Surfactants Monthly - September 2022

This month’s blog is one which chronicles, almost uniformly, a downward trend in pricing. This you may cheer you or not, depending on your perspective. There is no doubt that supply chain tightness is loosening and that is a good thing. Prices will find their own level in the coming months. I recently paid, through gritted teeth, an invoice on which was listed a “supply chain surcharge”. Take it off already! It’s annoying. The roller-coaster has surely turned.

We’ll jump straight into the news now and, if we have time, maybe get into some music at the end.

As always, a big shoutout and thanks to my friends and colleagues at ICIS for the news. I subscribe and you should too.

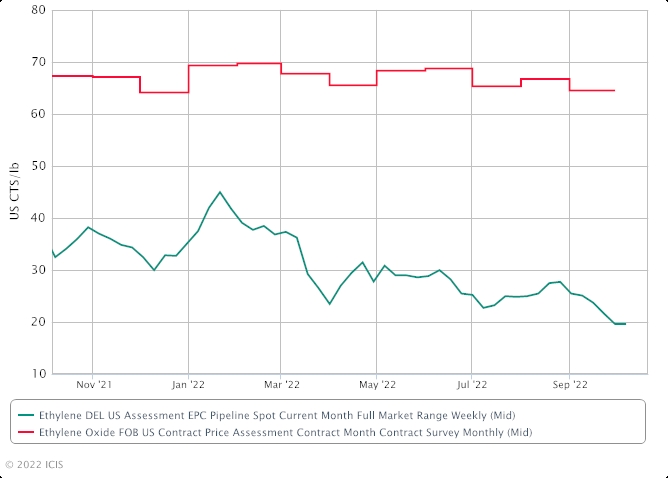

At the end of the month and, as I think we predicted in last month’s blog, September US ethylene oxide (EO) contracts were assessed at 64.55 cents/lb ($1,423.07/tonne)

The decrease in EO contract prices was due to a decrease in October ethylene contract prices. The supply of EO remains tight following a planned maintenance on a Seadrift, Texas plant, however, the market is expected to balance in Q4.

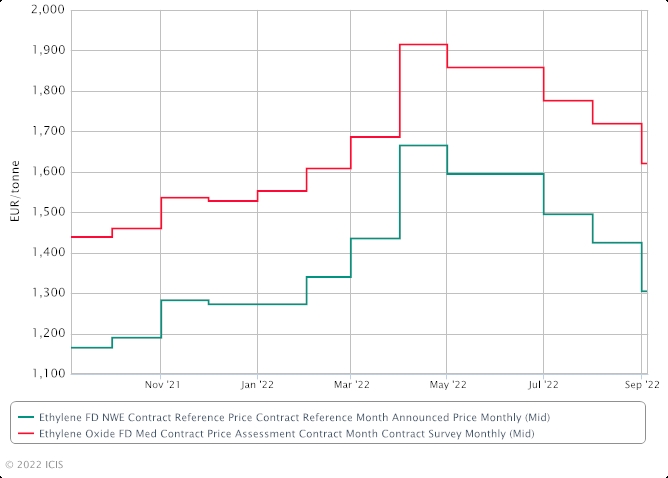

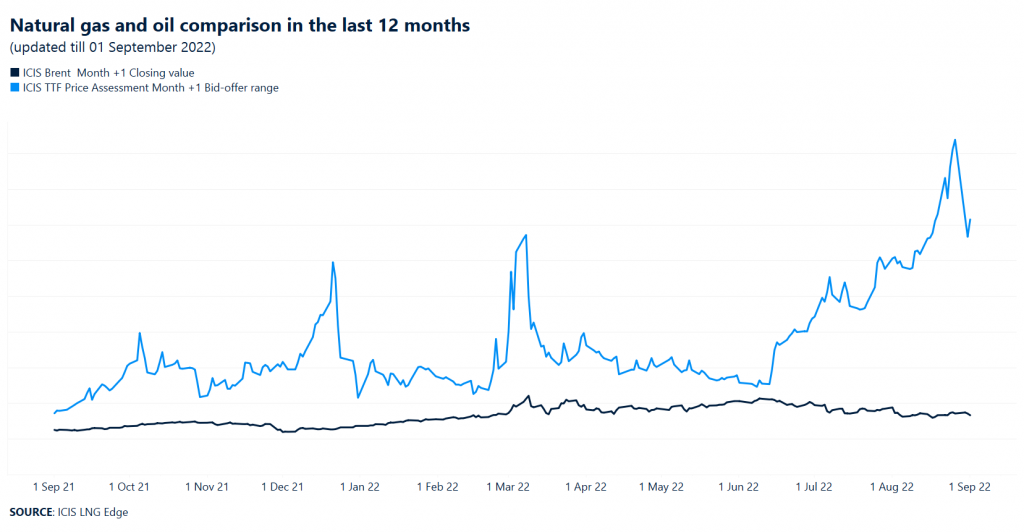

Meanwhile in Europe European ethylene oxide (EO) contract prices for September were assessed at a steep double-digit drop on the back of a sharp fall in upstream ethylene values. Despite the feedstock decreases, suppliers remain under production cost pressure due to the utility costs from high gas and electricity prices.

