Surfactants Monthly – May 2022

It looks like I may have been too tough on Tide in last month’s blog. I linked Stepan Company comments about the consumer markets in their quarterly report directly to our beloved brand leader in detergents, when in fact no such link was stated. The brand’s owner sprang promptly to its defense as they should. So there we are. Another reminder of the wide readership of the blog and the need to keep wilder musings to the music or culture sections.

Interestingly, the Wall Street Journal last week outlined some difficult trends in the consumer markets, in an article entitled “Shoppers Are Fretting. Stores Are Listening” along with a sub-head “Consumers are growing cautious, and companies from Walmart to Procter & Gamble are altering course to reflect changing budgets. ‘Mom only has money right now for the bare-bones basics.’ The article goes on to discuss how some consumers are shopping for cheaper alternatives to their normal purchases in order to mitigate the effects of inflation. Examples given include how Walmart is stocking more half gallons of milk for shoppers who can’t afford a full gallon. And P&G is touting a dish-soap bottle that allows users to save money by extracting every drop. However no mention of Tide. So for now…. I guess it’s

By the way, I know this is not the music section yet, but has there ever been a band who mastered the metal ballad to the extent that The Scorpions did? This is the highest, purest, most ridiculously over-the-top expression of that venerable art form. Crank it up and let the emotions course through your pulsing veins!

Also – by the way, no mention in the WSJ of Activist Investor Nelson Peltz and his battle with the management of Unilever. So nothing really to report there, unless you want continued tabloid fodder from the Nicloa (Peltz) / Brooklyn (Beckham) story, in which case.. https://www.dailymail.co.uk/tvshowbiz/nicola-peltz/index.html .

MAY 10 – 11TH, saw the 12th ICIS World Surfactants Conference in Jersey City and the first one back in person since May of 2019. It was great. Next year, 2023, our dates in Jersey City are May 4th and 5th. You can register your interest here. https://secureforms.icis.com/13thWorldSurfactantsConference-RegisterInterest

The 2022 conference broke a lot of news, and to the extent that some of that news was reported in the press, I will cover some of that (so that is some of some of the news – are you following this? Means I’ll write about only a fraction of what happened at the conference). The reason I do that is because; you gotta be there. It’s boring for me to try to re-tell what happened at the event and so you just have to be there. In fact, if you were there, you would have heard how I marshalled John Milton, Metallica, Diamond Head and the Cat and the Washing Machine in support of being there.

End of commercial. Start of News:

Interesting news from the Asian LAB markets as prices start to trend down (that’s right – down). The great Clive Ong of ICIS reported that the Asian and India linear alkylbenzene (LAB) market continues to struggle amid increased availability of Chinese cargoes. Buyers have become non-committal as they anticipate the ample supply to prevail in the near term.

- Chinese lockdown easing uneven and sporadic

- Buyers in Asia and India unhurried as supply ample

- Producer margins remains squeezed by firm upstream markets

Despite the announcement of easing of lockdowns in China, the pace of lifting restrictions remains slow and uneven, and very much depends on each locale.

Consequently, some participants anticipate that Chinese domestic demand might remain tepid in the near term, although some producers mulled higher prices in June.

The pressure to export remains for most Chinese producers as inventories remain elevated. The increased availability of Chinese lots at competitive prices, however, dampened buying impetus in Asia. “Customers are now pegging bids against the lower Chinese cargoes,” said a producer in NE Asia. Most suppliers in Asia are now targeting other destinations outside of the region, given the current low buying indications.

The Indian LAB market has also come under downward pressure from an influx of cargoes. One domestic producer has gone into extended shutdown from May, but local supply has swung from initially being tight to now rather adequate. “The market balance has been disrupted by inflow of cargoes,” said a producer in India. Buying indications have declined in recent weeks, with suppliers in Asia unable to achieve sales at previous levels. Apart from more suppliers targeting sales to the subcontinent ever since the anti-dumping duties five-year period lapsed in April, Chinese offers have undercut general offers by other suppliers in Asia and the Middle East. The increased availability of offers have prompted some buyers to wait and see, as they anticipate further weakness in the market. “Customers in India has lowered their bids and we are unable to meet these numbers,” said a trader in Asia.

