Greetings from Orlando. It’s good to see the ACI annual meeting back to full strength this year and to catch up with old friends and meet some new folks too. As usual, we don't report hearsay and tittle-tattle here on the blog. All’s we have here in the news section is what is already in the public domain, usually reported by my friends and partners at ICIS. If you really want to hear the latest ACI gossip, then go the meeting. As I always, say – you gotta be there! .

One thing I did pick up this week, is that we have a lot of new readers of the blog. Welcome! We do music here also. It’s usually at the end and so you can skip it if you like. But you shouldn't. The musical choices of this blog have been rated as impeccable by an independent global panel of experts, which I quickly assembled in Orlando over the past few days. Now you know.

The other thing you should know as a new reader is that I relentlessly, but transparently, shill for my other interests here. One such interest is the upcoming World Surfactant Conference coming up, May 4th and 5th in Jersey City. It’s co-produced by ICIS and features the best content and networking you can get, crammed into a day and a half. This time, we run directly after the SCC Supplier’s day. So, if you’re in town for that, why not make a week of it? My other, other interest is P2 Science, my actual day-job. There’s some news here but I guess I have to wait for a press release to come out – so stay tuned to Linkedin is probably the best thing there.

OK – The News

Toward the end of the month, the great Al Greenwood of ICIS noted that Dow has started the initial planning for its next wave of surfactant expansion projects. Dow is already locking in supply contracts with consumer and pharmaceutical customers, said Jim Fitterling, CEO. He made his comments during an earnings conference call. Dow should start up the additional alkoxylate capacity as well as polyurethane system investments in 2023-2025, it said. In total, those projects should contribute $100m-150m in earnings before interest, tax, depreciation and amortisation (EBITDA).

Dow did not provide details about where those expansion projects will be or the magnitude of the expansions. As readers will recall, among the earlier wave of alkoxylate expansions, Dow started up its US project in the third quarter, and the European portion should begin operations in the first quarter. In total, the earlier alkoxylate projects should contribute $50m-75m in EBITDA. The Louisiana expansion should add 60,000 tonnes/year of capacity, and the Spanish expansion should add 34,000 tonnes/year.

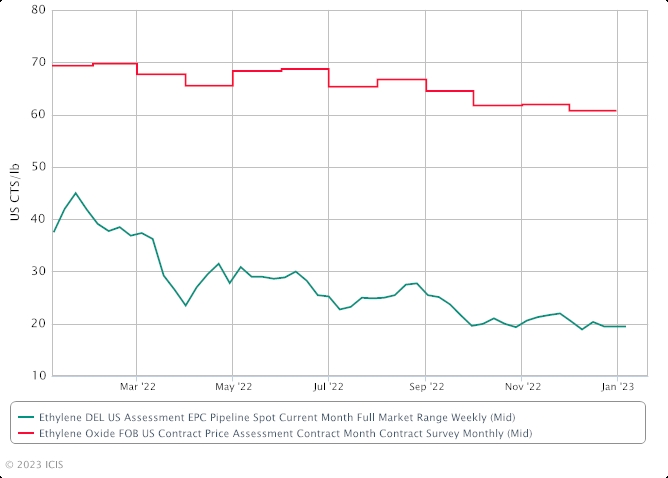

In other EO related news, ICIS reported December US ethylene oxide (EO) contracts were assessed at 60.75 cents/lb ($1,339.29/tonne). The decrease in EO contract prices is attributed to a decrease in ethylene contract prices in the month of December.

Availability of EO continues to improve, although recently, winter weather resulted in production disruptions for the market. Demand remains weak and is expected to stay weak through the first quarter.

