. Indorama also has ethoxylation capacity at its Port Neches site.

However, suppliers are wary of tolling product and/or exposing themselves to demurrage in the event the Clear Lake outage is short-lived, against the backdrop of otherwise weak demand conditions in the market. At the same time, with China poised to return to the market following the Lunar New Year holiday and Indonesia and Malaysia's current palm oil stocks in a tight balance, imports could slow to more typical levels, helping to balance the market.

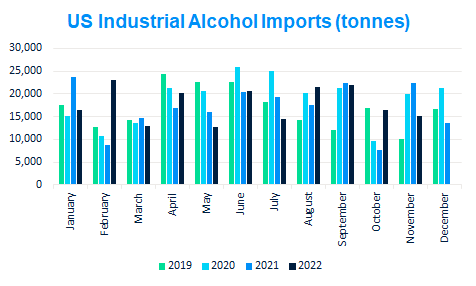

Source: ITC Trade Data

Source: ITC Trade Data

Market players estimated fatty alcohols demand in some segments down 20-30% from typical Q1 volumes because of the long supply environment.

In news from India; Godrej Industries Ltd (GIL) has appointed Vishal Sharma as Chief Executive Officer of GIL–Chemicals Business with effect from March 1, 2023. Vishal will report to Nitin Nabar, Executive Director and President (Chemicals), Godrej Industries Limited. Vishal will join Godrej from Ecolab where his previous role was as Senior Vice President of the India, Middle East and Africa (IMEA) region, based in Dubai since June 2020. In this role, Vishal led Ecolab’s strategy and operations in IMEA and was responsible for achieving record sales and profit growth in this region. Prior to this, Vishal led Ecolab’s Industrial business for Asia Pacific and was based in Singapore. He joined Ecolab in 2013 after 12 years at Diversey, Inc. Earlier in his career, Vishal also had a stint with GE (General Electric) in their Lighting business. Vishal has a Post-Graduate diploma in Management from IMDR Pune, and a Bachelor’s degree in Engineering from MIT Manipal in Mangalore.

And finally some very interesting news from a company I have been following for several years now, Consumertec of Ecuador. Among other things, the company provides Virtual Reality simulations to enable companies to experience how consumers in different parts of the world view garment cleanliness after various washing protocols. Last month the emailed me about their new Dingy and Double Dingy monitors. To me, whose white garments are only white until they are removed from the package, this was an intriguing development. On a special section on their website, Consumertec explains what this is all about:

Apparently, the "clean" fabric worn by consumers is not clean, it is a "dingy" fabric (percudido in Spanish or encardido in Portuguese). After the first cycles of wearing/washing/drying/wearing, some level of body and ambient soil redeposition occurs as well as white fabrics become yellowish due to a light induced loss of fluorescence, and finally become tinted by deposition of dyes coming from others garments and more importantly by deposition of dyes present in laundry product to improve visual perception. Therefore white clean garments in the market are really clean dingy garments, not-new-garments ready to wear, not ready to wash. Thank you Consumertec. So, I am not alone!

Consumertec (in a pretty amazing feat of market focus) has designed a group of test fabrics to represent this complex reality relevant to the worldwide laundry market. Laundry markets that they represent are: India (two versions), China (two versions), South east Asia, Australia/New Zealand, Japan, Western Europe, Russia, Balkans, Middle East/North Africa, Latin America, USA/Canada, Africa Sub-Saharan. SO, right there, you’ll notice India and China each have two types of Dingy but the US and Canada have only 1 type between them! How come? I honestly expected New Jersey to have it’s own special Dingy along with Manhattan having at least 2 and Brooklyn its very own. Anyway, each laundry market has been characterised by: environmental particle matter, land clays and dust, natural sun radiation during drying/wearing, washing conditions and laundry products. The general code of these group of clean dingy monitors are Dingy_CL

But wait! There’s more! Consumertec goes on to note that the word dingy is also used by consumers in regards to a different, yet related, aspect. It is used to refer to a specific garment area, an area that became soiled and stained nearly every time the garment was worn. Examples of such areas/soils are: collar&cuffs, armpit, socks, underwear liner ….er OK you get the idea... In all of these cases, a specific area in a garment becomes noticeably soiled, then washed, then soiled again in a repetitive fashion with the obvious consequence that soils tend to accumulate and then become difficult to remove: the “tough dingy areas”. In line with this, Consumertec developed the double dingy (DD) monitors, a group of test monitors that combine two consumer-relevant facts: dingy soiled/stained areas on dingy substrates. Currently available DD monitors are: collar&cuffs, armpit, underwear ….OK fine… produced after ten (10) cycles of washing/drying of the substrate and three (3) more cycles of soiling and washing to generate the dingy stained area. Wow! – right?

Finally, Consumertec mentions with some obvious satisfaction, continuous redeposition of body soils, including fatty materials present on dingy fabrics, become a source of unpleasant smells (their emphasis) in used garments, not removed during washing cycles, but masked by some laundry products and not by others. Consumers easily detect this peculiar rancid-like smell on worn fabrics which is characteristic of long life garments. The general code of these group of malodorous dingy monitors are Dingy_MS.

I urge you to check out the website which continues for another few pages, along with a spectral emitted radiance factor graph. Why did I enjoy this so much? Not 100% sure, but I think it’s to do with the detailed passion for the subject and the in-depth study that has gone into this whole area. It’s a real problem and these guys are scientifically framing a means to monitor, measure and ultimately solve it – all around the world. It’s focus. It’s craft. It’s market intimacy. I dunno. I just admire it.

Finally - the music section

February is the shortest month and so here is a selection of my favorite short songs (sorry that’s all I have for you) and I notice that many have already been in the blog over the years. But so what. Blogger picks the music right?

I’m an Upstart by the Angelic Upstarts – from my hometown, all those years ago.

Of course the great Ramones from Queens, of the same era

Anyone remember this one? Disco sucks. True or ?

I used to like this one – ATV

It’s not all punk though, what about this first 1:42 song on Van Halen’s first album?

Or look how much is packed into this 2:52 from VH’s 2nd album. Listen again – solidly packed right?

And this classic; Motorhead at 2:49

I love this. Lemmy was wont to sing tributes. His most heartfelt I think was to the Ramones – R.A.M.O.N.E.S

Here’s Lemmy’s tribute to himself. We are Motorhead (and we play rock ‘n roll)

Judas Priest, I think never gets enough credit. They had some incredible flashes of brilliance and originality. Here, at a touch over 3 minutes, is Dissident Aggressor from Sin after Sin. A favorite of rock clubs in the late 70’s. Again, I think so much is packed in here. Listen twice. See what I mean..?

That’s it for this month.