We’ve been writing fairly frequently about the German chemicals group, PCC recently and so I was pleased to see the recent news that they are considering building a new alkoxylates facility to produce non-ionic specialty surfactants and polyether polyols in the US. The company is evaluating two sites. A final investment decision has not yet been made. Project costs or capacities were not disclosed. Meanwhile, construction of an alkoxylates joint venture project with Petronas Chemicals at Kertih in Malaysia’s Terengganu state remains on track, with startup of production targeted for Q3 2023.

PCC disclosed the information in its Q1 results filing on Thursday. Q1 sales rose 65.2% year on year to €345.3m. Higher sales were cited to high average selling prices, particularly for polyols, surfactants and chlorine co-product caustic soda. Duisburg, Germany-based PCC is focused on chemical feedstocks and specialties. It also has a container logistics business.

Meanwhile, over in Asia, all eyes are on Indonesia as they wrestle with the various forms of export controls on palm oil: According tio ICIS reporting, there is a reasonable prospect that Indonesia will reimpose its domestic market obligation (DMO) policy on palm oil. This will keep 10 million tonnes of cooking oil in Indonesia, to ensure the country will have sufficient stock for food and other domestic needs. The news on 20 May comes a day after the Indonesian authorities said it would be lifting the prior export ban on palm oil on 23 May. Indonesian farmers had staged protests against the export ban earlier this week. “We will wait for the official announcement on DMO,” a regional fatty alcohols producer said “Crude palm oil futures have rebounded and regained what it lost earlier,” another supplier said. On 19 May, crude palm oil (CPO) futures for the most actively traded monthly contract closed lower at ringgit (M$) 6,072/tonne on the Bursa Malaysia Derivatives exchange, down from M$7,104/tonne on 29 April, after the announcement of the lifting of the export ban. "It's going to be [a] roller coaster [ride] for the CPO market," a separate regional oleochemical producer said.

The export ban on palm oil was implemented from 28 April by the Indonesian authorities, after its previous DMO regulations were unable to contain soaring domestic cooking oil prices earlier this year. In January, the Indonesian government imposed a DMO of 20% of companies' planned exports. This was raised to 30% in March, before it was scrapped in favour of higher export levies. Under the DMO policy, Indonesian companies had to show proof of their domestic sales of CPO and/or refined, bleached and deodorised (RBD) palm olein, to secure export approvals for oleochemicals, including fatty acids, fatty alcohols and soap noodles. Indonesia is the world’s largest palm oil producer and exporter, followed by Malaysia.

In a tremendous Insight Article by ICIS’ Joe Chang, he draws on data and analysis from many sources including a panel discussion at our conference. You should read the whole thing here https://subscriber.icis.com/news/petchem/news-article-00110765654 . A key piece of data and chart however, should make all readers sit up and take notice. Here it is:

A massive pile-up in inventories at key US big-box retailers may be a warning sign for chemicals demand, which has partly been propped up by the overbooking of orders.

- Walmart and Target disappointing Q1 results show huge inventory builds

- Retailers to start unwinding stocks through next couple quarters

- Retail destocking to trickle down to chemicals demand

The Clariant – SABIC relationship has been a subject of much speculation since the love-on-the-rebound matchup got started after the bungled Huntsman – Clariant hookup several years ago. ICIS recently reported that Clariant’s shares jumped in value on the prospect of a takeover of the Swiss specialty firm by Saudi producer SABIC. Speculation was prompted by Clariant's announcement that an agreement between it and SABIC will expire on 24 June. This means that Clariant could be vulnerable to a takeover, as petchems major SABIC can now exceed its 33.3% share in the company and would be able to nominate more than four supervisory board members.

The stock price gained 7.81% on the Swiss stock exchange over the course of a morning, although in the wake of an accounting investigation, remains 1.89% below the level of a year prior.

Apparently the governance agreement between the two firms will expire at Clariant’s annual general meeting (AGM) on 24 June, after being established in September 2018.

In response to the news, the Swiss firm acknowledged that SABIC could increase or decrease its stake in the company as any other shareholder, and that the runup in Clariant’s share price reflected speculation in the market. “We have worked together with their representatives on our Board for many years and have been fully aligned on our purpose-led strategy to deliver shareholder value,” a Clariant spokesperson said to ICIS.