As a reminder for blog readers: The majority of EO contracts are formula-based and the price movement comprises 80% of the change in the ethylene price and an additional conversion fee, or adder. Like ethylene, EO contracts are settled at the beginning of the month for the previous month’s price. EO is largely used to make monoethylene glycol (MEG), a key feedstock for polyethylene terephthalate (PET). EO’s secondary outlet is in surfactants. Other EO derivatives include glycol ethers, polyols for polyurethane (PU) systems, polyethylene glycol (PEG) and polyalkylene glycols. EO producers in the US include BASF, Dow, Eastman Chemical, Formosa Plastics, Indorama Ventures, Lotte Chemical, LyondellBasell, Sasol and Shell Chemical.

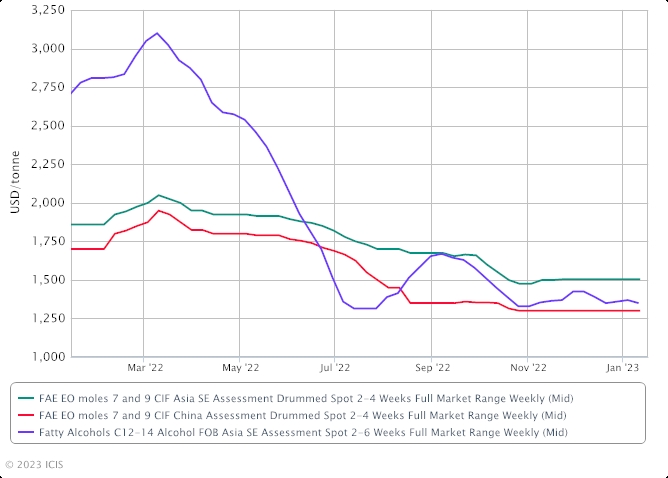

Sticking with the EO supply chain: ICIS reports that Asia’s fatty alcohol ethoxylates (FAEs) spot market is expected to rebound after the Lunar New Year holidays as demand has slowed in the run-up to the festive holidays.

- Spot trades slow ahead of the Lunar New Year holidays

- Lower feedstock fatty alcohol C12-14 weighs on demand

- Sentiment buoyed by reopening of China on 8 January

Lunar New Year fell on 22 January and trades have slowed down ahead of the festive holidays, which are also celebrated in several countries in Asia, including Indonesia, Malaysia, Singapore, Vietnam and South Korea. However, enquiries for February shipments have picked up following the reopening of China, although trades were scant due to the upcoming Lunar New Year holidays and fluctuations in the upstream palm kernel oil and feedstock fatty alcohols mid-cuts markets. Meanwhile, market sentiment has been buoyed by the re-opening of China’s borders on 8 January after nearly three years of pandemic-induced lockdowns and restrictions. “There are a lot of enquiries this week but buyers are hesitant to commit due to fluctuations in the feedstock fatty alcohol mid-cuts prices,” a regional supplier said. Feedstock fatty alcohol mid-cuts C12-14 prices have decreased recently, prompting buyers to hold back their FAE purchases and wait for a clearer outcome.

Meanwhile, suppliers are optimistic that China’s domestic market will rebound after the Lunar New Year holidays and that the US dollar-denominated spot market will follow suit. “We are expecting prices to rise, although there are some uncertainties and hopefully China will be buoyant after its reopening and lend support to the market,” another supplier said. The three-year pandemic-induced sporadic, partial and full lockdowns across major cities, towns and residences have suppressed domestic consumption and dented demand in the international spot market. The Chinese authorities scrapped the zero-COVID policy in December 2022 and downgraded the classification of COVID-19 to a lower category of infectious disease, and also removed quarantine requirements for inbound travellers from 8 January 2023.

