Surfactants Monthly - March 2022

Before we jump straight into the news: Please consider registering for our surfactants in-person event in May (10 – 11) in Jersey City, NJ. If you missed ACI in Orlando this year, now’s the chance to get back on the circuit, to meet old friends and new, to talk shop, to make deals, to learn a heck of a lot, to see who won the awards, to have a laugh and a joke and listen to some great music and just generally get back to normal. Everyone else will be there, pretty much, so.. yeah you should register, I think – Here's the link. https://events.icis.com/ehome/worldsurfactants/home/

News: I know most of you have been waiting on literal tenterhooks (not sure what tenterhooks are but I think you get it) to hear the next installment of the Activist Shareholder / Marmite Maker – Nelson Peltz / Unilever corporate thriller. Well, nothing much has happened in the past month as far as I can see from my searching of the financial press. So, OK, we can seek solace in the pages of the Daily Mail which can be relied upon to write about (and picture) Peltz daughter Nicola at least once every 48 hours. We are not disappointed. According to the one of the world’s most visited English language news websites (Not kidding. #4 behind the NY Times and ahead of the Grauniad[1].) Brooklyn Beckham and his fiancée Nicola Peltz looked sensational as they starred as the faces of Pepe Jeans' Spring/Summer 2022 campaign.

The article is, as always well sourced and illustrated. The happy, soon to be wed, couple struck a 60’s note in the black and white photoset. Anyhow that’s all I have from the house of Peltz this month. We can only hope for whatever is happening behind the scenes with Unilever to be made public in the financial or tabloid press next month. Let’s see.

Great news from Holiferm and Sasol on the last day of this month as reported by ICIS. Sasol has agreed a partnership with UK company Holiferm to develop new biosurfactants. Under the partnership, Sasol will purchase the majority of sophorolipids produced at a new Holiferm manufacturing facility that is due to start up in early 2023 in the UK. Sophorolipids are biosurfactants made through fermentation, using yeast to convert vegetable oils and glucose. “The Holiferm expertise in the area of fermentation technology and production is a perfect fit with Sasol’s position as a global leader in the supply of surfactants and surfactant intermediates into the fabric and home care, personal care as well as industrial and institutional cleaning markets,” Silke Hoppe, vice president, Essential Care Chemicals, at Sasol Chemicals, said in a statement.

Financial or other terms were not disclosed. Holiferm is a developer of fermentation technology to make biosurfactants. It has research and development facilities in Manchester and a commercial plant and a pilot project in the Liverpool area. [so this is great news from 2 companies that I know and respect greatly. Kudos to both and I look forward to hearing a great deal more about this collaboration.]

Tidying up news from a while back: Brazil’s competition authority, the Administrative Council of Economic Defense (CADE), has green-lit Indorama Ventures' (IVL's) acquisition of Ultrapar’s surfactants business, the Brazilian company said. IVL is to acquire the business for $1.3bn, the two companies announced in 2021. Thailand-headquartered IVL produces polyester, glycols and surfactants. “CADE [has] approved the sale of Oxiteno S.A. – Industria e Comercio [surfactants subsidiary] to Indorama Ventures PLC without restrictions,” said Ultrapar’s CFO, Rodrigo de Almeida Pizzinatto. “Provided there are no appeals by third-parties or by the CADE Court, the approval will become final within 15 days of the publication of the SG's recommendation.” With the Oxiteno acquisition, Indorama said it would become the largest nonionic producer of surfactants in the Americas.

AFPM had their annual meeting again in person in San Antonio last month and there were some interesting reports filed by ICIS from there. My policy of “you gotta be there” remains firmly in place. It’s not just for my own conferences. So, you won’t get a lot of detail about the event, however, some general news filed by ICIS from there is allowable. Here goes.

The great Lucas Hall of ICIS noted that the US oleochemicals demand outlook is mixed as economic concerns continue to mount against the backdrop of the Russia-Ukraine conflict.. While oleochemical markets are somewhat more resilient to economic fluctuations, given their role as building block chemicals in products consumed as part of everyday life, rising inflation and increased economic concerns will impact consumer spending habits. The personal care sector is the largest end market for oleochemicals, including cosmetics, fragrances, hair care and coloring products, sunscreen, toothpaste, and products for bathing, nail care, and shaving. Rising inflation is likely to lead to less consumer spending in segments like cosmetics, fragrances, hair dye and nail care. Consumers are also likely to choose lower-cost brands when deciding on products like soap, shampoos, conditioners and body wash, as well as toothpaste.

Similar trends are expected in cleaning and food markets, where consumers are expected to choose lower-cost options for cleaning products, grocery store food and pet food, especially as costs for other raw materials drives the price of premium products higher relative to in-house brands. Some market players see this as a potentially delayed impact, as continued raw material shortages globally continue to displace demand and production already on the forward books. Lead times for some oleochemical shipments from southeast Asia are as long as four-to-five months.

Longer-term, sustained economic pressures could prompt players to consider reformulating products such as toothpaste to use sorbitol instead of glycerine.

