It’s strictly business this month, with little time for music or general chit- chat. We’re saving that all for next month with a short story and some musical exploration – maybe combined, let’s see. The news is also somewhat slim. Nothing to read into that, really, just natural variation, I think.

So now – straight to the News, which as usual is largely courtesy of our good friends at ICIS.

Encouraging news out of Louisiana as Sasol reported that it expects to complete repair work at its Ziegler alcohol unit at Lake Charles, Louisiana, by the end of the first quarter of 2023, subject to delivery of equipment. The plant was damaged in a fire on 15 October. Sasol was able to restart alcohol production at 50% utilisation during November, while isolating the damaged section for repairs, it said. The timeline to resuming full production rates depends on completion of the repair work. The fire’s impact on production prompted Sasol to declare force majeure on supply of US Ziegler alcohols and derivative products in October. The force majeure will be lifted as soon as production rates and inventory levels improve, the company said.

Meanwhile in Asia, the alcohol ethoxylate picture continues to weaken according to ICIS: Asia’s fatty alcohol ethoxylates (FAEs) spot market is expected to remain sluggish till the end of the year due to prevailing weak macroeconomic conditions and the global downturn. Spot interest has been tepid due to various uncertainties.

Recession fears, inflation woes, the Russia-Ukraine war and the fallout from the sanctions on Russia have seen an escalating energy and food crisis weighing on demand and curbing spot appetite. “Spot business is limited and mostly restricted to small lots on a need-to basis,” a supplier said. The coronavirus pandemic-induced slowdown in the Chinese economy has also dented demand. “We are waiting for China to relax its zero COVID-19 policy and for Chinese demand to pick up but it looks like this policy will stay till March next year,” another supplier said. Factories in China have been shuttered or are running at lower rates due to the sporadic partial and full lockdown restrictions imposed on several cities to contain the spread of the virus. Manufacturing activities have stalled, hampering business activities. China's official purchasing managers index (PMI) showed the October manufacturing index at 49.2% and the non-manufacturing index at 48.7%, where both readings have fallen into the contraction range. Due to the uncertainties, trade has largely been restricted to term or contract shipments as buyers adopt a cautious stance and are reluctant to lock in any large forward spot shipments.

Interestingly, at the same time, fatty alcohol supply tightness in Asia leads to an uptick in pricing: Asia’s fatty alcohol mid-cuts market is likely to see a pick-up in spot enquiries due to limited spot availability from both planned and unplanned plant outages. “There is more demand from China for mid-cuts C12-14 cargoes due to the shortage of supply,” a regional supplier said. A regional fatty alcohols plant in southeast Asia was shut due to production issues, while two other plants in the region had been running at reduced rates after resuming production in October, following their planned three-week shutdowns. “We are planning to increase our plant utilisation rate as we are out of stocks till February,” another supplier said. [ Good timing given the overall economic situation, I’d say]

An excellent article by ICIS’ Al Greenwood gives us an early look at how Indorama’s IOD (Integrated Oxides and Derivatives) business is doing in South America – That is the old Oxiteno. Indorama expects surfactants demand in South America will continue to grow in the agricultural and energy markets, an executive said. Brazil had a good crop season this year and next year's production could reach a record, said Joao Parolin, CEO of Indorama's Integrated Oxides and Derivatives (IOD) business for South America. He made his comments on the sidelines of the annual meeting of the Latin American Petrochemical Association (APLA).

Agriculture is an important end market for surfactants, and Brazil is said to feed about 1bn people in the world each year with its products, Parolin said. Soybeans and corn rank among its largest agriculture crops. Brazil also produces sugarcane for sugar and ethanol as well as cotton for textiles, he said. Energy production is another important end market for surfactants, and oil output is expected to grow in Brazil. Parolin also pointed to rising oil production in Argentina. While energy and agriculture are important surfactant end markets, home and personal care (HPC) is the largest one. Inflation and the slowing economy are causing consumers to trade down and purchase lower cost products, Parolin said. These lower cost products use smaller amounts of surfactants.

However, home and personal care products must have some surfactants, and consumers will continue buying cleaning and personal-care products. As a result, demand will remain resilient. For paints and coatings, demand patterns are shifting from new homes and new automobiles to home renovation and automobile renovation, Parolin said.

And in related news: Indorama Ventures’ third-quarter net profit jumped year on year on the back of stronger polyethylene terephthalate (PET) and oxides earnings, but fell compared with the previous quarter as tailwinds seen earlier in the year started to normalise, the company said.

| IVL (in millions) | Q3 2022 | Q3 2021 | Change |

| Sales | 4,896 | 3,867 | 27% |

| EBITDA | 606 | 437 | 39% |

| Net profit* | 280 | 180 | 56% |

*after taxes and non-controlling interests

Key points

- Combined PET earnings before interest, taxes, depreciation and amortisation (EBITDA) rose 27% year on year as firmer volumes seen since the start of the year continued.