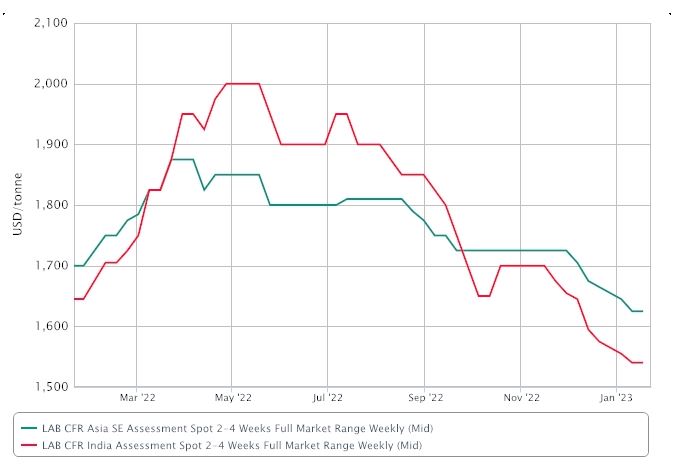

Also in Asia, The linear alkylbenzene (LAB) market in tapered off with the Lunar New Year holidays. Market participants expect activity in China and in the region to remain slow until February.

- Lower offers from China for February

- Tepid demand persists in Asia and south Asia

- Cautious optimism for Q2

Already, a Chinese producer has indicated lower offers for February cargoes as demand in the region remains lacklustre. Other makers in China have not indicated for February lots but market players anticipate a similar downward adjustment. Sales in domestic China have also fallen sharply in January, as demand waned with workers heading back to home provinces for the Lunar New Year, after zero-COVID policies were eased late last year. “After the Lunar New Year will be a traditionally slow season for LAB,” said a producer in China. However, some players looked forward to the second quarter for a revival in demand, since the easing of zero-COVID rules could spur manufacturing and trade. Others are less sanguine and believe that the mass migration during the Lunar New Year will likely trigger another big wave of infections after the holidays. This could again dampen trade and demand in China into the second quarter. At the same time, uncertain economic outlook amid recessionary and inflationary concerns will likely continue to weigh on sentiment across Asian players in the first half of the year.

The spot market in southeast Asia weakened to $1,625/tonne CFR (cost & freight) southeast (SE) Asia in January, from around $1,725/tonne CFR SE Asia in November 2022, ICIS data showed. Weaker prices, however, failed to stimulate much buying interest as buyers generally expect even lower values. Demand from the downstream sector also remained weak with LAB buyers lobbying for discounts. \ Suppliers in the region also found limited outlets elsewhere, as markets in India and Africa are also in a downdraft. Hence, margins of producers remain narrow as most have to dish out discounts to move cargoes. “India market prices are too low to consider, while Asia sellers now focus on this region and Africa,” said a seller in northeast Asia.

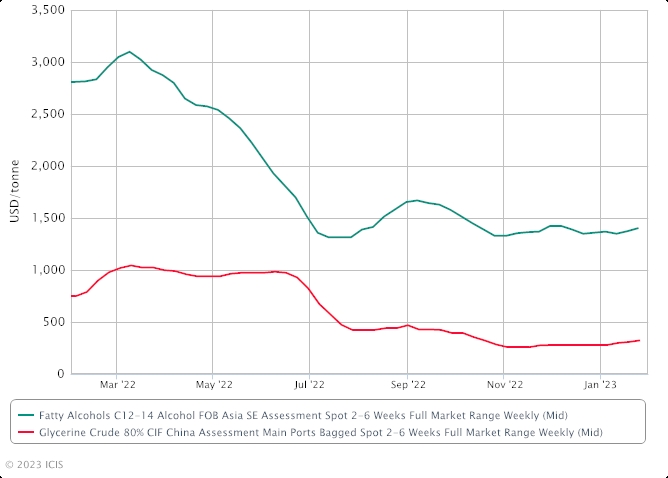

On the oleochemical side, Asia’s oleochemicals market is expected to see a resurgence in demand from China following its reopening after nearly three years of pandemic-induced lockdowns. This as reported by ICIS’ Helen Yan. China eased its zero-COVID policy in early December 2022 and lifted all restrictions and reopened its borders subsequently in early January 2023. “We are getting enquiries from China for prompt shipments of the fatty alcohols mid-cuts C12-14,” a regional supplier said. Market players anticipate Chinese spot interest to further gather momentum in the coming weeks, following their return from the Lunar New Year holidays. Suppliers are also expecting spot interest to pick up for glycerine. “I am hearing higher prices this week for both crude and refined glycerine, with China reopening and coming back after the holidays,” a trader said.