“Thanks to this close cooperation, we have built a high level of trust that does not necessarily need a formal governance agreement.” SABIC initially came in as a white-knight investor with an initial 24.99% stake bought from activist investors White Tail in 2018, in the wake of a failed merger with US producer Huntsman. This relationship is important to both parties, with SABIC CEO Yousef Al-Benyan mentioning it at the company’s first quarter financial results announcement for 2022. “Clariant is a part of SABIC’s strategy in our specialised business – we have been paying attention to Clariant and it remains a key part for our future strategy,” said Al-Benyan at the press conference following the results.

Clariant insisted that this stock market speculation would not disrupt efforts to stabilise the company. “We will continue to focus on executing Clariant’s purpose-led strategy to deliver profitable growth and value for all stakeholders including shareholders,” stated Clariant’s spokesperson. “After sharpening and pruning the portfolio profile over the last years, Clariant has one of the best specialty chemicals portfolios with an ambition to a top quartile specialty chemicals performance, underpinned by attractive 2025 financial targets.” Targets to 2025 include compound annual sales growth between 4-6%, group earnings before interest, tax, depreciation, and amortisation (EBITDA) margins of 19-21% and free cash flow conversion of around 40%. But this, coupled with its portfolio – which has been refined over the years – could serve to make Clariant an even more attractive option for takeover, according to Baader Bank analyst Markus Mayer.

“Clariant is the most obvious takeover target in the sector, as its valuation is far too cheap and the chemical processing catalyst market is after years of no change in a consolidation phase,” Mayer said in analyst note. “Chemical processing catalysts are late cyclical and will profit structurally from the high energy price level and high CO2 prices, plus Clariant has an overlooked white biotech platform and its therefore among our most preferred chemical companies.”

Since the agreement was signed, Clariant has undergone several changes at executive level. In the wake of share purchase, SABIC executive Ernest Occhiello was appointed CEO, but resigned with immediate effect, citing personal reasons, which saw Hariolf Kottmann reinstated as an interim in July 2019. Kottmann was replaced by current Clariant CEO Conrad Keijzer in January 2021 and announced that he would stand down as chairman of the board the following month. Stepan Lynen replaced long-term CFO Patrick Jany in February 2020, but in the wake of the recent investigation into Clariant’s accounting, it was announced he would step down from the role from 1 July. Lynen will be replaced by ENGIE North America CEO Bill Collins, who also served as the group’s deputy CFO.

OK so lot’s of Changes and maybe the Swiss specialty chemicals company can be picked up at a rather attractive multiple in today’s market and in the midst of today’s company news. Expect more than one suitor, in my view, although it is SABIC’s to consummate quickly or let go.

More Asian downward trends were reported mid-month by ICIS, this time in the PKO value chain. Lucas Hall, fatty alcohol and fatty acid guru, reported that a downtrend in feedstock palm kernel oil (PKO) costs in recent weeks has exerted downward sentiment on US fatty alcohols markets as wider concerns over Indonesia's ongoing export ban on crude palm oil, and refined bleached deodorised (RBD) palm olein, logistics and Chinese demand during ongoing lockdowns persist.

- Lower PKO costs exert downward sentiment

- Mid-cut supply sufficient to meet demand

- Long-chain alcohols remain snug to tight, namely C18

Although PKO costs have fallen in recent weeks as China's lockdowns persist, feedstock costs remain at historic highs, underpinning the wider market.

Source: CME Group, Matthes & Porton, WSJ Cash Markets

Logistics concerns, namely in container markets, are adding to the pressure, driving the premium for packaged material over bulk material to historic highs.

LyondellBasell and Sasol's JV US Lake Charles, Louisiana, cracker had an unplanned shutdown last week, according to market sources. A Sasol representative said there were no disruptions to US fatty alcohols production. \ Some southeast Asian producers are on their typical annual maintenance. Supply of mid-cut alcohol remains sufficient to meet demand, as the flow of bulk material remains in much better shape than container material, especially as so many containers are currently tied up in Chinese ports. Many players hedged against higher palm prices in Q4 and Q1, creating some carryover volume as the market approaches the summer low demand season. \ C16-18 alcohols remain snug to tight, particularly single-cut C18, as the PKO premium over CNO persists. While the downtrend in PKO may encourage increased consumption into the feedslate, C18 alcohol is expected to remain tight into Q3. CNO inherently produces less C18 content. Tight container markets are adding to the pressure, as most importers ship in container. Demand remains overall healthy to strong, with demand in industrial end markets largely outpaced available supply. Consumer segments are healthy but concerns over inflation are impacting forward sentiment.

