Independence Day Edition

My first American fireworks: Princeton, NJ, July 4th 1985. We sit on the bonnet (hood) of the car, leaning back on the windscreen (windshield) looking up, waiting for something to happen. A crummy high-school band starts up and a choir or whatever gets going – Oh-oh say can you see, by the dawn’s early light. Makes no sense. Apparently the Yanks have an even more boring national anthem than we do. What so proudly we hailed at the twilight’s last.. More nonsense. How much of this do we have to sit through before the fireworks? Whose broad stripes and bright stars. Good grief. This is bollocks. Shoulda brought more beer. O’er the ramparts.. Ramparts eh.. there’s that wine in the boot but it’s probably warm by now – anyway it’s a work day tomorrow, flying out 6AM so.. better just make this one last.

And the rockets’ red glaaaaare… BOOM BOOM WHOOSH.. Wow ****! The bombs bursting in aaaiiiiirr… BANG, BANG, B A N G Bloody ******’ ‘ell… BANG ! Now that’s fireworks, baby!

“Is that the national anthem?”

“Er.. yeah..”

“Oh – Frickin’ Wild. Is it always like this?”

“Erm .. yeah, well on July 4th.. you don’t have fireworks in England?”

“It’s not really the same”

The aerial assault continues and the band with choir also continues, albeit inaudibly and the home of the brave. Martial mayhem for ten more minutes to the delight of the assembled citizens. Finish the can. A few more lungfuls of gunpowder smoke and then back inside the car and we’re off home. A bloody crazy country. Their national anthem is literally a reenactment of a rocket attack – with actual rockets and bombs. And everyone loves it. Makes God Save the Queen seem a little… timid maybe? I get to learn later that the folks doing the attacking with the rockets that is commemorated each year, were the Brits, in 1812. A bit embarrassing really, but no-one seems to care. All water under the bridge ‘n all.

So to the present day and July 4th is still a little scary, honestly. Eardrums calloused from an early age by repeated exposure to heavy metal still get a shock from the bombs bursting in air. Even the reading of the declaration calls to mind the violence behind the founding of a modern, civilized society. The signers pledged to each other their lives, fortunes and sacred honor and that was no empty phrase. They were playing for keeps. Are we..?

Now to the News:

Thanks and appreciation to the great ICIS, from whom most of this news is abstracted. I encourage my readers to subscribe, like I do. Each subscriber from this blog earns me precisely nothing, but I think it will earn you some good market insights. End of commercial.

One of our regular readers, kindly brought to my attention that I failed to mention the Croda profit warning (the first in a long long while) in last month’s blog. My excuse hinged around the fact that the blog was late anyway and so.. and so on June 9th Croda issued something cutely named a Trading Update (gotta remember that) which copped to sales being off by double digit percent in the first 5 months of ’23. This due to customers de-stocking after building up huge inventories. Morningstar went on to note that Croda CRDA shares were down around 12%-15% intraday, June 9th after the company released a profit warning due to unexpected customer destocking. Referencing the first five months of the fiscal year, volumes in consumer care were down by double digits. In life sciences, the crop protection business was described as now experiencing rapid customer destocking plus the mix is weaker compared with the prior-year period due to lower sales for COVID-19 applications. Destocking is expected to continue in the second half of the year whereas the company was previously expecting a stronger demand environment in that period. Consequently, fiscal 2023 profit before tax is now expected to be between GBP 370 million and GBP 400 million, well below company-compiled consensus of GBP 452 million. Morningstar noted that they have been more bearish than consensus for quite some time and were already forecasting 2023 profit before tax of GBP 397 million. Croda shares have been overvalued for years in their opinion, especially during the pandemic due to rapid growth in its business supporting the COVID-19 vaccines. [hmm ok – so there you have it. Reversion to the mean maybe?]

Interestingly, a few other companies have followed suit. For Example as reported by ICIS, Ashland issued a profit warning for its upcoming fiscal third-quarter earnings also because of customer destocking. Ashland's fiscal third quarter runs through June. It expects Q3 sales to be $545m-550m, down 15% year on year. Sales fell for all of the company's segments. Ashland attributed the declines to rapid customer destocking, which caused volumes to drop. The decrease was partially offset by favourable pricing. Ashland expects to report $130m-135m in Q3 adjusted earnings before interest, tax, depreciation and amortisation (EBITDA), down 22-25% year on year. It attributed the decline to much lower sales volumes and reduced cost absorption from the steps the company took to control inventories. Those internal inventory-control measures resulted in $15m of reduced cost absorption, Ashland said.