Derived from animal fats and greases like tallow or vegetable oils like palm and coconut, fatty acids are mainly used in cosmetics and toiletries, as well as for the production of lubricants and plasticizers in rubber and polymer processing.

The US is a major net-importer of natural fatty alcohols and a key production region for synthetic (petrochemical) alcohols.

Additional dynamics in the feedstocks markets are the result of additions of capacity in petrochemicals as the great Lucas Hall also reports: Expanding US synthetic (petrochemical) alcohols capacity with the anticipated commercial startup of ExxonMobil's new linear alpha olefins (LAO) unit in Baytown, Texas, targeted for mid-2023 could create increased competition in the downstream alcohol ethoxylates market, said sources on the sidelines of this year's International Petrochemical Conference (IPC). The Baytown unit will have capacity to produce 350,000 tonnes/year and will produce 10 products that will be sold under the ELEVEXX brand name.

LAOs are used in plastic packaging, engine and industrial oils, surfactants and other specialty chemicals. C12, C14 and C16 LAOs are commonly used in the production of surfactants. Alcohol ethoxylates are largely used in the production of detergents.

Synthetic alcohols producers Sasol and Shell each have internal ethoxylation capacity in the US, while ExxonMobil currently does not. Indorama is poised to close its acquisition of Oxiteno from the Brazilian conglomerate Ultrapar in Q1 2022,

Stepan in October announced plans to build a new alkoxylation plant at its site in Pasadena, Texas. The new plant will provide “a flexible capacity” of 75,000 tonnes/year, capable of both ethoxylation and propoxylation. The plant is expected to come online in late 2023. When operational it will bring Stepan's alkoxylation network to three plants and position the company with a footprint in the US Gulf Coast. The US is a major net-importer of natural fatty alcohols and a key production region for synthetic alcohols.

Further detailed analysis of the US market by Lucas Hall shows further supply chain constraint and volatility: Increasing alcohol supply chain volatility is expected to underpin US fatty acids and alcohols markets into H2 2022, as demand for numerous carbon fractions continues to outpace supply against the backdrop of soaring feedstock costs and import disruptions globally, heading into this year’s International Petrochemical Conference (IPC). Crude oil and energy markets in general are also soaring alongside the Russia-Ukraine war.

Crude oil prices indirectly pressure feedstock fats and oils markets, as renewable fuels like biodiesel compete with petroleum-based fuels in the global market.

FEEDSTOCKS

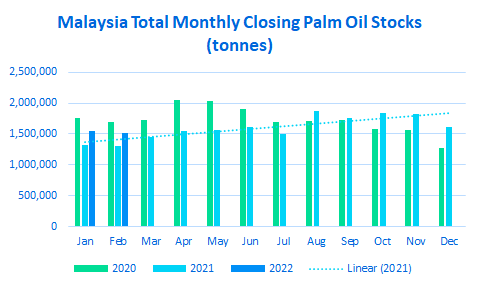

Malaysian palm oil stocks remain historically tight because of labour shortages in the first two years of the pandemic, with stock levels largely remaining below the 1.75-2.00m tonne threshold the market considers to be balanced. Malaysia supplies about one-third of global palm oil demand.

Source: Malaysian Palm Oil Board (MPOB)

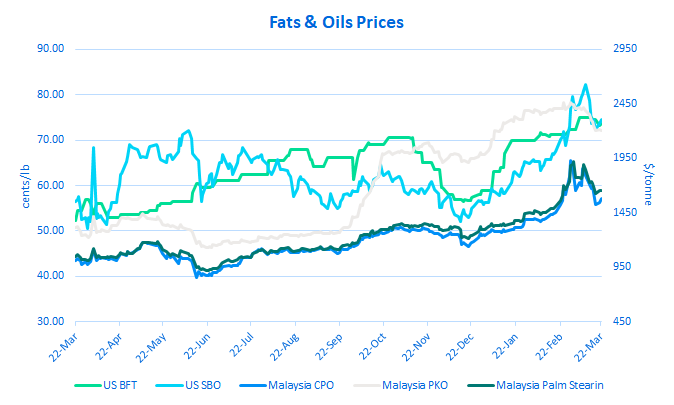

Stock levels were beginning to find more balance in H2 2021 following the peak summer palm harvest. However, stock levels fell alongside a move from the Indonesian government in late January to curb rising cooking oil prices by introducing export curbs on palm oil and palm products, further supporting the uptrend in vegetable oil costs. The government briefly expanded the export curbs in March before scrapping the policy in favour of an export tax, after the previous policy failed to reduce inflation. Soybean oil (SBO) markets are also historically tight because of drought conditions impacting production in both Argentina and Brazil. Argentina supplies a significant chunk of global SBO demand. Rapeseed oil has also been historically tight because of drought conditions in Canada in 2021. Canada supplies more than half of global rapeseed oil demand. The Russian invasion of Ukraine effectively slashed global sunflowerseed oil supply. Combined, the region supplies roughly 80% of global sunflowerseed oil demand. Sunflowerseed oil accounts for only 12% of global food oil consumption and 9% of total vegetable oil consumption - including biofuels and other industrial uses - according to the US Department of Agriculture (USDA). This sudden supply shortage against the backdrop of preexisting tight vegetable oil supply globally sent vegetable oil prices soaring even higher, as global players were forced to look elsewhere to satisfy demand.