Q3 contract discussions have yet to begin in earnest. One supplier said an ongoing disruption from one importer was creating short-term spot opportunities for mid-cut alcohols. Premiums for container volumes continue to widen over bulk volumes as logistics remain a challenge globally against the backdrop of ongoing lockdowns in the key China market and lingering logistics challenges in southeast Asia as the country curbs exports of various palm oil products. Players continue to closely monitor Indonesia's export bans on crude palm oil, and refined bleached deodorised (RBD) palm olein for potential impacts on margins and logistics from the country.

Q2 contract ranges*

| Product | Price (cents/lb) | INCO | Location |

| C12-C15 | 160-170 | DEL | USG |

| C16 | largely above 200 | DEL | USG |

| C18 | largely above 200 | DEL | USG |

| C16-18 | 195-215 | DEL | USG |

Premiums for mass balance (MB) material are largely in the range of 13-17 cents/lb over standard balance material. MB material remains tight as certified sustainable material becomes more challenging to source against the backdrop of ongoing supply-chain disruptions and the ongoing withhold release order (WRO) from the US Customs and Border Patrol (CBP) against Sime Darby Plantation Berhad and its subsidiaries and joint ventures, as well as FGV Holdings Berhad and its subsidiaries and joint ventures, from late 2020. In early 2022, the CBP said it found sufficient evidence of forced labour at Sime Darby, subjecting its imports to seizure and destruction. Supply is expected to remain tight over the medium-to-long term. The US is a major net-importer of natural fatty alcohols and a key production region for synthetic alcohols. The key end-use for mid-cut alcohols is surfactants. This class of chemical products comprise numerous cleaning and detergent uses, ranging from household agents to oilfield applications.

ICIS’s Joe Chang continued to rack an impressive month of Insight Articles, this time drawing substantially on Kevin Swift’s paper delivered at our May conference. By the way, Kevin, former Chief Economist at the American Chemistry Council is now Senior Economist at ICIS. And again, the the spirit of you gotta be there, I’ll just offer a snippet here:

A further snippet reported by Joe from our conference concerned logistics and order patterns, i.e.: The trend of buyers overbooking orders to ensure sufficient supply is unlikely to end anytime soon as logistics constraints persist, panelists at the 12th ICIS World Surfactants Conference said. “I don’t see this trend going away anytime soon. Unless sea freight rates decline, then [overbooking] and hoarding will continue,” said Eric Byer, president and CEO of the National Association of Chemical Distributors (NACD).

In what seems to be be now a pattern of downward trend news, US April ethylene oxide (EO) contracts fell by 2.20 cents/lb ($49/tonne), based on a decrease in US April ethylene contracts. April EO contracts were assessed at 60.8-70.3 cents/lb FOB (free on board). US natural gas futures soared above $8/MMBtu due to ongoing supply concerns ahead of higher demand this summer, which is pressuring feedstock ethane costs.

More EO should be pulled into derivatives as demand picks up going into summer, although co-raw material volatility will persist. Demand is looking strong in the short term during the peak bottled beverage and construction seasons, but there is some anxiety about long-term demand as the odds of a recession have gone up due to higher inflation, tighter monetary policy and worsening supply-chain woes. The majority of EO contracts are formula-based, and price movement comprises 80% of the change in the ethylene price and an additional conversion fee, or adder. Like ethylene, EO contracts are settled at the beginning of the month for the previous month’s price.

And in China: some price declines and stagnation reported in the China FAE market. Spot prices of FAE mols 7,9 have stagnated at $1,800/tonne CIF (cost, insurance & freight) since 14 April, ICIS data showed.

China's factory activity in April shrank for the second consecutive month, with the official purchasing managers’ index (PMI) dipping to 47.4 – its lowest level since February 2020 – according to the National Bureau of Statistics (NBS). The resurgence of COVID-19 cases had led to stricter control measures, which weighed on factory activities and demand, said the NBS. Separately, China's April general manufacturing PMI by Chinese media group Caixin also showed a sharper decline to 46.0 in April, from 48.1 in March.

The Caixin PMI covers small- and medium-sized firms, while the NBS's PMI concentrates on state-owned enterprises. A figure of 50 and above denotes expansion, while figures below that level signify contraction.