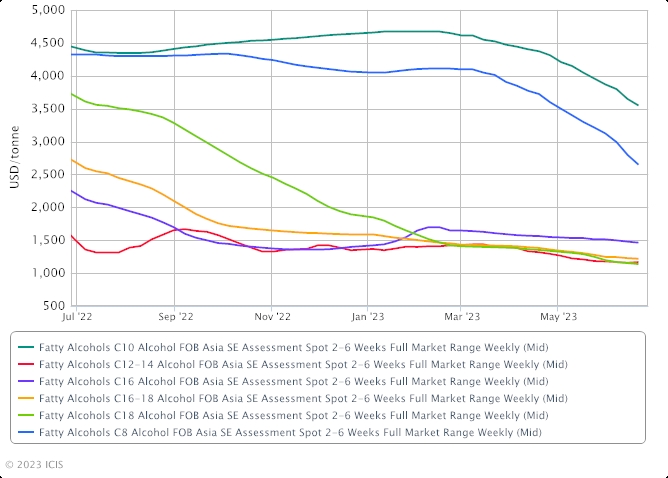

Over in Asia, ICIS’ great Helen Yan reports that Asia’s fatty alcohols market is expected to remain tepid in Q3 because of the slump in demand from the EU and a weak global macro-economic environment.

- Inflation woes and recession fears to weigh on demand

- Uncertainties to cloud Q3 outlook, buyers remain cautious

- Purchases mostly on hand-to-mouth basis, few bulk enquiries

Demand from Europe has slumped due to the recession in the Eurozone economies.

Inflation woes and recession amid the prolonged Ukraine-Russia conflict have derailed the global economy and weighed on demand, market sources said. “We are getting fewer enquiries for July-August shipments from the EU, with enquiries down about 50% from the usual purchasing volumes,” a regional fatty alcohols producer said.

“We used to export in bulk but purchases are now mostly on a hand-to-mouth basis for smaller isotank parcels,” he added. Buyers have been adopting a cautious and prudent stance in view of the uncertain and gloomy outlook amid the ongoing geopolitical tensions between China and the US, the two largest economies in the world, market sources said. Several fatty alcohols producers in southeast Asia have been grappling with shrinking demand by running their plants at reduced rates of 70-80% capacity.

Despite the slump in EU demand, there are expectations that demand in Asia may rebound in Q4. “The EU demand is still not back yet, but we continue to get enquiries from China, India, Japan, South Korea, Vietnam and the US,” another supplier said.

A little further downstream, Asia’s fatty alcohol ethoxylates (FAE) demand is expected to remain tepid in the near term as buyers continue to adopt a cautious stance amid weak macroeconomics and eroded consumer confidence.

- Buyers cautious and purchase mostly on need-to basis

- Consumer confidence eroded by weak macroeconomics

- Falling feedstock fatty alcohols mid-cuts C12-14 curb demand

Enquiries were few and far between for fresh spot shipments, with the buyers mostly adequately covered by term shipments. Spot trades, if any, were mostly confined to smaller parcels on a need-to basis. “Demand is slow as buyers are cautious and holding back any large forward spot shipments, given the bearish market sentiment and uncertainties,” a supplier said. Buyers were closely monitoring the feedstock fatty alcohols mid-cuts C12-14 and ethylene oxide (EO) markets. The feedstock fatty alcohols mid-cuts C12-14 prices had continued to fall, down by about $100/tonne from the previous month. Similarly, the other feedstock EO price had remained soft despite limited spot availability. A regional 136,000 tonne/year EO plant had been shut since February and is only expected to resume production in early July.

Meanwhile, the rebound in the Chinese market had been slower than expected despite its borders reopening in early January this year following a near three-year pandemic-induced lockdown restrictions. China's total exports in May dropped by 7.5% year on year to around $283.5bn, according to the nation’s official preliminary data released on Wednesday, 7 June. Meanwhile, the eurozone is now in recession as GDP in the first quarter was weaker than initial data suggested, according to the latest release from the EU’s statistical agency Eurostat on Thursday, 8 June.