Source: CME Group, Matthes & Porton, WSJ Cash Markets

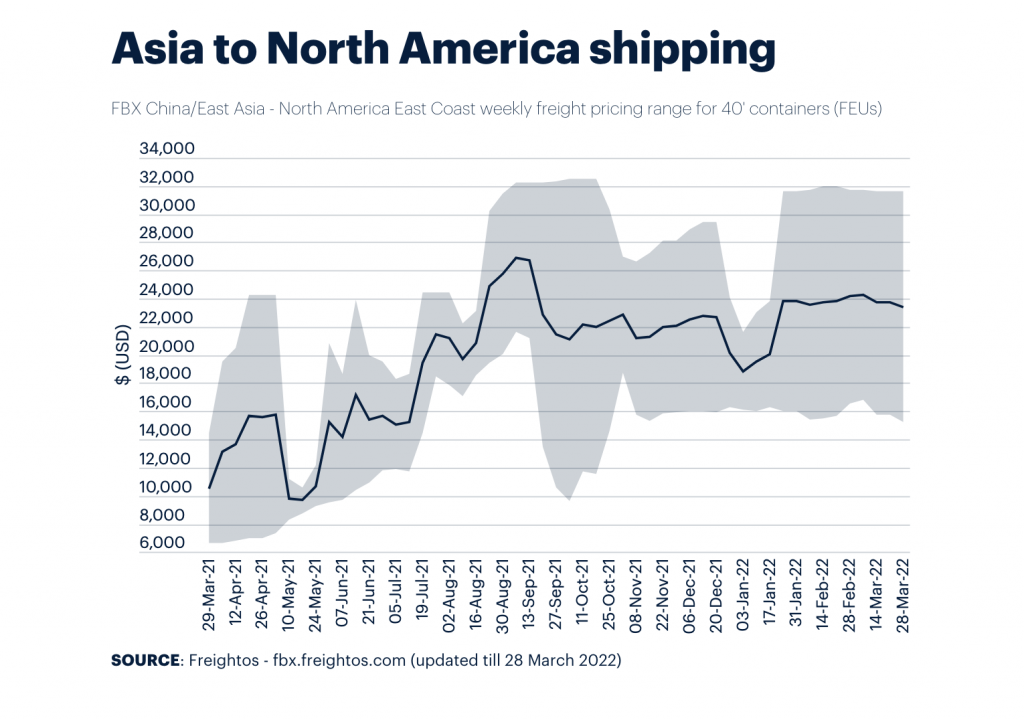

While vegetable oil prices have entered a downward correction in recent days now that Indonesia has removed the export curbs from the market, soaring energy and feedstock costs continue to squeeze production margins in southeast Asia. Squeezed production margins in southeast Asia have caused players in the region to reduce operating rates against the backdrop of preexisting cost pressures like high shipping equipment and freight costs. The Russia-Ukraine conflict threatens to further weigh on imports as shipping equipment and vessel space further tightens because of the supply chain disruptions from eastern Europe.

FATTY ACIDS

The combination of these issues is further increasing demand from the domestic market to satisfy the import shortfalls. Sustained import disruptions continue to support demand for domestic fatty acids. Multiple carbon fractions remain tight, including C8, C10, C8-10, C14, tallow based C18-oleic and stearic acids, and tall oil fatty acids (TOFA). Oleochemicals producers are running as hard as they can, as demand for fatty acids largely continues to outpace supply, but overall domestic oleochemical capacity is insufficient to make up for import shortfalls alone, keeping the market historically tight.

Domestic oleochemicals players are also facing supply chain disruptions, including raw material disruptions and higher shipping equipment and freight costs.

Beaded and flaked stearic acids from PMC Biogenix's US Memphis, Tennessee, site are expected to remain disrupted into H2 2022 as the company continues to make repairs following a fire at the site's packaging facility in January.

Price increase announcements (separately announced)

| Producer | Product | Proposed Increase | Targeted Date |

| Ingevity | Pine chemical-based products | Upwards of 50% | 1 April |

| Kraton | CTO refinery products, derivatives | Up to 15% | 1 April |

FATTY ALCOHOLS

Multiple carbon fractions remain tight, including C8, C10, C8-10, C16-18 blends and C18, depending on the supplier. C18 alcohols have grown increasingly tight in recent weeks as bullish feedstock palm kernel oil (PKO) costs encourage an increase in coconut oil (CNO) in the feedslate, inherently producing less C18 alcohol in the process.