One of the blog’s favorite companies, Galaxy Surfactants Ltd reported a 34% rise in total income at Rs. 1054.13 crores in Q4FY22 as against Rs.786.10 crores in same quarter last year. Net profit rose by 25% and reached Rs.98.40 crores as against Rs.78.68 crores for the period ended March 31, 2021. Company has reported 25% growth in EPS at Rs.27.76 for the period ended March 31, 2022 as compared to Rs.22.19 last year. The company has recommended final dividend of Rs.18/- per equity share of face value of Rs. 10/- each. For the full year, company's total income rose by 32% to reach Rs.3698.22 crores in FY22 as against Rs.2794.92 in FY21. However the net profit fell by -13% and stood at Rs.262.78 crores as against Rs.302.14 crores for the Financial Year ended March 31, 2021. EPS also went down by -13% to reach Rs.74.12 in FY22 versus Rs.85.22 in FY21.

Around the middle of May, my alma mater, Pilot Chemical announced some personnel moves. Hans Hummel has been named sustainability manager, a newly-created position, and Jeff Crume is now a business manager. Hummel will be responsible for further developing, overseeing and administering Pilot's sustainability strategy, which includes Environmental, Social and Governance (ESG) goals and initiatives around the four pillars of sustainability: Products, People, Planet and Governance & Ethics. Crume has been named business manager – Biocides. He brings a wealth of commercial experience to this role from his more than 20 years in chemical industry sales, marketing and business management roles. In this position, which he assumes as Hummel transitions to sustainability manager, Crume will be responsible for the profitable growth and management of Pilot Chemical’s Biocides business, including profitability, strategy development and execution, and product management activities.

And finally, some bullish news from Kao, as ICIS reported that Japan's Kao Corporation announced plans to build a new tertiary amine production plant in Pasadena, Texas, mainly to meet growing demand for sterilizing/cleaning applications but also for a wide range of other industrial applications, the company said in a news release. The new US production is scheduled to begin operations in January 2025 and will have an annual production capacity of 20,000 tonnes/year. Kao has the world's largest production capacity, with three production sites in Japan, the Philippines and Germany. A company source said the company expanded production at its Philippines site by 10,000 tonnes/year in 2021 and expects to expand production at its Germany site by 20,000 tonnes/year later this year. Kao uses proprietary catalyst technology that introduces dimethylamine into fatty alcohol in the presence of such a catalyst to produce selective tertiary amines. [very interesting] The derived tertiary amines are used as basic ingredients in hair conditioners, dishwashing detergents, disinfectants and many other household products.

