Surfactants Monthly – May 2021

It’s not Science Fiction

That was the quote “it’s not science fiction” that sealed it for me. It was spoken by David Grainger of Unilever during his keynote address on Thursday morning of our World Surfactant Conference last week. What did it seal? For me it sealed the fact that this was one of the most consequential conferences I have ever attended (let alone co-produced with my partners at ICIS). David was talking about Unilever Homecare’s commitment to eliminate the use of fossil fuels in cleaning and laundry products by 2030. That’s a big deal because, as David went on to detail, Unilever Homecare’s ingredients are mostly made from fossil-fuels – and furthermore, over half the greenhouse gas impact of Homecare is driven by ingredient choice. And of course, what is the #1 ingredient by weight and volume? Yep, right, so… a huge deal. David went on to provide some incredibly impactful information and insights, as well as previews of what’s to come from Unilever in meeting this self-imposed challenge within the next 8 years. And that’s as far as I can take you my dear reader. As you know, my philosophy is: “You gotta be there”. I will say one more thing though. David’s talk was about 18 minutes. The Q&A after was about 10 minutes. I came out of that half-hour feeling like I’d been on a 10 week immersion boot-camp for our industry. Yes, that’s right – it was indeed bigger on the inside – and that’s not science fiction.

We’re doing it again – not the same conference of course, but another event, November 9th and 10th targeted at the European and Asian markets. Stay tuned to our website here for details. End of commercial.

OK so now, before the news for May: I got a lot of interesting feedback on April's discussion of Black Sabbath, including their unexpected link to the world of surfactants (check last month’s blog if you’re curious). This month, we’ll investigate one of the intellectual heirs of Sabbath, Iron Maiden, founding members of the so-called NWOBHM. Skip to the end of the blog if you’re only here for the music.

Beginning of News: As always, much of the news here is brought to you courtesy of ICIS, my good friends and partners. You should subscribe here. I don't get anything if you do subscribe (if that was somehow causing you to hesitate?!) but, if, by subscribing, you are happy, then I’m happy and they are happy - so, you can increase the world’s inventory of happiness just by subscribing. And you’ll know everything that’s happening in the world of chemicals. That’s some deal eh? By the way, I try to remember to mark my opinion and flights of fancy in square brackets like this [ ] when I insert them into the news below. That way you know not to blame ICIS for anything that’s offensive or just not funny. The photos are all mine (or more accurately google images’ in most cases).

Top of the month, of course, we had an analysis of that Emery plant fire. According to ICIS, Asia’s fatty alcohols market is unlikely to see a significant impact from a fire at Emery Oleochemicals’ plant in Malaysia on 1 May. “There will be an impact, but probably not too much,” a regional fatty alcohols producer said. The plant has a capacity of 40,000 tonnes/year of fatty alcohols, market sources said. One person was killed and three others suffered minor injuries when two crude oil tanks caught fire at the Emery Oleochemicals plant in the Telok Panglima Garang industrial area in Malaysia on May 1. Selangor Fire and Rescue Department director Norazam Khamis said in a statement that they received a distress call at 5.36pm and firefighters from the Telok Panglima Garang, Banting and Andalas fire stations were deployed to the scene, according to Bernama, the Malaysia official news agency. [It’s always sad to read of death and injury in our industry. Please pause for a minute and remember – we work with some dangerous materials and with processes that deserve careful attention and vigilance at all times. Many of the readers, not all, of this blog don't actually touch the products we sell and buy. Please remember those that do – the many thousands up and down the value chain.]

Ethylene Oxide continues to make news in Europe. According to ICIS data, Europe’s ethylene contract reference price for May has been set at €1,050/tonne, up by €5/tonne from April. EO May prices increased by €4/tonne, to €1,220-1,388/tonne FD (free delivered) NWE (northwest Europe). Previously EO April contracts rose by double digits on the back of upstream ethylene moves. The European ethylene contract reference price for April was up by €40/tonne from March.

EO supply is balanced for the most part as preparations have been made for turnarounds during the second quarter. Surfactant, ethanolamine and glycol ether derivative demand is healthy. Downstream monoethylene glycol (MEG) demand was lacklustre due to lower downstream consumption.

[By the way, what’s going to happen with EO when Unilever ditches fossil products? Switching to non-ethoxylated surfactants or going to bio-EO (like Croda and India Glycols do) – or a bit of both? Something to think about.

Still with European EO – here’s a cool ICIS graphic tracking EO/EG turnarounds in Europe this year. Try another browser if it doesn't work for you.

