March (and early April) 2023

We’ve got some great news as reported from AFPM in San Antonio, by ICIS, this month. Also – your last chance to register for the May surfactant super-conference in Jersey City. I want to induce some serious FOMO here. If you’re not there, you’ll be missing out big time. So: Register Here.

And the music this month is inspired partly by the season and partly by what I listen to while penning these pages. I’m not sure what to make of it either, but there it is – at the end of the blog. If you’re motivated to go down a YouTube rabbit hole after listening to one of these selections, then great. I recommend it.

The News:

Not sure how much importance to place on this, but -OQ Chemicals has launched the first commercially available isononanoic acid made from both bio-based and circular feedstocks, the producer announced. The new product has over 70% bio-based content, providing manufacturers with a sustainable alternative to conventional isononanoic acid to meet growing demand for carboxylic acids. OQ Chemicals recently invested in capacity expansion for its carboxylic acids production in Germany and aims to make its large-scale production processes more sustainable and efficient. The product line uses the mass balance concept to trace renewable feedstocks in chemical production processes and allocate them to products, and received ISCC Plus certification, a globally recognised system for verifying sustainability credentials. Isononanoic acids can be used in applications for various consumer and industrial goods, including energy efficient lubricants, plasticizers, and surfactants.

The great Helen Yan of ICIS reported Asian spot interest in April shipments of fatty alcohol ethoxylates (FAE) is expected to pick up, due to rising feedstock costs and a supply crunch. “We are expecting discussions to pick up pace in the coming weeks for April shipments as we are getting more spot enquiries,” a regional FAE producer said.

FAE production has been curbed by limited spot supplies of EO and fatty alcohols C12-14 mid-cuts due to planned and unplanned shutdowns of both the feedstocks.

A regional upstream ethylene oxide (EO) unplanned shutdown has curbed EO spot supply. This upstream EO plant is expected to shut till June. It was shut earlier this year for maintenance, but production issues have extended its shutdown, market sources said. Meanwhile, the other feedstock fatty alcohols mid-cuts C12-14 prices have also been bolstered by improved demand at the same time that some plants are shut or scheduled to shut in June.

Demand for FAE is expected to improve due to an anticipated a boost in the hospitality and tourism industry following China’s reopening in January after nearly three years of pandemic-induced lockdown restrictions.

Also in Asia, ICIS reported that the Asian linear alkylbenzene (LAB) market came under more downward pressure, following the recent volatility in the crude oil markets from the financial turmoil in the Eurozone. [To me this is another signal of recession. I hate to say it, but it’s been there for a few months now. ]

- Buyers cautious and defer commitments

- Sellers mull lower values to engage buyers

- Downstream LAS sector struggles

Buying interest waned as users in the region prefer to wait and see, in view of the uncertain outlook in the near term. Some suppliers are willing to consider lower numbers to keep buyers engaged, but remain concerned over their margins.

Offers of Chinese products for April were heard in the low $1,500s/tonne FOB (free on board) China, but these could not interest buyers. Some Asian sellers held quotations in the low-to-mid $1,600s/tonne CFR (cost & freight) southeast (SE) Asia, but buying indications were heard at $1,580/tonne CFR SE Asia and lower. “Demand is weaker and buyers are hesitant to commit,” said a supplier in Asia. LAB is an organic compound used almost wholly as an intermediate in the production of surfactant linear alkylbenzene sulphonate (LAS), also known as linear alkylbenzene sulphonic acid (LABSA). LAB’s main end-market is the biodegradable detergents and other cleaners.

In India, demand for LAB was also lacklustre. The financial year-end has prompted end-users to keep lean inventories, resulting in slower demand. At the same time, market activity also slowed ahead of the certification deadline in April for suppliers to India by the Bureau of Industry Standards (BIS). Only a few producers are understood to have obtained the relevant certification. However, participants anticipate a further postponement to the deadline. “Trade has diminished with the BIS deadline just round the corner,” said a producer in India. Although sellers without the certification diverted some sales to other destinations such as Pakistan, Bangladesh and Africa, the India market remains saddled with stocks. “Despite slower spot imports, availability in India remains ample and the market is still under pressure,” said a trader in India. Offtakes from the downstream LAS sector remain dull with no signs of a pick-up so far. However, most players remain cautiously optimistic of stronger performance in the second quarter, when warmer weather sets in. “LAB and LAS demand typically pick up during the warmer months, so we are looking forward to that,” said a LAB buyer.