The downward correction across the oil palm complex following the removal of Indonesia's export curbs may encourage more players to increase their consumption of palm oil and PKO in the weeks to come. Mid-cut alcohol supply is relatively more balanced, but increasingly volatile supply chain conditions are also increasing demand in that market. Domestic natural and synthetic C18 alcohol availability is also tight, given the overarching supply tightness in southeast Asia. Freely negotiated US Q2 fatty alcohols contract negotiations have largely been heard at a sharp increase from Q1, tracking the above cost pressures and increasingly volatile supply chain conditions globally. Freely negotiated contracts for mid-cut alcohols have largely been heard in the low-to-high $1.60/lb DEL (delivered) US Gulf range. Discussions have been heard as high as $2.00/lb. Discussions for long-chain alcohols have largely been heard above $2.00/lb for both single-chain and blended C16-18 volumes. One supplier was heard lower than $2.00/lb on C16 alcohols, given their competitive supply position in the market. Few suppliers have the capability to ship and store long chain alcohols in bulk. Most suppliers ship by container, exerting pressure on the wider market the last several quarters.

In the wider market, concerns regarding US Customs and Border Protection's (CBP's) increased scrutiny on Malaysian-origin product persists, with isolated instances of imports being rejected or detained continuing to be heard in the market.

Meanwhile over in Asia, markets are trending in a somewhat different direction as reported by the prolific and insightful Helen Yan: Asia’s fatty alcohol ethoxylates (FAE) market is likely to soften in the near term, due to declining feedstock fatty alcohol C12-14 costs and a slowing Chinese economy.

- Indonesia increases CPO and PKO levies

- Lockdowns in China to weigh on demand

- Supply of fatty alcohols C12-14 to ease

The removal of Indonesia’s domestic market obligation (DMO) export curbs, replaced with an increase in levies on crude palm oil (CPO) and palm kernel oil (PKO), has eased feedstock fatty alcohols C12-14 supply from Indonesia at the same time that the coronavirus spike in China weighs on demand. China’s zero-COVID-19 strategy has seen full and partial lockdowns being imposed in numerous cities in the provinces of Jilin, Hebei, Shandong, and Guangdong, as well as in some communities in Shanghai.

Factories in China have been shut or are running at lower rates, while logistics and transportation issues have delayed shipments and deliveries following fresh lockdown restrictions to contain the highly infectious coronavirus Omicron variant. Spot prices of FAE mols 7, 9 fell by $50/tonne to $1,850-1,900/tonne CIF (cost, freight and insurance) China for drummed shipments in the week ended 24 March, ICIS data showed.

“Indonesian cargoes will be cheaper and more competitive with higher CPO and PKO levies and removal of the DMO policy,” a trader said.

In place of the DMO policy, Indonesia has raised its export levies on CPO and PKO.

The maximum levy rate has now been set at $375/tonne when the reference price for the edible oil hits $1,500 a tonne, up from $175 previously. CPO and PKO exports are subject to both levies and duties. The duties remain unchanged at $200/tonne for CPO and $245/tonne for PKO. Under the DMO policy, Indonesian companies had to show proof of their domestic sales of crude palm oil (CPO) and/or refined, bleached and deodorised palm olein to secure export approvals for oleochemicals including fatty acids, fatty alcohols, and soap noodles. On 10 March, Indonesian companies were required to sell 30% of their planned exports of CPO and olein in the domestic market, up from 20% previously. The DMO policy was initiated in late January to rein in soaring domestic cooking oil prices. Demand for cooking oil, derived mainly from palm oil, has surged ahead of the Muslim fasting month of Ramadan, which starts a month ahead of the upcoming Eid-ul-Fitr festive holiday in early May. The Indonesian government recently lifted the cap on retail prices of branded cooking oil and subsidized bulk domestic cooking oil. Indonesia is the world’s largest palm oil producer, followed by Malaysia. Indonesia produced 47 million tonnes of CPO in 2021, according to the Indonesian Palm Oil Association (GAPKI).

In contrast, the Asian linear alky benzene (LAB) market has been bolstered by rebounding crude oil prices. However, buyers remain slow to accept lofty offers by suppliers amid heightened uncertainty from the recent crude volatility. With crude markets likely to remain in a flux in the near term, the buy and sell gap between LAB buyers and sellers might need time to bridge.

- Volatile crude market causes hesitancy among buyers

- Suppliers’ margins eroded by buoyant upstream markets

- Chinese market dampened by lockdowns and logistics issues

Buyers remain mostly cautious after last week’s tumble in the crude oil market while sellers cited lofty selling indications amid eroded margins. “Costs are rising quickly and we need to reflect that in the LAB market,” said a supplier in Asia.

However, some sellers concede that buyers are slow to follow as uncertainty remains elevated. “Buyers are hesitant to commit to large price increments and will need some time to reconcile that cost push has lifted the market,” said another seller in Asia.

Offers were cited largely at around $2,000/tonne CFR (cost & freight) Asia and above, while buying indications were heard below $1,900/tonne CFR Asia. In China, the lockdowns across cities from the recent surge in COVID-19 cases weighed on demand and resulted in logistical issues inland. “Demand is a bit soft as the lockdowns affected trade; hopefully the restrictions can be lifted soon,” said a producer in China.