ICIS’ Nurluqman Suratman reports on dealmaking in the world of LAB. Saudi Arabia’s Farabi Petrochemicals Co has acquired a 50% stake in China’s Great Orient Chemical Taicang (GOCT) for an undisclosed amount. Farabi, the world’s leading linear alkylbenene (LAB) producer, is acquiring the stake from South Korea’s specialty chemical maker ISU Chemical Co, according to an official statement sent to ICIS. On 16 June, Farabi signed in Singapore a share purchase agreement with ISU, and a new shareholders’ agreement with GOCT and Trevose International - a subsidiary of Indonesian conglomerate Salim Group. Trevose International is an investment holding company based in Singapore which will retain its 50% in GOCT. GOCT has an annual output of around 100,000 tonnes of LAB, according to the ICIS Supply & Demand Database. “I am confident that Farabi Petrochemicals and SALIM group will present a great fit,” Farabi Group CEO Mohammed Al-Wadaey said. The new JV will retain GOCT’s existing partnerships and agreements with suppliers and customers.

Farabi has a total of 320,000 tonne/year LAB capacity at two sites in Saudi Arabia - a 200,000 tonne/year plant in Al Jubail and a 120,000 tonne/year plant in Yanbu, ICIS data show. South Korea’s ISU Chemical, on the other hand, has a smaller LAB capacity of 180,000 tonnes/year at its Ulsan complex, the data show. The new partnership of Farabi and Salim Group aims to capitalise on the synergistic strengths of Farabi as a major supplier of n-paraffin, a major feedstock consumed by GOCT.

Asia’s LAB market remains under downward pressure because of persisting weak demand. China and southeast Asia are major markets for LAB. “The Chinese domestic market equilibrium could be impacted with a major Middle Eastern producer now having access to it,” said a LAB producer in China. The Chinese market has been dominated by domestic Chinese makers Fushun Petrochemical, Jinling Petrochemical and Jintung Petrochemical. With competitively priced feedstock n-paraffin from the Middle East, some Chinese players anticipate that GOCT might be able to out compete domestic producers with the feedstock advantage. At the same time, GOCT would be able to tap into the Salim Group’s network in southeast Asia should the company chooses to compete there. Other advantages perceived by Chinese players for Farabi include earnings in the Chinese yuan (CNY) from LAB sales that it could utilize to settle trades with other Chinese entities.

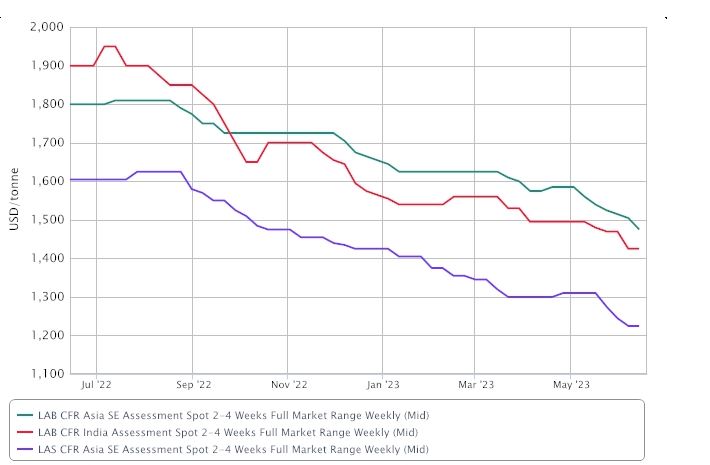

Staying with Asia LAB: The linear alkylbenzene (LAB) market in Asia remains under downward pressure from persisting weak demand. Suppliers in Asia and China concede that buying momentum remains weak with some mulling lower offers to keep buyers engaged. In the week ended 14 June, the Chinese domestic market hovered around yuan (CNY) 11,900/tonne DEL (delivered), but sellers concede that with demand in a low ebb, the local market remains under downward pressure which could see further price slippages in July. The weak domestic market has also prompted Chinese suppliers to look towards export destinations but these locations are similarly mired in weakness. “The east and south Asian destinations are all seeing poor demand and prices are not attractive,” said a producer in China. In the week ended 14 June, spot prices in southeast Asia slipped under $1,500/tonne CFR (cost & freight) SE (southeast) Asia, to as low as $1,450/tonne CFR SE Asia, ICIS data showed. However, buyers lobbied for even lower prices as supply in the region remains ample but sellers are hesitant to dish out further discounts amid narrow margins. “Buyers kept seeking lower numbers but we decided to withdraw as margins are bad,” said a trader in Asia.

Uncertain economic outlook continues to weigh on sentiment, prompting buyers to be unhurried. At the same time, the recent weak performance in upstream markets such as benzene also fueled expectations of lower LAB prices among buyers. Spot benzene prices in Asia fell under $800/tonne FOB (free on board) Korea in June from the recent peak of $1,020/tonne FOB Korea in mid April. “The weak upstream markets [are] unable to bolster LAB markets in India and Asia,” said a trader in the Middle East.

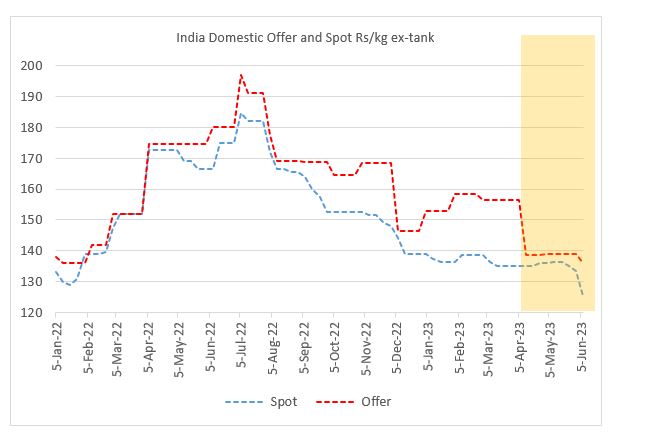

And in India: The linear alkylbenzene (LAB) domestic market in India remains under downward pressure with no pickup in demand. Suppliers cited June offers in the mid-to-high rupees (Rs) 130s/kg ex-tank but buying indications remain under Rs130/kg ex-tank. Spot deals were heard around Rs125-126/kg ex-tank, according to several sources in the trade. Prices were trading largely in the mid-Rs130s/kg ex-tank in May.

“The summer demand this year has been a letdown,” said a trader in India. May and June are typically strong months for LAB in India with demand petering out from July onwards. Despite the implementation of a certification program for suppliers of LAB into India by the Bureau of Indian Standards (BIS) in April, the market remains under downward pressure from soft demand. This is despite seeing less imports as those suppliers without the certification were unable to sell into the subcontinent. On the import front, prices were similarly under downward pressure with buying indications heard lower each week. Some suppliers caved in and dished out discounts to keep buyers engaged. However, deals remain limited as buyers continue to lower buying indications resulting in a buy-sell gap. Offers of spot material were in the $1,400s/tonne CFR India but buying indications have slipped to $1,300s/tonne CFR India.

“A supplier in the Middle East has offered in the low $1,400s/tonne CFR India but buyers are thinking under $1,400/tonne CFR India,” said a buyer in India.

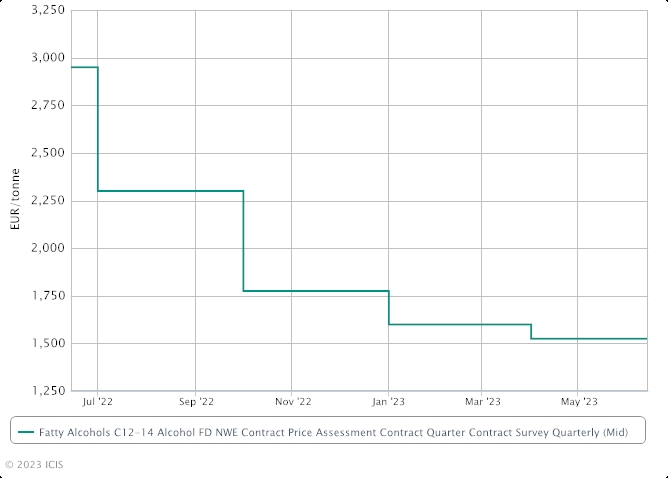

Meanwhile in Europe, fatty alcohols Q3 contract prices face downward pressure due to lacklustre demand being surpassed by healthy supply. Healthy domestic stock levels, competitive imports from Asia, low demand and falling palm kernel oil (PKO) values have all contributed to market weakness for fatty alcohols in late-Q2. Q3 contract discussions are still in their early stages, largely due to limited buying interest and expectations that prices could fall further in the coming weeks. So far, price ideas for Q3 have been heard at triple-digit decreases versus Q2. Demand over the summer is likely to be reduced due to seasonal shutdowns downstream. The downstream ethoxylates market so far shows no signs of increased demand for the second half (H2) of the year. More progress in the negotiations is expected in late-June and early-July.

Finally, news from Solvay. Remember a while back we reported the company was splitting up into 2 parts, and I got ChatGPT to write a clever analysis, which readers far preferred to the regular blog. So we’ve fired ChatGPT and replaced it with a human, who are generally more expensive but less annoying. Anyhow, we now hear from ICIS that Solvay announced the name of its specialties spin-off business on Friday.

Its commodities business, referred to as EssentialCo [I kinda liked that name] since the split was first announced, will remain as Solvay, while the specialties segment (‘SpecialtyCo’) will now be called SYENSQO.

Completion of the separation of the two business units is expected in December 2023, subject to satisfactory conditions. Solvay will comprise the mono-technology businesses including soda ash, peroxides, silica, solvents and rare earths, which generated €5.6bn in net sales in 2022. SYENSQO will cover specialty polymers, composites, surfactants, aroma, technology solutions, and oil and gas, as well as the four growth platforms in batteries, green hydrogen, thermoplastic composites and renewable materials, and biotechnology. In 2022, SYNESQO generated net sales of around €7.9bn.

[So readers, what do you think of the new name? In the interest of journalistic integrity and the vast amounts of money that Solvay pays the blog in advertising and sponsorship, I’ll abstain from comment – I’m kidding ! I have no journalistic integrity… oops, I mean – I have no advertising. I don’t know which is worse.. Anyway what do you think of the name?]And now to Music. I think some patriotic songs are in order don’t you. It is July 4th after all. Let’s get all unselfconscious and hand-on-heart shall we?

Joe Satriani kicks us off..

Madison Rising. I know nothing about them, but this is nice.

We may have featured this one before, but it never gets old.

Then there’s this one. A lot of people have read a lot into it. The flag was still there.

And apparently this is Florida Man, in what many commenters are saying is the most American thing ever. Hmmm

We like a bit of a capella here at the blog so..

And..Pentatonix

And because we like a bit of stairwell singing…

OK so that’s that. Now, obviously I have issues with the YouTube. Not just the de-platforming of Jordan Peterson but also the deletion of what seem like they would have been fascinating, North Korean propaganda videos. I am quite sure that I could consume both types of fare without rushing out into the streets and setting fire to cars or rubbish bins or whatnot. But despite all that, the algorithm continues to delight, intrigue and educate in the field of music. And, I don’t know about you, but it often seems to be the recommendation about a third of the way down the right hand side that is the real gem. The first 1 or 2 are a bit too obvious but keep going down the list and it starts to get interesting. And so it was that, during the intensive research for this blog, the following morsel was dangled just at the edge of my peripheral vision. Jazz Sabbath. A complete jazz album of Sabbs songs. This is not parody. It is real, in my uneducated opinion, jazz, built on the doom-laden songwriting of Osborne, Iommi, Ward and Butler. At first listen, it’s tricky to pick out the Sabbath riffs, then it hits. Wow. Here’s the album, first and then for comparison a couple of Sabbath originals.

Calls to mind a time a couple of years back, I was holding a meeting offsite at a WeWork type space and the college student running it, after explaining how to work the coffee machine, leaned in and said,

“you know you can request whatever music you like for us to play in afternoon”

- and then obviously mistaking me for someone with sophisticated taste -

“We have all the jazz greats…”

“Well I’m more of a 70’s heavy rock guy, you know”

“Yeah me too.. not allowed to play it though…”

“You’re a bit young for that type music aren’t you?”

“Me? No.. all the freaks like Black Sabbath, Judas Priest... I love that stuff”

“Freaks? Don’t sell yourself short.. got any Rush back there..?

“Thelonious Monk. That’s what we have for you, sir..” ????

“That’s fine. I’m sure one of my colleagues will request it..”