Meanwhile in the US, EO prices edged ahead and settled at an increase for the fifth consecutive month, following feedstock ethylene contracts. ICIS assessed April EO contracts at an increase of 0.2 cents/lb ($4/tonne) from the previous month. This puts contracts at 66.8-76.3 cents/lb FOB (free on board), higher by 43% than in April 2020.

Amid storm-related outages and cracker maintenance, feedstock ethylene contracts are at their highest level since October 2014. Wow – that kind of drives the point home right?

More capacity news from the US, as the effects of hurricane Laura continue to work their way through the supply chain. Sasol confirmed it has lifted the force majeure declaration in place for its linear alkyl benzene (LAB) products as of 29 April, according to a customer letter obtained by ICIS. The force majeure declaration remains in place for Sasol's US alcohol and ethoxylates products. The Lake Charles site has a surfactants capacity of 230,000 tonnes/year, according to ICIS Supply & Demand.

In other force majeure news: Indorama Venture Oxides (former Huntsman US Surfactants business) lifted its force majeure on surfactants, ethanolamines, and linear alkylbenzene (LAB) produced at its US Texas sites on 18 May, according to a customer letter. The lifting of the force majeure includes the following at the Port Neches, Texas, site: surfactants (all products and grades); ethanolamines (including monoethanolamine, diethanolamine, and triethanolamine all grades and specifications); and LAB (all products and grades). Indorama will operate under sales control for the suspended products due to strong demand, said the letter.

Unfortunately, it seems Shell is going in the opposite direction, declaring force majeure on linear alcohols and ethoxylates, effective May 17th, at the Geismar, LA plant – which, according ICIS data, has a capacity of 195 KMT/yr of alcohols. The problem is feedstock constraints from a third party supplier.

The great Lucas Hall (ICIS Reporter on the alcohols beat) played a pivotal role in our conference last week and continued also to crank out incredible insights into the fatty alcohols market. He reported early May that spot alcohol prices are trending higher than contract levels as demand outpaces supply. He notes that while Sasol lifted its force majeure on US linear alkyl benzene (LAB) on 29 April. The force majeure on alcohols and ethoxylates remains in place into May. Shell lifted its force majeure on alcohols from its Geismar, Louisiana, plant on 30 April, but some southeast Asian producers are conducting maintenance in Q2.

Demand across most end markets is strong to rebounding as the economy reopens from the coronavirus pandemic, including in the core surfactants and cleaning markets. Multiple surfactants producers are separately targeting price increases for May.

Oxiteno remains on force majeure for surfactants at its Pasadena, Texas, plant. Inventories throughout the supply chain are tight, following weather-related shutdowns in Texas in the US Gulf in February against the backdrop of preexisting supply chain disruptions from southeast Asia. [That's a lot of supply chain problems - with global causes and effects]

Shipping delays are being exacerbated, particularly for material shipped in isotank or otherwise packaged. Mid-cut volumes shipped in bulk are also facing delays. Many Q2 volumes are expected delayed until June or July.

In the palm products markets, PKO continued to increase as noted below.

| Product | Delivery | 4 May | 27 April |

| CPO | DEL, south Malaysia | M$4,600.00 | M$4,480.00 |

| PKO | DEL, south Malaysia | $1,391.92 | $1,404.80 |

| Palm Olein | FOB, Malaysia | $1,160.00 | $1,155.00 |

| Palm Stearin | FOB, Malaysia | $1,120.00 | $1,090.00 |

| PFAD | FOB, Malaysia | $1,012.5 | $990.00 |

All prices are on a per tonne basis.

Source: Matthes & Porton

Fatty alcohol prices also increased. Demand is outpacing available supply, with spot prices trending 5-10 cents higher than contracts, according to market sources. Supply is snug to tight across all carbon chains. Mid-cut availability is slightly improved - depending on the supplier - while logistics constraints are being exacerbated. C16-18 markets remain tight, including for single and blended cuts. Mass balance premiums edged higher on the top end to 5.0-8.0 cents/lb, from 5.0-7.5 cents/lb the previous week.

2020 for Oxiteno was a good year. Brazilian surfactant producer and blog favourite, Oxiteno reported a rise in year-on-year operating income. Quarter on quarter, operating income fell but only because the company reported a tax benefit in Q4 2020.