Over in India, local producers have sold out of March cargoes and are preparing to offer April lots from next week. Some sellers talked of hefty increments for April material, citing rapidly rising upstream costs. “Customers have snatched up March cargoes with much bargaining as they anticipate further increases for April,” said a producer in India.

Domestic India prices rebounded to the Indian rupees (Rs) 150s/kg ex-tank in March, from around Rs130/kg ex-tank in January. LAB is an organic compound used almost wholly as an intermediate in the production of surfactant linear alkyl benzene sulphonate (LAS), also known as linear alkyl benzene sulphonic acid (LABSA). LAB’s main end market is the biodegradable detergents and other cleaners.

Splitting is in the news again. And while Unilever is somewhat hesitant, Solvay has embraced this time-honored method of boosting shareholder value. ICIS reported thtast Solvay’s plan to split into two independent listed entities next year is driven by a push to unlock additional value in the business through intensified strategic focus and attracting different classes of investor, the CEO of the Belgium-based firm said on Tuesday. Solvay announced on Tuesday plans to break up the 159-year-old company into a lower-growth, cash-strong business containing more commoditised assets including its soda ash operations, and a more innovation-focused entity that could deliver higher returns. [so what side did surfactants end up on? Read on]

The process is expected to be complete in the second half of 2023.

Referred to for the time being as EssentialCo, the more commoditised business will house Solvay’s soda ash and derivatives operations, as well as peroxides and silica assets, with total annual 2021 sales of €4.1bn. The other arm, currently known as SpecialtyCo, houses two sub-divisions focused around materials, including composites and specialty polymers, and consumer and resources operations, including oil and gas service chemicals fragrances, and surfactants. [OK then, this seems like a reversal of the Solvay / Rhodia merger with some minor adjustments] The businesses generated revenues of €6bn last year.

The separation is to be achieved through a partial demerger of Solvay that will see the specialties assets spun off to SpecialtyCo. With an emphasis on unlocking value in the company beyond its current market valuation, the split allows for more precise targeting of specific parts of the investor landscape, according to Solvay CEO Ilhan Kadri.

“There are value stock owners,” she said, speaking at a press conference on Tuesday. “They like dividends, they like resilient cash cows over the cycle, and this is exactly what's EssentialCo is.” “There are other investors that like growth stocks, businesses and entities which are investing heavily in their top-line growth, and this is exactly the SpecialtyCo type of business model,” she added.

Solvay had already started work on carving out its soda ash operations, which produce strong cashflows but also heavy carbon output, and the other assets that are slated to go along with it into that new business have similar operational profiles, according to Kadri. “[These] are commodity-like businesses, they need to focus on operational excellence of cost effectiveness, or lean manufacturing,” she said. “They will have between medium to low type of growth, close to GDP, although some of them will do more. They will manage the energy transition specifically… they have a high cash delivery and are able to cover their needs with resilient cash generation,” she added.

The specialty operations will stand as more growth-focused, less bulk production businesses, Kadri said. “The SpecialtyCo… [businesses have] the same operating model very much concentrated on innovation, customer intimacy and meeting those unmet needs, with strategic flexibility,” she added.

The split companies will be better-positioned to provide stronger growth in the long term according to Kadri, with Solvay to continue to report as a single entity in the run-up to the break-up. The company declined to comment on the intended management for the two businesses, but stated that pro-forma updates would be issued throughout the process. No stone was left unturned in the plans to reorganise the business, according to Kadri, with the soda ash carve-out preparations giving the firm the opportunity to take a stronger look at Solvay’s fundamentals. Despite the work that preparing to break the business apart, the process does not preclude further divestments in the meantime.

“There are no sacred cows,” Kadri said. ] The shares of each company are expected to be listed on Euronext Brussels and Euronext Paris. Solvay shares were trading down 2.2% as of 13:28 GMT compared with Monday’s close, following the announcement of the split.

And speaking of splits, the some-time split-off (from Akzo) Nouryon’s adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) rose 10% year on year in 2021 on the back of strong growth for its surfactants and ethylene and sulphur derivatives operations, the Netherlands-based firm said earlier in March.

| ($m) | 2020 | 2021 | Change |

| Revenue | 4,207 | 4,917 | 17% |

| Adjusted EBITDA | 984 | 1,081 | 10% |

| Adjusted EBITDA margin (%) | 23.4% | 22.0% | |

Key points

- EBITDA at its performance formulations division rose 15% year on year, driven by strong demand from agriculture, hygiene, packaging, pharmaceuticals and oil and gas end markets.

- 2021 earning for technology solutions operations fell 3% due to higher energy and raw materials pricing.

- The company passed through 11% in price hikes in Q4 as energy cost increases accelerated.

- The company, which spun out its base chemicals operations into a separate business, Nobion, [are you following this?] under the ownership of Nouryon’s equity investors Carlyle and GIC, announced that it is looking at an initial public offering in September last year.