- Integrated oxides and derivatives earnings more than doubled year on year on the back of integration benefits from the acquisition of Brazil-based surfactants specialist Oxiteno in April this year. Fibres division earnings were steady year on year during the quarter.

- Earnings declined across the board quarter on quarter, with PET operations impacted by weak demand and high energy pricing in Europe and oxides performance hit by lockdowns in China.

“Our management is working hard to extract the advantages that we enjoy in terms of geographic leadership, product diversity, and an unmatched customer base of global household brands. Together with our habitual lens on cost management, these actions will help us to weather the economic challenges and continue to focus on our long-term potential,” said Indorama Ventures CEO D K Agarwal.

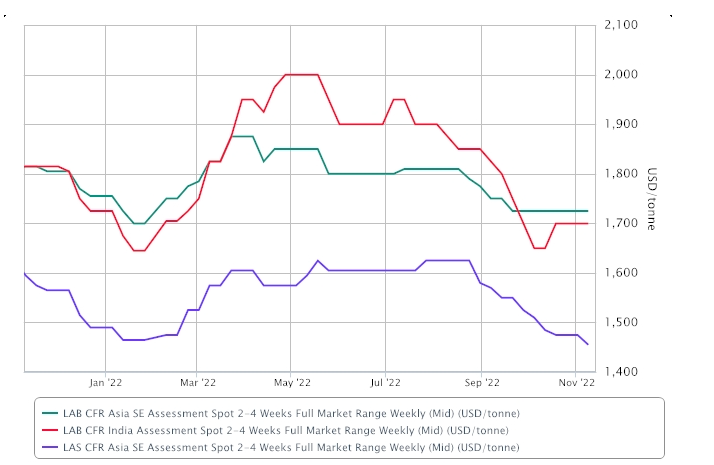

In a continuing saga of weak markets in Asia: ICIS reports that The Asian linear alkyl benzene (LAB) market has been flat in recent weeks and with the downstream LAB sulphonate (LAS) sector on the decline, the LAB market will continue to find limited support from the derivative sector.

- Weak economic outlook fans bearish LAB sentiment

- Firm crude oil, upstream markets squeeze LAB margins

- LAS demand tepid on weak detergent, cleaner market

The weak economic outlook coupled with recession fears continue to prompt austerity measures among consumers, with priority placed on food and energy over discretionary items such as detergents and cleaners. Consequently, demand for LAS remains in a low ebb, with appetite for spot cargoes weak. Most users have sufficient stock from contractual offtakes to meet production requirement. Suppliers concede that offers at $1,500/tonne CFR (cost & freight) SE (southeast) Asia were met with lukewarm interest, with sporadic sales in the mid-to-high $1,400s/tonne CFR SE Asia, according to ICIS data. Some buying indications have fallen under $1,400/tonne CFR SE Asia but sellers deemed these prices too low to consider, given LAB prices in the $1,700s/tonne CFR SE Asia. “The weak LAS market would continue to pressure the LAB sector,” said a trader of LAB in Asia. While demand for LAB remains weak, margins are squeezed by relatively firm crude oil and upstream markets. Yet, LAB sellers find difficulty in raising prices as demand for LAS remains lacklustre. Ample supply in the region has also prompted buyers to be unhurried. With the zero COVID-19 policy in China still in force, some participants are concerned that Chinese supply would grow as the market enters the year-end lull. If more lockdowns take place, trade and demand in China are expected to be constrained. This could spur suppliers to look to outside of China to mitigate rising stock. Two plants in Asia undergoing scheduled maintenance in November could help rein in availability in the near term. “In the short term, supply is tightened by plant turnarounds but the poor demand could extend to after the Lunar New Year holidays in late January,” said a buyer in northeast Asia.

An interesting piece of press published by Alcohols guru, Lucas Hall reads as follows: Sinarmas Cepsa Pte Ltd and its parents companies, CEPSA and Golden Agri-Resources (GAR), on Tuesday signed a Memorandum of Understanding to expand bio-based chemicals production at its site in Lubuk Gaung, Indonesia, according to a press release. [It looks like they are talking about fatty alcohols]. Sinarmas Cepsa cited growing demand for home and personal care products, as well as increased demand for sustainable, bio-based solutions across a variety of industries as the driver for global fatty acids and natural alcohols demand. “Sustainably sourced, bio-based alternatives are key requirements for our customers and the markets we serve,” said Sinarmas Cepsa CEO Kung Chee Wan. “We are excited to grow with our customers and increase the scale of our sustainable and traceable integrated supply chains.” Pending final investment decisions, Sinarmas Cepsa said the incremental production will bring additional employment and economic benefits to the local community. The site, which currently has an oleochemical production capacity of 200,000 tonnes/year, started production in 2017.