If, like me, you are wondering about this BIS business, here’s more from ICIS: India has implemented import certification for linear alkylbenzene (LAB) this week after several postponements previously. The Bureau of Indian Standards (BIS) certification mandate for LAB was said to be in force from this week, with no announcement of any further extension heard. “Since there is no extension, it is in force,” said a producer in India. Currently, only Farabi Petrochemicals Company of Saudi Arabia, SEEF Limited of Qatar and LABIX Co Ltd of Thailand are understood to have obtained the certification for LAB exports to India. India is a net importer of LAB though it has four domestic producers of the chemical. Other suppliers have applied for certification but have not yet received the necessary approval.

Huge news from Lyondell this month as, they put up their EO and derivatives unit for sale. ICIS notes that: LyondellBasell is exploring strategic options for its ethylene oxide (EO) and derivatives unit, the company said Tuesday during its Capital Markets Day investor presentation. Kim Foley, executive vice president of intermediates and derivatives and refining at the company, said that while the unit provides positive cash generation, access to advantaged feedstocks, GDP growth rates and very high asset reliability is not their core business. “We believe that this asset could provide even more value to a different owner,” Foley said. Foley said propylene oxide (PO) is core to the company, where it has industry leading technologies and the desire to grow with their customers. “We also need to make tough decisions to exit attractive, but maybe not core, businesses for us,” she said. EO is largely used to make monoethylene glycol (MEG), a key feedstock for polyethylene terephthalate (PET). EO’s secondary outlet is in surfactants. Other EO derivatives include glycol ethers, polyols for polyurethane (PU) systems, polyethylene glycol (PEG) and polyalkylene glycols. [That’s big news but perhaps not surprising. There are many companies for whom EO is very core; INEOS, Stepan, Dow, Indorama, to name a few. The timing for a sale could be good given the obvious strategic interest from these types of acquirers. Or maybe someone would now jump in – from overseas, like a Wilmar or KLK – or here in the US, like a Pilot Chemical. Or how about a consortium of stranded ethoxylators…sort of like an EO Gilligan’s island..? Should be interesting. Stay tuned to these pages and, well, come to our conference, where there will no doubt be hours worth of discussion, speculation and prognostication on this one. I ofen say we don’t trade in rumors here, but I can’t control every discussion at our events, can I?

We have a saying at the blog that “you gotta be there” at events and conferences and such, if you really want to know what happened there. That means we don’t report the scuttlebutt (strange word) and smoke-filled-room conversations (uh?) that happen at these things. All news here is already in the public domain – usually courtesy of my friends at ICIS. If you tell me something, it won’t show up in the blog – even if you want it to (Yes, that is regularly tried). Long preamble to .. ICIS did some very nice reporting from the AFPM in San Antonio and a chunk of it is surfactant related. Given that this is now all firmly in the public domain, I’m comfortable including some of it here. OK?

The ICIS alcohols guru, Lucas Hall, wrote a tremendous analysis, a portion of which we will put here. By the way, to hear live and in person, unscripted and unconstrained, from Lucas, come to – of course – our conference next week.

Lucas writes (in part): US fatty acids and fatty alcohols markets will continue to face headwinds through H1 2023, as a rebound in demand has yet to materialise in the key China market following the Lunar New Year holiday in late-January and macroeconomic concerns continue to mount globally, including fears of a US banking crisis. Demand woes will largely outweigh any major supply-related concerns heading into this year’s International Petrochemical Conference (IPC), as players continue to destock high-cost inventory that built up in late 2022. Demand largely remains below average, particularly into end-segments serving the automotive and construction sectors, where high interest rates and economic concerns continue to weigh on new vehicle purchases and maintenance as well as housing starts and home renovations. This impacts demand for oleochemicals used in the production of lubricants and greases, plastics, certain surfactants and tyres, among other products. Non-durable goods markets are generally more elastic, but high inflation and the erosion of disposable income also weighs on demand for these goods, which include food, pharmaceuticals, tobacco, clothing, household supplies and personal care products.

KLK Oleo announced on Wednesday plans to transition its Dusseldorf, Germany, site away from animal-based oleochemicals production to purely vegetable-based production by around mid-year 2023. KLK is the latest oleochemical producer to announce a transition away from traditionally animal-based production to vegetable-based production, against the backdrop of tightening feedstock availability coupled with increased consumption into biofuels.