- Gas surge still weighs on production costs heavily

- Energy surcharge discussion ongoing, more for 2023 contracts

- Demand outlook for surfactants good

September EO prices where assessed at a €98/tonne drop on both ends of the range, bringing prices to €1,502-1,640/tonne free delivered (FD) northwest Europe (NWE).

The ethylene contract price for September settled at €1,305/tonne, down €120/tonne from August. The debate over EO energy surcharges continues and is expected to feature heavily in contract talks for next year. Natural gas prices surged on Monday as Gazprom announced after the market’s close on Friday that Nord Stream flows would not restart as expected. EO market sources are discussing increased freight rates and additional energy adders for next year. There is hope that the situation will become clearer in the fourth quarter of the year despite the heightened uncertainty seen.

Demand is still good for certain derivatives such as surfactants and ethoxylates but demand for monoethylene glycol (MEG) remains poor. There is general concern for demand across commodities after the summer break, however. Eurozone manufacturing output contracted further month on month in August due to the rising cost of living eroding the purchasing power of consumers.

More BASF Surfactants! ICIS reported just today that BASF and South Korean producer Hannong Chemicals are planning to establish a joint venture for the commercial production of non-ionic surfactants in the Asia Pacific, the two firms said on Thursday. BASF will hold 51% and Hannong Chemicals 49% stake in the proposed joint venture called BASF Hannong Chemicals Solutions Ltd., they said in a joint statement. The joint venture will combine BASF’s technology and product innovation capabilities with Hannong’s production capabilities to supply non-ionic surfactant products to BASF and Hannong Chemicals, each with their own sales and distribution network, enabling the two companies to cater for increasing market demand, they said. The new company will be located in the Daejuk site at the Daesan Industrial Complex in South Korea. [I can’t say I know Hannong. Here’s their website].

More Alpha Olefins! ICIS reports that ExxonMobil’s 350,000 tonne/year linear alpha olefins (LAO) facility in Baytown, Texas, remains on track for start up in 2023. Announced in mid-2019, the facility will produce 10 products to be marketed under the ELEVEXX brand for external sales, but over half of the nameplate capacity is likely to be for captive use, according to Michael Fanset, global market development manager for performance olefins and derivatives at ExxonMobil “The right place to put this was in the US because that’s where the market is and where our customers are, both our internal and external customers,” Fanset said, speaking on the side lines of the annual meeting of the European Petrochemicals Association (EPCA) The decision to site the unit in Baytown was taken based on facility space, feedstock access and synergies with other production units at the site, including a solution polymers unit located close by. “Plot space fit, the feedstock was available, the were also some site synergies we could take advantage of,” Fanset said.

ExxonMobil announced at the start of this year plans to split its operations into three units, upstream, low-carbon solutions and product solutions, the later containing its downstream and chemicals operations. Part of its strategy on developing its chemicals assets has been to grow its footprint in the olefins derivatives space, according to Fanset. “We [have] a very clear direction on our chemicals strategy to grow olefins derivatives,” he said. “We are a big PE player, and a big PP player, but we wanted to diversify olefin derivatives and LAO does that as an ethylene-based derivative,” he said.

“LAO has been an enabler for what we call our performance products, it goes into performance PE, goes into synthetics,” he added. “We’ve been purchasing it on the outside so as we looked at that opportunity we also saw the number of the external markets that were complimentary to what we do, and so we see LAO as what we would call a performance product that we would be able to grow internally and externally.”

The company’s chemicals strategy “is growing through large complex size investments like this”, Fanset added. ExxonMobil has also completed a cracker and olefins derivatives complex with SABIC in Corpus Cristi at the end of 2021, and is expected to complete a large-scale polypropylene capacity expansion in Baton Rouge, Louisiana this year. LAOs are used in plastic packaging, engine and industrial oils, surfactants and other specialty chemicals.

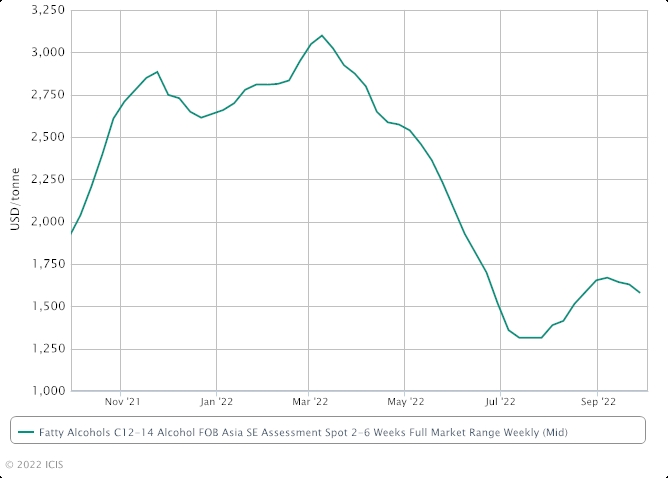

Continuing the downward trends news: ICIS reports that Asia’s fatty alcohols ethoxylates (FAE) demand is expected to remain subdued in the near term as buyers retreat from the market due to the price declines in the feedstock fatty alcohols mid-cuts C12-14 market and bearish market sentiment.

- Bearish sentiment, recession fears and inflation woes

- China to shut 1-7 October for National Day holidays

- Falling feedstock C12-14 fatty alcohols prices curb demand

Declining feedstock fatty alcohols mid-cuts C12-14 prices and uncertainties in the macroeconomics and geopolitics arena have been suppressing spot appetite, market sources said. The feedstock fatty alcohols mid-cuts C12-14 prices have fallen by about 5% since early September to $1,520-1,640/tonne FOB (free on board) southeast (SE) Asia on 28 September, ICIS data showed. “Recession, bearish sentiment, inflation and a strong US dollar versus local currencies have all weighed on demand,” a supplier said. “Spot purchases are limited and if any, are usually for smaller parcels on a need-to basis,” he added.

“There are few enquiries and Chinese demand is weak due to the uncertain market outlook and upcoming holidays in China,” another supplier said. The Chinese market is shut for the National Day holidays 1-7 October. China, the world’s second-biggest economy, is projected to grow at a much slower pace of 2.8% this year compared with an earlier forecast of 5.0%, according to the World Bank, amid the country’s zero-COVID policy and ongoing property crisis. It represents a sharp slowdown from the 2021 growth rate of 8.1% - the fastest recorded in a decade. The Chinese economy has been grappling with partial and full COVID-19 lockdowns and power rationing due to scorching heatwaves, which engulfed Sichuan and Chongqing municipality as well as several other cities and regions in China recently.

Toward the end of the month, Stepan Company announced Monday that it has finalised the acquisition of the surfactant business and associated assets of PerformanX Specialty Chemicals. The acquisition includes intellectual property, commercial relationships and inventory. "Alkoxylates are a core surfactant technology critical to Stepan's agriculture, oilfield, construction and household end use markets," said Scott R. Behrens, president and chief executive officer of Stepan Company. "We are pleased to have closed the acquisition of PerformanX and welcome PerformanX's customers to Stepan." Financial terms of the deal were not disclosed. In an earlier statement the company said that the PerformanX acquisition should increase the company's annual revenue by $20m and it should be accretive to its margins for earnings before interest, tax, depreciation and amortisation (EBITDA).

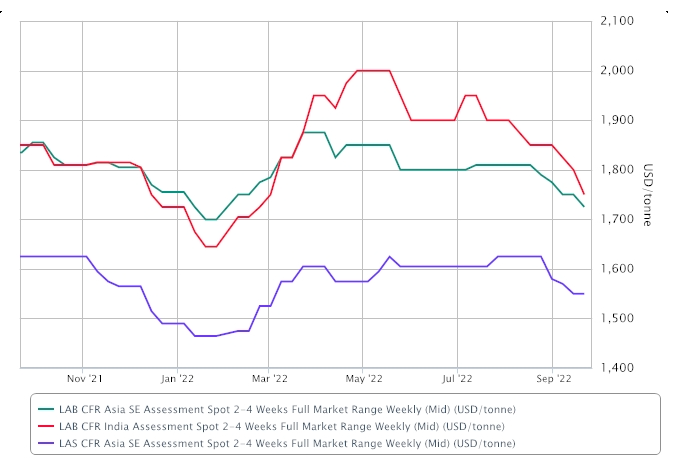

More downward pointing news: Southeast Asia’s linear alkylbenzene sulphonate (LAS) market remains under downward pressure amid weak performance in the feedstock linear alkylbenzene (LAB) sector. Spot LAS prices were at around $1,550/tonne CFR (cost and freight) SE (southeast) Asia, but suppliers talked of growing difficulty in sealing deals at current levels. Buyers have lobbied for parcels substantially below the offer prices, with the wide buy-sell gap reducing trade.

“Buying indications are declining and closing sales at current levels have become difficult,” said a supplier in northeast Asia. Weak economic outlook and inflationary pressures have also dampened the surfactant and detergent sector, prompting caution among buyers of LAS. “Inflation woes appear to have dented demand for detergents as people switch to cheaper alternatives or reduce the frequency of washing,” said a regional trader. With consumers prioritizing funds towards food and utilities, demand for detergents could ebb further in the near term. [Uh oh.. we talked about this a few blogs back. A bit like what happened in 2008 / 9 . ]

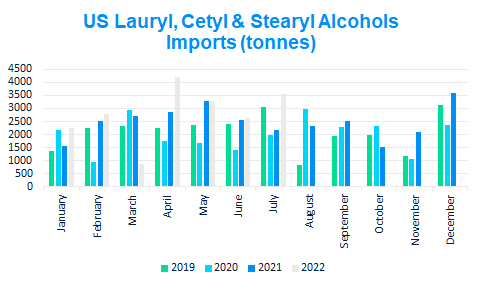

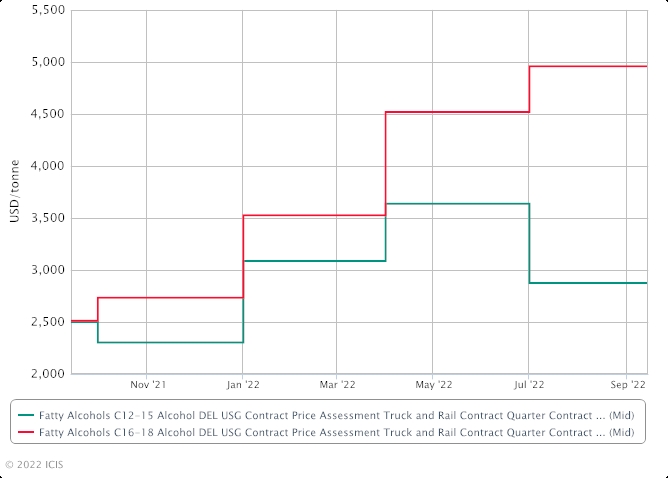

Another “Downward Pressure” headline featured by ICIS on article by detergent range alcohols guru, Lucas Hall. Lucas notes that Q4 fatty alcohols negotiations are ongoing, with freely negotiated settlements for mid-cut alcohols heard at a sharp decrease from Q3.

- Freely negotiated Q4 mid-cut contract settlements heard at sharp decrease

- C16-18 discussions ongoing alongside mixed feedstock, supply/demand fundamentals

- Economic concerns weighing on demand

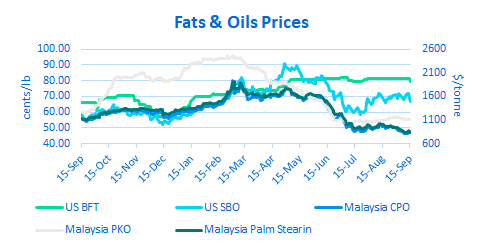

Contract negotiations typically conclude by early October. Mid-cut contracts face major downward pressure from a downward correction in feedstock palm kernel oil (PKO) the last several months.

Source: CME Group, Matthes & Porton, WSJ Cash Markets

Long supply and slowing demand is adding to the downward pressure.

Because mid-cut supply is long and demand waning, some producers are separately offering to average down higher-priced Q3 contracts by adding additional Q4 volume at lower levels.

Source: ITC

Negotiations for long chains are expected to be more drawn out, owing to mixed supply and demand fundamentals. C18 supply is particularly tight, offsetting the downward pressure felt from lower feedstock costs. Demand in the core surfactants market is slowing down and players are acting more conservatively as they manage their inventories with dampening consumer sentiment alongside mounting economic concerns.

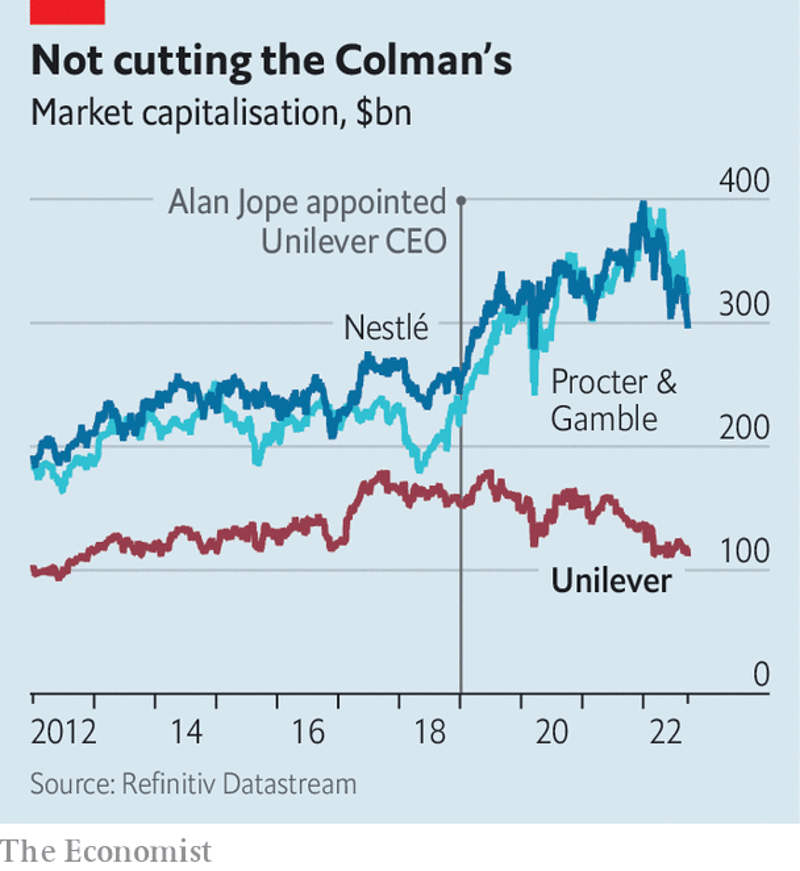

Finally, the Economist wrote an interesting piece on Unilever which we may consider as a continuation of the Acitivist Investor Peltz / Marmite Maker Unilever saga. Essentially, CEO Alan Jope announced his retirement on September 26th and UL stock popped in response. This however, did not detract form the longer term trend which the article was keen to emphasize, i.e.:

The article outlines many good things that happened under Jope including the simplification of the ridiculously complicated corporate structure and the focus on health and hygiene. The piece goes on to mention that any incoming CEO has to deal with relatively new board member Nelson Peltz and investor pressure to break up the company. Tough job no doubt. Would you want it? Think you could do better than Jope, even? Unless you are Laxman Narasimhan (who just left Reckitt to head up Starbucks - ugh!) the answer’s no you couldn't. And even if you are Laxman, the answer’s still only maybe. Now, as regular readers know, the blog’s fascination with Nelson Peltz extends to his extended family which includes daughter Nicola and her new spouse Brooklyn (Beckham), giving us a barely valid excuse for this.

So – that’s the end of the news. What else? Well, some music notes.

First, I read that Joey Ramone has sold a majority stake in his music catalog for $10 Million. Good for him, I guess. Sounds very corporate, doesn't it ? The Ramones were great though weren’t they? They came to the UK in ’76 and were part of that punk milieu of the 70’s with the Sex Pistols, Damned and lesser known bands like the Angelic Upstarts (of South Shields). I never saw them live; something to do with that tribalism back then. But some great songs really were a soundtrack to those teenage years. Starting with this classic. ; at less than 2 minutes

And this one – It sounds so American, right?

And – Beat on the Brat – with a baseball bat – also very American ..

And staying true to those 50’s rock-n-roll roots: Suzy is a headbanger

and the following song on the same album – Pinhead. Classic. Gabba gabba we accept you – what the heck does it mean? Apparently it’s reference to the 1932 movie, Freaks. Google it. Very weird.

But my favorite, for very personal reasons, is this one which featured for a brief while as a favorite of my daughter’s middle school class, much to consternation of the staff. Warthog – kinda reminiscent of the most urgent of the Sex Pistols right? Nice.

Something else, I’ve been listening to and – completely different. The instrumental album, Clarity Through Distortion by El Supremo. I know nothing about them and can’t remember how I stumbled across them on YouTube. But check it out. The album lives up to it’s title. There’s hints of Hawkwind, Deep Purple, Black Sabbath, proper (early) Pink Floyd, Gong and even Van Halen in there. Other than the intro and outro, one of my favorite pieces is Ultimate Dropout. Is that not a riff that could literally feed a family of carnivores for a month!? Self indulgent? Just touch. Give it a listen anyway.

That’s it - surfactants and music lovers. I’ll be on time with the blog next month for sure.