Surfactants Monthly – October 2022

I’ve been watching Derry Girls on Netflix. Set in Northern Ireland in the 90’s, it’s a comedy that relates the exploits of a group of Catholic schoolgirls in Derry / Londonderry / Derry / Londonderry / Derry – well depending on who you are….you know? Each half-hour episode manages to be funny, poignant and thought provoking. It’s the time of the peace process and the uneasy days leading up to a sort of détente between the factions. Bomb threats were still real and the Protestant and Catholic lives seemed like two worlds co-existing in the same time-space and only tangling at the edges with explosive results. It’s worth a try although viewers whose native language is American may need subtitles. Some of the contrasts are heart-wrenching. The protagonists, doing a silly dance as part of a school play, oblivious, while outside the road is closed by soldiers and their parents watch in silence on the telly as a bomb is defused. Some of the set-ups are ridiculous but are accepted without question by the viewer. One of the girl’s cousins, a boy visiting from England, is readily enrolled into the girls' school by the headmistress, a nun, – because, well, with an accent like that, how long will he last in the boys’ school? And we can’t let him go the Protestant school…..so… he's a Derry Girl! Check it out.

This month’s music exploration is inspired by Derry Girls. Season 3 opens with a retrospective by the girls’ parents as they look back fondly on a high school dance that took place in 1977. And right there in about 2 seconds there’s snippets of two great songs from Northern Irish bands of that 70’s era – and wow - did that open the floodgates of memories of a great album I bought in 1979 and one that I didn’t but must’ve heard a million times on John Peel on the radio back then. So after the surfactants news, we’ll get into that great music. As always, the sections are clearly labelled, so if you’re only here for the music – skip to the end.

The News

The month’s news continues to have a downward feel to it, price and demand-wise that is. Not that it’s necessarily a bad thing. Cycles happen. Ups are followed by downs. The cure for high prices is high prices, blah blah etc. It feels weird when you’re in it though. However, if you take a step back and think about your business plan, your idea, your value proposition. Is it good? Are you good with it? Then good. Some things you’d change? Some things you really have put off changing ‘cos you know, too crazy busy and stuff? Now’s a good time. That’s my sage management counsel - all included in the price of your blog subscription. You’re welcome.

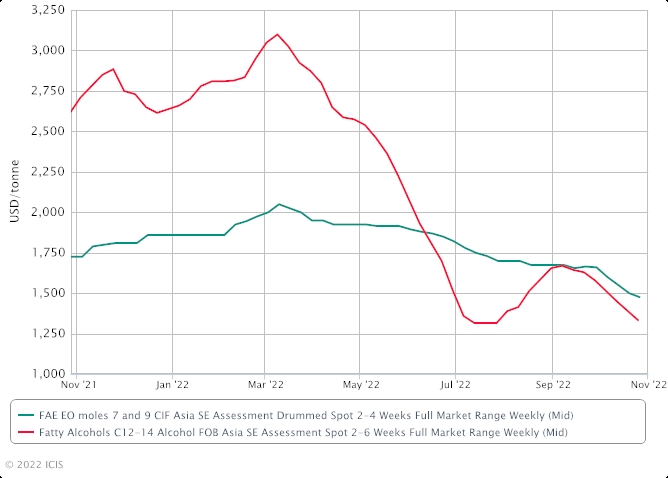

Asian ethoxylates posted another dodgy month according to ICIS. The market is expected to remain sluggish in the near term due to the decline in feedstock fatty alcohol mid-cuts C12-14 and prevailing weakness of local currencies versus the US dollar. “Demand is slow due to the falling feedstock C12-14 mid-cuts and currency depreciation,” a regional supplier said. Regional currencies including the Chinese yuan, Indian rupee, Japanese yen, Malaysian ringgit, South Korean won and Thai baht have all depreciated significantly against the US dollar this year [thanks uncle Fed!]. Spot prices of feedstock fatty alcohol mid-cuts C12-14 have fallen by about 20% since September to $1,330/tonne FOB (free on board) southeast (SE) Asia on 26 October, ICIS data shows. [is this a the canary in the coal-mine or is China digging their own coal mine?]