Twin Rivers Technologies is transitioning towards a more plant-based production programme for 2023, reducing their production of tallow-based material. Increased palm-based material is offsetting supply concerns in this area. This leaves Vantage and Emery as the primary tallow-based producers in the US by volume.

In other production news, Emery Oleochemical expects minimal impacts apart from some delays during the next 2-3 weeks as it cleans up and reorganises deliveries following the early-March fire at its Cincinnati, Ohio, site. The incident is fully contained and did not directly impact processing equipment. Damage was to ancillary equipment impacting only one processing step. The site has redundancies built into its production processes, limiting the impact.

PMC Biogenix continues repairs at its Memphis, Tennessee, site following a fire at the packaging portion of the facility in January 2022. The company continues to leverage existing assets and third parties to support disruptions stemming from the incident. The company has not provided a timeline for the repairs to be completed.

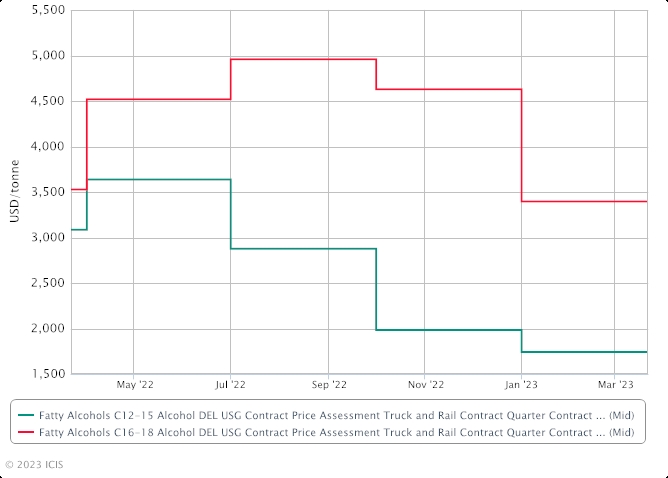

FATTY ALCOHOLS

Several carbon fractions also remain long, owing to higher imports in 2022 ahead of the protracted demand slowdown felt in the latter-half of the year. US Q2 fatty alcohols contract negotiations are ongoing, with freely-negotiated contracts mixed from their Q1 settlements. Freely-negotiated mid-cuts alcohols settlements are emerging mostly flat to slightly up, depending on their Q1 settlement. Contract volumes are mostly limited to restocking as continued long supply and below-average demand, including in the core consumer cleaning segment, weighing on the market ahead of the typical peak Q2 demand season.

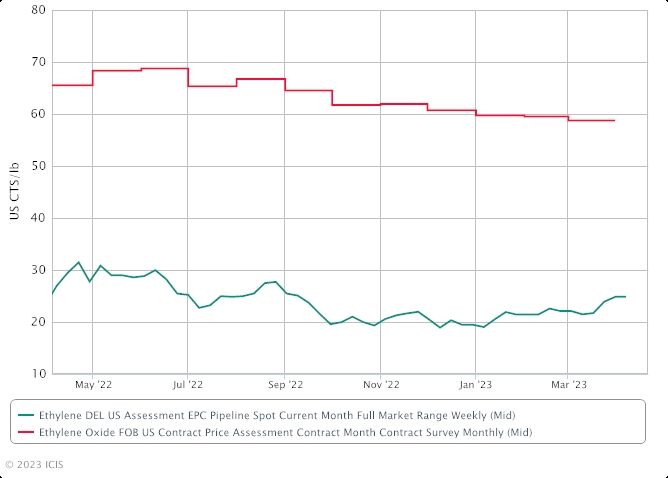

Ethylene oxide (EO) and ethylene glycols (EG) producer Indorama announced that a force majeure on its Clear Lake, Texas, plant has been lifted following the site’s restart, according to a customer letter from the company. Downstream alcohol ethoxylates supply was largely sufficient to meet demand during the outage and force majeure period, further suggesting long supply and below-average demand in the core consumer cleaning segment. Freely-negotiated long chain alcohols settlements are largely emerging at a sharp decrease from Q1. A return to more typical container freight costs has in turn put downward pressure on the bulk market. C16 supply is long, and C18 supply sufficient. C16-18 volumes with higher C16 content are trending sharply lower than those with higher C18 content, owing the length in the C16 market. One exception to the long supply and weak demand environment is short chains, where Sasol's ongoing force majeure keeps the market tight. Sasol's Ziegler alcohols unit continues to run at 50% and will be able to access 100% of capacity once repairs to the unit are complete, expected by end-March. Sasol is a major supplier of short chain alcohols.