The following shows the company's financial performance. Figures are in millions of Reais.

| Q1 21 | Q1 20 | Q4 20 | Y/Y | Q/Q | |

| Sales | 1,436.4 | 1,107.9 | 1,476.8 | 29.7 | -2.7 |

| Cost of sales | 1,104.9 | 876.9 | 1,186.4 | 26.0 | -6.9 |

| Gross profit | 331.5 | 231.0 | 290.4 | 43.5 | 14.2 |

| Operating income | 109.8 | 108.5 | 143.2 | 1.2 | -23.3 |

| Adjusted EBITDA | 226.9 | 192.6 | 261.9 | 17.8 | -13.4 |

Source: Oxiteno

Sales rose year on year because of favourable exchange rates and higher sales prices. Oxiteno achieved the higher prices because it sold a larger share of specialty [that’s non MEG] products. Quarter on quarter, sales fell because of lower volumes, which more than offset an 8% increase in dollar-based prices.

The following breaks down the company's sales volumes. Figures are in thousands of tonnes.

| Q1 21 | Q1 20 | Q4 20 | Y/Y | Q/Q | |

| Commodities | 19 | 32 | 33 | -40.6 | -42.4 |

| Specialities | 162 | 148 | 171 | 9.5 | -5.3 |

| Domestic | 127 | 128 | 154.0 | -0.8 | -17.5 |

| Foreign | 54 | 53 | 50.0 | 1.9 | 8.0 |

| TOTAL | 181 | 181 | 204.0 | 0.0 | -11.3 |

Source: Oxiteno

Volumes of specialty chemicals rose because of higher sales across all segments in Brazil, with a focus on agriculture as well as home and personal care.

Quarter on quarter, volumes of commodities fell because of scheduled shutdowns. During those shutdowns, Oxiteno placed a priority on the production of specialty chemicals. As we reported earlier, Oxiteno's plant in Pasadena, Texas, was shut down for about 30 days because of the polar storm that hit the state in mid-February.

Oxiteno is part of the Brazilian conglomerate Ultrapar and as we reported earlier Ultrapar is considering divesting Oxiteno. So, if you’re interested, you should get in touch. You’ll never have as good an opportunity to secure such a unique trophy asset in Latin American surfactants.

In related news, Oxiteno parent, Ultrapar said on Tuesday that it is in talks to sell its chain of pharmacies, Extrafarma. The company is currently negotiating with Empreendimentos Pague Menos S.A. the potential sale, but Ultrapar clarified there is no binding agreement and no guarantees of its potential completion.

The deal would make Pague Menos Brazil’s second biggest drugstore retailer.

Over in Asia, ethoxylate markets continue strong according to ICIS, supported in the near term by strong demand and rising upstream costs. In the week ended 6 May, spot prices of FAE mols 7, 9 were up $30/tonne week on week to average $1,725/tonne CIF (cost, freight and insurance) southeast (SE) Asia, ICIS data showed. Soaring coronavirus infections in Asia, including India, Malaysia, Thailand, the Philippines and Japan are expected to bolster demand for surfactants. [A horrible silver lining in an awful cloud].

Demand from downstream sodium lauryl ether sulfate (SLES), has increased following the resurgence of the coronavirus infections. India now has the highest number of coronavirus infections in the world, with more than 20 million cases, according to the World Health Organisation (WHO). Adding to the upward pressure is the margin squeeze from higher feedstock fatty alcohol blend C12-14 costs. Pricing indications for feedstock fatty alcohol blend C12-14 prices have increased further for July loadings as several suppliers have sold out for June loadings. “We are sold out for June and will likely revise our offers up for July shipments,” a regional fatty alcohol producer said.

In the week ended 5 May, fatty alcohol blend C12-14 prices were up $10/tonne week on week to average $2,110/tonne FOB (free on board) southeast (SE) Asia, ICIS data showed.

Mid-month in Asia – Oleochemicals markets stayed quite firmon upstream and freight costs pressures amid demand from China despite spot activities slowing down ahead of the Eid ul-Fitr holiday in southeast Asia. Demand for glycerine has outstripped supply due to dwindling crude glycerine supply from Brazil and strong demand for refined glycerine from the downstream epichlorohydrin (ECH) makers in China. The fatty alcohols market also saw firm demand due to near-term tight supply, market sources said. “The fatty alcohols market is still very strong due to the tightness for near-term product,” a regional fatty alcohols producer said. Emery Oleochemicals declared force majeure and stopped its fatty alcohols production at its plant in the Telok Panglima Garang industrial area in Malaysia following an explosion at its wastewater storage tank on 1 May. Other oleochemicals markets including fatty acids, soap noodles and fatty alcohol ethoxylates (FAE) are also seeing support from the upstream crude palm oil (CPO), palm kernel oil (PKO), palm stearin and competing soybean oil prices.

However, most buyers in southeast Asia have largely retreated to the sidelines due to the regional festival. Market activities in Malaysia and Indonesia, which are major oleochemicals producers and Muslim-majority countries, have slowed in the run-up to the holiday on 13 May amid renewed lockdown restrictions to curb the spread of the virus. Restriction measures have been tightened in several countries in southeast Asia, including Malaysia, Singapore and Thailand to contain the pandemic. “There are few enquires, practically zero this week, as buyers are not willing to commit due to the high prices and high freight costs,” a regional soap noodles maker said.

Freight costs have increased sharply in the global trade, curbing spot purchases as buyers were unwilling to build up their stocks and purchased largely on a need-to-basis.

Fatty alcohols ethoxylates (FAE) market activities have also slowed this week in southeast Asia due to the upcoming Eid ul-Fitr holiday. “We expect discussions for June contracts to start only towards the end of the month, and with Malaysia and Indonesia markets slowing down this week, the market in southeast Asia is likely to remain subdued,” a regional FAE producer said.

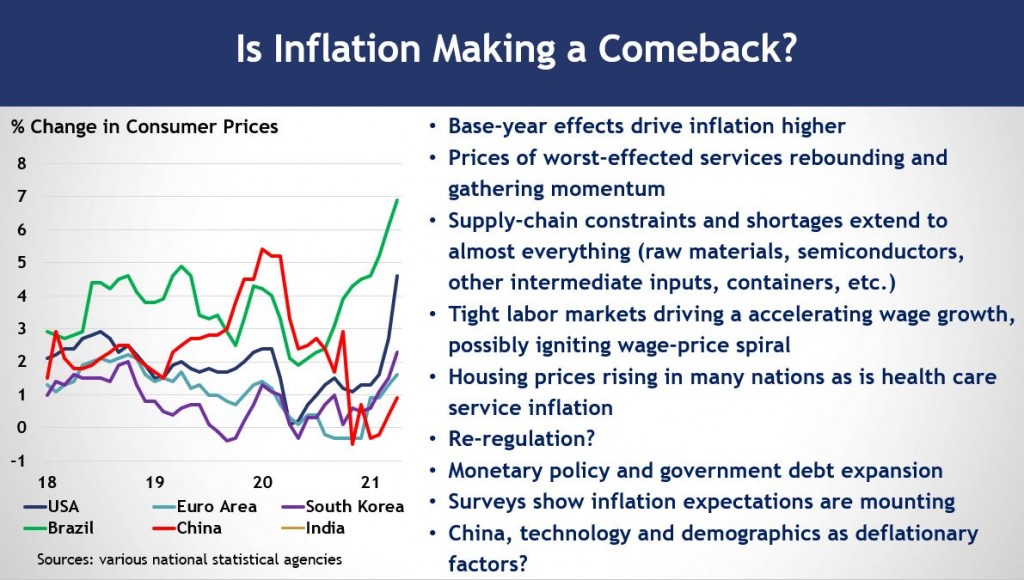

One more news item: Joe Chang, the great editor of ICIS News, wrote an excellent article about Kevin Swift’s keynote opening talk at our conference last week. I won’t except it here but you can read it at this link. He coverd the macro economy and items of interest to surfactants, of course. He also talked inflation, something most of us are seeing now, at least in our professional lives and, if you are looking to buy a car or a house, in our daily lives. Here’s a key chart that you may find interesting:

End of News – Beginning of Music Section

Last month we discussed Black Sabbath and their invention of the heavy metal genre in 1970. By 1980 however, much had changed. Sabbath lost front-man Ozzy Osbourne in 1979 and replaced him with Ronnie James Dio. A great vocalist, but, to many, it just wasn't the Sabs any more. Deep Purple split in 1976 and, while some spin-offs did excellent work, such as Richie Blackmore’s Rainbow, it felt like a gaping hole had been ripped into the fabric of heavy rock. Even the great Led Zeppelin couldn't continue after the death in October 1980 of John Bonham, one of the two greatest drummers in the world at the time. As these giants of heavy rock stumbled and fell, a new wave of counter-cultural excitement boiled over in the UK and US as punk bands like the Sex Pistols (1975), The Damned (1976) and The Ramones (1974) vomited onto the scene (a cheesy but entirely appropriate metaphor). The desolate no-mans land between heavy rock and punk had few inhabitants save, perhaps, the inimitable Motörhead, whose fans tended to go all-in like football supporters who could not countenance patronizing another club. And look, I’m not ignoring Judas Priest. Acolytes of Black Sabbath, they kept many a heavy rock fan going during the mid-seventies but by 1980 with the release of British Steel they were, meh, done. Then in 1980, something interesting happened. Iron Maiden, who had clearly been listening to a lot of Black Sabbath but also many other musical influences, in their teenage bedrooms, released their first album. Here’s the first track.

So much information packed in here: First the album cover. The person / creature thereon enshrined, ultimately goes on to adorn every subsequent album, millions of T shirts, millions of cans of beer and a 747 aeroplane. Eddie is a mascot to rank alongside the best in any field, but look closer. That street-scene could only be late 70’s early 80’s UK with the broken litter bin strapped to the lamp post in front of terraced houses. Now on to the sound. Vocalist Paul Dianno only lasted 2 albums but that scratchy punk snarl lefts its mark on the hearts of Maiden fans for 4 subsequent decades. This is not your older brother’s heavy metal for sure – nor is it exactly punk. There’s more though. The riff and opening verse says – heavy rock standard, but at 1:24, you know this is going to get interesting. By 1:46 you have that signature Maiden instrumental break releasing at 2:00 into a torrential solo. This was promising.

But it was two songs at the heart of the album that defined the Maiden sound for me and for the ages. The last song on side 1 and the first on side 2. Here’s Phantom of the Opera.

The first 22 seconds – hmm not your regular rock riff. The next 36 seconds – just crank it and tighen it further. An homage to Black Sabbath no doubt. But the mid-section builds on a sort of operatic theme culminating at 3:30 in the sort of almost Bach-like progression into a guitar duet, then a solo, then another solo, then re-progression then a re-crank up to a frenetic finish, that would come to define the Maiden experience. Wow right?

The first song on side 2 is an instrumental, Transylvania. Again there’s that cranking up in the middle from what was already a respectable headbanging pace. You can imagine what a live song this made from small pubs to stadiums.

Intriguingly though the first album ends on a somewhat schizophrenic note. The second last song sounds like a cross between something by the Damned and a rock anthem from the likes of Peter Frampton or any one of a number of anodyne American rock bands. The lyrics themselves, however, would make Cardi B, blush (actually not blush – more like nod appreciatively to a cultural forefather). The last song brings us safely back into Maiden / punk territory, but left many thinking and wondering – yeah great but will it continue.? Here’s both songs together.

The world had to wait another year, until the second album was released in 1981. All doubts were dispelled within the 1 minute and 45 seconds of the opening instrumental. This was prototypical Maiden, grandiose, classically inspired - the perfect aperitif for the second track, Wrathchild. So much in this song. That bit at about 3:12 – remind you of the Damned or the Stranglers maybe?

OK look, I’m putting the entire album here because I think it’s important that you listen to the whole thing. It’s only about 40 minutes – worth the investment.

So many highlights. How about the opening to Murders in Rue Morgue. Again – classic Maiden sound. Ghenghis Khan at 12:18 – just to remind you that this band is different and the weirdness of “Charlotte” won’t come back to haunt the growing fan base. I have to highlight a personal favorite and also soothe the outrage of the Judas Priest fans reacting to what I said a few paragraphs back. Check out the title track of the album at 19:15. That opening section remind you of anything? Clearly Maiden’s homage to Judas Priest circa Sad Wings of Destiny (1976) and Sin after Sin (1977). Beautiful.

I could go on – including to the post-Dianno albums with the equally great (but more conventionally heavy rock) vocals of Bruce Dickinson, but, again, I have a day-job. So I guess I’ll conclude. Iron Maiden was rightly welcomed as one of the leaders of the New Wave of British Heavy Metal (NWOBHM) a phrase coined by Geoff Barton of your blogger’s favorite newspaper of the time, Sounds. They continue today, hugely popular still, after 16 studio albums, selling over 100 Million copies.

Lessons for us in surfactants? Well, they did not create a genre like Black Sabbath did. But, for many, they did perfect a genre that was, arguably, largely abandoned by its early creators. And they never gave up. Never wobbled or bowed to notions of what was fashionable at the time. So look - you may not be able to create a market segment - but can you perfect it? Or - take flow chemistry. It's been created and developed. But can you take it and perfect it in some process application - at millions of MT/yr? I think you can.

To our refined 2020’s sensibilities the imagery and lyrical sentiments of the early Iron Maiden may seem a bit upsetting. The title and cover of that second album for example. But as an emotional outlet for working class youth of a certain age and testosterone level, there were many worse options, then and now. Check out this crowd from Santiago Chile in 2011, Ages must range from one third to one half the age of the band - and singing along to a song about the charge of the light brigade, a British military adventure of 1854. Something of value there, clearly.

That’s it for now. More news and music next month.