China's GDP growth is projected to rebound to 5.2% in 2023 from 3.0% last year as a sudden lifting of most its pandemic-related restrictions paved the way for a rapid rebound in economic activity, according to the World Economic Outlook (WEO) Update of the International Monetary Fund (IMF) released on Tuesday. The 2023 growth forecast for the world’s second-biggest economy was revised up from the IMF's previous estimate of 4.4%.

Meanwhile, Indonesia’s latest policy on increasing the supply of cooking oil in the domestic market prior to the Ramadan fasting period from late March is also expected to lend support to the upstream crude palm oil (CPO) market. On 30 January, the Indonesian authorities have mandated that cooking oil producers must increase supply to the domestic market by 50% for the next three months ahead of the Islamic religious festivities. Cooking oil is mainly derived from palm oil in Indonesia and a surge in demand for cooking oil is expected during the Ramadan fasting month ahead of the Eid ul-fitr holidays in late April. In 2022, Indonesia implemented a domestic market obligation (DMO) policy to curb CPO exports in a bid to ensure sufficient and affordable supplies of domestic cooking oil, following soaring domestic cooking oil prices during the Ramadan fasting month last year.

As you most likely know, palm oil makes up about a third of the world's vegetable oil market, with Indonesia accounting for about 60% of global supply. It is used in many things, including margarine, frying fats, lubricants, shampoo, cosmetics and detergents.

Oleochemical products, including fatty acids, fatty alcohols, glycerine, fatty alcohol ethoxylates and soap noodles, are derived mainly from palm oil in southeast Asia.

Indonesia is the world’s largest palm oil producer followed by Malaysia.

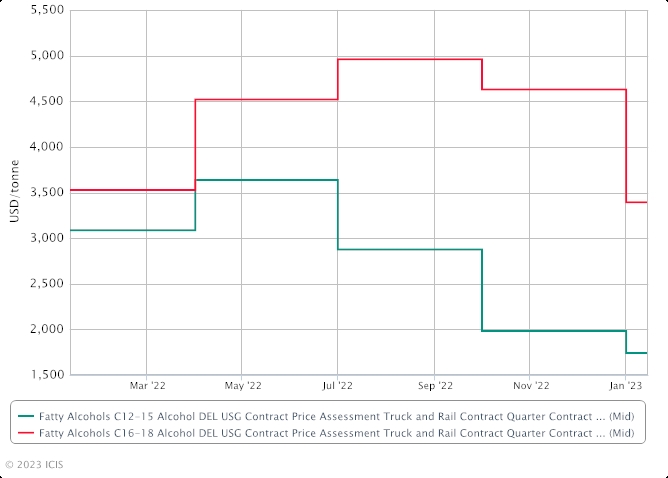

Back in the US, at the end of a long supply chain. Q1 fatty alcohols contracts settled down from Q4, tracking lengthening supply and weaker demand in the global market.

- US Q1 contracts settled down from Q4

- Q1 mid-cut demand weak on supply carryover

- C18 remains relatively snug compared to C16 as demand concerns persist

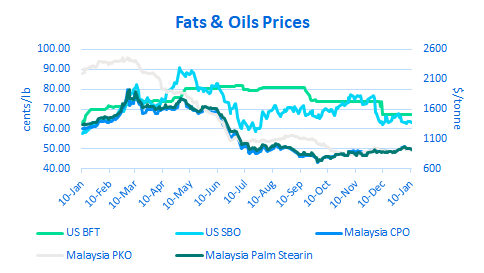

Q1 mid-cut alcohols demand is weak, with players largely looking to carry over their Q4 volume with a quarterly adjustment based on slightly lower average feedstock palm kernel oil (PKO) costs last quarter.

