Surfactants Monthly August & Early September 2020

First the ads: Our 2020 surfactants conference, September 16 – 18th is online and free (free of charge – yes that’s right!). Go to this link and register. You gotta register. Can’t just show up on the day. There is a practical limit to how many people can be accommodated on the platform. I don't know what that is but we have well over 500 already. Sign up. https://www.icisevents.com/ehome/index.php?eventid=200176800& That’s all the ads I have for you this week. From here on it’s solid red meat – that is news. No music or musings this time. We’ll have some of that at the conference.

The news:

As expected, Oxiteno had a pretty good second quarter as ICIS reported. Second-quarter operating income was positive versus a loss from the same period in 2019 because sales rose faster than costs (ah yes, that is the way to do it, I’m told).

The following shows the company's financial performance. Figures are in millions of reais (R).

| Rm | Q2 20 | Q2 19 | % |

| Sales | 1,201.0 | 1,066.3 | 12.6 |

| Cost of goods | 973.1 | 901.4 | 8.0 |

| Gross profit | 227.9 | 165 | 38.1 |

| Operating income | 50.1 | -7.2 | - |

Source: Oxiteno

Oxiteno attributed the rise in sales to a weaker currency. The average exchange rate of the real was R5.39 to the dollar during the second quarter, compared with R3.92 during the same time in 2019. About a third of Oxiteno's volumes are sold outside of Brazil, so these tend to benefit from a weaker currency.

The following breaks down Oxiteno's sales volumes by region.

| Q2 20 | Q2 19 | % | |

| TOTAL | 167,000 | 183,000 | -8.7 |

| Brazil | 111,000 | 132,000 | -15.9 |

| International | 56,000 | 51,000 | 9.8 |

Source: Oxiteno

The following breaks down the company's volumes by type.

| Q2 20 | Q2 19 | % | |

| TOTAL | 167,000 | 184,000 | -9.23913 |

| Specialty chemicals | 139,000 | 146,000 | -4.79452 |

| Commodities | 28,000 | 38,000 | -26.3158 |

Source: Oxiteno

Demand weakened from the coatings, automotive and oil-and-gas segments. This was partially offset by higher volumes from home and personal care as well as from the company's crop-solutions segment. Exports rose from Brazil and sales rose in the US, Oxiteno said. It’s nice to see sales continuing to rise in the US as that was quite an investment in alkoxylation recently. FInally; to those critics who have asked me if I have to use every mention of Oxiteno as a flimsy excuse to publish a picture of Gisele. The answer is yes.

The month started with EO news from China: China’s domestic ethylene oxide (EO) list prices dropped by another yuan (CNY) 400/tonne ex-tank or the equivalent of about 6% early in the month, according to market sources. The recent downtrend was mainly attributed to downstream demand volatility, such as in the monoethylene glycol (MEG), which in turn led to supply cuts at MEG’s production facilities. Another main downstream ethanolamines, whose demand was not performing as expected because of recent rains and flooding, also affected upstream EO. One of the largest EO producers in China - China Petroleum & Chemical Corp, or Sinopec, announced the revision of its list price to CNY6,600/tonne ex-tank.

Toward the end of the month however, China’s ethylene oxide (EO) list prices rose by another yuan (CNY) 200/tonne ex-tank in three days from 18 – 21 August, market sources said. Sinopec, one of the largest EO producers in China, announced the revision of its list price to CNY7,000/tonne ex-tank. “This [rise] is so sudden,” said a Chinese trader, adding that there was no real basis for the rise since downstream sectors were not doing very well. Values of EO’s main downstream monoethylene glycol (MEG) firmed this week on supply cuts in Asia and the Middle East, which may support EO’s rising trend. However, even as demand in another main downstream sector ethanolamines picked up this week, overall sentiment was still poor.

As is now customary in general, the US went in a different direction: US July ethylene oxide (EO) contracts rose on an increase in same-month feedstock ethylene contracts. ICIS assesses July EO contracts at 49.4-58.9 cents/lb ($1,089-1,298/tonne) FOB (free on board), higher by 0.8 cents/lb from the previous month. Feedstock ethylene contracts for July settled higher by 1 cent/lb, on higher spot prices and an increase in cash costs. Cracker issues limited supply as demand continued to recover. The majority of EO contracts are formula-based, and price movement comprises 80% of the change in the ethylene price and an additional conversion fee, or adder. Like ethylene, EO contracts are settled at the beginning of the month for the previous month’s price. Demand remains strong for high-purity EO for use in surfactants in cleaning products. Although downstream ethylene glycol (EG) is seeing healthy demand from packaging and construction, overall levels remain below normal due to depressed demand for polyester fibre. Yes – and that is a reminder to my surfactants students, that you gotta look at the entire economic picture of the asset you have deployed – and that will often depend on a number of completely different markets and products. Think about it.

Now updating to the beginning of September: US August ethylene oxide (EO) contracts have settled at an increase, on higher feedstock ethylene contracts. ICIS assesses August EO at 51.2-60.7 cents/lb ($1,129-1,338/tonne) FOB (free on board), up by 1.8 cents/lb from the previous month. US August ethylene contracts settled at an increase, as cracker issues curbed supply and downstream demand mostly remained strong. The August EO settlement is the fourth consecutive increase and the highest EO contract price level since January.