| Product | Price (cents/lb) | INCO | Location |

| C12-C15 | 73-85 | DEL | USG |

| C16 | low 90s - 150 | DEL | USG |

| C18 | high 140s - low 200s | DEL | USG |

| C16-18 | 138 - 170 | DEL | USG |

*The prices in the table represent a range of settlements for standard balance material heard throughout the quarter for the majority of market participants. Prices heard outside those listed in the table were excluded from the quarterly assessment as they were not viewed as representative of the wider market.

TRADE ACTIONS

US Customs and Border Protection (CBP) in February lifted a two-year ban on imports of palm oil products from Malaysia's Sime Darby Plantation Berhad (SDP), after findings that Sime Darby, its subsidiaries, and joint ventures no longer produce palm oil and derivative products using forced labour. Effective immediately, the US will allow shipments containing Sime Darby-produced palm oil and derivatives to enter the US, provided the imports are otherwise compliant with the law. The lifting of the ban may prompt an increase in US imports of oleochemicals, especially given prevailing weak demand in Asia and Europe and the strength of the US dollar against foreign currencies. The CBP maintains an import ban on FGV Holdings Berhad, in place since late September 2020. Malaysian material continues to be scrutinised over labour concerns in the country. The imposition in January of anti-dumping duties (ADDs) from the European Commission on fatty acid exports from Indonesia also has the potential to prompt increased exports to the US, particularly if Asian and European demand remains in doldrums.

Lucas also gleaned some additional surfactants insights at AFPM as follows: Global surfactants demand is expected down 10-15% in 2023, sources said on the sidelines of this year's International Petrochemical Conference (IPC). [This seems a bit high to me honestly] Fears over a global recession, made worse following the recent failure of two sizeable US banks - Silicon Valley Bank and Signature Bank - further dampens sentiment in an already weak demand environment. Reformulation and substitution add to the pressure as high input costs weigh on the margins for finished goods. High distillates prices and low chemical production margins also make renewable fuels production more economically attractive than chemical production, discouraging feedstock consumption into surfactants and intermediates over biofuels, particularly in Asia.

Another ICIS surfactants-heavyweight, Al Greenwood, wrote 3 articles on Indorama (in part - née Oxiteno) this month. I’ll pull some nuggets here for your consideration.

Indorama Ventures will increase its focus on organic growth and other internal expansion projects, all while remaining open to opportunities to acquire companies, the deputy CEO said in an interview with Al. Acquisitions have long been a key part of Indorama's corporate strategy, and they were central to a years-long project that created its polyester, surfactants and ethylene oxide (EO) businesses in the Americas.

"Certainly it remains a backbone of the group," said DK Agarwal, deputy group CEO, Indorama. That strategy culminated in the 2020 acquisition of Huntsman's EO, propylene oxide (PO) and surfactants business and the 2022 acquisition of Oxiteno, a Brazilian EO and surfactants producer. Those recent acquisitions are among the reasons why Indorama is increasing its focus on organic growth. The company is consolidating those businesses, he said. Also, those two acquisitions made Indorama the largest non-ionic surfactants producer in North and South America, Agarwal said. Surfactants are a part of Indorama's Integrated Oxides and Derivatives (IOD) business, and the company sees that segment as a growth engine for the company. The recent acquisitions have given Indorama good opportunities to invest in itself. Another reason to consider organic growth is the cost of capital, Agarwal said. Interest rates have increased, making it more expensive to fund acquisitions.

Indorama is not ruling out mergers and acquisitions (M&A) as long as the targets meet its criteria. Acquisitions need to fit into the company's core business; they need to meet Indorama's sustainability targets; and they need to provide the company with value-added products, Indorama said. Organic projects and acquisitions need to have a return on invested capital of more than 15%.

Then we dig deeply into Indorama’s surfactants business: And guess what – they’re pursuing specialties… aha.. As Al writes: Indorama Ventures wants a increasing share of its surfactants to be specialties as part of its strategy to grow the business. Surfactants are benefiting from a lot of long-term growth trends such as hygiene, a growing middle class, urbanisation, food and energy, said Alastair Port, executive vice president of the company's Integrated Oxides and Derivatives (IOD) business, which includes surfactants.

Indorama already has a portfolio of specialty products that serves such high-margin end markets as pharmaceuticals, food and cosmetics, Port said. Currently, specialty surfactants make up 15% of the business's sales volumes, he said. Indorama expects it can raise that share to 30%. It will do that in part through debottlenecking projects, he said. Indorama has some good assets that it obtained through its Oxiteno and Huntsman acquisitions. In addition, it plans develop a deep understanding of its existing markets as well as new markets it can penetrate, Port said. Meanwhile, Indorama has increased ability to develop new products and to innovate. It opened new labs near Houston, Mumbai and Shanghai, Port said.

Indorama sees sustainability as another way that it can increase its share of specialty surfactants, he said. Surfactants customers want to buy more sustainable products that have better performance without paying a price premium. "To hit those three things, you really have to redesign how the business is thinking about sustainability and innovation and hence become more specialised in what we do," Port said. "Innovation without sustainability doesn't work in this new society." Going forward, 50% of its new products launched from 2025 will be classed as sustainable, he said. In addition, 15% of its revenue will be from sustainable products. Port stressed that the company remains committed to its large-volume surfactants business. It remains important to Indorama and the company plans to continue growing with its customers.

In addition to debottlenecks, Indorama is exploring other ways to increase capacity.

The Huntsman and Indorama acquisitions have given Indorama a family of surfactants that it can now match with the plant that is most suited to make the product, Port said. That exercise in itself has increased output. Some of Indorama's existing plants have capabilities to make bespoke products, and Indorama could consider expanding these sites, Port said. Indorama is also in the early stages of evaluating possible greenfield projects, he said. India is attractive because of its high growth rates, he said. Europe is attractive in part because of its customer base.

Mergers and acquisitions (M&A) will play a role for expanding in regions where Indorama does not have a large manufacturing presence, Port said. Right now, its surfactants business is large in the Americas and small in Europe and Asia.

In general, it is challenging to grow organically in a region where a company has a small presence, Port said. Among the many end markets for surfactants, there are signs that paints and coatings may have bottomed out, Port said. That could lead to a recovery. Demand from the oil and gas end market continues to perform well, he said. Demand from fuels and lubricants remains stable. Demand for gas treating continues to grow, with renewable natural gas emerging as a meaningful market.

Back in the US, March ethylene oxide (EO) contracts were assessed by ICIS at 57.75-59.75 cents/lb ($1,273-1,317/tonne). EO contracts continue to see declines as upstream ethylene contract prices continue to fall. Demand for EO and its derivatives continues to be weak on recession fears coupled with low discretionary spending as a result of rising interest rates and mortgage rates continuing to put a damper on the construction industry. The demand outlook remains optimistic for Q2, although a steady increase in demand is expected.

The Music Section

This week in 2 parts. First up - what am I listening to when writing the blog. I've previously extolled the virtues of the label, Riding Easy Records. Here's another gem from them - Salem's Pot, Sweeden.

Next - gotta love a band named after a stimulant (the use of which we don't condone here. This blog was written to this music and coffee - Mystic Monk Pascha Java if you must know).

Another cool instrumental album that shuts out other distractions, if that makes sense.

And finally - From Croatia. These guys are great. Who knew?

Seasonal Music

I don't talk much about it here, but we have a great choir down the road, with which I have been honored to sing over the past few decades. Each one of these songs has featured in the past week and have a couple of things in common: they rock harder than Motorhead and pierce the heart and mind more thoroughly than Rush. Counter-cultural, norm-shattering slabs of pure soul.

Allegri’s Miserere – from Tenebrae. Psalm 50 as I'm sure David never imagined it. Wow!

O Vos Omnes. All you who pass by the way, wait and see.. is there any suffering like my suffering. It's also from the OT - book of Lamentations (1:12) but who else do you think sings it?

Crucifixus- by Antonio Lott. This just piles it on layer after layer. Close your eyes and you are there..

Popule Meus - O my people what have I done.. Super cool mix of Latin and Greek.

That's it. Register for our conference, please.