Source: CME Group, Matthes & Porton, WSJ Cash Markets

Mid-cut prices have largely returned to pre-pandemic levels. Single-cut C16 supply is also long, putting downward pressure on single-cut and C16-18 blends. C18 remains relatively tight, offsetting the downward pressure felt in that market. Container freight rates have corrected to more pre-pandemic levels, adding to the major downward pressure in the long-chain market where high container freights had previously pressured the market given the limited number of suppliers who deal in bulk. Demand into household, industrial and institutional and personal care markets remains slower than normal for Q1 given prevailing economic downturn globally. Sasol remains on force majeure for Ziegler alcohols and Ziegler alcohol-based surfactants and expects to complete repairs at its Lake Charles, Louisiana, site by the end of Q1.

Q1 contract ranges*

| Product | Price (cents/lb) | INCO | Location |

| C12-C15 | 73-85 | DEL | USG |

| C16 | low 90s - 150 | DEL | USG |

| C18 | high 140s - low 200s | DEL | USG |

| C16-18 | 138 - 170 | DEL | USG |

*The prices in the table represent a range of settlements for standard balance material heard throughout the quarter for the majority of market participants. Prices heard outside those listed in the table were excluded as they were not viewed as representative of the wider market.

An interesting analysis of Stepan’s recent price increase announcement by ICIS’ Lucas Hall is worth re-printing here: Stepan Company is targeting increases on list and off-list pricing for its chemical specialities, softener and tallow-related alkoxylates product categories. The increases took effect on 15 January, or as contracts stipulate.

The increases were announced against the backdrop of historically high tallow prices – seen in the last chart but one.

Although tallow prices have decreased in recent weeks, tallow markets remain historically high because of increased consumption into renewable fuels markets alongside ongoing capacity expansions in the renewable diesel space the next several years. Buyers are nonetheless expected to push back against the increases, says Lucas, given the recent drop in tallow prices against the backdrop of demand concerns in the wider market.

| Product Category | Stepan Company Trade Name(s) | Price Increase ($/lb) |

| Chem Specialties | BIO-TERGE PAS-8S | $0.05 |

| Softeners | ACCOSOFT STEPANTEX | $0.10 - $0.30 |

| Alkoxylates (Tallow Related) | BIO-SOFT, STEPAN, STEPANTEX, TOXIMUL | $0.02 - $0.12 |

Some Deal News: International chemicals distributor Univar Solutions has agreed to acquire Turkish specialty chemicals distributor Kale Kimya. Istanbul-based Kale Kimya has a product portfolio of beauty and personal care products, and home and industrial cleaning products, including surfactants, actives, emulsifiers, preservatives, UV filters, fragrances, polymers, conditioners, esters and emollients. "This acquisition further progresses our strategy to grow our Ingredients and Specialties business with a leading company that builds on and adds to our strengths, geographic footprint and product portfolio," Nick Powell, president of Global Ingredients & Specialties at Univar, said in a statement on Monday. Univar expects to complete the acquisition within the current Q1. Financial terms were not disclosed.

Other deal news: ICIS reports that Shell has agreed a deal to supply Henkel with surfactants feedstocks derived from renewable raw materials that is expected to replace up to 200,000 tonnes of fossil-based feedstocks over its five-year term, the UK-based oil and gas major said on Tuesday. Under the terms of the agreement, Shell will supply the Germany-based consumer goods firm with renewable-based surfactant feedstocks for its Persil, Purex, and All brands in North America. The deal is Shell’s first for the supply of renewable-based chemicals at commercial scale, and begins this year. The company will also add renewable-based feedstock capacity for its diesel hydrotreater unit (DHT) at its Norco, Louisiana, complex. “Through integration with Shell Geismar [Louisiana], the DHT Unit increases Shell’s capacity to produce a range of renewable-based chemicals for customers in North America and globally,” the company said.

The companies will use a third-party mass balance approach, where the amount of circular or bio-based content in the value chain is tracked by a separate entity. Terms of the deal were not disclosed.