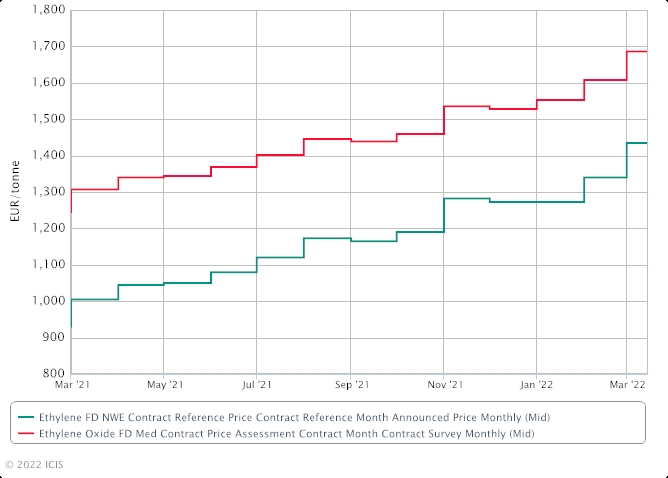

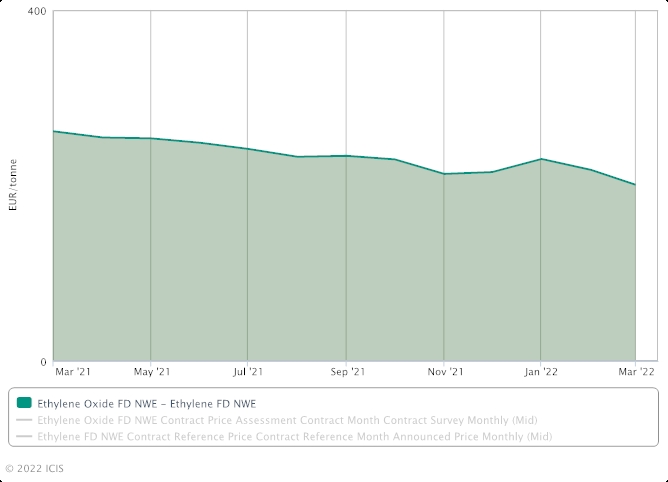

No blog is complete without a look at EO: ICIS notes that Ethylene oxide (EO) suppliers are dealing with high production costs and are increasingly concerned about the next ethylene contract price settlement for April.

Gains in naphtha this week have eaten into cracker margins, causing operating rates to be trimmed.

• High production costs lead to reduced operating rates

• Naphtha gains cause concern over April ethylene contract

• MEG margins under immense pressure from feedstocks

EO prices are at record highs, since ICIS started recording prices in 2004.

Now with the upstream developments, there is even more uncertainty for April.

The following graph shows the EO and ethylene spread has continued to decrease in 2022.

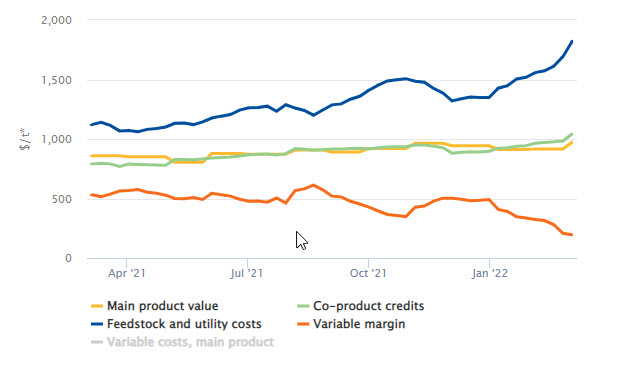

High production costs throughout 2022 have been eating away at downstream ethylene glycol margins. With another historically high ethylene contract price settlement on the cards, the situation is set to worsen, according to market sources. Previously, European MEG contract prices struggled to keep up with the increasing ethylene prices in 2021. MEG contract prices increased 33% in 12 months, while ethylene contract prices rose by 44%. In March, MEG contract prices increased by around 7% month on month, mirroring the ethylene increase. Some market participants were surprised, as it has been previously challenging from a supplier perspective to pass on the feedstock increases downstream. A settler added that it was needed to help the EU to continue operating. In the week to 4 March, European MEG margins fell further on stronger naphtha, LPG costs.