A bunch of news from Sasol after the Lake Charles fire in October. First, the lesson. If Sasol can have a fire at their plant, you can too. Sasol does things right and takes this stuff seriously. You do too. Accidents still happen. No-one means for their plant to combust but it happens. Have a big wide-open mind when looking at your systems. They will not catch everything.

Anyhow – ICIS reports that Sasol expects to have some production of Ziegler alcohols [these are the linear detergent range alcohols like 1214 etc] before the end of November after a fire shut the plant on 15 October. Major market players have not reported a major shock to their supply chains as a result of the disruption, as lengthening inventories against the backdrop of major economic headwinds globally exert added pressure on the market during the typical Q4 destocking season.

Sasol Updates

- 15 October: Fire at Ziegler alcohol plant causes unplanned shutdown, investigation underway

- 21 October: Sasol says fire limited to relatively small section of facility; declares force majeure on Ziegler alcohols, derivatives as it assesses damage, scope of repair

- 26 October: Sasol says fire limited to portion of plant for which it has redundant processes; continues investigation into fire, scope of repair; expects some production before end-November

The fire was isolated to a portion of the plant for which Sasol has redundant processes as a result of the Lake Charles Chemical Project investment. Sasol will work toward restarting the plant using the unaffected sections once all safety checks have been completed, with some production expected before the end of November. The force majeure on Ziegler alcohols and derivatives remains in place.

Meanwhile over in Europe, it’s not just BASF suffering from the energy crisis brought on by the way in Ukraine. As the great Al Greenwood reports in ICIS: Dow is cutting natural gas consumption by 15% at its European sites because of high costs, a company executive said. "Throughout the third quarter, Dow implemented plans to reduce natural gas consumption at our sites in Europe by more than 15% due to high energy costs," said Howard Ungerleider, Dow chief financial officer. He made his comments during an earnings conference call. During the third quarter, one of Dow's biggest challenges was expensive electricity, said Jim Fitterling, Dow CEO. In Europe, electricity prices were as high as €400/kWh.

To address high energy costs, Dow is working with European governments on policy proposals, Fitterling said. For its part, Dow acquired an equity stake in Hanseatic Energy Hub GmbH (HEH), a consortium building a liquefied natural gas (LNG) terminal at Dow’s site in Stade. Meanwhile, Germany’s economic affairs ministry chartered a fifth floating storage and regasification unit (FSRU) as the country seeks to quickly replace a shortfall in Russian gas deliveries. "We've got a good game plan to navigate the winter and to navigate the next year," Fitterling said.

Given the outlook in the upcoming months, Dow has announced a cost-cutting plan worth more than $1bn. One part of the plan will optimise Dow's mix of plants, products and applications, Fitterling said. Another part will lower rates for higher cost plants, he said. "We will continue to do that, especially in Europe while energy costs remain as they are." Right now, Dow does not have plans to shut down any plants, he said.

Other steps will reduce turnaround spending and improve operation efficiency, Fitterling said. Costs are starting to fall for commodities, raw materials, freight and logistics, he said. "We've got a big effort on purchased materials and freight and logistics to get costs down, and also on purchased services, including contract labour."

Dow is speeding up the completion of some of its digital projects, which Fitterling said should also cut costs. Other steps include maintaining a 15% reduction in capacity across Dow's polyethylene (PE) assets and placing a priority on its higher-margin functional polymers.

It is reducing operating rates across its polyurethane assets in Europe to mitigate high energy costs while still meeting demand. It is looking for ways to improve marine-packed cargo logistics along the US Gulf Coast. Dow started a cold furnace idling programme for its crackers. When Dow had idled its crackers in the past, it would keep its furnaces on hot stand-by. Because of the demand outlook, there is no need to do so, Fitterling said. Dow plans to idle assets across its Performance Materials and Coatings segment for two to six weeks to manage cost and match demand, it said. The segment includes Dow's Consumer Solutions business as well as its Coatings and Performance Monomers business. Coatings and Performance Monomers makes acrylates, acrylic binders, dispersants and vinyl acetate monomer (VAM). Consumer Solutions makes adhesives and sealings, surfactants and silicone products.

Some positive news from Dow in the same earnings call: HOUSTON (ICIS)--Dow has started up its US alkoxylation expansion project in the state of Louisiana, and it plans to commence its Spanish alkoxylation expansion project by the end of the year. The Louisiana expansion should add 60,000 tonnes/year, and the Spanish expansion should add 34,000 tonnes/year, CEO Jim Fitterling said. He made his comments during an earnings conference call. The surfactant expansions will serve pharmaceutical and home-care end markets. Dow's alkoxylates fall within the company's ethylene oxide (EO) chain. Monoethylene glycol (MEG) is the weaker part of that chain, Fitterling said. To address that weakness in the EO chain, Dow is concentrating its investments in higher-value applications, such as alkoxylates and amines for the company's oil-and-gas franchise.

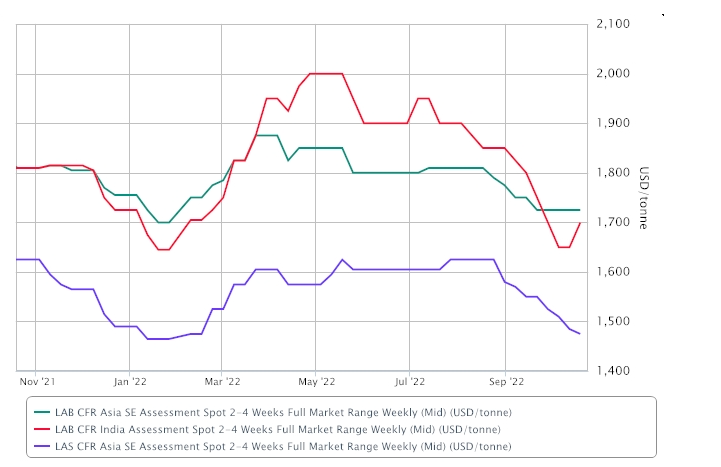

ICIS reports some interesting dynamics in the Asian LAB market : The market remains quiet while suppliers talked of squeezed margins from rising feedstock costs. The desire for higher values, however, were countered by the persistently weak demand in the region.

- Weak economic outlook weighs on sentiment

- Weak LAS and LABSA markets put dents on LAB demand

- Pressure on sellers as competition stays elevated

Chinese suppliers appear to still be staying away from regional markets in view of the prevailing tepid demand. Most suppliers have yet to quote offers after the Golden Week holiday in early October, as the market remains quiet amid the People’s Congress.

“Most sellers are focusing on the domestic markets since the export markets are generally weak,” said a producer in China. Spot prices in China rose to yuan (CNY) 12,700/tonne DEL (delivered) in October, from CNY12,000/tonne DEL in the first half of the year, market sources said. In spite of the stringent COVID-19 restrictions hampering trade and demand, buying momentum in the mainland remains adequate with Chinese makers having little impetus to look toward export destinations. Over in Asia, demand for downstream LAS (linear alkyl sulphonate) and LABSA (linear alkyl benzene sulphonic acid) remains at a low ebb with poor economic outlook amid recession fears hitting consumer demand of detergents and cleaners. Most users have sufficient contract volumes of LAB to meet production needs, resulting in thin activity in the spot market. The Indian LAB market was similarly lacklustre. Having just exited the traditionally slow monsoon season at the end of September, activity started to taper again ahead of the Diwali festivities next week. At the same time, competitive offers, first from the Chinese at the start of the third quarter, and more recently from the Middle East, continue to weigh down the market. Buyers, on the other hand, mostly buy on a need-to basis since most can rely on domestic supply. Others are cautious and slow to commit, as the availability of offers fuel the anticipation of a weakening market. “The import market is regularly facing competitive offers while buyers are non-committal,” said a trader in India.

Earnings Season: The closely watched Stepan results for Q3 came out a couple of weeks ago. Study it like scripture.. Q3 operating income rose 36% year on year, with sales rising 19% to $719m. Although Surfactants and Polymer sales volumes fell, sales rose on higher prices due to pass-through of higher raw material and logistics costs, the US-based producer of specialty and intermediate chemicals reported.

Q3 gross profit rose as sales grew at a faster pace than cost of sales [I love it when that happens, don’t you? But doesn't it remind you of a period not too long ago…?].

Stepan, Q3 ended 30 September:

| (in thousand $) | Q3 2022 | Q3 2021 | +/- % |

| Net Sales | 719,185 | 602,688 | 19.3% |

| Cost of sales | 600,709 | 510,792 | 17.6% |

| Gross profit | 118,476 | 91,896 | 28.9% |

| Operating income | 54,659 | 40,213 | 35.9% |

| Net income | 39,384 | 36,920 | 6.7% |

Surfactants Operating income was $39.0m, up 13% from $34.5m in Q3 2021, with the increase primarily driven by improved product and customer mix that was partially offset by an 8% decline in global sales volume. The sales volume decline was primarily due to lower global commodity laundry demand and raw material constraints in North America. Higher demand in the Functional Products and Institutional Cleaning end markets partially offset the decline in sales volume.

Polymers Operating income was $31.9m, up 61% year on year, with the increase primarily due to margin recovery and improved mix that was partially offset by a 10% decrease in global sales volume. The volume decrease was primarily due to an 8% decline in global rigid polyol demand driven by double digit declines in Europe and Asia.

Specialty Products Operating income was $9.7m, up from $2.4m in Q3 2021, with the increase primarily due to improved margins and customer mix within the medium chain triglycerides (MCTs) product line.

Over the next few quarters, Stepan will be challenged by slowing global economic growth, weakening consumer and construction demand, continued inflationary pressures and a stronger US dollar, CEO Scott Behrens said. For the full year of 2022, "we believe that Surfactants, Polymers and Specialty Products should all deliver full-year earnings growth versus prior year,” he said. "Surfactant volumes within the Functional Products and Industrial Cleaning end markets are expected to show full year growth over 2021,” he said. “Despite short-term volatility and challenges, we believe that the long-term outlook for rigid polyols will remain attractive as energy conservation efforts and more stringent building codes are expected to continue,” he said. In Q4, Stepan will incur incremental expenses because of planned maintenance at its North American phthalic anhydride (PA) plant, he added.

Back in Asia, ICIS’s great Helen Yan reports that the oleochemicals market is expected to remain flat in the fourth quarter due to the prevailing sluggish demand from China amid its zero-COVID policy, which is expected to remain in place for the rest of this year.

- China’s zero-COVID policy to weigh on Chinese demand

- Economic slowdown, global recession fears curb demand

- Monsoon rains from Nov-Feb may disrupt upstream palm supply

Demand from China has not picked up despite the return of players from the Golden Week holidays from 1-7 October. “With the zero-COVID policy remaining in place and no relaxation of this policy, Chinese demand is expected to remain slow or flat in the fourth quarter,” a trader said. The Chinese government did not announce any relaxation of its zero-COVID policy at the week-long 20th National Congress of the Communist Party of China (CPC), which started on 16 October in Beijing. Meanwhile, the continued decline in feedstock palm kernel oil (PKO) prices has curbed spot interest in mid-cut C12-14 fatty alcohols, as buyers stayed on the sidelines and adopted a cautious stance.

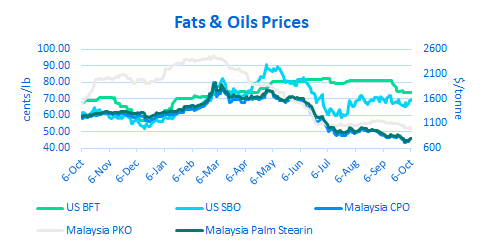

“The PKO price has fallen to around $880/tonne, down more than 20% since early September,” a supplier said. “However the monsoon rains from November to February may disrupt supplies and production output in upstream crude palm oil and palm kernel oil, which will lend support to the oleochemicals market,” he added. Mid-cut C12-14 fatty alcohol spot prices were at $1,450/tonne FOB (free on board) southeast (SE) Asia on 12 October, down about 13% since early September, ICIS data showed.

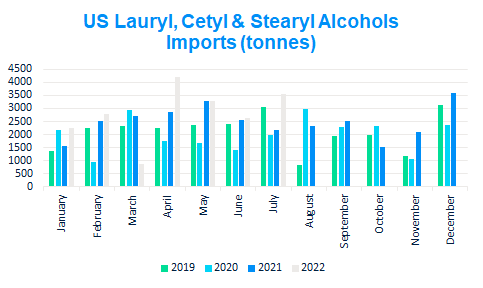

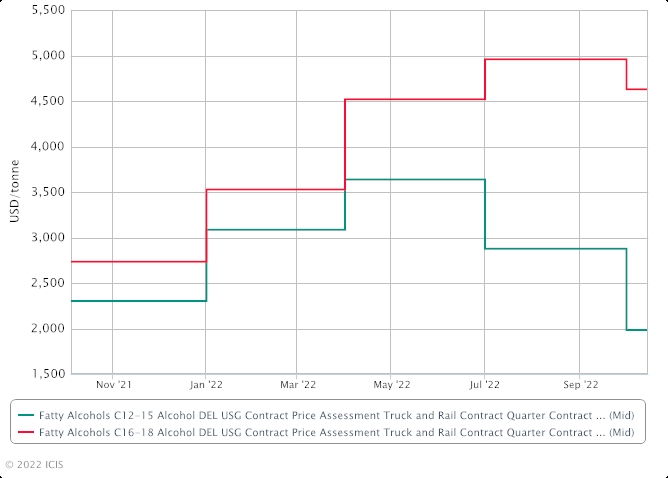

And so to the US, where Alcohols guru, Lucas Hall reports the same downward trends as noted elsewhere. US Q4 fatty alcohol contracts settled mostly lower from their Q3 settlements, tracking a downtrend in feedstock palm kernel oil (PKO) costs and improving to long supply as economic concerns mount.

- US Q4 contracts settle mostly lower

- Mid-cuts, single-cut C16 contracts see biggest drop

- C18, C16-18 see more modest decreases

Source: CME Group, Matthes & Porton, WSJ Cash Markets

Mid-cut alcohols contracts fell more than 31% from Q3. Mid-cut alcohols fell as the downtrend in PKO costs coincided with long supply and slowing demand, namely in consumer-end cleaning markets. C16-18 alcohols fell less than 7%. C16-18 alcohols fell less drastically as prevailing tight C18 supply offsets the downward pressure felt from lower feedstock costs and waning demand.

Source: ITC

In the long chains market, the premium on material with C18 content stems from continued tight supply associated with bottlenecks that cropped up earlier in the year when PKO costs were at a premium to alternative feedstock coconut oil (CNO). The PKO premium prompted an increase in CNO consumption in the feedslate. CNO produces much less C18 content by volume than PKO. PKO and CNO prices are close to parity, supply of other chains long and demand softening, which may impinge production and the supply recovery in C18 markets. Sasol confirmed it is completing a planned turnaround at its Louisiana site and plans to return to production sometime next week.

Q4 contract ranges*

| Product | Price (cents/lb) | INCO | Location |

| C12-C15 | 82-98 | DEL | USG |

| C16 | 120-150 | DEL | USG |

| C18 | 170-220 | DEL | USG |

| C16-18 | 190-230 | DEL | USG |

*The prices in the table represent a range of settlements for standard balance material heard throughout the quarter for the majority of market participants. Prices above and below those listed in the table were heard throughout the quarter but were excluded as they were not viewed as representative of the wider market.

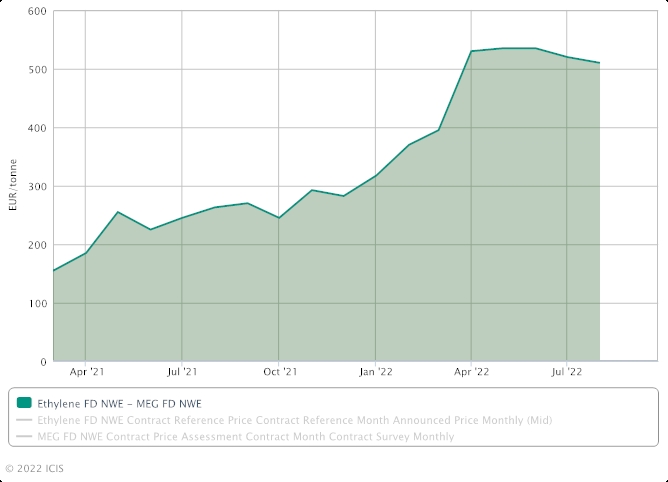

And– European EO. This is a tough one. It’s driven by the two forces of war-time energy costs and collapsing demand in the face of same. How does it all play out? Only the inimitable Melissa Hurley of ICIS can reliably lay it all out: European ethylene oxide (EO) suppliers have dealt with significant production cost pressures due to increasing utility costs from high gas and electricity prices. There are expectations that high gas prices will remain an ongoing issue into 4Q when 2023 adder fee talks ramp up.

According to Aura Sabadus, ICIS senior gas journalist, "Although gas prices are falling they are still likely to remain elevated compared with long-term averages, and especially against US gas (Henry Hub). So European petrochemical producers will still be at a competitive disadvantage to other regions."

Upstream ethylene prices rose by a record monthly adjustment in April, and there were additional double-digit energy surcharges applied in the EO market. Since April, however, ethylene prices have been on a four-month decline and have almost returned to January 2022 levels. Despite the ethylene cost relief, EO suppliers are still struggling with high utility costs and margin erosion. The EO price includes a conversion fee over the cost of ethylene, which is negotiated at the beginning of the year. Depending on the terms of an individual contract, the fee can be revised annually or fixed for several years at a time. Formulas can also vary in terms of ethylene cost pass through.

Ethylene prices have increased 12% in the past year. The ethylene and EO price spread peaked in April due to record prices, but since then ethylene prices have fallen, reducing the spread. Nonetheless, high utility costs have kept pressure on sellers' margins. In 2021, ethylene prices increased by around 48%. The increased cost resulted in stable-to-firm adder fees for 2022. Some EO contracts were stable at a high level or were not up for renewal, resulting in steady fees in some instances. In the Mediterranean, the increases were larger, depending on starting point and account.

There are a few planned ethylene glycol (EG) and EO shutdowns at the end of Q3 and the beginning of 4Q in Belgium and Germany. BASF has planned a EO maintenance turnaround at Ludwigshafen, Germany in November, and a planned turnaround is taking place in INEOS Antwerp for EG and EO in September. In 2021, supply was tighter due to more unplanned outages.

EO sources will discuss increased freight rates and additional energy adders for 2023. The EO production process is very energy intensive, and some companies have suffered from cost pressures due to emission adjustments. Producers are separately discussing adjustable variable adders based on published indices (inclusive of CO2, gas and electricity) which could move on a monthly basis.

Demand strength varies depending on EO derivative. MEG demand has been weaker than expected in 2022 whereas, surfactant demand has been better. Glycol margins are under greater pressure amid lengthy supply and weak demand, with production rates lowered this year as a result. Ethanolamine activity has picked after a particularly slow start to September. Glycol ether demand for the construction and automotive sectors remains slow, and there is little sign of improvement. Downstream affordability is a main concern as demand starts to decline for certain products. The rising cost of living and inflation is weighing on consumer confidence. On the consumer side, it is difficult to predict where demand is heading. EO demand into personal care remained steady this year, but there are concerns about general end-user demand due to the rising cost of living and rising inflation in Europe.

In August, INEOS Oxide launched a new low carbon, bio-attributed EO based on certified bio-based sources which delivers a greenhouse gas saving of over 100% compared to conventionally produced EO. Bio EO is currently at a notable premium to traditional EO. In Q1, Clariant launched its Vita 100% bio-based surfactants and polyethylene glycols (PEGs), and joined the Renewable Carbon Initiative (RCI) to promote using renewable raw materials instead of fossil-based carbon.

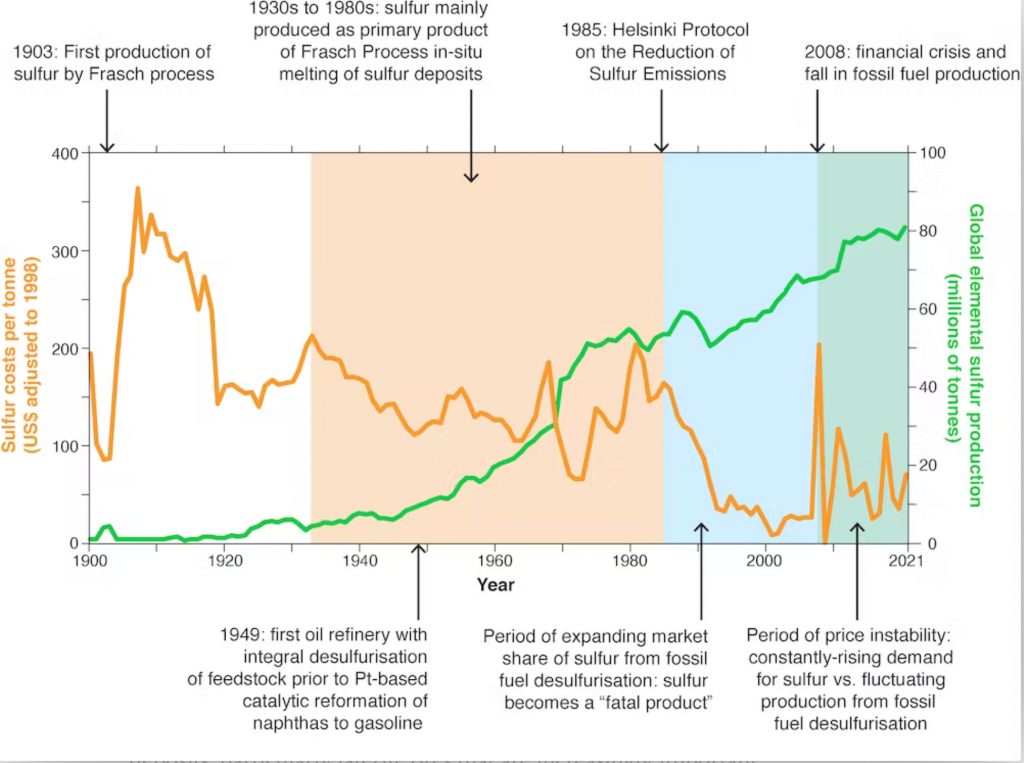

And finally – do want something else to worry about? OK then, courtesy of Chemwatch, an interesting website I peruse occasionally, there’s a sulfur shortage looming. Yep. As we know [you should know], sulfur today comes mainly as a byproduct of petroleum refining. Sulfur is usually present in fossil fuels at about 1-3% by weight, which accounts for 80% of the more than 80 million tonnes of annual global sulfur supply. The switch toward renewable energy is imminent, however, and with it an overhaul of crucial chemical processes and a loss of key reagents such as sulfuric acid in the scales we have currently. It’s predicted that demand will outstrip sulfur supply by anywhere from 40 to 130% by 2040, depending on the extent of renewable energy infrastructure. So – sulfonators, take heed. The article actually linked to an even more interesting piece on a site called “The Conversation” which I’ve not seen before. It’s worth checking out – this cool graph is there

This (the Conversation) article also says that the people who really get shafted by the sulfur shortage will be, guess who - the poor in the 3rd world whose food supply will be threatened. So – sulfonation – first world problem, maybe..?.

The Music

I gotta tell you, this is one of the greatest rock-n-roll albums ever made. And I suppose it falls into the category of punk. It ranks up there with the greatest works of the Sex Pistols, Damned and Ramones. And like the greatest of those it presents riffs and sentiments that also appeal to the most ardent fan of Black Sabbath, Deep Purple or Motorhead (the ultimate crossover band). I’m talking about Inflammable Material by Stiff Little Fingers. For tribal reasons, which I’ve written about in this blog before, I would never see the band live, but the album surely made a mark through it’s thousands of playings. The songs deal with the typical teenage angst and rage with an overlay of life in Northern Ireland during the troubles. It’s a potent mix which brings out the best in music and lyrics. So – let’s dig in. The album opens with this:

Oof yeah, right? That’s a punk anthem for sure. And the lyrics don't take too much reading to see that they’re an even-handed rejection of both oppressors and liberators. Not a monochrome scream against the man, like many of their peers’ songs.

We're a suspect device if we do what we're told

But a suspect device can score an own goal

I'm a suspect device the Army can't defuse

You're a suspect device they know they can't refuse

We're gonna blow up in their face

The other great album of the period, also from Northern Ireland is of course , The Undertones (1979). Pure pop, with punk sensibilities admittedly, but this is escapist pop with not a reference to the IRA, UDA, RUC, troubles, let alone bombs, bullets and barb-wire to be found. Perhaps the greatest pop song of all time – taking the hormones of a generation, distilling them, putting them through PG filter-paper and packaging for prime-time consumption is this – Teenage Kicks.

Back to SLF. Another monster of a song on the album is Alternative Ulster. This is a great live version from 1980

And, I mean would that opening not appeal to your average Ted Nugent fan. Would perhaps the sentiment not also? The lyrics are actually worth reading in their entirety – but here’s a snippet.

Get an Alternative Ulster

Be an anti-security force

Alter your native Ulster

Alter your native land

Let’s stick with SLF for another one. This is the song that did it for me. It’s a quivering slab of raw reggae. Their rendition of a Bob Marley song with lyrics adapted to the wrong place at the wrong time in Belfast. Johnny Was (a good man). Here’s a live version from the same concert.

In a top floor flat in the middle of the night

There's a man with rifle and Johnny in his sight,

I said oh no, we can't let that kind of thing happen here no more

Oh no

Johnny, Johnny, Johnny...

A single shot rings out in a Belfast night and I said oh

Johnny was a good man

You know, I never even listened to the original by Bob Marley. Let’s check it out together.

Well, that was an emotional tidal-wave. Did SLF do it justice? Yeah, I think so.

OK – time for some light relief, which the Undertones can certainly and reliably provide. Here comes the Summer. At 1 minute and 24 seconds from Top of the Pops

Now, SLF were not always, or even mostly, focused on the troubles. Often, their rage was directed at the ennui of teenage life in a post-industrial Northern town. Here – at 58 seconds – Here we are nowhere.

Is it a crime

To be young

Every time

We have some fun

They put us down

And tell us that we’re wrong

Every time they sing the same old song

Here we are nowhere

Maybe that’s where we belong

Rage was not a quality to be found in the Undertones work. The furthest they would go might be termed persistent insistence in the direction of a paramour. You’ve got my number. Why don't you use it?

So – what to make of all this? Two great bands emerging at the same time from the same town – a cauldron moreso than just a town, really, and with two completely different takes on the world in their music. If you had to choose, which do you prefer? Me? For breadth and depth and density and fullness and unashamedness and unselfconsciousness and rawness and barely-containedness and Fibonacci-jaggedness and singing-through-the-lump-in-the-throatedness of emotion, I have to go with SLF and anyway, the singer is Jake Burns so… Here’s a song replete with double-entendres and some entendres-not-so-double. Funny, I think. Barbed Wire Love

That’s it, music and surfactants lovers. See you soon.