I’ve long appreciated the Chemical Economics Handbook (CEH) series of reports, especially those related to surfactants. Recently, CEH updated its Alkylbenzenes report. Some key points from that include:

- World demand for LAB in 2022 was 3.52 Million MT and is projected to reach 4.07 Million MT by 2025.

- India is the largest country market, using 753,000 MT in 2020, projected to reach 1 Million MT in 2025

- Interestingly, India is a net importer of LAB and net exporter of LAS

- The US and Western Europe have had limited demand growth but continue to run their LAB plants close to capacity, exporting between 15 – 25% of production.

The LAB Supply / Demand Forecast by CEH looks as follows

(Thousands of MT per year):

| Region | Demand | Capacity |

| Indian Sub | 1,008 | 600 |

| China | 591 | 1,040 |

| NE Asia | 135 | 285 |

| SE Asia | 540 | 330 |

| N. America | 335 | 431 |

| S. America | 414 | 402 |

| W. Europe | 333 | 470 |

| C&E Europe | 93 | 60 |

| Middle East | 290 | 575 |

| Africa | 327 | 205 |

| TOTAL | 4,066 | 4,398 |

Rounding out this month: ICIS’ Joe Chang interviewed Rothschild’s Federico Mennella about financial trends in the chemical space. The following part is particularly relevant to surfactants : ..Another key trend is the move by diversified chemical companies towards more pure play specialties, particularly those with a favourable ESG/green chemistry angle. Belgium-based Solvay plans to split into two companies in 2023 - EssentialCo, a more commoditised business housing its soda ash and derivatives, peroxides and silica assets with about €4.1bn in sales, and SpecialtyCo, for its composites and specialty polymers, and consumer and resources operations, including oilfield chemicals, fragrances and surfactants with around €6bn in sales. This could provide opportunities for other players on both the buy and sell sides. Which is better? Essential or Special ? (think about it – and let me know)

Difficult question right?: Here’s what ChatGpt says “It depends on what you mean by "better." Being "essential" generally refers to being necessary or indispensable, while being "special" usually refers to being unique or exceptional. Both have their own advantages and disadvantages, and what is considered "better" can vary depending on the context and individual perspectives. Ultimately, whether it is better to be essential or special is subjective and can vary based on personal circumstances and priorities.”

That’s boring so let’s ask more specifically the question:

What factors should a CEO consider when looking at job opportunities at both companies

“As a CEO considering a job at either EssentialCo or SpecialtyCo, the following factors should be considered:

- EssentialCo:

- Market competitiveness: EssentialCo operates in commoditized markets, so it will require a CEO who is adept at managing a business in a highly competitive environment.

- Cost efficiency: EssentialCo will focus on reducing costs, so the CEO will need to be experienced in streamlining operations and finding ways to reduce expenses.

- Customer relationships: EssentialCo will rely heavily on strong customer relationships to maintain its market position. The CEO should have experience in building and maintaining strong customer relationships.

- SpecialtyCo:

- Innovation and R&D: SpecialtyCo will focus on developing new and innovative products, so the CEO will need to have experience in product development and a strong understanding of R&D processes.

- Market positioning: SpecialtyCo operates in specialized markets, so the CEO should have experience in positioning a business to be a leader in these markets.

- Diversification: SpecialtyCo will operate in multiple markets, so the CEO will need to have experience in managing a diversified business and balancing priorities across multiple markets.

Ultimately, the CEO should consider their skillset, experience and personal goals when deciding which company to join, as each company will have its own set of challenges and opportunities.”

Well there you are then, if this has been helpful in your career aspirations, let me know.