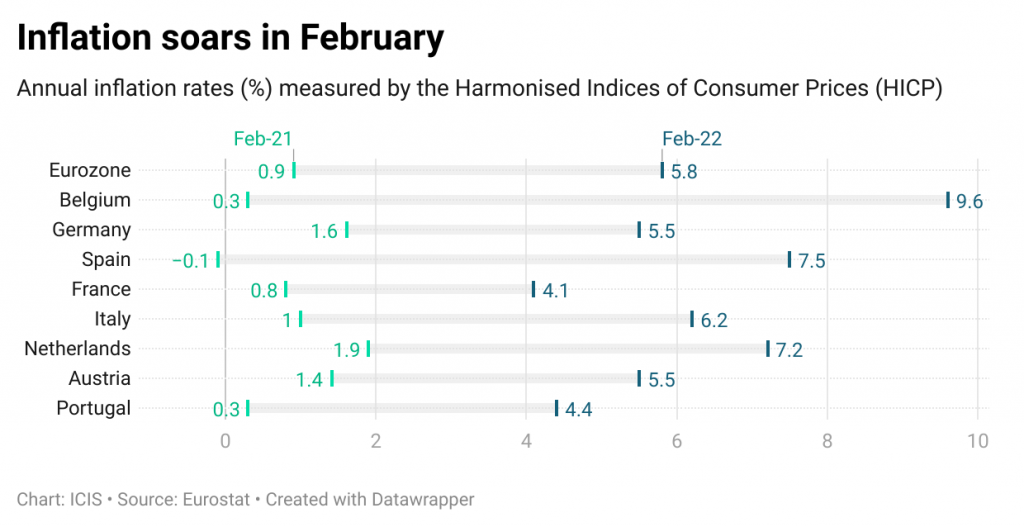

Certain EO derivatives are performing better such as surfactants and polyethylene glycol (PEG), leading suppliers to adjust EO production accordingly. End user demand could weaken in the face of higher inflation rates seen across Europe.

An interesting snippet from Reuters regarding sustainable palm oil: Malaysian tech firm DiBiz launched the world's first online marketplace for sustainable palm oil last month to encourage sales of products certified as environmentally compliant as buyers have avoided the more expensive goods. The trading platform, called Trustparent Marketplace, will link palm oil buyers and sellers across the supply chain and has additional measures for traceability to ensure the industry's commitment to "No Deforestation, No Peat and No Exploitation". "What this means is just like you go to Amazon to buy your products, now, every stakeholder in palm oil can come on to the Dibiz marketplace," said DiBiz co-founder and Chief Executive Officer U.R. Unnithan, who is also president of the Malaysian Biodiesel Association, told Reuters at the sidelines of an industry conference.

Critics blame the rapid expansion of palm plantations for rainforest deforestation and human rights abuses, prompting consumer boycotts against the edible oil.

But palm oil industry officials say such campaigns are hindering efforts to achieve sustainability certification and develop a market for certified sustainable palm oil (CSPO). About 14.6 million tonnes, or 19.3% of global palm oil produced is certified by the Roundtable of Sustainable Palm Oil (RSPO), which is seen as a global standard for sustainability claims. However, planters in Indonesia and Malaysia, the world's two largest palm oil producers, have complained that demand for the more expensive oil with CSPO certification is lacking despite investing millions to meet the requirements.

Kudos to our good friends at Galaxy Surfactants who announced last month that they gained distinct recognition as Supplier Engagement Leader 2021 awarded by a globally acclaimed body on environment impact measurement, Carbon Disclosure Project (CDP). The company earned the distinct ‘A’ rating as granted by CDP basis its deep sustainability focus across its business value chain ecosystem. Galaxy Surfactants has been recognized for successful engagement with their suppliers on climate change and played a crucial role in the transition towards the net-zero sustainable economy.

The Supplier Engagement Rating (SER) by the CDP evaluates corporate supply chain engagement on climate issues and helps companies identify as well as respond to environmental risk and opportunities through CDP’s industry-leading disclosure framework. K Natarajan, Chief Operating Officer, Galaxy Surfactants, said, “At Galaxy Surfactants, we pursue sustainability holistically by involving our value chain partners in our joint journey to mitigate environmental impact. Under this approach, one key focus is to reduce carbon footprint. Our constant endeavor is to decarbonize our value chain, accelerate climate solutions and improve our overall sustainability quotient. This recognition by CDP further strengthens our resolve to continue our environment-friendly pursuits and bring about a positive impact”.

And finally: Distributors are a key channel to market for surfactants manufacturers – and can be high-growth and profitable. That’s why we have Eric Byer, head of the NACD speaking at our upcoming conference in Jersey City (one more plug? Thanks). The world’s biggest chemical distributor, Brenntag has reported record results for financial year 2021 which was characterized by exceptional market conditions. Both global divisions, Brenntag Essentials and Brenntag Specialties, delivered excellent results in their first reported year within the new operating model.

Dr. Christian Kohlpaintner, Chief Executive Officer of Brenntag SE: “In 2021, Brenntag managed to maintain supply under very challenging conditions and continued to provide products and services to our customers throughout the year. We achieved this mainly due to the long-lasting relationships with our supply partners as well as the exceptional efforts and expertise of our Brenntag employees. Our unique global presence in 78 countries, our strong position in our industry segments and our intimate product knowledge were decisive to navigate well through 2021.”

In 2021, Brenntag generated sales of 14,383 million EUR. Operating gross profit rose by 19.6% to 3,379 million EUR compared to 2,869 million EUR in the previous year. Brenntag accomplished to translate the positive gross profit growth into an over proportional growth (+29.5%) of operating EBITDA to 1,345 million EUR. Profit after tax remained largely stable with a total of 461 million EUR despite EBIT being impacted mainly by extraordinary expenses due to excise tax payments and provisions. Earnings per share ended at 2.90 EUR.

