Surfactants Monthly – June 2020

Guide to this month’s huge blog post – in order of the sections below:

Business – dates for your calendar

Musings – thoughts, music videos. You know the stuff we do

News – what happened in surfactants in June

Guest Posts – from Clariant and Modular Genetics

More Musings – there’s a Rush video this month, so keep reading

End

Business

Surfactants Training Course July 14- 16th. This is the first fully online high production value digital offering in the surfactants space. It’ll cost you but it’s worth it. The course focuses on the business of surfactants and is a brand new digital version of the hugely successful course I have taught for 8 years. Sign up here .

The 10th World Surfactactants Conference will place - online - September 14 - 16th. Stay tuned for a great announcement about this. It will be unique and I believe you will love it.

P2 Presents – Know Your Customer July 9th at 10.00 AM and 2.00 PM. This is free! We go deep into the heart and mind of a cosmetics and makeup consumer. What can we, as ingredient suppliers and brand managers, learn from what we hear? A lot. Join me in this unscripted and somewhat surprising presentation by green chemistry company, P2 Science. Think about this: In the last few months, two Kardashian sisters (Kim and Kylie Jenner) have had their cosmetics companies valued, in transactions, at over $1 Billion each. At the same time, cosmetics, as a category is down due to the pandemic, private label is in the ascendant and brands in general are under fire from all directions for all sorts of reasons. What do do? Listen to your customer, really intently. You’l be surprised at what you learn. You must register in advance here: It’s free though.

Musings

So, I’m reading that the ‘burbs are now the place to be. With cities full of COVID and looting, the suburbs are looking like a peaceful, socially distanced, idyll with decent schools, nice lawns, landscaping and, actually pretty good drive-thru options for, like, coffee and stuff and there’s a Wholefoods not that far, sometimes. I’m told by a colleague that New Jersey is one big suburb and I think he’s right. You know how Scotland became known as the land of the mountain and the flood, thanks mainly to the poetic work of Walter Scott? (O Caledonia! stern and wild…) anyway, New Jersey is known as the land of the jughandle and the stripmall, thanks mainly to the fact that it is. Nonetheless, realtors tell me that folks can’t wait to relocate over the bridges and through the tunnels to NJ from NY. And the pattern is repeated elsewhere from Chicago to Los Angeles. What does this mean? Well, for the chemical industry, it’s probably good. Suburbanites consume more than city dwellers if only because the have more place to put stuff. This pulls through the entire value chain. And as for chemicals themselves, I reckon the average 1 acre lot round here consumes enough lawn chemicals in a given summer to keep a small to mid-sized country’s farming sector supported for a year.

But what of the spiritual and moral effects of suburbanization, I hear you ask? Is this an unreservedly positive trend we are seeing? Well, 70’s pop group, The Members said it best in their classic Sound of the Suburbs. A cautionary tale for putative suburban migrants.

Same old boring Sunday morning

Old man's out washing the car

Mum's in the kitchen, cooking Sunday dinner

Her best meal. Moaning while it lasts…

Having said that, however, these same boys caution against a starry eyed view of the city, even if your suburban life seems like a dead end. Because, well..

Living in a bedsit

Travelling on a tube train

Working all day long

And you know no-one, so you don't go out

And you eat out of tins and you watch television

Solitary Confinement..

Take a listen. The lyrics at one point almost breach the blog’s G-rating rule, but not quite, I think.

News

The month starts with a healthy slug of EO news in a focus article by Antoinette Smith of ICIS.

May ethylene oxide (EO) contracts settled at an increase, in line with upstream ethylene contracts. The increase is amid a mixed picture for downstream demand. ICIS assessed May EO contracts at 48.2-57.7 cents/lb ($1,063-1,272/tonne) FOB (free on board), higher by 2.8 cents/lb from the previous month.

Demand for EO from downstream ethylene glycols (EG) has remained steady to lower. Monoethylene glycol (MEG) exports to China continue at high levels, and North American demand into polyethylene terephthalate (PET) packaging for cleaning products and sanitizers remains strong. However, consumption from water and carbonated drinks is easing, as consumers work through volumes from [COVID induced] panic purchases.