Meanwhile in Europe: The European ethylene contract reference price for September has been set at a rollover from August, at €785/tonne. The vast majority of EO contracts are formula based, with price movement comprising 80-85% of the change in the monthly ethylene contract price. ICIS uses an average of 82% of the ethylene contract price in its calculations. September EO contract prices are between €1,033-1,201/tonne free delivered (FD) northwest Europe (NWE). There is some uncertainty surrounding supply balances as Shell entered turnaround this week.

The EO/EG Shell Moerdijk turnaround started early September and is expected to last for around six weeks, according to market sources. The exact dates are unconfirmed by the company though. Previously the turnaround was due to start in the second quarter but was postponed. In mid August, the cracker experienced a factory failure, but later came back online. The company did not have comments on the status of individual units, according to a press spokesperson. A short turnaround at BASF's Antwerp EO/EG facility is expected to take place at the end of October. The dates are unclear, as this has not been confirmed by the company. Some market sources added that it could take a minimum of two weeks; others suggest it will be a short turnaround.

Downstream MEG supply is very limited, due to local constraints and also lack of imports in the wake of Hurricane Laura. Previously, some downstream polyol sources referred to low availability of EO, key ingredients in polyols production, particularly in southern Europe.

More shuffling of the deck in surfactants capacity in Asia, with BASF playing dealer and croupier (I’m not sure if this is an appropriate analogy. The last time I went to Atlantic City, it was 1984, I was driving a convertible, thinking I was a hotshot and the car got towed and, well, I never went back). As reported by ICIS, BASF will raise its alkoxylate capacity in Asia Pacific through acquisition of production facilities from China’s Shanghai Petrochemical Co (SPC), the company said in a statement. The new investment will help double BASF’s alkoxylate capacity at its Jinshan site in Shanghai from end 2020. Capacity figures are not revealed – good for them. “This investment reinforces BASF’s commitment to China and makes Jinshan a significant production base for a range of products across the Care Chemicals portfolio in the region,” said Dr. Stephan Kothrade, President and Chairman Greater China, BASF.

The great Lucas Hall, who will be speaking at the conference next week wrote one of a few excellent analyses on fatty alcohols in ICIS news as follows: A growing supply overhang from Q2 alongside weaker demand in Q3 is expected to weigh on the US fatty alcohols market ahead of the start of Q4 negotiations, even as feedstock costs across the oil palm complex remain volatile. Some mid-cut alcohols sellers and buyers are looking to destock or resell spare volumes amid sufficient supply for the cleaning sector and continued slack demand in industrial end markets.

Single cut C16 and C18 demand is also slow amid decreased demand in industrial polymer markets because the downturn in the automotive and construction sectors. Blended C16-18 cuts demand is slightly more stable. This comes after market participants stockpiled in Q2 as the onset of the coronavirus pandemic prompted a sharp uptick in demand across the cleaning sector.

The March plunge in crude oil futures as well as lockdowns and other movement restrictions put in place to thwart the spread of the virus, meanwhile, weighed on demand in industrial sectors like automotive, construction and oil and gas. These sectors are recovering slower than expected, even as crude prices recover and movement restrictions have eased. While the pandemic initially prompted supply chain disruptions from Southeast Asia and Europe, as of Q3 the supply chain has largely been restored. Now that demand has slowed and panic-buying largely ceased, imports that were originally contracted in Q2 are now arriving in Q3, leading to a growing supply overhang. Nonetheless, volatility in across the feedstock oil complex is expected to be a major factor in the Q4 negotiations.

Despite volatility, feedstock costs are generally trending higher, underpinned by an increase in exports over the last couple months against the backdrop of alleged lower than expected production during the summer palm harvest. While the upward trend is likely to put upward pressure on the early Q4 negotiations, buyers are likely unwilling to accept commensurate price increases given easing supply chain constraints and the softer-than-expected demand environment in the aforementioned end markets.

Some expect the uptrend in feedstock costs to continue amid increased demand for edible oils in China and elsewhere over July and August against the backdrop of upcoming turnarounds globally. Feedstocks have also seen support from revised supply expectations in southeast Asia following poor weather and alleged labour shortages in the region during the summer palm harvest. In response, buyers have largely adopted a wait-and-see stance, sitting on their current volumes amid expectations that the summer harvest will ultimately result in higher palm oil stocks and prompt a further downward correction in prices.