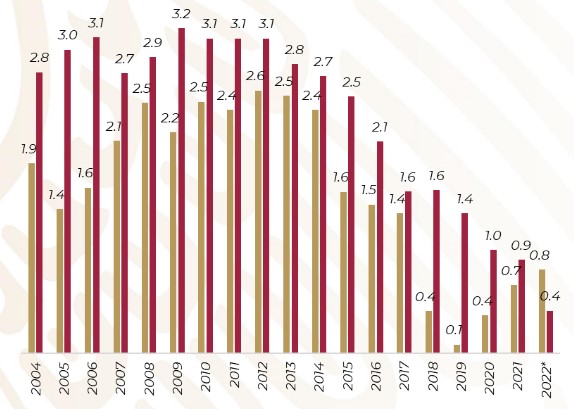

ICIS’s Al Greenwood has published an excellent analysis of the sad state of the Mexican chemical industry. A portion of this work, of particular relevance to surfactants, I excerpt here: For years, Mexico's chemical plants have struggled with chronic shortages of feedstock, and the country is unlikely to reverse those shortages. All of Mexico's crackers rely on ethane as a feedstock, and most of that ethane comes from the associated gas produced from the country's oil wells. Mexican oil production has been in long-term decline. A new fields programme by state energy producer Pemex was supposed to reverse those declines. Oil production remained stuck below 1.80m bbl/day, lower than Pemex's goal of 1.95m bbl/day for 2022. Tellingly, Pemex third-quarter investor presentation excluded slides showing its forecasts for oil production. Fitch Ratings and Moody's Investor Services doubt that Pemex's oil production will increase by any significant amounts in the next few years. The company lacks the money to increase spending on exploration and production.

Mexico has tried to offset the declines in ethane production through imports, but these have been insufficient. The following table shows Mexico's ethylene production over the years. Figures are in millions of tonnes/day. The red bar represents ethylene. The yellow bar is ammonia. The year 2022 runs through August.

Source: Secretary of Energy (SENER)

The decline in ethylene production has troubling implications because Mexico does not produce enough ethylene for its ethylene oxide (EO) plants. Recently, Pemex shut down its EO plant in La Cangrejera, leaving Mexico with just one EO plant in Morelos, Veracruz state. Pemex is Mexico's sole producer of EO, and the chemical is too dangerous to ship overseas, leaving downstream consumers such as surfactants producers with no alternative sources. Ugh.

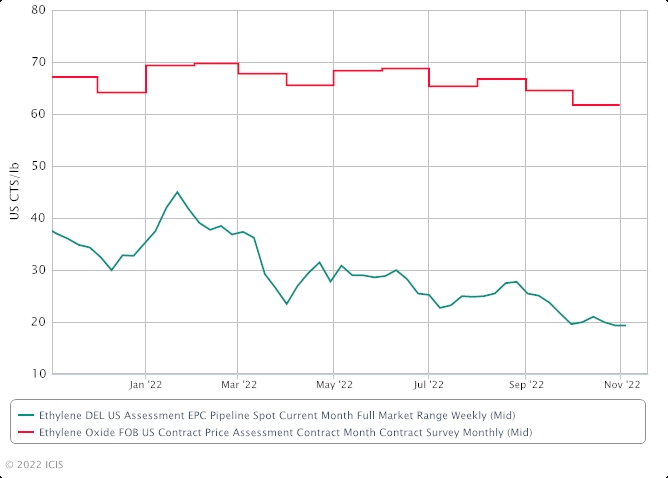

And finally, US October ethylene oxide (EO) contracts were assessed at 61.75 cents/lb ($1,361.34/tonne). The decrease in EO contract prices was a result of the continued decrease in ethylene contract prices for the month of October. Initially, supply was tight on the market due to planned maintenance on a Seadrift, Texas plant. The maintenance has since been extended, however, availability of EO is improving. Demand for EO and its derivatives has decreased on recession fears as well as increased interest rates and inflation. The market is expected to continue to balance in Q4.

And that is it for this month. Brief, - but I think we got the basics for the month. Watch out for our end of year, fiction, music – and surfactants double-issue.