And finally; some further news from the Holiferm / Sasol partnership: They announced a week ago, a collaboration to produce and market rhamnolipids and mannosylerythritol lipids (MELs). This collaboration expands the partnership announced in March 2022 between the two companies to develop and commercialise another biosurfactant product, sophorolipids. The partnership will use Holiferm’s proprietary technology to develop the fermentation-derived biosurfactants. Sasol and Holiferm will develop and commercialise formulations and applications for the new molecules. Biosurfactants use natural materials to produce surfactants, which are key ingredients in detergents, cleaning products and personal care products. Sophorolipids, rhamnolipids and MELs are all glycolipids made through fermentation, using yeast or bacteria to convert vegetable oils and/or sugars into final product. The Holiferm process offers an extensive reduction in carbon footprint compared with conventional surfactants… “The imminent commercial launch of our second and third products validates Holiferm’s process to develop process technologies to produce chemicals from natural raw materials and enable their broad commercialisation,” said Vicky De Groof, Chief Technical Officer of Holiferm. “It is also a testament to the exceptional work of the laboratory team.”

“By expanding our product portfolio from sophorolipids to include rhamnolipids and MELs, we aim to provide our customers a platform of solutions based solely on biosurfactants,” said Silke Hoppe, Vice President of Essential Care Chemicals for Sasol Chemicals. “Their carbon footprint as well as their mildness and high performance places these products in a leading position in today’s biosurfactant market.”

Since March 2022, Sasol and Holiferm have collaborated on research and development into accelerating innovation to help meet the growing demand for sustainable solutions in primary surfactants. This has now been expanded to include developing processes to manufacture rhamnolipids and MELs. The companies’ joint aspiration is to prepare for testing at pilot plant scale, before they begin a full manufacturing process at Holiferm’s Wallasey plant.

And now for some music notes.

Isn’t YouTube an incredibly useful public utility? Here’s what I’ve been listening to on that wonderful app this past month. I stumbled across a new (for me) band from Ireland called Electric Octopus. They sound like you might imagine they would; long fluid instrumental jams with hints of psychedelia and jazz. And I mean l – o – n – g.. Check out this 4 hour monster – Driving Under the Influence of Jams:

And another 4 hour plus album – Line Standing

Music to write blogs by for sure.

I was recently alerted to the music of Greta Van Fleet. Zeppelin fan? Certainly sounds like these lads have listened to a bit of Zep. Here’s Black Sun Rising

Right? Clearly Zep inspired but original music nonetheless.

Here’s a live couple of songs. I hesitated to post this because of the, well, the clothing but you have to admire such unselfconsciousness right?

What do you think?

Here’s another interesting artist that was brough to my attention, Dorothy.

Mainstream but the lass can sing right?

Here’s a crowd pleaser – Black Sheep.

She’s been around for a while. Here’s an older one. I quite like it.

I can’t help but think of this band of my youth when I hear Dorothy. Of course it’s the great Runaways. Wasted from 1977 (Yes 1977)

So, OK look, yes; fodder for teenage boys but still decent rock ‘n roll..right? I bought this album back then (1976)

All this, also called to mind Wendy O’ Williams and the Plasmatics from the late 70’s early 80’s I’d put some videos here but I literally could not find a single one suitable for this family blog. So I’ll leave you to head over to YouTube and see for yourselves if you are curious. Caution.. not exactly G-rated but definitely rock ‘n roll. If you think some things you’re seeing in today’s media herald the end of civilization, then check out Butcher Baby by the Plasmatics on Youtube. Civilization was clearly ending 40 years ago.

And then there’s The Well. I posted a piece by this psychedelic / stoner / metal band last month without even realizing they would also fit this month’s theme. Here's a live set they played in Brooklyn a few years ago.

Look closely. Like some Iommic (I’m talking Tony here) faerie love-child (grand-child maybe more chronologically accurate) - that’s a girl up there on bass and vocals, Lisa Alley.. Does it matter? No.

Anyway, the gig was produced by Kerrang a British rock magazine, named after the opening word of a review of a 1977 Rush concert by Sounds journalist Geoff Barton. Proving, again, that all things come back, ultimately, to Rush. Including our World Surfactants Conference for which Rush is our unofficial musical patron. So..

And while we’re listening to Rush, check this one out from a live gig in Toronto: Spirit of Radio with a Paint it Black prelude. Glorious!