Summer is the typical peak season for PET, especially in bottling for carbonated drinks. Because of lockdown measures, high US unemployment and related drops in consumer spending, that peak remains in doubt, and may already have occurred, with increased purchases as lockdowns began. In addition, a carbon dioxide (CO2) shortage could ultimately affect demand for PET bottles. The start of summer typically marks a demand spike from the beverage industry, which uses CO2 to carbonate drinks, said Rich Gottwald, president of the Compressed Gas Association, a trade group.It is unclear how the coronavirus will affect this seasonal trend in the key carbonated drinks sector, but if drink production is lower, demand for PET bottles may decline as well.

Automotive production recently resumed after a two-month hiatus, increasing demand for antifreeze-grade MEG. Vehicle production rates are unlikely to reach pre-virus levels before 2021, however, according to Rhian O'Connor, ICIS lead analyst.

Demand for diethylene glycol (DEG) remains subdued, with construction projects only starting to ramp back up as lockdown measures ease. The peak summer season could yet occur, but is likely to be below levels previously expected for this year, even if a second wave of coronavirus infections does not occur.

Capital expenditures have been scaled back across many sectors, reducing demand for DEG end uses.US construction spending in April fell month on month, but rose year on year on a seasonally adjusted basis, the US Census Bureau said.

Higher purity EO uses, such as cleansers and disinfectants, have surged in demand amid the coronavirus pandemic, and that demand is expected to continue in the near future. For example, in downstream glycol ethers, demand from the cleansers and disinfectant markets is steady. Packaging adhesives, paper coatings and do-it-yourself (DIY) paints continue to drive some glycol ethers demand, although demand from those sectors is expected to dissipate as demand from automobile production and contractor paint projects increases.

The upstream ethylene settlement was higher than the previous month, by 3.5 cents/lb, on rising spot prices and higher cash costs. Feedstock ethane supply has been reduced because of lower drilling rates, but is still ample on generally weak demand due to the coronavirus.

Meanwhile in China, the domestic ethylene oxide (EO) list prices rose by yuan (CNY) 200/tonne early on Wednesday, according to market sources. This rise marks the fifth consecutive rise every week since late April. A hike of CNY200-300/tonne was reported in every announcement, with the latest increase last Monday. One of the largest EO producers in China - China Petroleum & Chemical Corp, or Sinopec, announced the revision of its list price to CNY7,200/tonne ex-tank. The continuous growth in EO prices was generally attributed to strong feedstock ethylene values and robust performance of main downstream monoethylene glycol (MEG).

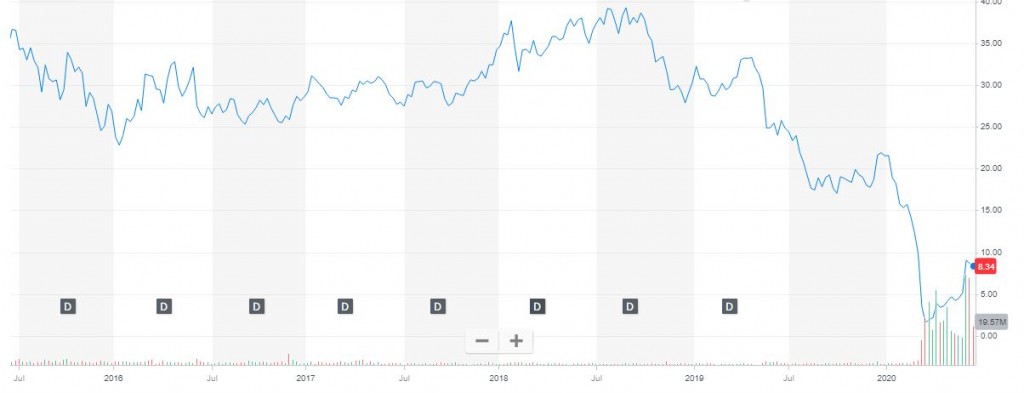

Lots of new news re Sasol this month. As reported in April’s blog, Sasol is looking for a partner (ie money) for it’s Louisiana site and hired BofA to run a process. As anyone who has been around this sort of situation knows, once a process like this gets underway, in the public eye, many outcomes are possible and change can occur rapidly and often unpredictably. There is often immense shareholder pressure on management to make something happen and produce the value.

So, mid month, the great Al Greenwood of ICIS reported that Sasol is attracting bids from at least five companies who are interested in acquiring a stake in the chemical complex it is building in Lake Charles, Louisiana. If Al reports it, I believe it to be true, even if the information probably came from an IBanker running the process (I’m just guessing on that score) The source confirmed an earlier article from Bloomberg, which reported that INEOS, LyondellBasell and Chevron Phillips Chemical were proceeding into a second round of bidding for a stake in the complex. Two potential buyers from Asia [which makes perfect sense] have also entered the second round, the source said. LyondellBasell did not immediately respond to a request for comment. INEOS said it had no comments. Chevron Phillips Chemical said it had no comments.

Sasol said, "Our expanded asset disposal process has yielded good interest by strong contenders for a number of our assets." The stake could bring Sasol more than $2bn, Bloomberg reported. Earlier on 12 March, Sasol said it was reviewing a number of actions to address challenges created by the coronavirus and the decline in oil and chemical prices. Among those actions was "the potential for exploring partnering options at Sasol’s US Base Chemicals business”. Sasol would maintain a majority interest in the project, but the size of the minority stake in the complex would be significant. Sasol is under severe financial stress from the debt taken on for the Louisiana project and the collapse in crude oil prices. The cost of the project has risen from $9bn to up to $12.9bn.

Among the units at the project, the 1.5m tonne/year ethane cracker is producing to plan within pipeline specifications. The ethoxylates unit achieved beneficial operation at the end of January. The linear low density polyethylene (LLDPE) and the ethylene oxide/ethylene glycol (EO/EG) units were producing at targeted levels The fatty alcohols expansions are now expected at the end of the second quarter. Sasol plans to start-up the new 420,000 tonnes/year low density polyethylene (LDPE) plant in the second half of 2020.

In additional Sasol news, ICIS reported Sasol has raised its debt ceiling with lenders, plans to abandon oil activities in West Africa and will review jobs as the troubled company refocuses on specialty chemicals, gas and renewables. [That’s smart, but honestly when I think Sasol, I don't necessarily think renewables, but let’s see..]

The company said in a recent press release it has negotiated an increase in debt covenants from December from three-to-four times (3x - 4x) net debt in relation to earnings before interest, tax, depreciation and amortization (EBITDA). It was granted a waiver for its June covenant. Sasol now has to prioritise debt reduction and has agreed to no dividend payments or acquisitions while leverage remains above 3x net debt/EBITDA. The company’s credit rating was downgraded by two notches earlier this year, adding around $40m to annual interest payments.

In March, it launched a rights issue aiming to raise $6bn in cash by the end of 2021. Sasol said on Thursday it has liquidity headroom above $1bn.

In April, Sasol announced significant cuts to capital expenditure, a freeze on company pension fund contributions, and salary cuts for managers. It also has an accelerated asset disposal programme. The company said that after South Africa’s lockdown was eased on 1 June it has ramped up production at units which had been closed by falling demand for fuel and chemicals. These include ammonia, nitric acid and chlor-vinyl plants in Sasolburg which restarted in May.

Sasol said its new business model, called Sasol 2.0, will focus on specialty chemicals where it has differentiated capabilities and strong market positions which can be expanded over time. The energy business will comprise the Southern African value chain and focus on gas as a key feedstock, with renewables as a secondary energy source. All oil growth activities in West Africa will be discontinued. “The reset of the strategy necessitates a revised operating model, which is still under development and will be announced in the second quarter of financial year 2021,” it said in a statement. There will be a strong focus on cash generation; and the two market-facing divisions each responsible for their own profit and loss, management of resources, and development.

A focused and robust review of the business, and the associated workforce structures, is underway and a detailed update will be provided to stakeholders alongside the full year results,” it said. These are due to be published in September.

Sasol is currently a major coal producer, with the company championing coal-to-fuel and chemicals production using the Fischer-Tropsch process after the second world war. It was number 48 in the 2019 ICIS Top 100 Chemical Companies, with 2018 chemicals revenues of $7.56bn.

Another large multinational, vertically integrated into surfactants is enjoying somewhat less stressful times. That’s Saudi Aramco. In an outstanding article, which I will excerpt here, ICIS’s Joseph Chang notes that Saudi Aramco will boost its chemicals investments in emerging economies, especially in Asia. They’ll pursue opportunities for partnership in many Asian countries such as India, Malaysia, China and South Korea to build on and grow our business as a crude supplier and a downstream investor. In India, Aramco continues to work with the Abu Dhabi National Oil Co (ADNOC) and a consortium of Indian oil companies - Indian Oil Corp, Bharat Petroleum and Hindustan Petroleum - to build a mega refining and petrochemical complex in Raigad, on the west coast.

The project is estimated to cost around $70bn, according to the UAE state-run news agency in November 2019.

Joe goes on to note that Aramco will make a greater push to compete not only in large scale petrochemicals, but further downstream in specialty chemicals as well - a shift highlighted by the completion of its $69.1bn acquisition of a 70% stake in SABIC on 17 June. “Together with SABIC, we can now accelerate our growth in petrochemicals by integrating world-class production of feedstocks by Aramco with conversion into petrochemicals, increasing existing chemicals volumes and further enhancing our international reach,” said Aramco’s SVP of Downstream. As blog readers well know, SABIC is a major player in petrochemicals and polymers, as well as specialty engineering plastics, composites, thermosets, additives and surfactants. SABIC in March 2020 lifted its stake in Switzerland-based specialty chemicals company Clariant from 24.99%, to 31.5%, closer to the one-third level that would trigger a mandatory takeover offer based on Swiss securities law. Clariant’s portfolio includes catalysts, personal and consumer care chemicals and ingredients (i.e. surfactants), additives, flame retardants, functional minerals, oil and mining chemicals and aviation fluids.

Aramco is also banking on major efforts in R&D and sustainability to improve its competitive position going forward. R&D is not the first thing that comes to mind when thinking about the world’s largest oil producer. However, the company has a global network of 12 R&D centres and employs around 1,300 scientists and engineers.

Aramco, SABIC, Clariant – very interesting and certainly room for more chapters in this story, Sasol perhaps? Or something a little more downstream involved in sulfonation, ethoxylation, specialties etc.. Let’s again see. This market continues to consolidate into the domain of the giants – the Godzillas and King Kongs as I’ve often spoken about. Aramco though. That’s a big bugger for sure. It’s the world’s biggest oil producer and the world’s largest company by market cap at $1.9 Trillion. It is owned and controlled by the government of Saudi Arabia, which means King Salman and his son.

In detergent range alcohol news: ICIS’ Louis Hall reports that US Q3 fatty alcohols contract negotiations are ongoing. Q3 contract prices will be assessed the second week of July. The negotiations are largely being driven by supply and demand fundamentals versus outright movements in feedstock costs. Freely-negotiated mid-cut contracts are emerging at a wide range while C16-18 contracts are emerging at a narrower range. Although some Q2 volumes of both mid-cut and C16-18 alcohols are delayed into the third quarter as a result of supply chain disruptions during the coronavirus outbreak, stockpiling and panic buying has largely ceased. As a result, many buyers are committing to less volumes for Q3 as they await their Q2 volumes and gauge the supply and demand outlook for the second-half of the year. Some suppliers are still tight on material, however - especially on mid-cuts - prompting a wide range freely-negotiated contracts.

As note above, Sasol reached beneficial operations at its Lake Charles, Louisiana Ziegler alcohols expansion on 18 June and Guerbet alcohols unit on 23 June, with limited commercial volumes expected available in July. Most of the volumes are already accounted for and not expected to have a major impact on Q3 contracts. At the same time, feedstock costs remain volatile, with some players expecting the easing movement restrictions to put upward pressure on the oil palm complex amid pent up edible oil demand, and others expected the summer harvest season to put downward pressure on the market. Some oleochemicals producers will also take seasonal maintenance over the summer.

Freely-negotiated mid-cut alcohol contracts are emerging at a range from the low-60s to upper-70s lb cents/DEL (delivered) US Gulf. Freely-negotiated C16-18 alcohols contracts are emerging at a range of the upper-70s to lower-80s cents/lb DEL US Gulf. RSPO trademark premiums have risen, given lingering Q2 supply constraints, with premiums heard at 3-5 cents/lb depending on the supplier/manufacturer.

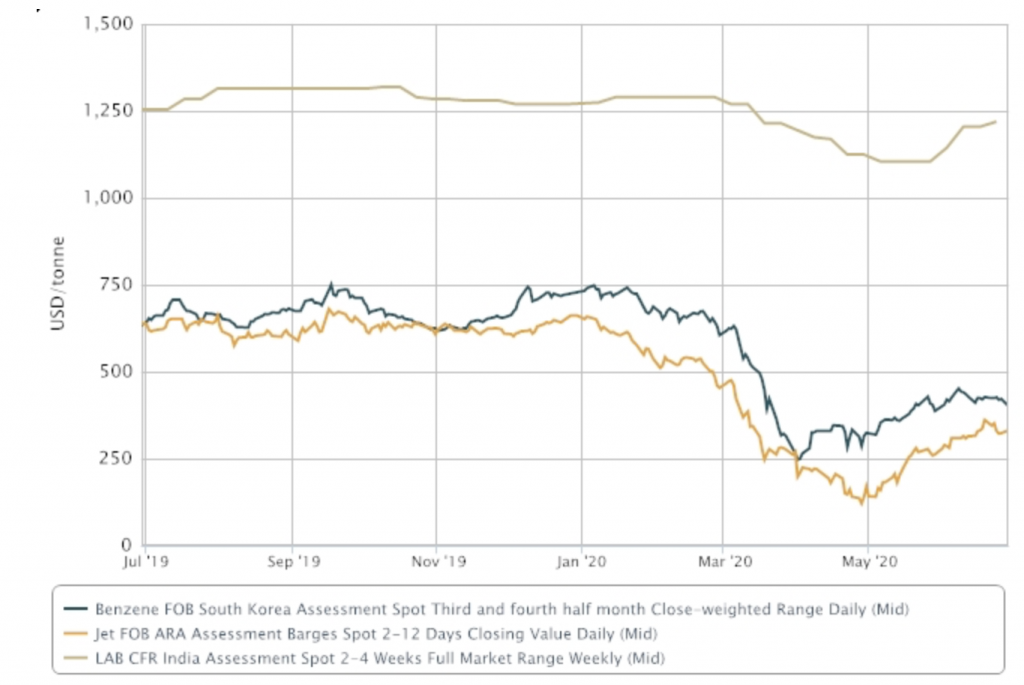

The other big hydrophobe, LAB, made some news in India this month as reported by ICIS’s Yuanlin Koh. Domestic linear alkylbenzene (LAB) producers in India have hiked their offers for July by about 12% from June. The hike comes amid higher feedstock crude and benzene costs seen from June, and limited domestic material in the country.

There are four major producers in India – namely Reliance Industries, Indian Oil Corporation (IOC), Tamilnadu Petroproducts (TPL), and Nirma Limited – who announce their list prices at the beginning of each month. In July, Reliance’s list prices were at Indian rupees (Rs) 111/kg ex-tank, IOC at Rs120/kg ex-tank, TPL at Rs125/kg ex-tank, and Nirma at Rs110/kg ex-tank. Buyers in the market have yet to respond to the hike in prices, but suppliers are confident that some buyers would be able to procure at these levels. “We are not going to give any discounts,” said a domestic producer. This sentiment was echoed by at least one other manufacturer.

In miscellaneous surfactants news: someone sent me this “media advisory” like we’re a real news outlet or something. I’m not sure what to make of that honestly but here it is for your information: Actually, if you want to send me news – about your own company (not your competitors for example) that you’d like to see in the blog, then that’s fine by me. Just make it interesting, you know?

BASF increases prices of betaines and alkanolamides in North America

FLORHAM PARK, NJ, June 26, 2020 – Effective July 15th, 2020, or as contracts allow, BASF Care Chemicals North America will raise list and off-list prices of certain betaine and alkanolamide surfactants by $0.04 per kilogram. These product lines include the BASF Dehyton® and Comperlan® brands.

Betaine amphoteric surfactants are commonly used in shampoos, shower and bath preparations and skin cleansers. Products that use alkanolamide surfactants include non-irritating shampoo, liquid bath soap, hair care products, lotions, creams, cleaning products and cosmetics, pharmaceutical, biochemical and biomedical products.

I couldn’t resist this weird news form Marmite. In a time of societal unrest and pandemic, Marmite is teaming up with the Unilever-owned brand to launch a body spray and shower gel. [Yes this is not a joke. It’s from Cosmetics Business Magazine]. Marmite, the 'love it or hate it' British breakfast spread staple, has partnered with male grooming brand Lynx for the launch of two body care products. The Lynx Africa & Marmite launches (from £2.84) are said to combine the Lynx Africa fragrance with that of the yeast extract, which gained a Royal Warrant from the Queen in 2016. Key notes include marmite, white moss and green herbs with woody scents of creamy sandalwood. With Marmite branding featuring on packaging, the Lynx Africa & Marmite Body Spray and Lynx Africa & Marmite Shower Gel also carry the red, green and black tones of the Lynx range.

Lynx's parent company Unilever said the collaboration is the brand’s biggest fragrance challenge to date and sure to divide opinion as well as peak consumer curiosity. Jamie Brooks, Lynx Brand Lead, said: “Lynx Africa is turning 25 this year, and to celebrate, we’re adding another unexpected fragrance mash up to our portfolio,” he said. “Having launched Leather & Cookies [wait what? I love these guys!] earlier this year, we’ve decided to step it up another notch, taking on our biggest fragrance challenge yet, by collaborating with one of the most polarising and iconic brands in the UK – Marmite. “With Lynx Marmite we’re bringing the world of food into the fragrance category with a pairing no one knew they needed. “Love it or hate it, it’s guaranteed to get the country talking, and is definitely one for the lovers.” [I’m honestly intrigued and a little disturbed by this last comment. What does he mean by this? Is there a subreddit we can consult? In the interest of maintaining the blog’s G rating, I’m moving on]

A fascinating piece in Bloomberg this month talked about returning to work in thoroughly disinfected offices and how the cure may well be worse than the disease for some people. This may not be the typical media hysteria around chemicals. It’s worth a read. Here’s a condensed version. It’s worth checking the link to “List N” which has products on there from Stepan, P&G, Clorox, Ecolab, Pilot and others:

Businesses across the U.S. have begun intensive Covid-19 disinfection regimens, exposing returning workers and consumers to some chemicals that are largely untested for human health, a development that’s alarming health and environmental safety experts. The rush to disinfect is well-intentioned. Executives want to protect employees while abiding by U.S. Centers for Disease Control & Prevention guidelines (and to avoid liability). Pre-pandemic, corporate cleaning staffs typically “freshened” lobbies every three hours, sanitized restrooms every four hours and cleaned other areas at night, said Rich Feczko, national director of systems, standards and innovation at Crothall Healthcare, which cleans hundreds of hospitals.

That pace has now accelerated. “Our frequencies have ramped up in public places like lobbies and elevators to 6-8 times per day,” said Feczko. Restrooms are cleaned every two hours. “Before the pandemic, clients were happy if their trash was emptied and vacuum marks were in the plush carpet,” said Jill Frey, owner of Ohio-based Cummins Facility Services. Now, customers ask for sanitization (reducing pathogens on a surface) and disinfection (killing all pathogens). “This is a hazardous proposition,” said Dr. Claudia Miller, an immunologist, allergist and co-author of Chemical Exposures: Low Levels and High Stakes. “Cleaners tend to go in with hugely toxic chemicals. We’re creating another problem for a whole group of people, and I’m not sure we’re actually controlling infections.”

Cleaning companies are selecting disinfectants from hundreds on List N, the month-old compendium of products approved by the Environmental Protection Agency to kill the novel coronavirus. Those chemicals have passed tests to show they’re effective against the pathogen, but “this doesn’t mean that they have been approved because they’re considered safe with regard to human health,” said exposure scientist Lesliam Quirós-Alcalá, an assistant professor at Johns Hopkins Bloomberg School of Public Health.

The article ends up - In the meantime, commercial landlords can’t wait for science, and may be incentivized to choose the cheapest methods, said Michael Silver, chairman of commercial real estate group Vestian. “If a business comes up with a great plan, and the landlord agrees, then who’s paying for it?” Silver said. “You wonder why anyone would want to go back to work to begin with.” [indeed – wow! ]

A strange piece from Reuters about BASF. Although in light of what we learned about Saudi Aramco above, maybe not so strange. : BASF, the world’s largest chemicals maker by sales, said it was mindful of the risk of an unsolicited takeover approach or of an attack from activist investors and was ready to react. Speaking at BASF’s virtual annual shareholders’ meeting, Chief Executive Martin Brudermueller said he could not rule out unwanted attempts to take control over the company, given the decline in its market value. “We are monitoring market developments and are preparing for such situations,” said Brudermueller, adding that being transparent about its business and future strategy was the most important tool to ward off unwanted approaches. The group’s market value has lost more than 20% this year to 49 billion euros ($55 billion) as the coronavirus pandemic weighed on global industrial demand for BASF’s chemicals and plastics. [Hmm.. for a $1.9Tn market cap company, like Aramco (do I have to spell it out), this is a tasty morsel no?

We’ve written a lot about dioxane in recent months. Here’s something from Pilot Chemical as reported in Global Cosmetics: Pilot Chemical has launched Calfoam ES-701 10 MAX and Calfoam ES-702 10 MAX, 70% active solutions of sodium lauryl ether sulfate with a 1,4-dioxane specification below 10 ppm, which provide drop-in solutions for compliance with looming 1,4-dioxane end-use product regulations*. [Jumping right in with a clear product offering. Good for them. ]

Guest Posts

Now we have two brief guest posts from Clariant and Modular Genetics

First up Clariant

Dirk Leinweber – Director Competence Center Surfactants at Clariant - presented during the recent European ICIS surfactant conference in 2019 about bio-based surfactants and showed how sustainability fuels innovation at Clariant. Dirk focused on key structural features of bio-based surfactants like oleochemicals and sugars and showed that “green does necessarily clean”!

Our newly developed glucamide surfactants – GlucoPureTM – are sugar surfactants for maximum performance. Sustainability is a key driver for new product developments in the home care industry. The consumer however is not willing to sacrifice cleaning efficiency, since performance is still the single most important feature in any Home Care product. GlucoPureTM is the next generation of sugar surfactants based on sugar and natural oils such as RSPO certified palm or sunflower oil, resulting in a Renewable Carbon Index of up to 96%.

GlucoPureTM doesn’t compromise on performance. You can finally have a surfactant with a truly green profile and a top cleaning effect. Our application tests show a much superior cleaning performance when compared e.g. to alkyl polyglycosides. GlucoPureTM can replace amine oxides in green formulations, keeping the cleaning performance and improving the toxicological profile significantly. Finally, GlucoPureTM is one of the mildest surfactants in the market. Internal Zein tests proved this surfactant to be milder than traditional surfactants, such as alkyl ether sulfates, alkylsulfates and even betaines.

In Personal Care our Glucamide surfactants are marketed as GlucoTainTM and they indulge the senses through a range of individual foam structures – from fluffy to rich and light to caring, in skin and hair care products. GlucoTainTM embraces mildness without compromising on cleansing and is ideal for new platforms and sulfate-free formulations. GlucoTainTM is suitable for hair care and skin cleansing applications such as shampoos, shower gels, soaps, facial cleansers and shaving foams.

GlucoPureTM and GlucoTainTM qualify for EcoTain® – EcoTain® is our label for sustainability excellence products and solutions showcasing best-in-class performance. They highlight our contribution to a sustainable future and add value to our customers and society as a whole. Each product and solution carrying the EcoTain® label has undergone a systematic, in-depth screening process using 36 criteria in all three sustainability dimensions: social, environmental and economic. Through this process, EcoTain® sets an ambitious benchmark, which distinguishes products that significantly exceed market standards in general and have best-in-class performance in one or several criteria screened. We evaluate the overall benefits and impacts across the entire value chain and product life cycle. By uncovering value-adding sustainability benefits, EcoTain® empowers our customers to differentiate in the market and contributes to their sustainability goals. EcoTain® inspires and helps us realize our vision of becoming the global leading company for specialty chemicals. We will reach this goal by making meaningful contributions to our customers and society as a whole, through outstanding offerings and by continuously developing our product portfolio towards sustainability excellence.

Clariant cares about our homes – ensuring that ingredients are safer for the people who work with them as well as for the end user and the environment is a primary concern. EcoTain® home care ingredients have a much friendlier composition, avoiding substances of (high?) concern. The concept also involves careful sourcing of raw materials with the focus on renewable resources wherever possible. Because “less is more”, multifunctional products are preferred in order to reduce the complexity of formulations, as are strategies to reduce energy and water consumption during production and application. And to help cut the cost of logistics and transportation along with their environmental consequences, EcoTain® products are produced in multiple sites around the world.

Next Up Modular Genetics

This guest post is from Kevin Jarrell, CEO, Modular Genetics, Inc. (Modular). I recently participated in a panel discussion at the 8th ICIS European Surfactants Conference in Amsterdam, 2019. Neil was an excellent moderator, prompting my colleagues and me to share our views on the future of the biosurfactant sector of our industry. This topic is of keen interest to us all. Consider, for example, the results of Neil’s live conference survey. The meeting attendees ranked the ascent of bio-based surfactants as one of the most important current trends in our industry. For those of you who missed the panel discussion, I’ll offer a brief summary of the key points.

Biotechnology methods are being used successfully to develop surfactants with structures and functions similar or identical to those of surfactants in commercial use today. These technical advances enable the manufacturing of “drop-in-replacement” surfactants, synthesized from carbohydrate without the use of oil as a raw material, creating an opportunity to maintain price and performance while reducing the need for oil as a feedstock for surfactant manufacturing. The main message is biotechnology is creating a new supply chain for surfactant production. Neil and others at the conference repeatedly referred to this new supply chain as the “third leg”. In the early days of our industry, surfactants were manufactured from petrochemical feedstocks. Over time, a second “leg” was added—a second feedstock for surfactant manufacturing--oils derived from plants. Biotechnology is the third wave, enabling direct conversion of carbohydrate into finished surfactant products without the use of oil as a raw material. The third wave is growing, enabling us to meet customer needs with biodegradable surfactants, produced by fermentation of carbohydrate, and purified using only water as a solvent. Biosurfactant producers are scaling-up, customers are buying, and a new supply chain is being established. Stay tuned to this Blog for future updates!

More Musings

I know at least a few of you know already what comes next in this section. The subject of suburbs cannot go without mention of their Canadian equivalent, sudivisions. Nowhere is the dreamer of the mystic so alone. The suburbs have no charms to soothe the restless dreams of youth. You’ve been forewarned.

Hey by the way, can you believe the musicianship?. Incredible!

That’s it. Don't forget to sign up for July 9th and July 14 – 16th

P2 Presents – Know Your Customer July 9th

Surfactants Training Course July 14- 16th.

Short Preview

But let's end with this..

Neil