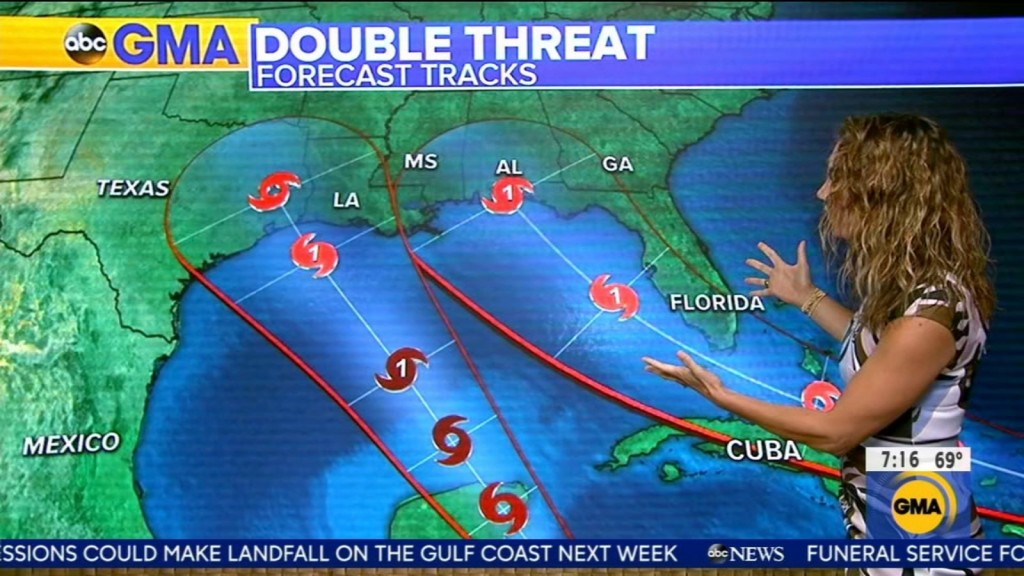

Hurricane Laura hit a lot of chemical production capacity, starting late August, and that included surfactants. ICIS did an outstanding analysis of the impact on chemicals here https://subscriber.icis.com/news/petchem/news-article-00110545466 It may require a subscription, but if you’re not a subscriber, by now, come on, why not ? (OK that was one more ad)

Indorama (formerly Huntsman) in Chocolate Bayou, TX shut down it’s 182,000 MT / yr LAB plant.

Sasol declared force majeure on the performance chemicals portfolio produced at its US Lake Charles, Louisiana, Chemical Complex in the aftermath of Hurricane Laura.

The force majeure includes alcohol, surfactant, alkylate and glycol products. The complex remained shut on September 1st after the energy and petrochemicals major brought it, along with units in Greens Bayou and Winnie, Texas, down in preparation for the storm hitting the US Gulf Coast last week. Early assessments indicated no damage to process equipment and no flooding impact from the storm surge, although high wind speeds resulted in damage to the cooling towers at the Lake Charles complex. Greens Bayou and Winnie units were not affected by the storm. However, an electrical blackout continues as a result of the damage to the transmission lines coming into Lake Charles, keeping the complex's operating units offline.

Sasol's Lake Charles site has a linear alcohols capacity of 110,000 tonnes/year, according to the ICIS Supply and Demand Database. The Lake Charles site has a surfactants capacity of 230,000 tonnes/year, according to ICIS Supply & Demand.

Map and product list - Dowload the Pdf from ICIS showing key impacts of the hurricane

Finally in interesting sustainability news: Unilever ups the ante again with a bold pronouncement, September 2nd : Unilever will derive 100% of the chemicals used in its cleaning and laundry product formulations from renewable or recycled carbon by 2030, eliminating its use of fossil fuel-derived carbon in the sector, the company. Unilever also committed to halve the use of virgin plastics in plastics packaging by 2025. The aim is at the core of the company’s ‘Clean Future’ innovation programme, which will look at ways to change how some of Unilever's best-known cleaning and laundry products are created, manufactured and packaged. Petrochemicals such as soda ash (? Not sure what this means) and surfactants such as ethylene oxide (EO) (surely – surfactant intermediates?) are used in the manufacture of household cleaning products, and polymers such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) are used in primary and secondary packaging. The move is part of the company’s wider pledge of net zero emissions by 2039, and is expected to reduce Unilever’s carbon footprint of product formulations used in cleaning and laundry products by 20%. The company has ring-fenced €1bn for the Clean Future project, which will be used to finance biotechnology research, CO2 and waste utilisation, and low carbon chemistry. This investment will also be used to create biodegradable and water-efficient product formulations.

Peter ter Kulve, Unilever’s president of Home Care, said, “As an industry, we must break our dependence on fossil fuels, including as a raw material for our products. We must stop pumping carbon from under the ground when there is ample carbon on and above the ground if we can learn to utilise it at scale." Ter Kulve concluded, “A new bioeconomy is rising from the ashes of fossil fuels.” According to data submitted to the Ellen MacArthur Foundation’s Global Commitment pledge, Unilever used 610,000 tonnes of plastics packaging volume in 2018. Whether or not the company intends to reduce its virgin plastics use through light weighting and substitution to alternative packaging types, or to increase the amount of recycled content in its packaging is not clear. – So my comment – clearly a big impact on surfactants like LAB and Ethoxylates. And potentially a boost for Palm derivatives and possibly bio-surfactants. Let’s see.

That's it. Here's a pitch as to why you should register for the conference next week - if there's space left.

Alright then, here's one music video that is exactly as advertised. Enjoy: