Surfactants Monthly – June 2021

Huge month for news, again. Lots happening with Oxiteno, Indorama, BASF, Colonial Chemical, Stepan, Amyris, M&A and much more. Before we get to that – this:

Heads-up! This is to all the renewable and sustainable brands out there. Kylie Jenner is coming to your party and your life won’t be the same again. Regular readers of the blog know of my fascination with the Kardashians and know also that it is not born of prurient interest. Their influence on the culture and therefore our business is significant.

Back in May of this year, Kylie Cosmetics swept its Instagram completely clean and posted a single photo of Kylie Jenner with the caption, "something is coming," After two months of waiting, Jenner finally, on July 1st, revealed what she's been working on with her billion-dollar brand. From here on, we’re quoting the IG post “The new @kyliecosmetics is coming JULY 15, 9am pst on KylieCosmetics.com! Everything is clean, vegan, and ready to go global. This means no animal oils, parabens or gluten, and we banned a list of over 1,600 other ingredients from being used in products, but made sure everything has amazing pigmentation and performance.” Let me set your mind at ease by assuring any Kylie fans reading, that the legendary Kylie lip kits are included in this relaunch. In fact, the press release by Coty (51% owner of Kylie Cosmetics) emphasizes that “The new and upgraded formula of Matte Liquid Lipstick is long-lasting with a budge-resistant 8-hour wear time, while the new lip liner is waterproof and long-lasting for up to 24-hours”

Smart blog readers know what this means. When Kylie goes green and vegan and gluten-free and has a list of 1,600 banned ingredients and drops performance test data into her press releases, well what are you doing? Being green? Even Kylie is green, so what’s so great about that? This re-launch on July 15th 9AM PST (12 Noon Eastern) erases one huge reason why customers might have preferred any niche sustainable brand to the Kylie juggernaut. When Kylie Jenner starts playing in your sandbox, well it’s not your sandbox anymore. You know how the world works. Being nice and sustainable is not enough now. You’ve got to be that and brilliant and innovative and have product performance that shocks your customers with how great it is. And keep doing it – over and over and over again. Hey look – two things. First - good luck to the lass. She’s 23, a billionaire and, by all appearances, works hard at it. And how many companies do you know, burn all their existing formulas and basically start again? Second – what are you going to do about it? Curl your lip, roll your eyes, feel all intellectual and indignant – sure allow yourself that for a few seconds then get to work. You can do what she did. Believe me. Do you want to? That’s another question. It’s OK if you don’t, but then maybe don’t despise Kylie for wanting to.

I want to give a big shout-out to Victoria Meyer and her Chemical Show podcast. She’s got about 12 episodes up on YouTube now and there’s some really interesting stuff there. I encourage you to check it out and subscribe. Among interviews with some real thought-leaders and fascinating people in chemicals, I managed to sneak in under some pretense or other. Here’s Victoria’s interview with me:

Another shout-out to Deciem, a cosmetics brand with a bit of a crazy history and now part of Estee Lauder. They have posted a video called “what is chemicals”. In all of 90 seconds they nail an issue that many of us in the industry have lamented and, frankly, just complained about, for decades. I know little about the products, but this video is a masterpiece. Check it out:

Cool right? Send it to your friends and family. Here’s a thought – those of you with school-age kids, maybe you’re on the PTA or something like that – do you think the teacher might show this to the kids ? It’s 90 seconds. Think about it.

OK here starts the news:

Those of our readers in certain countries like the US, UK etc.. may be looking at COVID largely in the rear-view mirror. In many other parts of the world, not so. In an excellent article, Helen Yan of ICIS detailed how continuing lockdowns in Malaysia are affecting the palm plantations and thus, of course, surfactants. Helen notes that palm oil output in Malaysia will be limited by a manpower crunch as the country goes into a nationwide lockdown for two weeks from 1 June, but demand is expected to slow down from downstream oleochemicals markets.

Malaysia has imposed stricter movement restrictions on agriculture, limiting the labor force of palm oil mills and refineries to 60% to curb the spread of Covid-19. The pandemic has already seen a reduction in migrant labour at palm oil plantations in the country due to closure of borders, and the latest renewed lockdown restrictions are expected to further lower palm oil supply, market sources said. The expected reduction in palm oil supply in the near term may lend support to the derivative fatty acids, fatty alcohols, glycerine and soap noodles markets. But this will be offset by slowing demand as buyers retreat and hold off large purchases given the uncertain outlook, market sources said. A resurgence in the coronavirus outbreak in Asia - including India, Japan, Malaysia, Singapore, Taiwan, Thailand and Vietnam - has weighed on market sentiment.

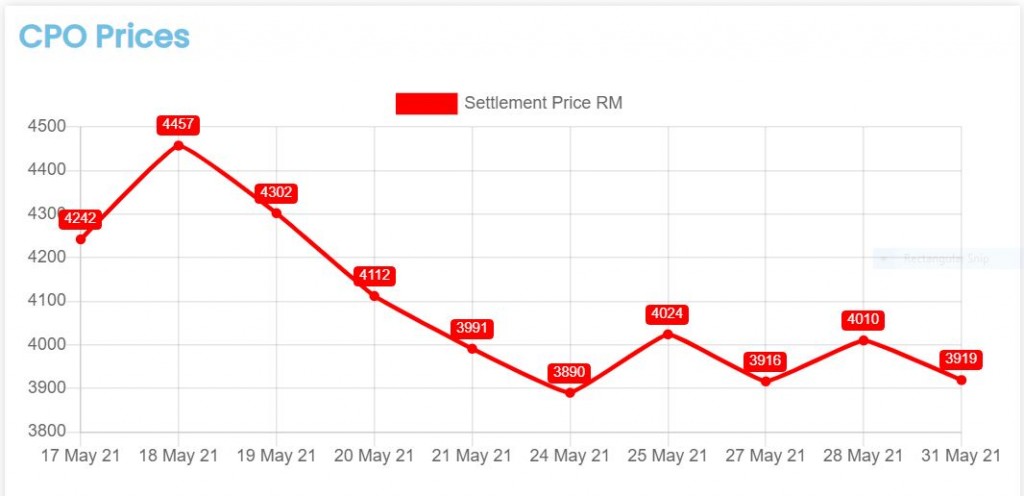

Demand for palm oil, an edible oil, has fallen as India - a key importer - grapples with the resurgence of the coronavirus. Falling palm oil consumption has led to downward price pressure on crude palm oil (CPO), palm kernel oil (PKO), and palm stearin recently, market sources said.

CPO futures on 31 May fell to Malaysian ringgit (M$) 3,919/tonne, down from a record high of M$4,506/tonne on 12 May, according to Bursa Malaysia.

Source: Bursa Malaysia

Down the supply chain, demand for derivatives including fatty acids, fatty alcohols, glycerine, fatty alcohol ethoxylates and soap noodles, is also expected to weaken in the near term. “Demand for some fatty acids products, which are used in personal care applications such as cosmetics has dropped significantly due to women working from home,” a regional producer said. Fatty alcohols such as C12-14 blend, which are used in surfactants and cleaning agents, also saw a decline in prices recently.

In the week to 26 May, fatty alcohols C12-14 blend fell $80/tonne week on week to $2,050-2,150/tonne FOB (free on board) SE (southeast) Asia, ICIS data showed.

Demand for surfactants in Asia has weakened due to a slowdown in market and economic activities, as shops, factories, hotels, gyms, restaurants, cafes and retail outlets are shuttered following renewed lockdown restrictions to contain the spread of the highly infectious virus variant from India, market sources said. Soap noodles demand has also weakened, with prices of those with 80/20 blend falling $45/tonne week on week to an average of $1,000/tonne FOB SE Asia on 27 May, ICIS data showed.

From BASF: BASF has completed the sale of its Kankakee, Illinois, manufacturing site and associated businesses to private investor One Rock Capital Partners, the Germany-headquartered producer said on Tuesday. First announced in December 2020, the deal includes the anionic surfactants, vegetable-baed raw materials, and natural vitamin E production, with the newly-independent entity to be known as Kensing, BASD said First put up for sale after BASF determined that the business does not fit into its core strategy amid a move to rationalise its surfactants and vegetable oil-based raw materials manufacturing footprint, the deal will see 190 employee move over to the new entity. BASF continues to operate a sterol ester food ingredient business in Illertissen, Germany. The deal value was not disclosed, but media reports around the time of the initial sale announcement pegged the value of the site at $250m.

“With this step, we optimise the global manufacturing footprint of our division,” said BASF care chemicals president Ralph Schweens. Best of luck to Kensing - said your blogger.

Things are pretty interesting in the world of EO and we have a few stories here. First up in Europe, ICIS reports that the European June ethylene oxide (EO) contract price increased by double-digits, following continued upstream ethylene gains. June EO prices were assessed at a €25/tonne increase at both ends of the range, bringing prices to €1,245-1,413/tonne free delivered (FD) northwest Europe (NWE).

The European ethylene June contract reference price has been set at €1,080/tonne, up €30/tonne from May, reaching a two-and-a-half-year high. In 2021, EO contract prices have increased by approximately 16% on average, according to ICIS data. Non-integrated suppliers have dealt with unrelenting production cost hikes this year so far.

The vast majority of EO contracts are formula-based, with the price movement representing 80-85% of the change in the monthly ethylene contract price. ICIS uses an average of 82% for the ethylene contract price in its calculations.

Supply is balanced-to-snug and availability could tighten further in June and July during the planned turnarounds. Demand is healthy with strong consumption seen in the surfactants market. PKN Orlen's planned maintenance at its ethylene oxide (EO) and ethylene glycol (EG) facility in Plock, Poland, is expected to continue, possibly until end of June, according to sources. This has not been officially confirmed. There is also a planned maintenance expected at BASF's EO facility in Ludwigshafen, Germany, at the end of the second quarter. This is not officially confirmed. Additionally, there is a planned turnaround in Antwerp at Ineos’ EO/EG facility expected in June. Availability of additional EO volumes outside contracts could be hard to obtain, a market source added at the end of May.

Here, again, is the cool EO turnaround tool that ICIS provides. Check it out. Should work on most browsers.

In contrast to Europe, US prices are heading down, as reported by ICIS’s Antoinette Smith. She noted that US ethylene oxide (EO) contracts for May fell by 11%, tracking the feedstock ethylene settlement. ICIS assessed May EO lower by 7.6 cents/lb ($168/tonne), at 59.2-68.7 cents/lb FOB (free on board). Despite the drop, EO prices remain 21% higher year on year, amid strong derivative demand and recurrent production issues. Feedstock ethylene contracts for May settled at their largest drop since 2008, due to lower average spot prices and decreased cash costs. The majority of EO contracts are formula-based and price movement comprises 80% of the change in the ethylene price and an additional conversion fee, or adder. Like ethylene, EO contracts are settled at the beginning of the month for the previous month’s price.

Lots happening in alcohols also. The great Lucas Hall of ICIS reported in early June that higher freight costs are offsetting volatile-but-overall-bullish feedstock markets against the backdrop of rebounding-to-strong demand across the wider market, as the US economy recovers from the height of the coronavirus pandemic.

Fats and oils recuperated earlier losses, tracking higher crude oil prices as fuels demand increases ahead of the summer driving season. Soybean oil costs also increased ahead of expectations of intense hot weather across the Northern Plains and the US Midwest. Bleachable fancy tallow (BFT) costs inched higher after JBS temporarily shut a number of facilities following a cyberattack earlier in the week.

Freight costs remain bullish on tight shipping equipment availability and vessel space in southeast Asia and tight rail and truck availability in the US. One buyer noted difficulty getting railcars in the Houston, Texas, area. Feedstock costs remain bullish on as demand outpaces production. Demand across the wider market continues to outpace supply. The delayed and otherwise disrupted import market continues to support demand for domestically-produced fatty acids. However, domestic availability is also tight amid the aforementioned supply chain constraints on top of ongoing production disruptions among the two major synthetic alcohol producers in the US. (More on this later)

Derivative demand into Mexico remains strong amid ongoing raw materials shortages in the country, namely of ethylene oxide (EO). Demand across the oil and gas sector is ramping up with higher crude oil prices. The US is a major net-importer of natural fatty alcohols and a key production region for synthetic alcohols.

Freely-negotiated Q3 alcohols contracts are largely emerging at a moderate increase from Q2.

Q2 contract ranges

| Product | Price (cents/lb) | INCO | Location |

| C12-C15 | 100-110 | DEL | USG |

| C16 | 90-107 | DEL | USG |

| C18 | 80-97 | DEL | USG |

| C16-18 | 85-109 | DEL | USG |

Spot

Mid-cut rail prices have largely been heard in the $1.10-1.15/lb DEL (delivered) USG (US Gulf) range.

Mid-cut truck prices have been heard as high as $1.20/lb DEL USG.

C16 prices have been heard as high as $1.30/lb DEL MW (Midwest).

C18 prices have been heard as high as $1.26/lb DEL MW.

C16-18 prices have been heard as high as the mid-$1.20/lb DEL MW range.

Amid this general inflationary environment, it’s no surprise that surfactants are following trend – as evidenced by Stepan’s recent announcement on pricing.

Stepan Company announced price increases on a range of US surfactants, effective 15 June, according a company pricing announcement.

Stepan is seeking price increases for surfactants in the following product categories:

| Product Category | Price Increase ($/lb) |

| Alkyl Benzene Sulfonic Acids | $0.09 – $0.11 |

| Alkyl Benzene Sulfonates & Dry Sulfonates |

$0.03 – $0.29 |

| Lauryl Alcohol Sulfates | $0.04 |

| Short Chain Alcohol Sulfates | $0.02 - $0.04 |

| Low Active Alkyl Ether Sulfates (Natural) | $0.03 |

| High Active Alkyl Ether Sulfates (Natural) | $0.04 |

| Ether Sulfates - Phenol | $0.04 |

| Dry Olefin Sulfonates | $0.03 |

| Dry Sulfates | $0.10 |

| Hydrotropes | $0.03 |

| Sulfonated Methyl Esters | $0.06 |

| Amides | $0.05 - $0.20 |

| Betaines, Sultaines and other Amphoterics |

$0.08 |

| Amine Oxides | $0.05 |

| Sulfoacetates | $0.15 |

| Sulfosuccinates & Sulfosuccinate Blends |

$0.04 - $0.08 |

| Methyl Esters | $0.18 - $0.56 |

| Specialty Esters | $0.16 - $0.21 |

| Industrial Polyesters | $0.15 |

| Glycerol Mono Stearates | $0.05 - $0.13 |

| Biocidal, Industrial & Cosmetic Quats | $0.01 – $0.07 |

| Softeners | $0.03 - $0.38 |

| Phosphate Esters | $0.02 - $0.16 |

| Alkoxylates | $0.02 - $0.33 |

Stepan issued the price increase announcement as demand continues to outpace supply amid continued raw materials shortages and internal/external shipping logistics constraints as the economy continues to reopen from the pandemic. Surfactants markets remain tight following supply chain disruptions in Texas and the US Gulf in mid-February, with multiple players throughout the supply chain still on force majeure.

Continuing news from Brazil. The talented and prolific Al Greenwood of ICIS wrote an outstanding analysis fo the current set of Brazilian chemical companies that are up for sale today. I won’t give you the whole article here but rather will encourage you to read it on the ICIS site here. We’ll talk about Oxiteno later. However, Braskem, Oxiteno’s supplier of ethylene, deserves a mention. The company owns all of Brazil's crackers as well as its polyethylene (PE) and polypropylene (PP) plants. Braskem's largest shareholder, the construction company Novonor, has said the sale of its stake is part of its plan to emerge from bankruptcy. Novonor filed for bankruptcy back when it was called Odebrecht. [The Odebrecht name had some negative connotations, not solely connected with a bankruptcy so a name-change wasn't a bad idea] Among the reported companies interested in acquiring Novonor's stake are the private-equity firm Advent International and the Emerati sovereign-wealth fund Mubadala. Both were reported by the Brazilian publication O Estado de Sao Paulo. Petrobras, the second largest shareholder, has repeatedly stated its intention to sell its stake in Braskem. Petrobras owns 36.15% of Braskem's total capital, compared with Novonor's stake of 38.33%.

Some interesting news from Amyris, as reported by ICIS. Amyris has filed a binding term sheet for the acquisition of OLIKA California-headquartered Amyris did not disclose the sum put forward in the bid, but the deal would provide synergy and allow Amyris to grow in the health and beauty markets. OLIKA uses sustainable, natural ingredients to produce its three hand sanitiser made using six essential oils. The business has been led by Alastair Dorward – founder and former CEO of Method Products, as well as previous roles at Own Beauty and Smitten Ice Cream – who has been at the helm since 2019. Dorward will join synthetic biotechnology firm Amyris as Chief Brand Officer to join existing management to focus on sustainability and efficacy in the beauty and wellness markets, while accelerating growth for the company’s consumer brands. Given the small size OLIKA, the deal has been characterized by at least one observer as an “acqui-hire” of Dorward. Interesting.

Back to Brazil: The aforementioned Al Greenwood has also reported that Ultrapar has entered exclusive talks with Indorama to sell its surfactants business, Oxiteno. The two companies are still discussing financial terms, and they have not signed any contracts or sales agreements, Ultrapar said. [which makes you wonder why the news was leaked – perhaps it was unintentional?] Indorama did not immediately respond to a request for comment. The possible sale of Oxiteno comes as Ultrapar is seeking to build on its existing fuel distribution businesses. Its fuel retailing business, Ipiranga, is pursuing the acquisition of Petrobras' Alberto Pasqualini Refinery (REFAP) in the southern state of Rio Grande do Sul. It would be Ipiranga's sole refinery. REFAP can process 201,000 bbl/day of crude. Ultrapar also owns the fuel distributor Ultragaz, liquid bulk storage firm Ultracargo and drugstore chain Extrafarma. Ultrapar is in talks to sell Extrafarma. Ultrapar has since signed an agreement to sell Extrafarma to Pague Menos for reais (R) 700m ($139m).

Now, interestingly, Reuters reported the Oxiteno deal being discussed with Indorama at an EV of $1.5Bn which is about about 10X 2020 EBITDA. This seems at the lower end of what I thought it might be. Scott-Macon’s 2020 review of transaction multiples has specialty deals at 14.3 and commodities at 9.3. Perhaps factoring in the Oxiteno product mix and the geography of the assets the number is fair. Anyhow the deal is clearly not done yet and anything, including a bidding war, could still happen.

Meanwhile over in Asia – the great Helen Yan Asia’s fatty alcohol ethoxylates (FAE) demand may wane in July due to economic fallout from the coronavirus resurgence.

Declining upstream ethylene and feedstock fatty alcohol values have also added to downward pressure. Spot appetite has been suppressed by renewed lockdown restrictions following the resurgence of the virus in parts of Asia. Retail outlets, shopping malls, hotels, restaurants, bars, cafes, cinemas, gyms, factories and offices have been shuttered in varying degrees across the region to contain the spread.

Demand for surfactants from the commercial and industrial sectors has weakened due to the renewed lockdown restrictions and rising business costs. Soaring freight rates, limited container ships, congested ports, delayed shipments and manpower constraints all added to the rising costs that market players have had to grapple with in the first half of this year. This has prompted buyers to seek significant discounts, given the challenging business environment and uncertainty, market sources said. “Chinese buyers are seeking lower prices due to the drop in upstream ethylene and feedstock fatty alcohol values. Demand has also remained weak amid the prevailing bearish sentiment,” a trader said.

Ethylene fell by $70/tonne to $880/tonne CFR (cost and freight) southeast (SE) Asia in the week ended 11 June, ICIS data showed. Feedstock fatty alcohols C12-14 blend fell by $60/tonne to $2,005/tonne FOB (free on board) southeast Asia in the week ended 16 June, ICIS data showed. “We expect July to be tough, with weak demand and lower feedstock costs likely to put downward pressure on prices,” a regional producer based in southeast Asia said. FAE mols 7, 9 spot prices fell by $130/tonne in the week ended 17 June to $1,420/tonne CIF (cost, freight and insurance) China, ICIS data showed

At the other end of the surfactant chain (the hydrophobe end), Helen also reports that Southeast Asia’s fatty alcohols producers will tap the export markets in Europe and the US to compensate for the sluggish demand in Asia. “Europe is tight and there is pent-up demand in the EU,” a regional producer said. “Supply for the mid-cuts is still tight due to production issues in Asia while demand in the US is strong,” another supplier said.

Asia’s mid-cut fatty alcohol C12-14 prices fell by $65/tonne on week to $1,940/tonne FOB (free on board) southeast (SE) Asia on 23 June, ICIS data showed .

Declining upstream palm oil complex values including crude palm oil (CPO) and feedstock palm kernel oil (PKO) values had dampened sentiment and weighed on demand.

Source: Matthes & Porton

Declining upstream palm oil complex values including crude palm oil (CPO) and feedstock palm kernel oil (PKO) values had dampened sentiment and weighed on demand.

| Product | Delivery | 22-Jun | 15-Jun |

| CPO | DEL, south Malaysia | M$3,650.00 | M$3,750.00 |

| PKO | DEL, south Malaysia | $1,133.05 | $1,184.77 |

| Palm Olein | FOB, Malaysia | $955.00 | $990.00 |

| Palm Stearin | FOB, Malaysia | $920.00 | $960.00 |

| PFAD | FOB, Malaysia | $880.00 | $905.00 |

All prices are on a per tonne basis.

Source: Matthes & Porton

Enquiries for fresh spot shipments have fallen as buyers in Asia retreated to the sidelines in anticipation of lower prices. Spot appetite has been suppressed due to the economic fall-out from renewed lockdown restrictions to contain the coronavirus resurgence. Demand from the commercial and industrial sectors for surfactants or cleaning agents such as disinfectants and detergents, has dropped as a result of the lockdown restrictions. The slow pace of vaccination rollouts in southeast Asia, a major oleochemicals production hub, has also hampered the economic recovery and delayed the re-opening of the regional economies.

Finally, mega-kudos to great friends of the blog, Colonial Chemical who in a press release dated July 4th let us know they are a winner in the 2021 EPA Green Chemistry Challenge Awards Program, specifically in the focus area of The Design of Greener Chemicals.

More details from the EPA Website - Colonial Chemical is being recognized for developing Suga®Boost surfactant blends that use more environmentally friendly chemicals than traditional cleaning surfactants. Specifically, Suga®Boost surfactants consume less energy to create, are biodegradable, and are derived from plant-based materials, with performance that demonstrates potential to replace EO-containing surfactants such as SLES and APEs.

Colonial discovered that blends of functionalized alkyl polyglucoside (APG) surfactants provide cleaning performance that is equal to or better than Alkyl Phenol Ethoxylates (APEs) while avoiding environmental issues related to aquatic toxicity, endocrine disruption, and carcinogenic impurities. Suga®Boost surfactants are blends of derivatized APGs prepared by attaching functional groups such as sulfonate, phosphate, quaternary ammonium, glycinate, and citrate. Suga®Boost blends do not yield toxic substances as they biodegrade. They are mild and safe for the formulator and end-user. Lastly, Suga®Boost blends require less energy to manufacture and require only water as a solvent during manufacture and cleanup. These functionalized APG surfactants have the potential to replace EO-containing surfactants worldwide. Furthermore, Suga®Boost and its underlying chemistry has the potential to expand into wipe products, disinfecting cleaners, dish washing, carpet cleaning, and fabric care.

Well done Colonial! Great company and great people.

July 4th: As regular blog readers know, in our small town, several hundred people gather every Independence day morning outside the town hall to read the declaration together – each of about a hundred readers with a sentence or the name of a signer to read to the group. For the last 20 years or so, I have had a specific part reserved for me to read; that is the last 2 sentences of the second paragraph. “The history of the present king of Great Britain is a history of repeated injuries and usurpations, all having in direct object the establishment of an absolute tyranny over these states. To prove this, let facts be submitted to a candid world”.

I’ve gotten to love a number of things about the part over the years. First, it’s not personal – neither to King George, nor to the people of Great Britain. The reference is to the “present king” as if to hold out hope that things can and will be different with future kings. Although of course, in that future, the relationship will be one of equals – that is (from the end of the penultimate paragraph of the declaration) enemies in war, in peace, friends. Second, of course is that beautiful word usurpations. This is the second appearance of the word in the declaration after the more famous “long train of abuses and usurpations” earlier in the paragraph. What does it mean? Turns out there’s a legal meaning[1] that is The illegal encroachment or assumption of the use of authority, power, or property properly belonging to another; the interruption or disturbance of an individual in his or her right or possession. The appeal to law – which happens early and then often in the document, is impressive and broad, covering English laws as well as “the Laws of Nature and of Nature’s God..” in the first sentence.

There’s more. These injuries and usurpations are cited as having a “direct object” – and that is the establishment of an absolute tyrrany. They could have just talked about the effect or result of the usurpations, but no – the much stronger direct object drives home the intentionality of the king’s actions. This was clearly a deliberately planned and executed campaign in pursuit of a clear objective – tyranny. Why absolute though? Why the use of this modifier in front of tyranny? Isn’t tyranny, by it’s nature, absolute? To our modern understanding, probably. Back then, when a much greater proportion of the world than today, was living under some form of tyranny, perhaps the writers thought the emphasis of absolute was needed. The next short sentence, to me, is one of the most important in the whole document.

It says in part “..let facts be submitted..”. This tees up the rest of the document and the majority of it – which is a careful recitation of facts, supporting the rather bold and serious move of establishing an independent state. The document is more than anything, factual – albeit expressed most poetically. And those facts are now being told to a “candid world”. Odd use of the word candid right? The meaning we understand is honest – usually about a difficult subject. In this case, however, the archaic meaning of candid as unbiased is intended. The writers are addressing the world and implicitly encourages it to listen in an unbiased way. I like that expectation of the very best from the audience, regardless of whether it would be forthcoming.

There’s just one more thing, I have to point out. The first sentence of the 2 – it only has one comma in it. If I were writing it today, I would have put 2 more. But this was clearly written for reading out loud. The rhythm and the momentum are just superb. It flows and carries with it, both the reader and listener. In can’t wait until next July 4th.

That’s it – I hope all of you in these United States had a great Independence Day. Think of those who, still today, endure injuries and usurpations under tyranny. They are many and we are ever more close and interconnected with them. Perhaps you even know one or two. Let’s be part of a candid world and carefully evaluate the facts presented to us.

Here’s some relevant music to play us out this month.

Elton John – 1974 – Philadelphia Freedom

America – by The Nice – a single in 1968

Metallica – Don’t Tread on Me - 1991 (I think)

And an unlikely rendition of the National Anthem by the great American band, Kiss - from 2016

Footnotes:

[1] West's Encyclopedia of American Law, edition 2. S.v. "Usurpation." Retrieved July 4 2021 from https://legal-dictionary.thefreedictionary.com/Usurpation