The implementation of Project Brenntag, the first step of Brenntag’s comprehensive transformation journey, was started at the beginning of 2021. The transformation is ahead of plan and continues to make very good progress in achieving additional operating EBITDA of 220 million EUR annually by the end of 2023. Since its inception, Project Brenntag has generated around 120 million EUR delivering already more than 50% of the expected uplift. Additionally, the optimization of Brenntag's global site network is ongoing. Of the around 100 planned site closures across all regions by 2023, 72 have been completed to date. Furthermore, since the initiation of the program, 925 jobs have been reduced structurally and in a socially responsible manner out of approximately 1,300 planned in total by 2023. The new Go-to-market approach is now fully implemented globally with dedicated sales organizations for the two global divisions, Brenntag Essentials and Brenntag Specialties. Project Brenntag is designed to build the strong basis for sustainable organic earnings growth in the coming years. It will expand Brenntag’s global market leading position through an increased focus, reduced complexity, and even stronger partnerships with customers and suppliers.

Brenntag can look back on a long-standing history of strategic Mergers & Acquisitions activities and an impressive track record of successful transactions. In 2021, Brenntag acquired six companies with a cumulative enterprise value of 440 million EUR, the highest investment amount in M&A since 2015. Around 80% of this M&A spend was related to the highly attractive Life Science segment, and here especially to the nutrition industry. Highlights included the acquisitions of Zhongbai Xingye in mainland China and of JM Swank in North America. As a result of those two acquisitions, Brenntag’s 2021 global nutrition business grew to around 2 billion EUR in sales. Overall, acquisitions contributed 33 million EUR to Brenntag’s operating EBITDA in 2021, of which the majority was attributable to the deals closed in 2021.

Dr. Christian Kohlpaintner, Chief Executive Officer of Brenntag SE, said: “Brenntag’s business model again proved its resilience in particularly difficult times of severe pressure on global supply chains. We expect the overall macro-economic, geopolitical, and the associated operational conditions to remain challenging. Supply chains have been and still are under severe pressure, further impacting production and supply. We only expect some normalization of market conditions later in the year. Against this background, we currently expect a positive performance at operating EBITDA in 2022 with both divisions contributing to this growth.”

In light of current economic conditions, Brenntag Group expects the operating EBITDA for financial year 2022 to be between 1,450 million and 1,550 million EUR. This forecast considers a normalizing market environment later in the year, includes the potential efficiency improvement driven by the measures of Project Brenntag as well as the contributions to earnings from acquisitions already closed and assumes that exchange rates will remain stable on the level at the time of the guidance publication. The global economy is expected to continue to be severely impacted by exceptional influencing factors that cannot be reliably forecast, such as the COVID-19 pandemic, current geopolitical developments, pressure on global supply chains, inflationary tendencies, and price volatility.

At the General Shareholders’ Meeting on June 9, 2022, the Board of Management together with the Supervisory Board will propose a dividend increase of 7.4%, which translates into a dividend of 1.45 EUR per share (2020: 1.35 EUR). This is the 11th consecutive dividend increase since the IPO in 2010. The payout ratio of 50% from profits after tax attributable to Brenntag shareholders follows Brenntag’s dividend policy.

End of the news: Beginning of the music section: Occasionally, Spotify does a good thing for me and recommends a decent playlist. This month, the Blues playlist really hit the mark and got me digging into Youtube for more detailed research. Why? Maybe the news has got us all in that frame of mind. I can’t say blues is the answer to our troubles but there were some great songs from 40 – 50 years ago or so that have clearly influenced thousands of musicians since. Here’s a few, I’ve been listening too.

First; check out this quivering slice of red meat for hard-blues lovers from English band Spooky Tooth; Evil Woman (1969). The Hammond organ, grinding guitar riff, insane vocals. And that solo – Wow! Is it possible that this one song sent both Black Sabbath and Deep Purple in the right direction to the benefit of literally billions of music fans. Yes. It’s possible. Honestly, it’s likely.

Not convinced? Here’s 1971 Sweetleaf from the Sabs

OK so on to a related band, Humble Pie with Steve Marriott on vocals in 1971 – Black Coffee, a Robert Plant influence do you think?

Here’s Zep themselves. How many more times from a ’71 live performance

How about Robin Trower? This is a 1974 performance of Bridge of Sighs. It’s blues. It’s psychedelic. It’s Gorgeous..

How about one of the progenitors – John Mayall’s Blues Breakers – this one from 1966 with EC (who many claimed at the time was G)

Let’s wrap it up with Mr. Big by Free performed at the Isle of Wight in 1970. Now here’s something you might not know. Paul Rodgers on Vocals (who went on to headline Bad Company) is from Middlesborough in the Northeast of England. So, now you know. Demography is not destiny.

Ah lovely right? See you all in May.

[1] https://pressgazette.co.uk/top-50-largest-news-websites-in-the-world-right-wing-outlets-see-biggest-growth/