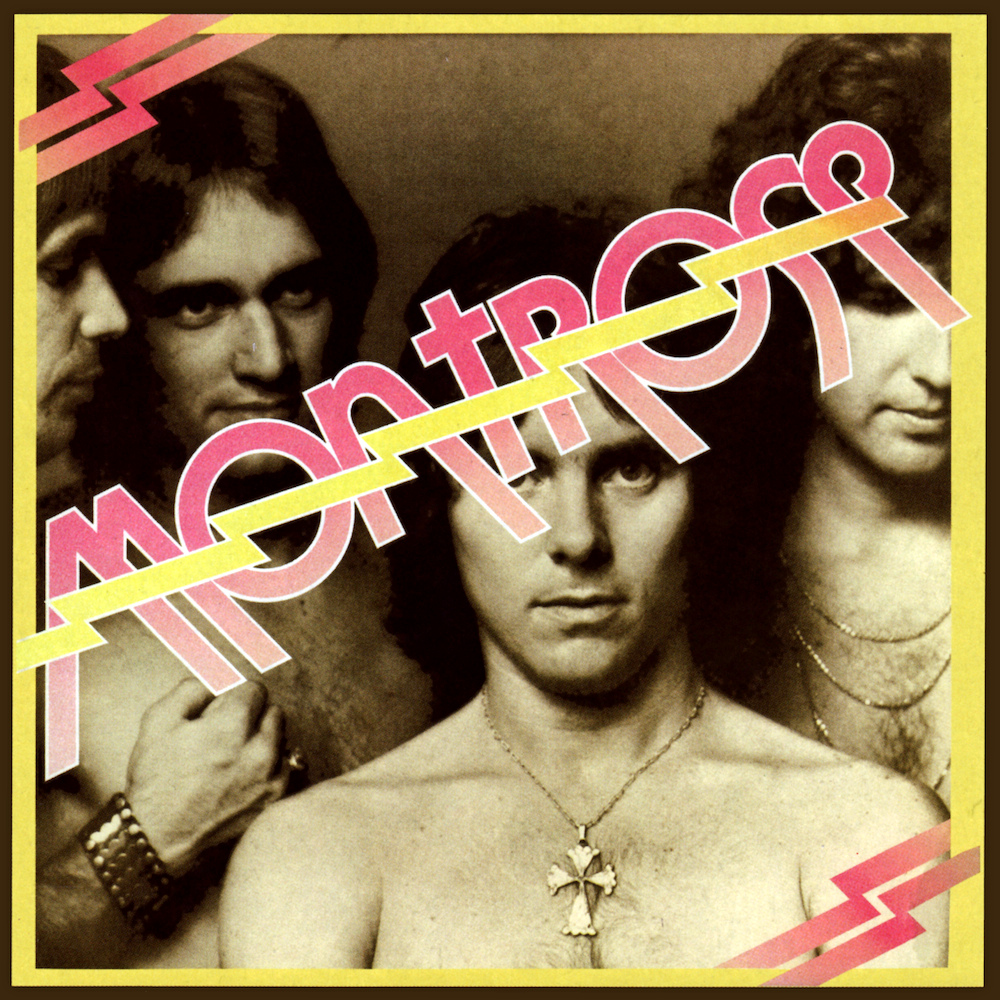

The Music Section: This month Spotify has sought to remind me what an outstanding album Montrose was. The eponymous first album from the American heavy rock band named after lead guitarist Ronnie Montrose was released in 1973 and accompanied many a maths homework session for me over the high-school years. And was most likely responsible for the untimely demise of some substantial quantity of braincells. Worth it though.

Montrose was arguably Van Halen before Van Halen was. This first album clocks in at 32 minutes and 8 songs. Produced by Ted Templeman who also went on to produce Van Halen’s first album. The other VH link? Sammy Hagar on vocals of course.

When Montrose first came to tour the UK, they were opening for venerable British rockers, Status Quo (remember them?). Anyway, the cult following that Montrose built up made a great show of coming to the front of Newcastle City Hall to support Ronnie, Sammy and gang and then leaving the venue before Status Quo came on. Not me though. I’d paid for 2 bands so…

Here's the whole album – apparently recorded to YouTube from the vinyl. You should listen to the whole thing. It’s only 32 minutes!

Some highlights: Rock the Nation, opens the album with a 3 minute declaration that Montrose is the first American heavy metal band. Why American? Well the enthusiastic cowbell for one thing – and the whole “across the nation" thing”. Brits typically didn't sing in such terms. Hey doesn't young Sammy Hagar sound just great?!?!

The next 2 songs, I always regarded as a pair as they always seemed to be played together at the various heavy rock discos in those days. Was not Ronnie Montrose clearly the direct inspiration for Eddie Van Halen? The second song of of the pair, Space Station #5, for me has always been the greatest ever heavy rock song without a guitar solo. Check it out. Where’s the solo? Well actually, it occurred to me just a few days ago that it’s hidden in plain sight right at the start of the song. Listen to it again. Cool right? Anyway, I think a solo in the middle would have unnecessarily interrupted the careening progression of a beautifully crafted heavy rock paen to blasting into space. Ah.. so many braincells killed by this one. I probably coulda been another Einstein, maybe.

The next one I’d like to draw your attention to is Rock Candy. Opens with Bonham-like percussion, a screeching guitar that would make Ted Nugent stop in his tracks and Sammy Hagar at his full throated best. Story about this one: I had intended to use this track during one of our surfactants conferences a few years ago. The message was around something about making everything count; guitar, bass, drums, vocals. Everything is individually and collectively brilliant in this song. However it wasn't until my close advisor and spouse pointed out to me the nature of the lyrics that would be considered somewhat inappropriate for our (then) 2018 sensibilities, that I scratched it in favour of a much safer Scorpions ballad. Pity.

And the last song. Make it last. Is it a ballad or a kind of an anthem? Who cares. Since then, there’s been so many imitators. It’s a perfect song to end an album with right? Funny thing about this one. I’d listen to Sammy back then singing about being 17 and 21 and 25 and I’d think that’s so old and how would things actually be then. Interestingly in that 17 – 25 stretch, it turns out a lot of great things happened. Fell in and out of love a bunch of times then got married. Still married. Still in love. Keep on rolling, make it last. Keep on rolling….